JLL Grand Rapids Office Insight & Statistics - Q1 2018

•

0 likes•32 views

After a few years of steady growth, rents seems to have plateaued, while vacancies have stabilized. Conditions are likely to remain steady until the new Class A supply begins to deliver. The west side remains a hot market for both leasing and development activity, and we expect to see some tenants leaving downtown to explore opportunities in cheaper, trendier submarkets.

Report

Share

Report

Share

Download to read offline

Recommended

JLL Grand Rapids Office Insight & Statistics - Q2 2017

The west side of downtown has seen increased activity over the past few months, quickly becoming one of the city’s hottest areas. After seeing retail and multifamily move into the area, office leasing and development activity is seeing an uptick.

JLL Grand Rapids Office Insight & Statistics - Q3 2018

Overall vacancy in the Grand Rapids metro is currently 10.2 percent, down 2.1 percent year-over-year. Asking rents downtown seem to have leveled off this year, consistently hovering around $20.00 per-square-foot each quarter and currently sitting at $20.45 per-square-foot. There are 174,000 square feet of office space under construction, most of which is in the Warner Building development, set to deliver in early 2019.

JLL Grand Rapids Office Insight & Statistics - Q4 2017

Grand Rapids’ office market saw healthy growth in the fourth quarter of 2017 as rents continue to increase and vacancies steadily decline. The average asking rent in the Grand Rapids market is now $17.84 per square foot while overall vacancy sits at 12.9 percent. New construction has begun and other projects continue to fill the pipeline.

JLL Grand Rapids Office Insight & Statistics - Q3 2017

Conditions in the Grand Rapids office market continue to improve steadily. While overall vacancy has steadily across the metro, downtown Class A space has seen an uptick in vacancy due to consolidation, most notably Fifth Third Bank, who vacated approximately 70,000 feet at 200 Monroe to 111 Lyon St NW.

JLL Grand Rapids Office Insight & Statistics - Spring 2017

Leasing velocity remains healthy, while rents are holding strong. The urban core is among the most active areas of the market, as newly renovated inventory will soon deliver at 50 Monroe and 250 Monroe.

JLL Grand Rapids Office Insight & Statistics - Q2 2019

Market-wide vacancies fell to 9.3 percent, as just over 81,000 square feet of space was absorbed. Average asking rents came in at $19.18 per-square-foot, a 6.4 percent increase year-over-year, with Downtown’s Class A market leading all submarkets with an average asking rent of $22.80 per-square-foot...

JLL West Michigan Industrial Insight & Statistics - Q1 2020

While West Michigan market has seen historically low vacancy figures and impressive rent growth the past few years, we should expect things to slow in Q2 as the effects of the COVID-19 pandemic begin to take hold. Market fundamentals remain stable; however, given the current uncertainty, we expect leasing and sales activity to slow considerably in the near term as occupiers evaluate their current and future space needs.

JLL Cleveland Office Outlook: Q4 2017

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

Recommended

JLL Grand Rapids Office Insight & Statistics - Q2 2017

The west side of downtown has seen increased activity over the past few months, quickly becoming one of the city’s hottest areas. After seeing retail and multifamily move into the area, office leasing and development activity is seeing an uptick.

JLL Grand Rapids Office Insight & Statistics - Q3 2018

Overall vacancy in the Grand Rapids metro is currently 10.2 percent, down 2.1 percent year-over-year. Asking rents downtown seem to have leveled off this year, consistently hovering around $20.00 per-square-foot each quarter and currently sitting at $20.45 per-square-foot. There are 174,000 square feet of office space under construction, most of which is in the Warner Building development, set to deliver in early 2019.

JLL Grand Rapids Office Insight & Statistics - Q4 2017

Grand Rapids’ office market saw healthy growth in the fourth quarter of 2017 as rents continue to increase and vacancies steadily decline. The average asking rent in the Grand Rapids market is now $17.84 per square foot while overall vacancy sits at 12.9 percent. New construction has begun and other projects continue to fill the pipeline.

JLL Grand Rapids Office Insight & Statistics - Q3 2017

Conditions in the Grand Rapids office market continue to improve steadily. While overall vacancy has steadily across the metro, downtown Class A space has seen an uptick in vacancy due to consolidation, most notably Fifth Third Bank, who vacated approximately 70,000 feet at 200 Monroe to 111 Lyon St NW.

JLL Grand Rapids Office Insight & Statistics - Spring 2017

Leasing velocity remains healthy, while rents are holding strong. The urban core is among the most active areas of the market, as newly renovated inventory will soon deliver at 50 Monroe and 250 Monroe.

JLL Grand Rapids Office Insight & Statistics - Q2 2019

Market-wide vacancies fell to 9.3 percent, as just over 81,000 square feet of space was absorbed. Average asking rents came in at $19.18 per-square-foot, a 6.4 percent increase year-over-year, with Downtown’s Class A market leading all submarkets with an average asking rent of $22.80 per-square-foot...

