JLL West Michigan Industrial Insight & Statistics - Q2 2018

•

0 likes•11 views

Conditions remain strong in the West Michigan industrial market. Vacancy currently sits at 3.9 percent, as over 1.1 million square feet has been absorbed so far in 2018. We continue to see positive rent growht, driven by compressed vacancies and high demand still in the market. Spaces have been leasing fast, and buildings that are for sale are not on the market for long.

Report

Share

Report

Share

Download to read offline

Recommended

JLL West Michigan Industrial Insight & Statistics - Q1 2018

Conditions in the West Michigan industrial market continue improving. Vacancy has fallen yet again to 3.7 percent, dropping 1.4 percent year-over-year. Average asking rents are currently $3.42 per square foot, having risen by 19 cents over the same period. Over 1.7 million square feet was absorbed in West Michigan during the first quarter.

JLL West Michigan Industrial Insight & Statistics - Q4 2019

The fourth quarter brought a slowdown to the West Michigan industrial market. Vacancies have risen 70 basis points year-over-year and appear to level off at 4.1 percent. Rent growth has also slowed, as average asking rents market-wide have dropped by 3.7 percent year-over-year. While the market has cooled somewhat, construction activity in the region remains robust.

JLL West Michigan Industrial Insight & Statistics - Q3 2019

While conditions in the West Michigan industrial market have remained stable in the third quarter, both vacancies and rent growth have leveled off this year. Market-wide vacancy is currently 3.7 percent, illustrating how tight the market is, and average asking rents have held steady since the beginning of the year, currently coming in at $3.45 per square foot.

JLL West Michigan Industrial Insight & Statistics - Q4 2018

In the fourth quarter, total vacancy fell ten basis points to 3.4 percent, while average asking rents grew by 3.6 percent and currently come in at $3.73 per square foot across the region. Average asking rents have increased 13.7 percent year-over-year, illustrating just how big of a spike there has been in asking rents over the past twelve months.

JLL West Michigan Industrial Insight & Statistics - Q1 2019

Following a significant spike in asking rents at the end of last year, average asking rents have returned to normalcy, coming in at $3.42 per square foot, which is flat year-over-year. Vacancy fell ten basis points in the first quarter as almost 413,000 square feet of space was absorbed market-wide.

JLL West Michigan Industrial Insight & Statistics - Q2 2019

The second quarter brought a continuation of the positive trends seen in the West Michigan market over the past year, but things have slowed slightly from the recent torrid pace. Vacancies have leveled off at 3.6 percent, representing a deceleration of the steady downward trend seen over the past few years...

JLL West Michigan Industrial Insight & Statistics - Q3 2018

The third quarter of 2018 was another positive period for the West Michigan industrial market. Vacancy fell by 40 basis points quarter-over-quarter, as 628,225 square feet of space was absorbed, while rent growth continued yet again, with average asking rents increasing by 2.3 percent over the same period. Current average rents are $3.60 per-square-foot, while vacancy is at a staggering 3.5 percent across the region.

JLL West Michigan Industrial Insight & Statistics - Q3 2017

The third quarter of 2017 saw the steady improvement of market conditions for the West Michigan industrial market. Asking rental rates continued their rise due to high demand and low vacancy. Asking rents rose three basis points quarter-over-quarter, while vacancy fell 50 basis points quarter-over-quarter.

Recommended

JLL West Michigan Industrial Insight & Statistics - Q1 2018

Conditions in the West Michigan industrial market continue improving. Vacancy has fallen yet again to 3.7 percent, dropping 1.4 percent year-over-year. Average asking rents are currently $3.42 per square foot, having risen by 19 cents over the same period. Over 1.7 million square feet was absorbed in West Michigan during the first quarter.

JLL West Michigan Industrial Insight & Statistics - Q4 2019

The fourth quarter brought a slowdown to the West Michigan industrial market. Vacancies have risen 70 basis points year-over-year and appear to level off at 4.1 percent. Rent growth has also slowed, as average asking rents market-wide have dropped by 3.7 percent year-over-year. While the market has cooled somewhat, construction activity in the region remains robust.

JLL West Michigan Industrial Insight & Statistics - Q3 2019

While conditions in the West Michigan industrial market have remained stable in the third quarter, both vacancies and rent growth have leveled off this year. Market-wide vacancy is currently 3.7 percent, illustrating how tight the market is, and average asking rents have held steady since the beginning of the year, currently coming in at $3.45 per square foot.

JLL West Michigan Industrial Insight & Statistics - Q4 2018

In the fourth quarter, total vacancy fell ten basis points to 3.4 percent, while average asking rents grew by 3.6 percent and currently come in at $3.73 per square foot across the region. Average asking rents have increased 13.7 percent year-over-year, illustrating just how big of a spike there has been in asking rents over the past twelve months.

JLL West Michigan Industrial Insight & Statistics - Q1 2019

Following a significant spike in asking rents at the end of last year, average asking rents have returned to normalcy, coming in at $3.42 per square foot, which is flat year-over-year. Vacancy fell ten basis points in the first quarter as almost 413,000 square feet of space was absorbed market-wide.

