JLL West Michigan Industrial Insight & Statistics - Q3 2017

•

0 likes•38 views

The third quarter of 2017 saw the steady improvement of market conditions for the West Michigan industrial market. Asking rental rates continued their rise due to high demand and low vacancy. Asking rents rose three basis points quarter-over-quarter, while vacancy fell 50 basis points quarter-over-quarter.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Q4 2018 | Austin Industrial | Research & Forecast Commercial Real Estate ReportAustin’s industrial market closes 2018 with new buildings and high absorption

Austin’s industrial market closes 2018 with new buildings and high absorptionColliers International | Houston

More Related Content

What's hot

Q4 2018 | Austin Industrial | Research & Forecast Commercial Real Estate ReportAustin’s industrial market closes 2018 with new buildings and high absorption

Austin’s industrial market closes 2018 with new buildings and high absorptionColliers International | Houston

What's hot (20)

JLL Detroit Industrial Insight & Statistics - Q4 2019

JLL Detroit Industrial Insight & Statistics - Q4 2019

JLL Pittsburgh Industrial Insight & Statistics - Q1 2017

JLL Pittsburgh Industrial Insight & Statistics - Q1 2017

JLL Pittsburgh Industrial Insight & Statistics - Q3 2021

JLL Pittsburgh Industrial Insight & Statistics - Q3 2021

JLL Pittsburgh Industrial Insight & Statistics - Q4 2021

JLL Pittsburgh Industrial Insight & Statistics - Q4 2021

JLL Detroit Industrial Insight & Statistics - Q1 2019

JLL Detroit Industrial Insight & Statistics - Q1 2019

JLL Pittsburgh Industrial Insight & Statistics - Q2 2021

JLL Pittsburgh Industrial Insight & Statistics - Q2 2021

JLL Pittsburgh Industrial Insight & Statistics - Q2 2019

JLL Pittsburgh Industrial Insight & Statistics - Q2 2019

JLL Pittsburgh Industrial Insight & Statistics - Q1 2021

JLL Pittsburgh Industrial Insight & Statistics - Q1 2021

JLL Detroit Industrial Insight & Statistics - Q2 2017

JLL Detroit Industrial Insight & Statistics - Q2 2017

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

JLL West Michigan Industrial Insight & Statistics - Q3 2019

JLL West Michigan Industrial Insight & Statistics - Q3 2019

Austin’s industrial market closes 2018 with new buildings and high absorption

Austin’s industrial market closes 2018 with new buildings and high absorption

Industrial Insight and Statistics: Dallas-Fort Worth (2019-Q2)

Industrial Insight and Statistics: Dallas-Fort Worth (2019-Q2)

JLL Pittsburgh Industrial Insight & Statistics - Q3 2018

JLL Pittsburgh Industrial Insight & Statistics - Q3 2018

JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

Q4 2017 | Austin Industrial | Research & Forecast Report

Q4 2017 | Austin Industrial | Research & Forecast Report

Q1 2017 Austin Industrial Research & Forecast Report

Q1 2017 Austin Industrial Research & Forecast Report

Similar to JLL West Michigan Industrial Insight & Statistics - Q3 2017

Similar to JLL West Michigan Industrial Insight & Statistics - Q3 2017 (18)

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

JLL Pittsburgh Industrial Insight & Statistics - Q4 2018

JLL Pittsburgh Industrial Insight & Statistics - Q4 2018

JLL Grand Rapids Office Insight & Statistics - Q2 2018

JLL Grand Rapids Office Insight & Statistics - Q2 2018

JLL Pittsburgh Industrial Insight & Statistics - Q4 2019

JLL Pittsburgh Industrial Insight & Statistics - Q4 2019

JLL Pittsburgh Industrial Insight & Statistics - Q2 2018

JLL Pittsburgh Industrial Insight & Statistics - Q2 2018

JLL Detroit Industrial Insight & Statistics - Q4 2018

JLL Detroit Industrial Insight & Statistics - Q4 2018

JLL Pittsburgh Industrial Insight & Statistics - Q3 2019

JLL Pittsburgh Industrial Insight & Statistics - Q3 2019

JLL Detroit Industrial Insight & Statistics - Q4 2018

JLL Detroit Industrial Insight & Statistics - Q4 2018

Recently uploaded

Recently uploaded (20)