JLL West Michigan Industrial Insight & Statistics - Q1 2020

While West Michigan market has seen historically low vacancy figures and impressive rent growth the past few years, we should expect things to slow in Q2 as the effects of the COVID-19 pandemic begin to take hold. Market fundamentals remain stable; however, given the current uncertainty, we expect leasing and sales activity to slow considerably in the near term as occupiers evaluate their current and future space needs.

JLL Cleveland Office Outlook: Q4 2017

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Ann Arbor Office Insight & Statistics - Spring 2018

Office space in the Ann Arbor market remains in high demand in early 2018. Total vacancy has decreased 1.7 percent year-over-year to its current 8.3 percent. The average asking rent for the market is $24.09 per square foot, while downtown and suburban rents are $30.62 and $23.09 per square foot, respectively.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

Broward County Office Outlook - Q4 2018

Fort Lauderdale's office mrakt is on solid footing entering 2019!

JLL Detroit Industrial Insight & Statistics - Q2 2017

Market sentiment remains positive, yet leasing activity was somewhat muted in the second quarter. Low market availability for quality space has encouraged build-to-suit projects as well as speculative construction.

JLL Pittsburgh Office Insight & Statistics - Q1 2018

New development is multiplying in the Fringe and Oakland / East End submarket. Demand from the technology industry continues to brew. However, leasing activity has not yet brought absorption back to positive.

JLL Pittsburgh Office Insight & Statistics - Q1 2020

The year started off strong, but uncertainty presents itself as the COVID-19 outbreak impacts the economy.

JLL Detroit Industrial Insight & Statistics - Q1 2019

For the remainder of 2019, we expect the excellent fundamentals to remain. Rent growth should continue albeit at a slower pace than seen in previous quarters. The construction pipeline is healthy with over 3.1 million in development.

JLL Pittsburgh Office Insight & Statistics - Q3 2021

The third quarter experienced positive absorption as leasing slowly recovers.

JLL Pittsburgh Office Insight & Statistics - Q2 2021

Total net absorption remains negative for the year, however recent leasing suggests companies are committing long-term to office space in Pittsburgh.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

Pittsburgh industrial market vacancy rates are declining and asking rents are increasing. New speculative construction reveals a healthy investor appetite in a growing market.

JLL Grand Rapids - Skyline 2019

The Grand Rapids Skyline has a concentration of vacancies in only a handful of buildings, but next year you will see a significant change...

JLL Grand Rapids Office Insight & Statistics - Q3 2019

While rent growth has leveled off in the Grand Rapids office market, vacancies compressed further in the third quarter. Average asking rents are $18.74 per square foot across the market, while market-wide vacancy currently sits at 8.5 percent, down 1.7 percent over the same period. The high-profile Warner Building development delivered fully-leased in August, adding 118,000 square feet to the downtown Class A inventory.

JLL West Michigan Industrial Insight & Statistics - Q1 2018

Conditions in the West Michigan industrial market continue improving. Vacancy has fallen yet again to 3.7 percent, dropping 1.4 percent year-over-year. Average asking rents are currently $3.42 per square foot, having risen by 19 cents over the same period. Over 1.7 million square feet was absorbed in West Michigan during the first quarter.

JLL Grand Rapids Office Insight - Fall 2016

Companies rooted in the twenty first century - think technology and healthcare - understand the correlation between a rich cultural environment and attracting top notch talent.

JLL West Michigan Industrial Insight & Statistics - Q2 2018

Conditions remain strong in the West Michigan industrial market. Vacancy currently sits at 3.9 percent, as over 1.1 million square feet has been absorbed so far in 2018. We continue to see positive rent growht, driven by compressed vacancies and high demand still in the market. Spaces have been leasing fast, and buildings that are for sale are not on the market for long.

JLL Pittsburgh Office Insight & Statistics - Q1 2019

The new year begins with positive absorption, along with two new construction deliveries in the Fringe submarket.

JLL Grand Rapids Office Insight & Statistics - Q2 2018

The second quarter showed continued positive trends in the Grand Rapids office market. Total vacancy fell to 10.0 percent as nearly 190,000 square feet of space has been absorbed so far in 2018. Rent growth has slowed this year with current average asking rents coming in at $18.02.

JLL Grand Rapids Office Insight & Statistics - Q4 2018

Since last quarter, vacancy across the market fell by 20 basis points to an impressive 10.0 percent, while averaging asking rent growth was flat, currently sitting at $18.45 per square foot.

More Related Content

What's hot

JLL Ann Arbor Office Insight & Statistics - Spring 2018

Office space in the Ann Arbor market remains in high demand in early 2018. Total vacancy has decreased 1.7 percent year-over-year to its current 8.3 percent. The average asking rent for the market is $24.09 per square foot, while downtown and suburban rents are $30.62 and $23.09 per square foot, respectively.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q1 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

Broward County Office Outlook - Q4 2018

Fort Lauderdale's office mrakt is on solid footing entering 2019!