JLL West Michigan Industrial Insight & Statistics - Q2 2019

The second quarter brought a continuation of the positive trends seen in the West Michigan market over the past year, but things have slowed slightly from the recent torrid pace. Vacancies have leveled off at 3.6 percent, representing a deceleration of the steady downward trend seen over the past few years...

JLL West Michigan Industrial Insight & Statistics - Q3 2018

The third quarter of 2018 was another positive period for the West Michigan industrial market. Vacancy fell by 40 basis points quarter-over-quarter, as 628,225 square feet of space was absorbed, while rent growth continued yet again, with average asking rents increasing by 2.3 percent over the same period. Current average rents are $3.60 per-square-foot, while vacancy is at a staggering 3.5 percent across the region.

JLL West Michigan Industrial Insight & Statistics - Q3 2017

The third quarter of 2017 saw the steady improvement of market conditions for the West Michigan industrial market. Asking rental rates continued their rise due to high demand and low vacancy. Asking rents rose three basis points quarter-over-quarter, while vacancy fell 50 basis points quarter-over-quarter.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2019

- Construction of new industrial developments is increasing in the Pittsburgh region, concentrated in the West and Beaver County submarkets, with over 1.3 million square feet under construction.

- While net absorption for the year remains low due to low vacancy rates, absorption is expected to increase as new developments deliver. Industrial leasing activity is shifting towards new construction projects.

- JobsOhio provided a $30 million grant to help advance plans for a potential second petrochemical facility in Belmont County, Ohio, which could further drive demand for industrial and distribution space in the region.

JLL Detroit Industrial Insight & Statistics - Q4 2019

Detroit’s industrial market ended 2019 on a strong note, as nearly 1.5 million square feet was absorbed in the fourth quarter. Average asking rents have grown by 4.4 percent year-over-year, while vacancies have leveled off over the same period. Leasing activity was healthy in the fourth quarter with some of the more significant deals being Piston Automotive renewing their lease for 256,100 square feet in Redford and Ternes Packaging taking 303,000 square feet in Pontiac.

JLL - Tampa Bay 2018 Q2 Industrial Outlook

- Net absorption in the second quarter slowed compared to the first quarter but remained positive, helping to keep overall vacancy rates steady near 4.0%.

- Deliveries of new industrial space matched absorption levels year-to-date, which is unusual and could help alleviate tight availability conditions if deliveries continue.

- Polk County saw the largest absorption gains led by two large moves into a newly delivered distribution center in Auburndale.

JLL - Tampa Bay 2018 Q1 Industrial Outlook

The industrial real estate market in Tampa Bay started 2018 strongly, with positive net absorption and declining vacancy. However, a lack of large blocks of available space may limit activity over the year. Nearly 4.5 million square feet of new construction is underway, much of it pre-leased, which will help meet demand. Asking rental rates increased by 0.7% in the first quarter due to tight market conditions and new deliveries are expected to further increase rents throughout 2018. The East Tampa submarket is seeing the largest amount of new development.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2021

There was a slowing of Industrial leasing activity for the summer, but as Amazon proposes to expand their footprint, they have introduced a new type of warehouse to the region.

JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

Industrial developers and investors are in touch with the pulse of the industrial marketplace and are taking aggressive steps to meet the potential increase in demand for modern, Class A space.

JLL Pittsburgh Industrial Insight & Statistics - Q1 2017

- The supply of natural gas has saturated the local market and the need for additional pipeline to transport the supply has become priority.

- Warehouse and distribution demand remains steady, but commitments from large users have yet to surface in 2017.

- Shell continues to buy more properties and land for the pipeline to the cracker plant, all while obtaining local approval to build the plant.

JLL Pittsburgh Industrial Insight & Statistics - Q4 2021

Pittsburgh's industrial market experienced one of the highest absorption years in the region's history driven by increased consumer demand in goods.

Austin’s industrial market closes 2018 with new buildings and high absorption

Austin’s industrial market closes 2018 with new buildings and high absorptionColliers International | Houston

Austin's industrial market posted positive net absorption of 539,820 square feet in Q4 2018, bringing the annual total to 1,222,219 square feet. Rental rates increased both quarterly and annually, with the average citywide rate reaching $10.98 per square foot. New construction remained active with 11 buildings delivered and 14 new projects commenced, totaling over 861,000 square feet added in the quarter. The industrial market outlook for Q1 2019 includes over 1.3 million square feet of space expected to deliver and over 330,000 square feet of pre-leased space across 10 blocks over 10,000 square feet.JLL Grand Rapids Office Insight & Statistics - Q4 2017

Grand Rapids’ office market saw healthy growth in the fourth quarter of 2017 as rents continue to increase and vacancies steadily decline. The average asking rent in the Grand Rapids market is now $17.84 per square foot while overall vacancy sits at 12.9 percent. New construction has begun and other projects continue to fill the pipeline.

JLL Pittsburgh Industrial Insight & Statistics - Q1 2021

Pittsburgh's industrial market started 2021 strong with nearly 800,000 square feet of positive absorption and 1.7 million square feet under construction. Several new construction projects were announced in the first quarter, including a 280,000 square foot Amazon distribution facility. Developers are optimistic about speculative projects due to limited supply and quick lease-up times. Significant lease transactions in the first quarter contributed to an overall decline in vacancy to 6.1%. The industrial market is well positioned to continue growing in 2021 as development aims to match high demand and the economy recovers from the pandemic.