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

Cheap Rate ✨➥9711108085▻✨Call Girls In Amar Colony (Delhi)

Cheap Rate ✨➥9711108085▻✨Call Girls In Amar Colony (Delhi)

9990771857 Call Girls in Dwarka Sector 7 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 7 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 6 Delhi (Call Girls) Delhi

2k Shots ≽ 9205541914 ≼ Call Girls In Sainik Farm (Delhi)

2k Shots ≽ 9205541914 ≼ Call Girls In Sainik Farm (Delhi)

Cheap Rate ✨➥9711108085▻✨Call Girls In Malviya Nagar(Delhi)

Cheap Rate ✨➥9711108085▻✨Call Girls In Malviya Nagar(Delhi)

Call Girls in Anand Vihar Delhi +91 8447779280}Call Girls In Delhi Best in D...

Call Girls in Anand Vihar Delhi +91 8447779280}Call Girls In Delhi Best in D...

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

The Gale at Godrej Park World Hinjewadi Pune Brochure.pdf

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

MEQ Mainstreet Equity Corp Q2 2024 Investor Presentation

9990771857 Call Girls in Dwarka Sector 1 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 1 Delhi (Call Girls) Delhi

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

Enjoy Night ≽ 8448380779 ≼ Call Girls In Huda City Centre (Gurgaon)

9990771857 Call Girls in Dwarka Sector 08 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 08 Delhi (Call Girls) Delhi

JLL West Michigan Industrial Insight & Statistics - Q3 2017

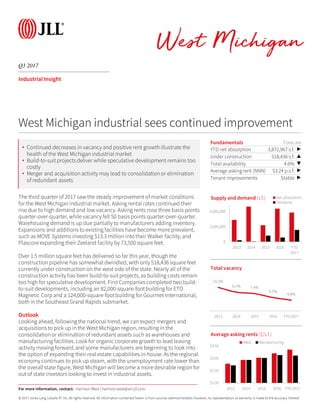

- 1. © 2017 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemedreliable; however, no representation or warranty is made to the accuracy thereof. Q3 2017 West Michigan Industrial Insight The third quarter of 2017 saw the steady improvement of market conditions for the West Michigan industrial market. Asking rental rates continued their rise due to high demand and low vacancy. Asking rents rose three basis points quarter-over-quarter, while vacancy fell 50 basis points quarter-over-quarter. Warehousing demand is up due partially to manufacturers adding inventory. Expansions and additions to existing facilities have become more prevalent, such as MOVE Systems investing $13.3 million into their Walker facility, and Plascore expanding their Zeeland facility by 73,500 square feet. Over 1.5 million square feet has delivered so far this year, though the construction pipeline has somewhat dwindled, with only 518,436 square feet currently under construction on the west side of the state. Nearly all of the construction activity has been build-to-suitprojects, as building costs remain too high for speculative development. First Companies completed two build- to-suit developments, including an 82,000-square-footbuilding for ETO Magnetic Corp and a 124,000-square-footbuilding for Gourmet International, both in the Southeast Grand Rapids submarket. Outlook Looking ahead, following the national trend, we can expect mergers and acquisitions to pick up in the West Michigan region, resulting in the consolidationor elimination of redundant assets such as warehouses and manufacturing facilities. Look for organic corporate growth to lead leasing activity moving forward, and some manufacturers are beginning to look into the option of expanding their real estate capabilities in-house. As the regional economy continues to pick up steam, with the unemployment rate lower than the overall state figure, West Michigan will become a more desirable region for out of state investors looking to invest in industrial assets. Fundamentals Forecast YTD net absorption 3,872,967 s.f. ▶ Under construction 518,436 s.f. ▲ Total availability 4.6% ▼ Average asking rent (NNN) $3.24 p.s.f. ▶ Tenant improvements Stable ▶ 0 2,000,000 4,000,000 2013 2014 2015 2016 YTD 2017 Supply and demand (s.f.) Net absorption Deliveries West Michigan industrial sees continued improvement 10.1% 8.1% 7.4% 5.7% 4.6% 2013 2014 2015 2016 YTD 2017 Total vacancy For more information, contact: Harrison West | harrison.west@am.jll.com • Continued decreases in vacancy and positive rent growth illustrate the health of the West Michigan industrial market • Build-to-suit projects deliver while speculative development remains too costly • Merger and acquisitionactivity may lead to consolidationor elimination of redundant assets $2.00 $2.50 $3.00 $3.50 2013 2014 2015 2016 YTD 2017 Average asking rents ($/s.f.) W&D Manufacturing