JLL Detroit Industrial Insight & Statistics - Q2 2017

Market sentiment remains positive, yet leasing activity was somewhat muted in the second quarter. Low market availability for quality space has encouraged build-to-suit projects as well as speculative construction.

JLL Pittsburgh Office Insight & Statistics - Q1 2018

New development is multiplying in the Fringe and Oakland / East End submarket. Demand from the technology industry continues to brew. However, leasing activity has not yet brought absorption back to positive.

JLL Pittsburgh Office Insight & Statistics - Q1 2020

The year started off strong, but uncertainty presents itself as the COVID-19 outbreak impacts the economy.

JLL Detroit Industrial Insight & Statistics - Q1 2019

For the remainder of 2019, we expect the excellent fundamentals to remain. Rent growth should continue albeit at a slower pace than seen in previous quarters. The construction pipeline is healthy with over 3.1 million in development.

JLL Pittsburgh Office Insight & Statistics - Q3 2021

The third quarter experienced positive absorption as leasing slowly recovers.

JLL Pittsburgh Office Insight & Statistics - Q2 2021

Total net absorption remains negative for the year, however recent leasing suggests companies are committing long-term to office space in Pittsburgh.

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

Pittsburgh industrial market vacancy rates are declining and asking rents are increasing. New speculative construction reveals a healthy investor appetite in a growing market.

JLL Grand Rapids - Skyline 2019

The Grand Rapids Skyline has a concentration of vacancies in only a handful of buildings, but next year you will see a significant change...

JLL Grand Rapids Office Insight & Statistics - Q3 2019

While rent growth has leveled off in the Grand Rapids office market, vacancies compressed further in the third quarter. Average asking rents are $18.74 per square foot across the market, while market-wide vacancy currently sits at 8.5 percent, down 1.7 percent over the same period. The high-profile Warner Building development delivered fully-leased in August, adding 118,000 square feet to the downtown Class A inventory.

JLL West Michigan Industrial Insight & Statistics - Q1 2018

Conditions in the West Michigan industrial market continue improving. Vacancy has fallen yet again to 3.7 percent, dropping 1.4 percent year-over-year. Average asking rents are currently $3.42 per square foot, having risen by 19 cents over the same period. Over 1.7 million square feet was absorbed in West Michigan during the first quarter.

JLL Grand Rapids Office Insight - Fall 2016

Companies rooted in the twenty first century - think technology and healthcare - understand the correlation between a rich cultural environment and attracting top notch talent.

JLL West Michigan Industrial Insight & Statistics - Q2 2018

Conditions remain strong in the West Michigan industrial market. Vacancy currently sits at 3.9 percent, as over 1.1 million square feet has been absorbed so far in 2018. We continue to see positive rent growht, driven by compressed vacancies and high demand still in the market. Spaces have been leasing fast, and buildings that are for sale are not on the market for long.

JLL Pittsburgh Office Insight & Statistics - Q1 2019

The new year begins with positive absorption, along with two new construction deliveries in the Fringe submarket.

What's hot (20)

JLL Ann Arbor Office Insight & Statistics - Spring 2018

JLL Ann Arbor Office Insight & Statistics - Spring 2018

JLL Detroit Industrial Insight & Statistics - Q2 2017

JLL Detroit Industrial Insight & Statistics - Q2 2017

JLL Pittsburgh Office Insight & Statistics - Q1 2018

JLL Pittsburgh Office Insight & Statistics - Q1 2018

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Detroit Industrial Insight & Statistics - Q1 2019

JLL Detroit Industrial Insight & Statistics - Q1 2019

JLL Pittsburgh Office Insight & Statistics - Q3 2021

JLL Pittsburgh Office Insight & Statistics - Q3 2021

JLL Pittsburgh Office Insight & Statistics - Q2 2021

JLL Pittsburgh Office Insight & Statistics - Q2 2021

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

JLL Grand Rapids Office Insight & Statistics - Q3 2019

JLL Grand Rapids Office Insight & Statistics - Q3 2019

JLL West Michigan Industrial Insight & Statistics - Q1 2018

JLL West Michigan Industrial Insight & Statistics - Q1 2018

JLL West Michigan Industrial Insight & Statistics - Q2 2018

JLL West Michigan Industrial Insight & Statistics - Q2 2018

JLL Pittsburgh Office Insight & Statistics - Q1 2019

JLL Pittsburgh Office Insight & Statistics - Q1 2019

Similar to JLL Grand Rapids Office Insight & Statistics - Q1 2018

JLL Grand Rapids Office Insight & Statistics - Q2 2018

The second quarter showed continued positive trends in the Grand Rapids office market. Total vacancy fell to 10.0 percent as nearly 190,000 square feet of space has been absorbed so far in 2018. Rent growth has slowed this year with current average asking rents coming in at $18.02.