JLL Pittsburgh Office Insight & Statistics - Q3 2021

The document summarizes the Q3 2021 real estate market report for Pittsburgh, Pennsylvania. It finds that new leasing is slowly recovering as more companies begin returning to offices, representing 81% of 2020 levels. However, net absorption remains negative as the recovery remains gradual. Asking rental rates have increased slightly by 2.4% year-over-year as new construction delivers at higher prices. Tenants continue pursuing newer, higher-quality buildings in desirable locations like the Strip District. New construction has lagged pre-pandemic levels, which will constrain supply growth over the next year.

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

Pittsburgh's industrial market was strong and steady going into the new decade. The COVID-19 outbreak caused a pause in development, but Pittsburgh is positioned to rebound.

JLL Grand Rapids Office Insight & Statistics - Q1 2018

After a few years of steady growth, rents seems to have plateaued, while vacancies have stabilized. Conditions are likely to remain steady until the new Class A supply begins to deliver. The west side remains a hot market for both leasing and development activity, and we expect to see some tenants leaving downtown to explore opportunities in cheaper, trendier submarkets.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

Pittsburgh industrial market vacancy rates are declining and asking rents are increasing. New speculative construction reveals a healthy investor appetite in a growing market.

JLL Cleveland Industrial Outlook: Q3 2018

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

JLL Pittsburgh Industrial Insight & Statistics - Q4 2019

Pittsburgh continues proving that it is a viable location for distribution as Amazon grows their industrial presence in the region.

Q1 2018 | Fort Bend | Submarket Snapshot

The Fort Bend commercial real estate market saw declines in the office sector in Q1 2018, with negative net absorption and increased vacancy. The medical office sector also experienced higher vacancy rates due to new construction deliveries. Industrial vacancy rates rose slightly while rental rates increased. Retail saw positive net absorption and higher rental rates during the quarter. Overall vacancy rates increased in office and medical office but decreased for retail.

JLL Grand Rapids Office Insight & Statistics - Q3 2018

Overall vacancy in the Grand Rapids metro is currently 10.2 percent, down 2.1 percent year-over-year. Asking rents downtown seem to have leveled off this year, consistently hovering around $20.00 per-square-foot each quarter and currently sitting at $20.45 per-square-foot. There are 174,000 square feet of office space under construction, most of which is in the Warner Building development, set to deliver in early 2019.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2020

The Pittsburgh market has felt the effects of COVID in other property types, but industrial continues to move forward due to e-commerce and distribution demand.

@JLL Q4 Houston Industrial Insight & Statistics

- Big-box demand continued in Houston with population-driven users like Costco and Ikea making long-term commitments through major land purchases and planned developments.

- While northern submarkets led leasing activity earlier in the year, the southeast submarket captured over 50% of deals in Q4 2018, including several large expansions by distribution companies.

- New industrial supply slightly outpaced demand in 2018, causing vacancy to rise slightly from 4.9% to 5.1%, but this small increase does not threaten Houston's landlord-favorable market conditions.

JLL Houston Industrial Report Q4

- Big-box demand continued in Houston in Q4 2018, with Costco purchasing 150 acres and Ikea acquiring 164 acres for large projects.

- The Southeast submarket captured over 50% of leasing activity in Q4, with several large expansions by distribution companies.

- While demand outpaced supply, new deliveries in 2018 finished ahead of net absorption, causing vacancy to rise slightly from 4.9% to 5.1%.

More Related Content

What's hot

JLL Pittsburgh Industrial Insight & Statistics - Q3 2019

- Construction of new industrial developments is increasing in the Pittsburgh region, concentrated in the West and Beaver County submarkets, with over 1.3 million square feet under construction.

- While net absorption for the year remains low due to low vacancy rates, absorption is expected to increase as new developments deliver. Industrial leasing activity is shifting towards new construction projects.

- JobsOhio provided a $30 million grant to help advance plans for a potential second petrochemical facility in Belmont County, Ohio, which could further drive demand for industrial and distribution space in the region.

JLL Detroit Industrial Insight & Statistics - Q4 2019

Detroit’s industrial market ended 2019 on a strong note, as nearly 1.5 million square feet was absorbed in the fourth quarter. Average asking rents have grown by 4.4 percent year-over-year, while vacancies have leveled off over the same period. Leasing activity was healthy in the fourth quarter with some of the more significant deals being Piston Automotive renewing their lease for 256,100 square feet in Redford and Ternes Packaging taking 303,000 square feet in Pontiac.

JLL - Tampa Bay 2018 Q2 Industrial Outlook

- Net absorption in the second quarter slowed compared to the first quarter but remained positive, helping to keep overall vacancy rates steady near 4.0%.

- Deliveries of new industrial space matched absorption levels year-to-date, which is unusual and could help alleviate tight availability conditions if deliveries continue.

