JLL Grand Rapids Office Insight & Statistics - Q3 2018

•

0 likes•7 views

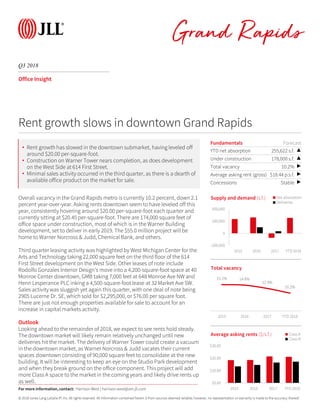

Overall vacancy in the Grand Rapids metro is currently 10.2 percent, down 2.1 percent year-over-year. Asking rents downtown seem to have leveled off this year, consistently hovering around $20.00 per-square-foot each quarter and currently sitting at $20.45 per-square-foot. There are 174,000 square feet of office space under construction, most of which is in the Warner Building development, set to deliver in early 2019.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

JLL Pittsburgh Industrial Insight & Statistics - Q3 2017

JLL Grand Rapids Office Insight & Statistics - Q2 2018

JLL Grand Rapids Office Insight & Statistics - Q2 2018

JLL Pittsburgh Office Insight & Statistics - Q1 2018

JLL Pittsburgh Office Insight & Statistics - Q1 2018

JLL Grand Rapids Office Insight & Statistics - Q4 2018

JLL Grand Rapids Office Insight & Statistics - Q4 2018

JLL Pittsburgh Office Insight & Statistics - Q4 2019

JLL Pittsburgh Office Insight & Statistics - Q4 2019

JLL Grand Rapids Office Insight & Statistics - Q4 2017

JLL Grand Rapids Office Insight & Statistics - Q4 2017

JLL Grand Rapids Office Insight & Statistics - Q2 2017

JLL Grand Rapids Office Insight & Statistics - Q2 2017

JLL Grand Rapids Office Insight & Statistics - Q3 2017

JLL Grand Rapids Office Insight & Statistics - Q3 2017

JLL Cincinnati Office Insight & Statistics - Q3 2016

JLL Cincinnati Office Insight & Statistics - Q3 2016

JLL West Michigan Industrial Insight & Statistics - Q2 2018

JLL West Michigan Industrial Insight & Statistics - Q2 2018

JLL Cincinnati Office Insight & Statistics - Q2 2016

JLL Cincinnati Office Insight & Statistics - Q2 2016

JLL Ann Arbor Office Insight & Statistics - Spring 2018

JLL Ann Arbor Office Insight & Statistics - Spring 2018

Cushman & Wakefield Montreal Americas Marketbeat Office Q12019 #CRE #RealEstate

Cushman & Wakefield Montreal Americas Marketbeat Office Q12019 #CRE #RealEstate

Similar to JLL Grand Rapids Office Insight & Statistics - Q3 2018

Similar to JLL Grand Rapids Office Insight & Statistics - Q3 2018 (20)

JLL Grand Rapids Office Insight & Statistics - Q3 2019

JLL Grand Rapids Office Insight & Statistics - Q3 2019

JLL Grand Rapids Office Insight & Statistics - Q1 2019

JLL Grand Rapids Office Insight & Statistics - Q1 2019

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

JLL Pittsburgh Industrial Insight & Statistics - Q1 2018

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL West Michigan Industrial Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q3 2018

JLL Pittsburgh Office Insight & Statistics - Q4 2018

JLL Pittsburgh Office Insight & Statistics - Q4 2018

JLL Pittsburgh Office Insight & Statistics - Q3 2019

JLL Pittsburgh Office Insight & Statistics - Q3 2019

Recently uploaded

Recently uploaded (20)

Elegant Evergreen Homes - Timeless Luxury in Yelahanka, Bangalore

Elegant Evergreen Homes - Timeless Luxury in Yelahanka, Bangalore

Urbanrise Paradise on Earth - Unveiling Unprecedented Luxury in Exquisite Vil...

Urbanrise Paradise on Earth - Unveiling Unprecedented Luxury in Exquisite Vil...