JLL Grand Rapids Office Insight & Statistics - Q4 2018

Since last quarter, vacancy across the market fell by 20 basis points to an impressive 10.0 percent, while averaging asking rent growth was flat, currently sitting at $18.45 per square foot.

JLL Grand Rapids Office Insight & Statistics - Q1 2019

Looking ahead, we expect conditions to remain stable. Both vacancy and rent growth have leveled off over the past several quarters. Moving forward, construction figures will increase as Studio Park’s office component breaks ground and development along the East Paris Corridor increases.

JLL Grand Rapids Office Insight & Statistics - Q4 2019

The fourth quarter was a continuation of the stable conditions in the Grand Rapids office market. Both rent growth and vacancies remained relatively flat year-over-year, and most of the quarter’s leasing activity was made up of transactions under 10,000 square feet.

JLL Ann Arbor Office Insight & Statistics - Fall 2017

The Ann Arbor office market continues to tighten as tenants encounter limited availability and asking rents remain high. Downtown Class A asking rents saw an increase of 1.8 percent, while overall rates decreased by 1.6 percent since the first half of 2017.

JLL Grand Rapids Office Insight & Statistics - Q1 2020

Looking ahead we expect to see the decelerating conditions to continue. The market has already showed signs of a slowdown over the past year. Now, with increased global uncertainty due to COVID-19, we expect leasing activity to slow, as tenants become reluctant to commit, while sales activity is likely to halt as well. JLL will be closely monitoring rental rates and vacancy levels, as well as key tenants in the market during this period of economic volatility.

Tampa Bay 2018 Q1 Office Outlook

The numbers are out, and the Tampa Bay office market started the year strong. Ever tightening vacancy and climbing asking rates could make 2018 the year we see development in downtown and the suburbs alike!

JLL Louisville Office Outlook - Q2 2018

An in-depth look at the Louisville office market. Analysis includes sales, leasing, construction and employment.

JLL Cleveland Office Outlook: Q1 2017

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Pittsburgh Office Insight & Statistics - Q4 2018

Urban leasing activity concentrates in new construction, making it difficult for the existing product to compete without proper upgrades.

JLL Cincinnati Industrial Outlook Q4 2020

An in-depth look at the Cincinnati industrial market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q2 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Cleveland Office Outlook: Q2 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL Dayton Office Report Summer 2020

An in-depth look at the Cincinnati office market. Analysis includes leasing, sales, construction and employment.

National Dashboard Report | Office - Metro Areas with Population < 1M

This is the National Dashboard of Canada office markets with a population under one million for the second quarter of 2018.

Atlanta Q4 Market Update - Office

Atlanta's office market rebounded

in the fourth quarter of 2018 after

two consecutive quarters of negative

absorption. Leasing activity well ahead

of 2017's pace allowed the market to

record the second strongest quarter of

absorption since 2015. As the market

moves in a positive direction, vacancy

rates will continue to decline while rental

rates increase at a faster pace.

JLL - Tampa Bay 2018 Q2 Industrial Outlook

Check out the latest data on the industrial market in Tampa.

JLL Cleveland Office Outlook: Q3 2018

An in-depth look at the Cleveland office market. Analysis includes leasing, sales, construction and employment.

JLL West Michigan Industrial Insight & Statistics - Q4 2018

In the fourth quarter, total vacancy fell ten basis points to 3.4 percent, while average asking rents grew by 3.6 percent and currently come in at $3.73 per square foot across the region. Average asking rents have increased 13.7 percent year-over-year, illustrating just how big of a spike there has been in asking rents over the past twelve months.

Similar to JLL Grand Rapids Office Insight & Statistics - Q1 2018 (20)

JLL Grand Rapids Office Insight & Statistics - Q2 2018

JLL Grand Rapids Office Insight & Statistics - Q2 2018

JLL Grand Rapids Office Insight & Statistics - Q4 2018

JLL Grand Rapids Office Insight & Statistics - Q4 2018

JLL Grand Rapids Office Insight & Statistics - Q1 2019

JLL Grand Rapids Office Insight & Statistics - Q1 2019

JLL Grand Rapids Office Insight & Statistics - Q4 2019

JLL Grand Rapids Office Insight & Statistics - Q4 2019

JLL Ann Arbor Office Insight & Statistics - Fall 2017

JLL Ann Arbor Office Insight & Statistics - Fall 2017

JLL Grand Rapids Office Insight & Statistics - Q1 2020

JLL Grand Rapids Office Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q4 2018

JLL Pittsburgh Office Insight & Statistics - Q4 2018

National Dashboard Report | Office - Metro Areas with Population < 1M

National Dashboard Report | Office - Metro Areas with Population < 1M

JLL West Michigan Industrial Insight & Statistics - Q4 2018

JLL West Michigan Industrial Insight & Statistics - Q4 2018

Recently uploaded

Killer Referans Bahcesehir Catalog Listing Turkey

Referans Bahcesehir which is being constructed, in the center of the most regional destination as Bahçeşehir, shines out with its central location and unique landscape including social facilities such as a fitness center, sauna, sports facilities, children’s playground and recreational areas.

