JLL Q4 Houston Industrial Insight

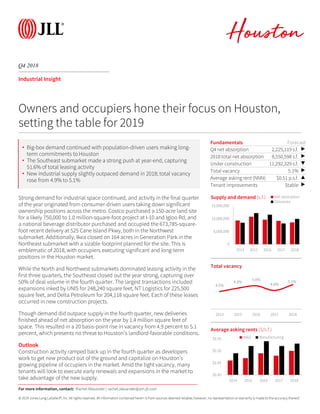

- 1. © 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q4 2018 Houston Industrial Insight Strong demand for industrial space continued, and activity in the final quarter of the year originated from consumer-driven users taking down significant ownership positions across the metro. Costco purchased a 150-acre land site for a likely 750,000 to 1.0 million-square-foot project at I-10 and Igloo Rd, and a national beverage distributor purchased and occupied the 673,785-square- foot recent delivery at 525 Cane Island Pkwy, both in the Northwest submarket. Additionally, Ikea closed on 164 acres in Generation Park in the Northeast submarket with a sizable footprint planned for the site. This is emblematic of 2018, with occupiers executing significant and long-term positions in the Houston market. While the North and Northwest submarkets dominated leasing activity in the first three quarters, the Southeast closed out the year strong, capturing over 50% of deal volume in the fourth quarter. The largest transactions included expansions inked by UNIS for 248,240 square feet, NT Logistics for 225,500 square feet, and Delta Petroleum for 204,118 square feet. Each of these leases occurred in new construction projects. Though demand did outpace supply in the fourth quarter, new deliveries finished ahead of net absorption on the year by 1.4 million square feet of space. This resulted in a 20 basis-point rise in vacancy from 4.9 percent to 5.1 percent, which presents no threat to Houston’s landlord-favorable conditions. Outlook Construction activity ramped back up in the fourth quarter as developers work to get new product out of the ground and capitalize on Houston’s growing pipeline of occupiers in the market. Amid the tight vacancy, many tenants will look to execute early renewals and expansions in the market to take advantage of the new supply. Fundamentals Forecast Q4 net absorption 2,225,119 s.f. ▶ 2018 total net absorption 8,550,598 s.f. ▶ Under construction 11,292,329 s.f. ▼ Total vacancy 5.1% ▶ Average asking rent (NNN) $0.51 p.s.f. ▲ Tenant improvements Stable ▶ 0 5,000,000 10,000,000 15,000,000 2014 2015 2016 2017 2018 Supply and demand (s.f.) Net absorption Deliveries Owners and occupiers hone their focus on Houston, setting the table for 2019 4.5% 4.8% 5.0% 4.6% 5.1% 2014 2015 2016 2017 2018 Total vacancy For more information, contact: Rachel Alexander | rachel.alexander@am.jll.com • Big-box demand continued with population-driven users making long- term commitments to Houston • The Southeast submarket made a strong push at year-end, capturing 51.6% of total leasing activity • New industrial supply slightly outpaced demand in 2018; total vacancy rose from 4.9% to 5.1% $0.40 $0.45 $0.50 $0.55 2014 2015 2016 2017 2018 Average asking rents ($/s.f.) W&D Manufacturing