- Polk County saw the largest absorption gains led by two large moves into a newly delivered distribution center in Auburndale.

JLL - Tampa Bay 2018 Q1 Industrial Outlook

The industrial real estate market in Tampa Bay started 2018 strongly, with positive net absorption and declining vacancy. However, a lack of large blocks of available space may limit activity over the year. Nearly 4.5 million square feet of new construction is underway, much of it pre-leased, which will help meet demand. Asking rental rates increased by 0.7% in the first quarter due to tight market conditions and new deliveries are expected to further increase rents throughout 2018. The East Tampa submarket is seeing the largest amount of new development.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2021

There was a slowing of Industrial leasing activity for the summer, but as Amazon proposes to expand their footprint, they have introduced a new type of warehouse to the region.

JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

Industrial developers and investors are in touch with the pulse of the industrial marketplace and are taking aggressive steps to meet the potential increase in demand for modern, Class A space.

JLL Pittsburgh Industrial Insight & Statistics - Q1 2017

- The supply of natural gas has saturated the local market and the need for additional pipeline to transport the supply has become priority.

- Warehouse and distribution demand remains steady, but commitments from large users have yet to surface in 2017.

- Shell continues to buy more properties and land for the pipeline to the cracker plant, all while obtaining local approval to build the plant.

JLL Pittsburgh Industrial Insight & Statistics - Q4 2021

Pittsburgh's industrial market experienced one of the highest absorption years in the region's history driven by increased consumer demand in goods.

Austin’s industrial market closes 2018 with new buildings and high absorption

Austin’s industrial market closes 2018 with new buildings and high absorptionColliers International | Houston

Austin's industrial market posted positive net absorption of 539,820 square feet in Q4 2018, bringing the annual total to 1,222,219 square feet. Rental rates increased both quarterly and annually, with the average citywide rate reaching $10.98 per square foot. New construction remained active with 11 buildings delivered and 14 new projects commenced, totaling over 861,000 square feet added in the quarter. The industrial market outlook for Q1 2019 includes over 1.3 million square feet of space expected to deliver and over 330,000 square feet of pre-leased space across 10 blocks over 10,000 square feet.JLL Grand Rapids Office Insight & Statistics - Q4 2017

Grand Rapids’ office market saw healthy growth in the fourth quarter of 2017 as rents continue to increase and vacancies steadily decline. The average asking rent in the Grand Rapids market is now $17.84 per square foot while overall vacancy sits at 12.9 percent. New construction has begun and other projects continue to fill the pipeline.

JLL Pittsburgh Industrial Insight & Statistics - Q1 2021

Pittsburgh's industrial market started 2021 strong with nearly 800,000 square feet of positive absorption and 1.7 million square feet under construction. Several new construction projects were announced in the first quarter, including a 280,000 square foot Amazon distribution facility. Developers are optimistic about speculative projects due to limited supply and quick lease-up times. Significant lease transactions in the first quarter contributed to an overall decline in vacancy to 6.1%. The industrial market is well positioned to continue growing in 2021 as development aims to match high demand and the economy recovers from the pandemic.

JLL Pittsburgh Office Insight & Statistics - Q3 2021

The document summarizes the Q3 2021 real estate market report for Pittsburgh, Pennsylvania. It finds that new leasing is slowly recovering as more companies begin returning to offices, representing 81% of 2020 levels. However, net absorption remains negative as the recovery remains gradual. Asking rental rates have increased slightly by 2.4% year-over-year as new construction delivers at higher prices. Tenants continue pursuing newer, higher-quality buildings in desirable locations like the Strip District. New construction has lagged pre-pandemic levels, which will constrain supply growth over the next year.

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

Pittsburgh's industrial market was strong and steady going into the new decade. The COVID-19 outbreak caused a pause in development, but Pittsburgh is positioned to rebound.

JLL Grand Rapids Office Insight & Statistics - Q1 2018

After a few years of steady growth, rents seems to have plateaued, while vacancies have stabilized. Conditions are likely to remain steady until the new Class A supply begins to deliver. The west side remains a hot market for both leasing and development activity, and we expect to see some tenants leaving downtown to explore opportunities in cheaper, trendier submarkets.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

Pittsburgh industrial market vacancy rates are declining and asking rents are increasing. New speculative construction reveals a healthy investor appetite in a growing market.

JLL Cleveland Industrial Outlook: Q3 2018

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

JLL Pittsburgh Industrial Insight & Statistics - Q4 2019

Pittsburgh continues proving that it is a viable location for distribution as Amazon grows their industrial presence in the region.

Q1 2018 | Fort Bend | Submarket Snapshot

The Fort Bend commercial real estate market saw declines in the office sector in Q1 2018, with negative net absorption and increased vacancy. The medical office sector also experienced higher vacancy rates due to new construction deliveries. Industrial vacancy rates rose slightly while rental rates increased. Retail saw positive net absorption and higher rental rates during the quarter. Overall vacancy rates increased in office and medical office but decreased for retail.