Not only drawing attention for immediate surroundings including commercial centers and private schools but also providing the easily accessible location with closeness to Tem Highway and connection roads, ongoing construction of 3rd Bridge Connection roads and Metro Projects

Bahcesehir is a rising value in the great city of Istanbul… Located at a new transportation junction in the northwest of the City… Located at such a spot that the access roads for the 3rd bridge and for the 3rd Airport will reach the region in 2016. The Marmaray and the Subway will extend all the way to Referans Bahcesehir respectively in 2018 and 2019.

465 flats and 34 stores are designed with an outstanding approach and arranged with a unique perspective offering the following options: 1 plus 1, 2 plus 1, 3 plus 1, 3.5 plus 1, 4 plus 1, and 4.5 plus 1. It is planned so as to safeguard you and your loved ones based upon a modern, technological safety approach. As you experience the joy and luxury here, you will be content and feet at ease.

It is worth seeing both inside and outside with heart-warming cafes, tasty restaurants and elegant stores… And it is ready to offer a vivacious social life with a warm and cozy space design.

A folding swimming pool and indoor swimming pools, playgrounds, Turkish bath, sauna… It has them all. Everything you need for your well-being and for having a pleasant time will be at your service. You simply need to align the rhythm of life with the rhythm of Referans Bahcesehir.

https://listingturkey.com/property/referans-bahcesehir/

Urbanrise Paradise on Earth - Unveiling Unprecedented Luxury in Exquisite Vil...

Immerse yourself in the epitome of luxury living at Urbanrise Paradise on Earth. These opulent 4 BHK villas, nestled off the prestigious Kanakapura Road in Bangalore, redefine elegance and sophistication. With meticulous craftsmanship, breathtaking design, and unparalleled amenities, Urbanrise Paradise on Earth offers a sanctuary where every moment is infused with luxury and serenity. Experience a life of grandeur and indulgence at this exclusive residential enclave.

Optimizing Your MCA Lead Capture Process for Better Results

Need MCA leads? No sweat! MCAs are great for small biz funding. Learn how to snag top-notch leads: businesses needing cash, with repayment ability, decision-makers, and accurate contacts. Use content, social ads, lead platforms, partnerships, and capture processes for quality leads.

https://www.leadgeneration.media/blog/b/streamline-your-mca-sales-process-with-pre-qualified-leads

Green Homes, Islamabad Presentation .pdf

Green Homes Islamabad offers beautifully designed 5, 8, and 10 Marla homes near the airport and motorway. Enjoy luxury, convenience, and high rental returns in a prime location.

Brigade Insignia at Yelahanka Brochure.pdf

Brigade Insignia offers meticulously designed apartments with modern architecture and premium finishes. The project features spacious 3,3.5,4 and 5 BHK units, each thoughtfully planned to provide maximum comfort, natural light, and ventilation.

https://www.newprojectbangalore.com/brigade-insignia-yelahanka-bangalore.html

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

Load-bearing walls are the backbone of any home construction, providing crucial structural support that carries the weight of the house above. For companies like Brick and Bolt Mysore and Bricknbolt Faridabad, understanding and properly implementing these elements are key to constructing safe and durable buildings.

One20 North Vancouver Floor Plans by Three Shores Development.

One20 North Vancouver Floor Plans by Three Shores Development.

How to Scan Tenants in NYC - You Should Know!

Scanning tenants in NYC requires a thorough and compliant approach to ensure you find reliable renters. For a positive rental experience, consider hiring a property management service. Belgium Management LLC specializes in NYC rental property management and tenant relationship management. We prioritize tenant satisfaction, making us a trusted name in New York property management. Our dedicated team ensures tenants feel valued and supported throughout their lease.

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Tersane Suites Residences is a luxurious real estate project located in the heart of Istanbul, next to the beautiful Golden Horn. This unique development offers hotel concept residences with Rixos management, making it the perfect choice for both homeowners and investors.

The Tersane Suites Residences offers a wide range of options, from studio apartments to spacious four-bedroom units, all designed to the highest standard. The suites are finished with high-quality materials and feature modern, open-plan living spaces, fully-equipped kitchens, and large balconies with stunning views of the city and sea.

One of the standout features of Tersane Suites Residences is the Rixos management, which provides a truly exclusive and upscale living experience. Residents will have access to a range of luxury amenities, including a fitness center, spa, and indoor and outdoor swimming pools. Plus, the on-site restaurants and cafes provide a taste of the local and international cuisine.

The Tersane Suites Residences also offers a great opportunity for investors, as it provides a rental guarantee program. This means that investors can enjoy a steady income stream, with the peace of mind that their property is being managed by a reputable and experienced team.