- 2. © 2017 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemedreliable; however, no representation or warranty is made to the accuracy thereof. Q3 2017 West Michigan Industrial Statistics For more information, contact: Harrison West | harrison.west@am.jll.com Inventory (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Total availability (s.f.) Total availability (%) Average total asking rent ($ p.s.f.) YTD completions (s.f.) Under construction (s.f.) Market Totals Warehouse & Distribution 97,895,241 2,143,904 2.2% 5,697,883 5.8% $3.35 1,171,512 438,000 Manufacturing 130,834,990 1,729,063 1.3% 4,745,719 3.6% $3.11 390,000 80,436 Totals 228,730,231 3,872,967 1.7% 10,443,602 4.6% $3.24 1,561,512 518,436 Flex 10,645,240 13,734 0.1% 577,970 5.4% $5.08 46,300 0 Northeast Grand Rapids Warehouse & Distribution 6,365,435 347,824 5.5% 116,186 1.8% $3.04 0 0 Manufacturing 7,955,299 37,121 0.5% 48,122 0.6% $3.49 0 0 Totals 14,320,734 384,945 2.7% 164,308 1.1% $3.17 0 0 Flex 266,671 4,169 1.6% 0 0.0% NA 0 0 Northwest Grand Rapids Warehouse & Distribution 8,422,513 599,744 7.1% 550,683 6.5% $3.39 343,483 0 Manufacturing 12,426,324 639,273 5.1% 362,025 2.9% $3.55 0 0 Totals 20,848,837 1,239,017 5.9% 912,708 4.4% $3.45 343,483 0 Flex 1,169,050 0 0.0% 0 0.0% NA 0 0 Southeast Grand Rapids Warehouse & Distribution 30,967,328 -210 0.0% 1,746,409 5.6% $3.37 391,490 357,000 Manufacturing 28,688,224 1,114,722 3.9% 660,472 2.3% $3.55 240,000 0 Totals 59,655,552 1,114,512 1.9% 2,406,881 4.0% $3.42 631,490 357,000 Flex 3,571,213 149,637 4.2% 45,365 1.3% $6.75 0 0 Southwest Grand Rapids Warehouse & Distribution 13,262,529 408,966 3.1% 144,370 1.1% $4.82 116,680 81,000 Manufacturing 28,001,012 227,103 0.8% 144,370 0.5% $3.66 0 0 Totals 41,263,541 636,069 1.5% 288,740 0.7% $4.24 116,680 81,000 Flex 809,872 15,000 1.9% 800 0.1% $4.75 0 0 Southwest Michigan Warehouse & Distribution 18,223,949 560,898 3.1% 2,615,306 14.4% $3.14 85,742 0 Manufacturing 24,154,440 -187,677 -0.8% 2,008,497 8.3% $3.44 0 0 Totals 42,378,389 373,221 0.9% 4,623,803 10.9% $3.27 85,742 0 Flex 2,904,964 -33,773 -1.2% 339,308 11.7% $4.06 46,300 0 West Shore Warehouse & Distribution 20,653,487 226,682 1.1% 524,929 2.5% $3.94 234,117 0 Manufacturing 29,609,691 -101,479 -0.3% 1,522,233 5.1% $2.32 150,000 80,436 Totals 50,263,178 125,203 0.2% 2,047,162 4.1% $2.74 384,117 80,436 Flex 1,923,470 -121,299 -6.3% 192,497 10.0% $6.50 0 0