JLL Grand Rapids Office Insight & Statistics - Q3 2018

Overall vacancy in the Grand Rapids metro is currently 10.2 percent, down 2.1 percent year-over-year. Asking rents downtown seem to have leveled off this year, consistently hovering around $20.00 per-square-foot each quarter and currently sitting at $20.45 per-square-foot. There are 174,000 square feet of office space under construction, most of which is in the Warner Building development, set to deliver in early 2019.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2020

The Pittsburgh market has felt the effects of COVID in other property types, but industrial continues to move forward due to e-commerce and distribution demand.

What's hot (20)

JLL Pittsburgh Industrial Insight & Statistics - Q3 2019

JLL Pittsburgh Industrial Insight & Statistics - Q3 2019

JLL Detroit Industrial Insight & Statistics - Q4 2019

JLL Detroit Industrial Insight & Statistics - Q4 2019

JLL Pittsburgh Industrial Insight & Statistics - Q3 2021

JLL Pittsburgh Industrial Insight & Statistics - Q3 2021

JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

JLL Pittsburgh Industrial Insight & Statistics - Q1 2017

JLL Pittsburgh Industrial Insight & Statistics - Q1 2017

JLL Pittsburgh Industrial Insight & Statistics - Q4 2021

JLL Pittsburgh Industrial Insight & Statistics - Q4 2021

Austin’s industrial market closes 2018 with new buildings and high absorption

Austin’s industrial market closes 2018 with new buildings and high absorption

JLL Grand Rapids Office Insight & Statistics - Q4 2017

JLL Grand Rapids Office Insight & Statistics - Q4 2017

JLL Pittsburgh Industrial Insight & Statistics - Q1 2021

JLL Pittsburgh Industrial Insight & Statistics - Q1 2021

JLL Pittsburgh Office Insight & Statistics - Q3 2021

JLL Pittsburgh Office Insight & Statistics - Q3 2021

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Industrial Insight & Statistics - Q1 2020

JLL Grand Rapids Office Insight & Statistics - Q1 2018

JLL Grand Rapids Office Insight & Statistics - Q1 2018

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

JLL Pittsburgh Industrial Insight & Statistics - Q4 2019

JLL Pittsburgh Industrial Insight & Statistics - Q4 2019

JLL Grand Rapids Office Insight & Statistics - Q3 2018

JLL Grand Rapids Office Insight & Statistics - Q3 2018

JLL Pittsburgh Industrial Insight & Statistics - Q3 2020

JLL Pittsburgh Industrial Insight & Statistics - Q3 2020

Similar to JLL West Michigan Industrial Insight & Statistics - Q2 2018

@JLL Q4 Houston Industrial Insight & Statistics

- Big-box demand continued in Houston with population-driven users like Costco and Ikea making long-term commitments through major land purchases and planned developments.

- While northern submarkets led leasing activity earlier in the year, the southeast submarket captured over 50% of deals in Q4 2018, including several large expansions by distribution companies.

- New industrial supply slightly outpaced demand in 2018, causing vacancy to rise slightly from 4.9% to 5.1%, but this small increase does not threaten Houston's landlord-favorable market conditions.

JLL Houston Industrial Report Q4

- Big-box demand continued in Houston in Q4 2018, with Costco purchasing 150 acres and Ikea acquiring 164 acres for large projects.

- The Southeast submarket captured over 50% of leasing activity in Q4, with several large expansions by distribution companies.

- While demand outpaced supply, new deliveries in 2018 finished ahead of net absorption, causing vacancy to rise slightly from 4.9% to 5.1%.

JLL Houston Industrial Report Q4

- Big-box demand continued in Houston in Q4 2018, with Costco purchasing 150 acres and Ikea acquiring 164 acres for large projects.

- The Southeast submarket captured over 50% of leasing activity in Q4, with several large expansions by distribution companies.

- While demand outpaced supply, new deliveries in 2018 finished ahead of net absorption, causing vacancy to rise slightly from 4.9% to 5.1%.

JLL Q4 Houston Industrial Insight

- Big-box demand continued in Houston in Q4 2018, with Costco purchasing 150 acres and Ikea acquiring 164 acres for large projects.

- The Southeast submarket captured over 50% of leasing activity in Q4, with several large expansions by distribution companies.

- While demand outpaced supply, new deliveries in 2018 finished ahead of net absorption, causing vacancy to rise slightly from 4.9% to 5.1%.

JLL West Michigan Industrial Insight & Statistics - Q1 2020

While West Michigan market has seen historically low vacancy figures and impressive rent growth the past few years, we should expect things to slow in Q2 as the effects of the COVID-19 pandemic begin to take hold. Market fundamentals remain stable; however, given the current uncertainty, we expect leasing and sales activity to slow considerably in the near term as occupiers evaluate their current and future space needs.

Houston industrial report suite q1 2018

Take a look into the first quarter of 2018 market highlights in the Houston area regarding Industrial Insight and Market Statistics

JLL Cleveland Industrial Outlook: Q4 2018

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Industrial Outlook: Q4 2018

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Industrial Outlook Q3 2019

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction, and employment.

JLL Cleveland Industrial Outlook: Q3 2019

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Industrial Outlook: Q1 2019

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

JLL Detroit Industrial Insight & Statistics - Q1 2019

For the remainder of 2019, we expect the excellent fundamentals to remain. Rent growth should continue albeit at a slower pace than seen in previous quarters. The construction pipeline is healthy with over 3.1 million in development.