The location of Tersane Suites Residences is also unbeatable, with easy access to the city’s main transportation links and within close proximity to the historic center, making it the perfect base for exploring all that Istanbul has to offer.

2BHK-3BHK NEW FLAT FOR SALE IN TUPUDANA,RANCHI.

Flat available for sale

Location- Tupudana, Ranchi

Savitri enclave

Area- 3BHK

Rate- 4000/sq.ft.

Super Build Up Area-1629 sq.ft.

Build-up area-1253 sq.ft.

Rate- 65lakh16k(approx)

Floor available- Flat available in all floor(G+12)

Balcony- 2

Washroom- 2

Parking - CAR PARKING

Amenities- Joggers track,temple, children's park,gym,banquet hall (5 Lakh)

Possession year (Handover year)- Dec 2025

Outside View from the apartment and flat balcony is very beautiful.

For more information contact AASHIYANA STAR PROPERTIES

7766900371

Torun Center Residences Istanbul - Listing Turkey

THERE IS LIFE IN ITS CENTER!

The most energetic spot of the city that will add utterly different pleasures to your life, with a park that will make Istanbul breathe, delighting indoor and outdoor bistros, cafes, restaurants, the brand-new Food Hall concept, where dozens of unique tastes are served together, market area, cinema, theater, fitness club, SPA and event venue...

All the pleasures that will enrich your lives are awaiting you on the most beautiful side of the city, at Torun Center Residences. In Mecidiyeköy, where the heart of Istanbul beats, business, life and entertainment opportunities are located at the exact center, at Torun Center, the most beautiful side of the city.

Penthouse apartments and different styles of flats from 1 + 1 to 4 + 1, from 100 to 425 square meters in a 42-story residence tower, have been designed for those who want to live in the center of magnificence. Torun Center is the redefinition of a better life with specially landscaped floor gardens, apartment options with private balconies, and automatic glass systems equipped with Trickle Ventilation that offers clean air comfort.

Business and life in the same place

Excellent service

Torun Center has many delightful details, from a swimming pool to sunbathing and resting terrace. With 24/7 concierge services, 24/7 security, valet, technical service, closed-circuit camera system (CCTV), central heating and cooling system, it makes your life easier.

Delightful details

The two-story Torun Center Lounge, with its indoor and outdoor seating areas, children's playroom, private dining and TV lounge, promises unforgettable memories to you and your loved ones with its unique Istanbul view.

Neighboring to the most pleasant square of Istanbul

A few steps from the Torun Center Residences, you can reach the city's most modern city square and open the doors of a quality city life. Torun Center Residences brings together on the same project the long-awaited city life for Istanbul and gourmet restaurants, cafes, gym and SPA, and state-of-the-art cinema and Artı Stage, hosting the most famous plays of the season.

Located at the intersection of alternative public transportation options such as the metro and Metrobus, Torun Center comes to the fore as the most accessible office for both sides of Istanbul. With a central location and rich transportation lines, Torun Center offices make life easier for employees and increase productivity.

Simpolo Company Profile & Corporate Logo

Simpolo Tiles & Bathware

Tile ho,

toh Simpolo.

Since the first steps were taken in 1977, Simpolo Ceramics has carved its niche as a consistently growing organisation with unparalleled innovation and passion rooted in simplicity.

We endure gratification for every experience we offer, created to share something meaningful. It may not resonate with the majority, but that makes us a class apart. If only a handful were to understand the purpose of our existence, we would be proud to have found our believers. Rather, people with whom we can share our beliefs.

VISUALIZER

Design your space in your style with our very own Visualizer. Now, you can choose the tiles of your liking from our wide selection and see how they would look in a space. Select the tile from the multiple options and the visualiser will replace the surfaces in the image with the selected tiles. This way, instead of just your imagination, you can choose the tiles for your place by getting an actual picture of how they would look in a space. So, design your space the way you desire digitally and implement it in real life to get the best results!

You can also share this visualiser with others to help them design their space.

Committed to delighting customers with world-class ceramic products and services. Make Simpolo synonymous with the best quality and set new benchmarks of excellence for all stakeholders. Pursue best business practices with utmost integrity to make Simpolo an exciting organisation to work with, for vendors, channel partners, investors and employees alike.

Gain worldwide recognition in the field of ceramic building products through Research and Innovation and bring an enhanced lifestyle within reach for every household.

One FNG by Group 108 Sector 142 Noida Construction Update

One FNG by Group 108 is launching a new commercial project in Sector 142 Noida. Office space and high street retail shops on the FNG and Noida Expressway. For more information visit the website https://www.onefng.com/

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus on Public Safety as Job #1, Engagement, Wealth of HOA, Branding, Communication, Culture, Civic Responsibility

SVN Live 6.3.24 Weekly Property Broadcast

The SVN® organization shares a portion of their new weekly listings via their SVN Live® Weekly Property Broadcast. Visit https://svn.com/svn-live/ if you would like to attend our weekly call, which we open up to the brokerage community.