- 2. Houston Q4 2018 Industrial Statistics Inventory (s.f.) Quarterly total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Total vacancy (%) Total availability (%) Average direct asking rent ($ p.s.f.) Quarterly completions (s.f.) YTD completions (s.f.) Under construction (s.f.) Houston Totals Warehouse & Distribution 335,361,374 1,684,256 7,788,367 2.3% 5.7% 9.6% $0.51 2,005,984 9,044,244 10,971,714 Manufacturing 86,102,237 212,704 434,072 0.5% 3.1% 5.0% $0.56 0 863,160 320,000 Totals 421,963,617 2,225,119 8,550,598 2.0% 5.1% 8.7% $0.51 2,005,984 9,907,404 11,291,714 Submarkets CBD Warehouse & Distribution 29,909,599 -271,617 -518,577 -1.7% 7.3% 9.8% $0.46 0 0 0 Manufacturing 8,669,501 22,615 56,908 0.7% 1.9% 8.4% $0.55 0 0 0 Totals 38,579,100 -249,002 -461,669 -1.2% 6.1% 9.5% $0.46 0 0 0 Northwest Warehouse & Distribution 98,813,223 1,860,324 3,474,264 3.5% 6.1% 10.0% $0.55 629,325 3,658,699 2,446,065 Manufacturing 22,923,897 -134,422 -315,795 -1.4% 3.4% 4.6% $0.56 0 63,420 320,000 Totals 121,737,120 1,554,055 2,986,622 2.5% 5.6% 9.0% $0.55 629,325 3,722,119 2,766,065 North Warehouse & Distribution 55,584,827 -647,034 1,193,741 2.1% 7.2% 11.6% $0.51 106,000 1,060,706 2,833,442 Manufacturing 13,748,751 53,267 -122,370 -0.9% 7.1% 9.2% $0.61 0 87,000 0 Totals 69,333,578 -593,767 1,071,371 1.5% 7.2% 11.1% $0.53 106,000 1,147,706 2,833,442 Northeast Warehouse & Distribution 23,133,795 -182,686 -123,547 -0.5% 4.2% 9.7% $0.44 0 164,500 1,005,400 Manufacturing 6,944,575 -25,000 -64,930 -0.9% 2.8% 4.0% $0.51 0 0 0 Totals 30,078,370 -207,686 -188,477 -0.6% 3.9% 8.4% $0.45 0 164,500 1,005,400 Southeast Warehouse & Distribution 63,177,554 198,211 2,886,009 4.6% 5.1% 8.3% $0.51 694,909 3,495,339 3,744,062 Manufacturing 18,181,278 209,744 949,484 5.2% 0.5% 2.0% $0.60 0 712,740 0 Totals 81,858,838 907,961 4,335,499 5.3% 4.1% 6.9% $0.52 694,909 4,208,079 3,744,062 South Warehouse & Distribution 26,860,250 26,224 -229,069 -0.9% 4.3% 9.0% $0.42 0 64,500 35,765 Manufacturing 8,413,524 0 -27,925 -0.3% 0.9% 2.5% $0.48 0 0 0 Totals 35,273,774 26,224 -256,994 -0.7% 3.5% 7.5% $0.45 0 64,500 35,765 Southwest Warehouse & Distribution 37,882,126 700,834 1,105,546 2.9% 3.7% 8.0% $0.56 575,750 600,500 906,980 Manufacturing 7,220,711 86,500 -41,300 -0.6% 6.0% 5.7% $0.62 0 0 0 Totals 45,102,837 787,334 1,064,246 2.4% 4.1% 7.6% $0.57 575,750 600,500 906,980 Rachel Alexander | Research Manager 1400 Post Oak Blvd., Suite 1100, Houston, TX 77056 | tel +1 713 888 4044 | rachel.alexander@am.jll.com 2019 Jones Lang LaSalle IP, Inc. All rights reserved.

- 3. Houston Q4 2018 Industrial leasing activity This report analyzes all closed industrial leases > 20,000 s.f. 46 2,744,780 2,533,926 210,854 - 212 19,123,403 Avg. building construction date 44% 13% 15% 7% 19% 1% Top 10 lease transactions during the quarter Size Building status Year built 248,240 Planned 2019 225,500 Under Construction 2019 204,118 Under Construction 2019 194,293 Existing 1999 129,807 Existing 2000 127,526 Under Construction 2019 104,975 Existing 1965 104,000 Existing 2013 103,466 Existing 2009 102,122 Under Construction 2019 NT Logistics 900 Georgia Ave Southeast Delta Petroleum Company DirectSoutheastUndisclosed 1100 Pasadena Fwy Access World 5515 Ameriport Pkwy Southeast Direct Bermingham Controls 6535 Guhn Rd Northwest Sublease Franklin Valve 500 Northpark Central Dr North Direct MRC Global 1302 Wharton Weems Blvd Southeast HydroChem Direct Colorado Boxed Beef Co 1190 West Loop N CBD Direct Direct Lease type 10565 Red Bluff Rd Southeast Direct 5515 Ameriport Pkwy Southeast Southeast5411 Ameriport Pkwy Direct Direct UNIS Company Tenant Address Submarket Avg. lease size (in s.f.) Relocation within market Extension (< 36-month term) Expansion in market New to market Renewal Renewal and expansion Leasing activity by submarket QTD At a glance Total leases QTD Total s.f. leased QTD Leasing activity by size QTD Total s.f. leased QTD: Warehouse/Distribution Leasing activity QTD 2000 Total s.f. leased QTD: Manufacturing Leasing activity (s.f.) by transaction type QTD Total s.f. leased QTD: Special Purpose Total leases YTD 59,669 Total s.f. leased YTD 9 13 28 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1,800,000 100,000-249,999 50,000-99,999 20,000-49,999 Total leased Number of leases 52% 14% 14% 9% 8% Southeast North Northwest CBD Southwest Northeast South 2,000,000 4,000,000 6,000,000 8,000,000 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Historical leasing activity Source: JLL Research 2019 Jones Lang LaSalle IP, Inc. All rights reserved.