JLL Cleveland Industrial Outlook: Q4 2017

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Industrial Outlook Q4 2019

An in-depth look at the Cleveland industrial market. Analysis includes leasing, sales, construction and employment.

JLL St. Louis Industrial Outlook Q3 2019

- Build-to-suit projects continue to dominate new construction in the St. Louis industrial market, accounting for over 50% of new starts in Q3 2019.

- Vacancy rates increased to 4.9% as several large speculative buildings with available space are expected to deliver by the end of the year.

- Employment growth in St. Louis remains strong, outpacing national growth, driven largely by growth in the industrial and manufacturing sectors.

JLL Detroit Industrial Insight & Statistics - Q4 2017

Overall vacancy fell by six basis points to 5.7 percent, while average asking rents rose by ten cents to $4.98 per square foot. In total, 9.6 million square feet was absorbed in 2017. The total construction pipeline fell just shy of topping 4.0 million square feet, while 1.7 million square feet delivered throughout the year.

JLL Pittsburgh Industrial Insight & Statistics - Q2 2019

The document discusses industrial real estate trends in the Pittsburgh region in Q2 2019. It notes that Nord-Lock committed to a 125,000 square foot build-to-suit in Clinton Commerce Park, continuing development in the West submarket. It also discusses speculation around redevelopment of the former Sears Outlet property in the Downtown submarket. Industrial sales volume in the region has reached nearly $50 million for the first half of 2019, with all transactions outside Downtown.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

Similar to JLL West Michigan Industrial Insight & Statistics - Q2 2018 (20)

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL Detroit Industrial Insight & Statistics - Q1 2019

JLL Detroit Industrial Insight & Statistics - Q1 2019

JLL Detroit Industrial Insight & Statistics - Q4 2017

JLL Detroit Industrial Insight & Statistics - Q4 2017

JLL Pittsburgh Industrial Insight & Statistics - Q2 2019

JLL Pittsburgh Industrial Insight & Statistics - Q2 2019

Recently uploaded

Why is Revit MEP Outsourcing considered an as good option for construction pr...

Outsourcing MEP modeling services require effective collaboration and coordination amongst multiple engineering trades. The engineers and the designers often change the details of the MEP projects, but the work of Revit MEP drafting services is having the master plan and model of the complete project. To have proper coordination and installation, there is a need to execute the project effectively. Hence, the work of Revit family creation facilitates the MEP engineers.

Living in an UBER World - June '24 Sales Meeting

June 2024 Lancaster County Sales Meeting for Berkshire Hathaway HomeServices Homesale Realty covering the following topics: 1. VA Suspends Buyer Agent Payment Plan (article), 2. Frequently Used Terms in title, 3. Zillow Showcase Overview, 4. QuickBuy commission promotion, 5. Documenting Cooperative Compensation, 6. NAR's Code of Ethics - Mass Media Solicitations, 7. Is it really cheaper to rent? 8. Do's and Don't's when Terminating the Agreement of Sale, 9. Living in an UBER World

Anilesh Ahuja Pioneering a Paradigm Shift in Real Estate Success.pptx

Anilesh Ahuja journey is a testament to the power of vision, resilience, and unwavering determination. As a visionary leader, he continues to inspire and empower others to dream big and challenge the status quo. His legacy extends far beyond the realm of real estate, leaving an indelible mark on the industry and the world at large.

Signature Global TITANIUM SPR | 3.5 & 4.5BHK High rise Apartments in Gurgaon

Signature Global TITANIUM SPR launched a high rise apartments in Gurgaon . In this project Signature Global offers 3.5 & 4.5 BHK high rise Apartment at sector 71 Gurgaon SPR Road. Signature Global Titanium SPR is IGBC Gold certified, a testament to our commitment to sustainability.

Stark Builders: Where Quality Meets Craftsmanship!

At Stark Builders our vision is to redefine the renovation experience by combining both stunning design and high quality construction skills. We believe that by delivering both these key aspects together we are able to achieve incredible results for our clients and ensure every project reflects their vision and enhances their lifestyle.

Although we are not all related by blood we have created a team of highly professional and hardworking individuals who share the common goal of delivering beautiful and functional renovated spaces. Our tight nit team are able to work together in a way where we pour our passion into each and every project as we have a love for what we do. Building is our life.

Floople Real Estate Market in the UK - Current Trends and Future Prospects

Housing prices, rental rates, market demand, and investment trends

Sunrise Infra Properties Company Profile Pradeep.pdf

COmpany Profile of SunRise Infra Properties Pvt. Ltd.

SVN Live 6.17.24 Weekly Property Broadcast

The SVN® organization shares a portion of their new weekly listings via their SVN Live® Weekly Property Broadcast. Visit https://svn.com/svn-live/ if you would like to attend our weekly call, which we open up to the brokerage community.