Riverview City Loni Kalbhor Pune Brochure

500 acres of brilliance await you here at Riverview City which offers modern living, effortless convenience, and a beautiful natural setting. It is a mega township by Magarpatta City in Loni Kalbhor, Pune. Enjoy easy access to work, schools, and fun while experiencing a perfect work-life balance.

Visit - magarpattacity.developerprojects.in

MC Heights-Best Construction Company in jhang

MC Heights stands as the epitome of excellence in construction within Jhang. With a commitment to unparalleled quality and innovative design, MC Heights redefines urban living in the heart of Jhang. Offering luxurious residential spaces, cutting-edge commercial complexes, and vibrant community areas, MC Heights caters to the diverse needs of modern lifestyles. Our dedication to superior craftsmanship and customer satisfaction ensures that every aspect of MC Heights exceeds expectations, making it the premier choice for those seeking unparalleled sophistication and comfort in Jhang.

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

=== Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szeto) ===

Ever been curious about Real Estate Investing in the US?? At Volition, for the past 14 years, we have been focused on helping investors invest in over $250M of real estate and generate $100M of wealth in the Toronto market, but we are always open to learning more about other business models and learning from other investors.

The US has always been an intriguing market to invest in. But the US is a big place… if you’re interested in investing in the US, you probably have a lot of questions, like:

☑️ Specifically WHERE should you invest?

☑️ What are the best markets to invest in and why?

☑️ How much are property prices there?

☑️ What are the returns like?

☑️ What is cashflow like?

☑️ Compared to investing in Toronto or other cities in Ontario, what are the benefits / tradeoffs?

☑️ What ownership structure should I use?

☑️ What are the tax implications?

☑️ Can I get financing?

☑️ What are tenants like?

Enter Erwin Szeto, a longtime friend of Volition. Since 2005, Erwin Szeto and his team have navigated the challenging landscape of being landlords in Ontario. Now, they are shifting their focus and guiding their clients' investments toward the more landlord-friendly environment of the USA. This decision comes after assisting Canadian clients in transacting over $440,000,000 in income properties. Faced with issues like affordability constraints, tenant-friendly laws, rent control, and rental licensing in Canada, Erwin sees a clear opportunity in the U.S. Here, there is a significant influx of investments leading to the creation of high-paying manufacturing jobs. Erwin and his clients are poised to capitalize on these opportunities where landlord rights are stronger and there is no rent control.

To facilitate this transition, Erwin has partnered with and become a client of SHARE, a one-stop-shop U.S. Asset Manager. Founded by Canadians for Canadians, SHARE enables as passive an ownership experience as possible for landlords in the U.S., while still maintaining direct, 100% ownership.

Erwin is “Making Real Estate Investing Great Again”!!

Website: https://www.infinitywealth.ca/

Facebook: https://www.facebook.com/iwinrealestate and https://www.facebook.com/ErwinSzetoOfficial

Podcast: https://www.truthaboutrealestateinvesting.ca/

Instagram: https://www.instagram.com/iwinrealestate/ and https://www.instagram.com/erwinszeto/

Omaxe Sports City Dwarka A Comprehensive Guide

Omaxe Sports City Dwarka stands out as a premier residential and recreational destination, offering a blend of luxury and sports-centric living. Located in the thriving area of Dwarka, this project by Omaxe Limited is designed to cater to modern lifestyle needs while promoting a healthy, active living environment.

Recently uploaded (20)

Urbanrise Paradise on Earth - Unveiling Unprecedented Luxury in Exquisite Vil...

Urbanrise Paradise on Earth - Unveiling Unprecedented Luxury in Exquisite Vil...

Optimizing Your MCA Lead Capture Process for Better Results

Optimizing Your MCA Lead Capture Process for Better Results

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

BricknBolt Understanding Load-Bearing Walls and Their Structural Support in H...

One20 North Vancouver Floor Plans by Three Shores Development.

One20 North Vancouver Floor Plans by Three Shores Development.

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

Rixos Tersane Istanbul Residences Brochure_May2024_ENG.pdf

One FNG by Group 108 Sector 142 Noida Construction Update

One FNG by Group 108 Sector 142 Noida Construction Update

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Presentation to Windust Meadows HOA Board of Directors June 4, 2024: Focus o...

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

Investing In The US As A Canadian… And How To Do It RIGHT!! (feat. Erwin Szet...