- 4. Q4 2018 Industrial development This report analyzes all industrial developments under construction & new deliveries > 30,000 s.f. Total leased at delivery (%) 68.1% Total speculative at delivery (s.f.) 5,302,479 Total BTS at delivery (s.f.) 3,587,776 Total Owner-User at delivery (s.f.) 1,017,149 Total # of properties delivered 62 Asking rental rate (low - high) Withheld Top 5 projects delivered to date Building RBA (s.f.) Delivery date Leased at delivery (%) Amazon Distribution Center 1,016,000 Q1 2018 100% Ravago Americas 712,740 Q1 2018 100% 525 Cane Island Pkwy 673,785 Q3 2018 0% Emser Tile 601,426 Q2 2018 100% Best Buy Distribution Center 554,000 Q4 2018 100% Total pre-leased (%) 40.1% Total speculative under construction (s.f.) 8,700,544 Total BTS under construction (s.f.) 2,051,170 Total Owner-user under construction (s.f.) 540,000 Total # of properties UC 52 Asking rental rate (low - high) Withheld Top 5 projects currently under construction Building RBA (s.f.) Delivery date Pre-leased (%) Grocers Supply 727,600 Q2 2019 100% Air 59 Logistics Center 685,400 Q4 2019 0% Conn's Distribution Center 656,658 Q2 2019 100% Port Crossing Commerce Center Bldg 2 600,360 Q1 2019 100% PBP Building 519,224 Q2 2019 100% BTS Speculative BTS Submarket Under construction 11,291,714 Under construction (s.f.) Under construction in-depth Upcoming deliveries by year (s.f., excludes YTD completions) New deliveries Completions in-depth 9,907,404 Total delivered YTD (s.f.) Historical deliveries (s.f.) Construction typeOwnerSubmarket Southwest North Northwest Southeast Northwest Seefried Properties Hines Oakmont Industrial Ravago Americas Duke Realty BTS Owner-user Southeast Southeast North North North BTS Speculative Owner Construction type BTS Artis REIT Liberty Property Trust Liberty Property Trust Archway Properties Liberty Property Trust Speculative BTS 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000 2014 2015 2016 2017 2018 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 2019 BTS Owner-user Speculative Source: JLL Research 2019 Jones Lang LaSalle IP, Inc. All rights reserved.