Future of andhra pradesh real estate.pdf

Andhra Pradesh, known for its strategic location on the southeastern coast of India, has emerged as a key player in India’s industrial landscape. Over the decades, the state has witnessed significant growth across various sectors,

Listing Turkey - Piyalepasa Istanbul Catalog

We are working around the clock to transform a long-time dream into reality. As a result, Piyalepasa Istanbul will be the largest privately developed urban regeneration project in Turkey.

THE NEIGHBORHOOD WE HAVE BEEN LONGING FOR IS COMING TO LIFE

The good old days of the Piyalepasa neighborhood are being brought back to life with Piyalepasa Istanbul houses, residences, offices, hotels and a pedestrianized shopping avenue.

The wide streets of this 82.000 square meter development conveniently face the main boulevard in a prime Beyoglu location. “Piyalepaşa İstanbul” stands out as the only project designed to offer a neighborhood lifestyle, complete with its grocers, bagel sellers and greengrocer. Piyalepasa Istanbul has all the values to make it an authentic neighborhood, our very own community.

A NEIGHBORHOOD FULL OF LIFE, IN THE HEART OF THE CITY!

“Piyalepaşa İstanbul” is a “mixed-use” concept containing all the elements for a vibrant social life with houses, residences, offices, hotels and high street shopping.

“Piyalepaşa İstanbul” will take the liveliness of Istanbul into its heart. The elegant sparkle of Nisantasi, the young and colorful Besiktas, the variety and multicultural heritage of Istiklal Street will all be contained within the streets of this neighborhood.

“Piyalepaşa İstanbul” bears traces of the most beautiful examples of Turkish architecture from the Seljuks to the Ottomans and from Anatolia to Rumelia. With its graded facades, wide eaves, bay windows, pools, and interior courtyard systems, it offers a new living space without disrupting the city’s silhouette and neighborhood.

“Piyalepaşa İstanbul” is the new attraction of this splendid city.

TO BE AT THE CENTER OF ISTANBUL… THIS IS REAL LUXURY!

With its proximity to D-100 highway, connecting roads and tunnels, “Piyalepaşa İstanbul” is only minutes away from Kabatas, Besiktas, the Golden Horn and Karakoy.

“Piyalepaşa İstanbul” is close to the prestigious new Istanbul Court House, a major hospital, the Perpa trade center and the city’s most lively neighborhoods. With its shuttle service to Okmeydani Metrobus station, Sishane and the Court House subway stations, “Piyalepaşa İstanbul” will provide you with the most convenient transport connections.

https://listingturkey.com/property/piyalepasa-istanbul/

Office Building for Sale - 2810 City View Drive, Madison, WI

36,778 sq. ft. building; Zoning: SE (Suburban Employment): The (SE) District allows numerous commercial site uses; Passenger elevator; Private and common restrooms; Fully sprinkled; Data center with a grounded floor and a specialized HVAC system; 60 KVA back-up generator; Building/pylon signage; Potential to purchase adjacent parcels; Sale Price: $4,413,360

Recently uploaded (11)

Why is Revit MEP Outsourcing considered an as good option for construction pr...

Why is Revit MEP Outsourcing considered an as good option for construction pr...

Anilesh Ahuja Pioneering a Paradigm Shift in Real Estate Success.pptx

Anilesh Ahuja Pioneering a Paradigm Shift in Real Estate Success.pptx

Signature Global TITANIUM SPR | 3.5 & 4.5BHK High rise Apartments in Gurgaon

Signature Global TITANIUM SPR | 3.5 & 4.5BHK High rise Apartments in Gurgaon

Stark Builders: Where Quality Meets Craftsmanship!

Stark Builders: Where Quality Meets Craftsmanship!