JLL Grand Rapids Office Insight & Statistics - Q1 2018

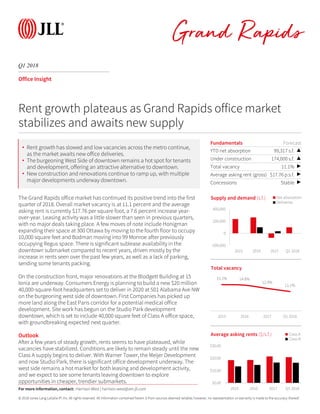

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Grand Rapids Office Insight The Grand Rapids office market has continued its positive trend into the first quarter of 2018. Overall market vacancy is at 11.1 percent and the average asking rent is currently $17.76 per square foot, a 7.6 percent increase year- over-year. Leasing activity was a little slower than seen in previous quarters, with no major deals taking place. A few moves of note include Honigman expanding their space at 300 Ottawa by moving to the fourth floor to occupy 10,000 square feet and Bodman moving into 99 Monroe after previously occupying Regus space. There is significant sublease availability in the downtown submarket compared to recent years, driven mostly by the increase in rents seen over the past few years, as well as a lack of parking, sending some tenants packing. On the construction front, major renovations at the Blodgett Building at 15 Ionia are underway. Consumers Energy is planning to build a new $20 million 40,000-square-foot headquarters set to deliver in 2020 at 501 Alabama Ave NW on the burgeoning west side of downtown. First Companies has picked up more land along the East Paris corridor for a potential medical office development. Site work has begun on the Studio Park development downtown, which is set to include 40,000 square feet of Class A office space, with groundbreaking expected next quarter. Outlook After a few years of steady growth, rents seems to have plateaued, while vacancies have stabilized. Conditions are likely to remain steady until the new Class A supply begins to deliver. With Warner Tower, the Meijer Development and now Studio Park, there is significant office development underway. The west side remains a hot market for both leasing and development activity, and we expect to see some tenants leaving downtown to explore opportunities in cheaper, trendier submarkets. Fundamentals Forecast YTD net absorption 99,317 s.f. ▲ Under construction 174,000 s.f. ▲ Total vacancy 11.1% ▶ Average asking rent (gross) $17.76 p.s.f. ▶ Concessions Stable ▶ -200,000 0 200,000 400,000 2015 2016 2017 Q1 2018 Supply and demand (s.f.) Net absorption Deliveries Rent growth plateaus as Grand Rapids office market stabilizes and awaits new supply 15.1% 14.8% 12.9% 11.1% 2015 2016 2017 Q1 2018 Total vacancy $0.00 $10.00 $20.00 $30.00 2015 2016 2017 Q1 2018 Average asking rents ($/s.f.) Class A Class B For more information, contact: Harrison West | harrison.west@am.jll.com • Rent growth has slowed and low vacancies across the metro continue, as the market awaits new office deliveries. • The burgeoning West Side of downtown remains a hot spot for tenants and development, offering an attractive alternative to downtown. • New construction and renovations continue to ramp up, with multiple major developments underway downtown.

- 2. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Office Statistics Grand Rapids Class Inventory (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (s.f.) Total vacancy (%) Average asking rent ($ p.s.f.) YTD completions (s.f.) Under construction (s.f.) Downtown Totals 5,426,240 -16,858 -0.3% 10.9% 610,851 11.3% $20.44 0 174,000 Northeast Totals 764,896 37,048 4.8% 5.5% 42,245 5.5% $10.28 0 0 Northwest Totals 411,996 0 0.0% 0.0% 31,000 7.5% $19.95 0 0 Southeast Totals 3,884,259 63,162 1.6% 11.8% 482,417 12.4% $15.37 0 0 Southwest Totals 461,442 15,965 3.5% 10.2% 47,080 10.2% $12.73 0 0 Suburbs Totals 5,522,593 116,175 2.1% 9.9% 602,742 10.9% $15.04 0 0 Totals Totals 10,948,833 99,317 0.9% 10.4% 1,213,593 11.1% $17.76 0 174,000 Downtown A 1,739,199 6,803 0.4% 14.8% 268,804 15.5% $22.61 0 174,000 Northeast A 121,746 0 0.0% 0.0% 0 0.0% NA 0 0 Southeast A 574,983 506 0.1% 17.1% 98,196 17.1% $16.24 0 0 Southwest A 18,800 0 0.0% 0.0% 0 0.0% NA 0 0 Suburbs A 715,529 506 0.1% 13.7% 98,196 13.7% $16.24 0 0 Totals A 2,454,728 7,309 0.3% 14.5% 367,000 15.0% $20.91 0 174,000 Downtown B 3,687,041 -23,661 -0.6% 9.0% 342,047 9.3% $18.73 0 0 Northeast B 643,150 37,048 5.8% 6.6% 42,245 6.6% $10.28 0 0 Northwest B 411,996 0 0.0% 0.0% 31,000 7.5% $19.95 0 0 Southeast B 3,309,276 62,656 1.9% 10.9% 384,221 11.6% $15.15 0 0 Southwest B 442,642 15,965 3.6% 10.6% 47,080 10.6% $12.73 0 0 Suburbs B 4,807,064 115,669 2.4% 9.4% 504,546 10.5% $14.81 0 0 Totals B 8,494,105 92,008 1.1% 9.2% 846,593 10.0% $16.39 0 0 For more information, contact: Harrison West | harrison.west@am.jll.com