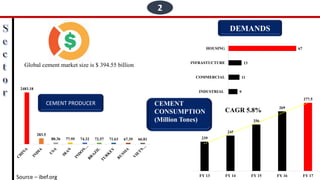

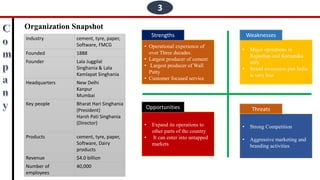

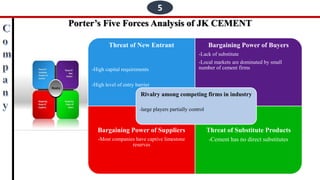

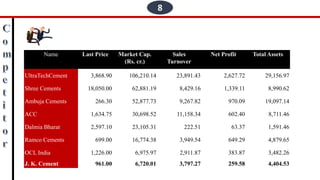

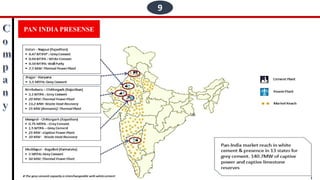

JK Cement is a leading cement producer in India with a market size of $394.55 billion and over three decades of operational experience. The company focuses on customer service and has a significant presence in Rajasthan and Karnataka, while facing threats from strong competition and market entry barriers. Financially, JK Cement reported a net profit of $259.58 million and total assets of $4.4 billion, with expectations of growth in the white cement market due to rising housing demand.