Redevelopment in Pune Challenges & Solutions (PPT).pdf

Redevelopment in Pune Challenges & Solutions (PPT).pdf

Transforming Your Home Expert Guide to Renovations and Extensions in Upwey

Transforming Your Home Expert Guide to Renovations and Extensions in Upwey

Salarpuria Sattva Lakeridge Neopolis Hyderabad.pdf.pdf

Salarpuria Sattva Lakeridge Neopolis Hyderabad.pdf.pdf

Property Forms PDF Guide for UK Residential Property

Property Forms PDF Guide for UK Residential Property

JLL Grand Rapids Office Insight & Statistics - Q3 2018

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q3 2018 Grand Rapids Office Insight Overall vacancy in the Grand Rapids metro is currently 10.2 percent, down 2.1 percent year-over-year. Asking rents downtown seem to have leveled off this year, consistently hovering around $20.00 per-square-foot each quarter and currently sitting at $20.45 per-square-foot. There are 174,000 square feet of office space under construction, most of which is in the Warner Building development, set to deliver in early 2019. The $55.0 million project will be home to Warner Norcross & Judd, Chemical Bank, and others. Third quarter leasing activity was highlighted by West Michigan Center for the Arts and Technology taking 22,000 square feet on the third floor of the 614 First Street development on the West Side. Other leases of note include Rodolfo Gonzales Interior Design’s move into a 4,200-square-foot space at 40 Monroe Center downtown, GMB taking 7,000 feet at 648 Monroe Ave NW and Henn Lesperance PLC inking a 4,500-square-foot lease at 32 Market Ave SW. Sales activity was sluggish yet again this quarter, with one deal of note being 2905 Lucerne Dr. SE, which sold for $2,295,000, or $76.00 per square foot. There are just not enough properties available for sale to account for an increase in capital markets activity. Outlook Looking ahead to the remainder of 2018, we expect to see rents hold steady. The downtown market will likely remain relatively unchanged until new deliveries hit the market. The delivery of Warner Tower could create a vacuum in the downtown market, as Warner Norcross & Judd vacates their current spaces downtown consisting of 90,000 square feet to consolidate at the new building. It will be interesting to keep an eye on the Studio Park development and when they break ground on the office component. This project will add more Class A space to the market in the coming years and likely drive rents up as well. Fundamentals Forecast YTD net absorption 255,622 s.f. ▲ Under construction 178,000 s.f. ▲ Total vacancy 10.2% ▶ Average asking rent (gross) $18.44 p.s.f. ▶ Concessions Stable ▶ -200,000 0 200,000 400,000 2015 2016 2017 YTD 2018 Supply and demand (s.f.) Net absorption Deliveries Rent growth slows in downtown Grand Rapids 15.1% 14.8% 12.9% 10.2% 2015 2016 2017 YTD 2018 Total vacancy $0.00 $10.00 $20.00 $30.00 2015 2016 2017 YTD 2018 Average asking rents ($/s.f.) Class A Class B For more information, contact: Harrison West | harrison.west@am.jll.com • Rent growth has slowed in the downtown submarket, having leveled off around $20.00 per-square-foot. • Construction on Warner Tower nears completion, as does development on the West Side at 614 First Street. • Minimal sales activity occurred in the third quarter, as there is a dearth of available office product on the market for sale.

- 2. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q3 2018 Office Statistics Grand Rapids For more information, contact: Harrison West | harrison.west@am.jll.com Class Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD Completions (s.f.) Under Development (s.f.) Downtown Totals 5,272,368 14,374 55,755 1.1% 9.8% 10.5% $20.45 0 178,000 Downtown Totals 5,272,368 14,374 55,755 1.1% 9.8% 10.5% $20.45 0 178,000 Northeast Totals 764,896 11,156 47,956 6.3% 5.4% 5.4% $16.88 0 0 Northwest Totals 411,996 0 0 0.0% 0.0% 7.5% N/A 0 0 Southeast Totals 3,884,259 -13,136 152,038 3.9% 10.4% 10.7% $16.32 0 0 Southwest Totals 461,442 -5,936 -127 0.0% 13.7% 13.7% $14.03 0 0 Suburbs Totals 5,522,593 -7,916 199,867 3.6% 9.2% 10.0% $15.98 0 0 West Michigan Totals 10,794,961 6,458 255,622 2.4% 9.5% 10.2% $18.44 0 178,000 Downtown A 1,739,199 29,396 83,686 4.8% 10.4% 11.0% $22.38 0 178,000 Downtown A 1,739,199 29,396 83,686 4.8% 10.4% 11.0% $22.38 0 178,000 Northeast A 121,746 0 0 0.0% 0.0% 0.0% N/A 0 0 Southeast A 574,983 -11,060 -6,488 -1.1% 18.3% 18.3% $18.39 0 0 Southwest A 18,800 0 0 0.0% 0.0% 0.0% N/A 0 0 Suburbs A 715,529 -11,060 -6,488 -0.9% 14.7% 14.7% $18.39 0 0 West Michigan A 2,454,728 18,336 77,198 3.1% 11.6% 12.1% $21.17 0 178,000 Downtown B 3,533,169 -15,022 -27,931 -0.8% 9.6% 10.2% $19.22 0 0 Downtown B 3,533,169 -15,022 -27,931 -0.8% 9.6% 10.2% $19.22 0 0 Northeast B 643,150 11,156 47,956 7.5% 6.4% 6.4% $16.88 0 0 Northwest B 411,996 0 0 0.0% 0.0% 7.5% N/A 0 0 Southeast B 3,309,276 -2,076 158,526 4.8% 9.0% 9.4% $15.51 0 0 Southwest B 442,642 -5,936 -127 0.0% 14.3% 14.3% $14.03 0 0 Suburbs B 4,807,064 3,144 206,355 4.3% 8.4% 9.3% $15.35 0 0 West Michigan B 8,340,233 -11,878 178,424 2.1% 8.9% 9.7% $17.23 0 0