- 5. Houston Q4 2018 Industrial sales activity This report analyzes all industrial sales > 30,000 s.f. $821,818,357 42 $87.69 5.15% 92.7% 7.3% 4.50-5.25% 0 0 $0 6.50-7.25% 0 42 $821,818,357 Top 10 sales transactions this year Size (s.f.) $ p.s.f. Sale date 1,275,645 $116 Aug-18 1,047,797 $102 Sep-18 951,651 $85 Dec-18 700,644 Undisclosed Feb-18 674,418 $117 Aug-18 601,426 $82 Nov-18 554,000 $87 Nov-18 419,850 $61 Jul-18 351,960 $98 Apr-18 293,280 $70 Sep-18 10633, 10643 & 10653 W Airport Blvd Black Creek Group Crow Holdings $34,492,080 11833 Cutten Rd Black Creek Group Clay Development & Construction $20,529,600 636 Highway 90 Zurich Seefried Properties $47,967,364 Multiple Wilson Investment Properties Jaymar Investments $25,650,000 Multiple Cabot Properties Hines $79,200,000 10433 Ella Blvd Clarion Capital Hines $49,500,000 1190 West Loop N New Mountain Capital Cbbc Real Estate Holdings Inc $81,287,081 10700 Telge Rd Crow Holdings Albertsons Companies Undisclosed 10910 & 10920 W Sam Houston Pkwy N Exeter Property Group Adler Kawa Real Estate Advisors $148,000,000 7865-7909 Northcourt Rd ASB Capital Mgmt Barings $106,875,294 Building address Buyer company Seller company Sales price $ Core Class A Flex Average partial interest acquired Number of domestic buyers Domestic capital $ Sales volume $ by submarket Top buyers (s.f.) Top sellers (s.f.) Cap rate range Transactions details Core Class A Ind. Number of partial interest transactions Number of foreign buyers Foreign capital $ At a glance Sales activity by building type Total volume YTD Number of transactions YTD Average Class A price p.s.f. YTD Average Class A cap rate YTD Warehouse/Dist. sales volume as % of total YTD Manufacturing sales volume as % of total YTD 18% 15% 14% 10% 10% 9% 9% 8% 7% Exeter Property Group ASB Capital Mgmt New Mountain Capital Crow Holdings Cabot Properties Black Creek Group Clarion Capital Zurich STAG Industrial 18% 18% 15% 14% 10% 8% 6% 6% 5% Hines Adler Kawa Real Estate Advisors Barings Cbbc Real Estate Holdings Inc Albertsons Companies Seefried Properties Jaymar Investments Clay Development & Construction Crow Holdings $761,558,447 $60,259,910 9,998,675 1,146,960 0 s.f. 2,000,000 s.f. 4,000,000 s.f. 6,000,000 s.f. 8,000,000 s.f. 10,000,000 s.f. 12,000,000 s.f. $0 $100,000,000 $200,000,000 $300,000,000 $400,000,000 $500,000,000 $600,000,000 $700,000,000 $800,000,000 $900,000,000 Warehouse / Distribution Manufacturing $7,100,000 $71,295,404 $94,342,985 $106,799,600 $173,219,444 $369,060,924 South Southeast CBD North Southwest Northwest Source: JLL Research 2019 Jones Lang LaSalle IP, Inc. All rights reserved.

- 6. Q4 2018 Warehouse/Distribution large blocks This report analyzes existing and under construction contiguous warehouse/distribution blocks > 100,000 s.f. Address Submarket Block size Year built Hwy 59 & Will Clayton Pkwy Northeast 685,400 2019 611 S Cravens Rd Southwest 477,355 2019 4600 Underwood Rd Southeast 404,160 2019 10700 Telge Rd Northwest 401,753 1983 9800 Derrington Rd Northwest 368,467 2019 30 Esplanade Blvd North 351,400 2019 2851 E Pasadena Blvd Southeast 349,050 2019 411 Brisbane St South 345,100 1973 8221 Volta Dr North 337,700 2019 5623 AmeriPort Pkwy Southeast 337,040 2019 Submarket concentrations Total number of blocks Total s.f. of blocks Largest block 79 15,588,109 685,400 Northeast Southwest Southeast Northwest North South Top 10 largest contiguous blocks CBD Quick stats 685,400 477,355 404,160 401,753 351,400 345,100 238,011 Submarket Houston Largest block by submarket Blocks by size s.f. Total market availability 197,318Average block 12 16 19 32 0 5 10 15 20 25 30 35 300,000 + 200,000 - 299,999 150,000 - 199,999 100,000 - 149,999 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Northwest, 4,969,498 North, 2,890,787 Northeast, 1,672,060 Southeast, 3,493,006 South, 578,100 Southwest, 1,274,681 CBD, 709,977 Source: JLL Research 2019 Jones Lang LaSalle IP, Inc. All rights reserved.