Floople Real Estate Market in the UK - Current Trends and Future Prospects

Floople Real Estate Market in the UK - Current Trends and Future Prospects

Sunrise Infra Properties Company Profile Pradeep.pdf

Sunrise Infra Properties Company Profile Pradeep.pdf

Office Building for Sale - 2810 City View Drive, Madison, WI

Office Building for Sale - 2810 City View Drive, Madison, WI

JLL West Michigan Industrial Insight & Statistics - Q2 2018

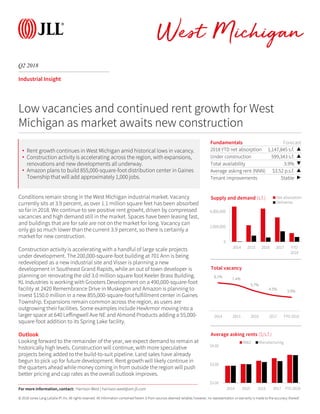

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q2 2018 West Michigan Industrial Insight Conditions remain strong in the West Michigan industrial market. Vacancy currently sits at 3.9 percent, as over 1.1 million square feet has been absorbed so far in 2018. We continue to see positive rent growht, driven by compressed vacancies and high demand still in the market. Spaces have been leasing fast, and buildings that are for sale are not on the market for long. Vacancy can only go so much lower than the current 3.9 percent, so there is certainly a market for new construction. Construction activity is accelerating with a handful of large scale projects under development. The 200,000-square-foot building at 701 Ann is being redeveloped as a new industrial site and Visser is planning a new development in Southeast Grand Rapids, while an out of town developer is planning on renovating the old 3.0 million square foot Keeler Brass Building. KL Industries is working with Grooters Development on a 490,000-square-foot facility at 2420 Remembrance Drive in Muskegon and Amazon is planning to invest $150.0 million in a new 855,000-square-foot fulfillment center in Gaines Township. Expansions remain common across the region, as users are outgrowing their facilities. Some examples include HexArmor moving into a larger space at 640 Leffingwell Ave NE and Almond Products adding a 55,000- square-foot addition to its Spring Lake facility. Outlook Looking forward to the remainder of the year, we expect demand to remain at historically high levels. Construction will continue, with more speculative projects being added to the build-to-suit pipeline. Land sales have already begun to pick up for future development. Rent growth will likely continue in the quarters ahead while money coming in from outside the region will push better pricing and cap rates as the overall outlook improves. Fundamentals Forecast 2018 YTD net absorption 1,147,845 s.f. ▲ Under construction 599,343 s.f. ▲ Total availability 3.9% ▼ Average asking rent (NNN) $3.52 p.s.f. ▲ Tenant improvements Stable ▶ 0 2,000,000 4,000,000 2014 2015 2016 2017 YTD 2018 Supply and demand (s.f.) Net absorption Deliveries Low vacancies and continued rent growth for West Michigan as market awaits new construction 8.1% 7.4% 5.7% 4.5% 3.9% 2014 2015 2016 2017 YTD 2018 Total vacancy For more information, contact: Harrison West | harrison.west@am.jll.com • Rent growth continues in West Michigan amid historical lows in vacancy. • Construction activity is accelerating across the region, with expansions, renovations and new developments all underway. • Amazon plans to build 855,000-square-foot distribution center in Gaines Township that will add approximately 1,000 jobs. $2.00 $3.00 $4.00 2014 2015 2016 2017 YTD 2018 Average asking rents ($/s.f.) W&D Manufacturing

- 2. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q2 2018 West Michigan Industrial Statistics For more information, contact: Harrison West | harrison.west@am.jll.com Inventory (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Total availability (s.f.) Total availability (%) Average total asking rent ($ p.s.f.) YTD completions (s.f.) Under construction (s.f.) Market Totals Warehouse & Distribution 105,493,287 813,458 0.8% 5,735,905 5.4% $3.52 558,278 563,343 Manufacturing 130,590,111 334,387 0.3% 3,423,874 2.6% $3.50 81,712 36,000 Totals 236,083,398 1,147,845 0.5% 9,159,779 3.9% $3.52 639,990 599,343 Flex 10,389,445 50,536 0.5% 445,672 4.3% $7.18 0 0 Northeast Grand Rapids Warehouse & Distribution 6,936,764 -8,374 -0.1% 142,880 2.1% $2.82 0 0 Manufacturing 7,818,787 7,191 0.1% 277,331 3.5% $3.64 0 0 Totals 14,755,551 -1,183 0.0% 420,211 2.8% $3.36 0 0 Flex 266,671 0 0.0% 0 0.0% $0.00 0 0 Northwest Grand Rapids Warehouse & Distribution 8,838,382 123,336 1.4% 360,503 4.1% $3.11 36,250 0 Manufacturing 12,268,413 73,743 0.6% 589,001 4.8% $3.29 0 0 Totals 21,106,795 197,079 0.9% 949,504 4.5% $3.22 36,250 0 Flex 1,166,957 0 0.0% 0 0.0% $0.00 0 0 Southeast Grand Rapids Warehouse & Distribution 32,147,753 -84,118 -0.3% 1,550,437 4.8% $3.42 441,028 0 Manufacturing 28,815,222 282,776 1.0% 538,216 1.9% $3.90 0 0 Totals 60,962,975 198,658 0.3% 2,088,653 3.4% $3.54 441,028 0 Flex 3,571,213 -16,225 -0.5% 40,631 1.1% $8.33 0 0 Southwest Grand Rapids Warehouse & Distribution 14,418,351 133,793 0.9% 260,900 1.8% $4.42 81,000 250,000 Manufacturing 28,098,273 49,586 0.2% 279,572 1.0% $4.06 0 0 Totals 42,516,624 183,379 0.4% 540,472 1.3% $4.23 81,000 250,000 Flex 809,872 2,294 0.3% 0 0.0% $0.00 0 0 Southwest Michigan Warehouse & Distribution 21,483,009 668,896 3.1% 2,913,962 13.6% $3.61 0 163,343 Manufacturing 24,118,216 525,043 2.2% 725,218 3.0% $3.40 0 36,000 Totals 45,601,225 1,193,939 2.6% 3,639,180 8.0% $3.57 0 199,343 Flex 2,651,262 46,429 1.8% 230,582 8.7% $7.50 0 0 West Shore Warehouse & Distribution 21,669,028 -20,075 -0.1% 507,223 2.3% $3.38 0 150,000 Manufacturing 29,471,200 -603,952 -2.0% 1,014,536 3.4% $3.30 81,712 0 Totals 51,140,228 -624,027 -1.2% 1,521,759 3.0% $3.33 81,712 150,000 Flex 1,923,470 18,038 0.9% 174,459 9.1% $6.50 0 0