Embed presentation

Download to read offline

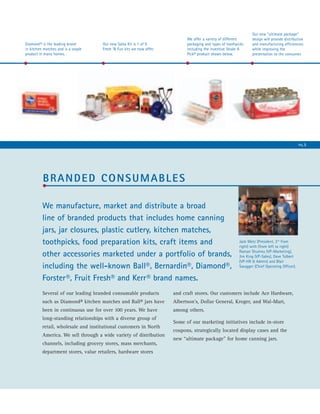

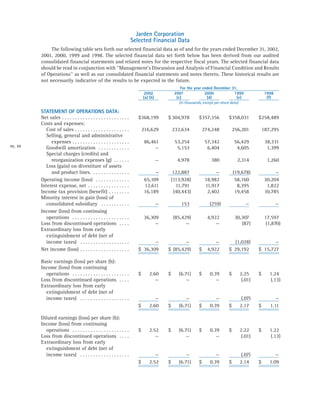

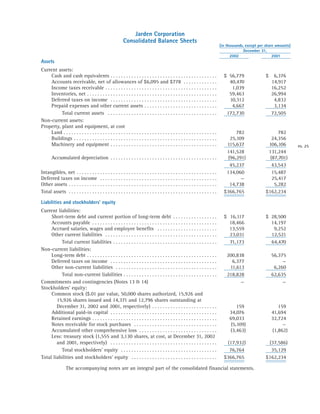

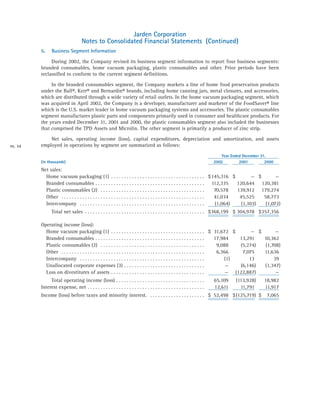

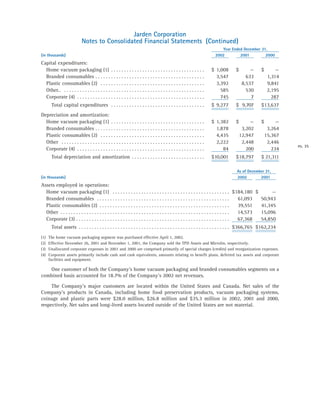

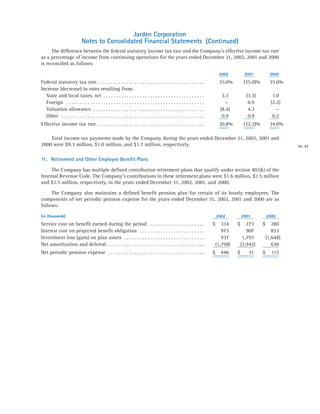

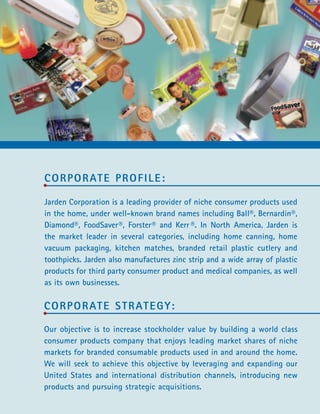

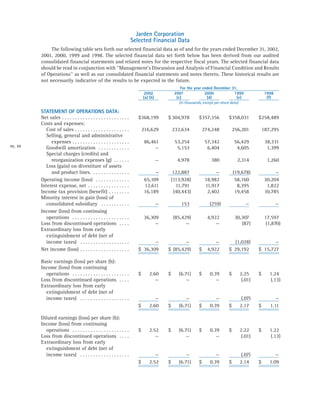

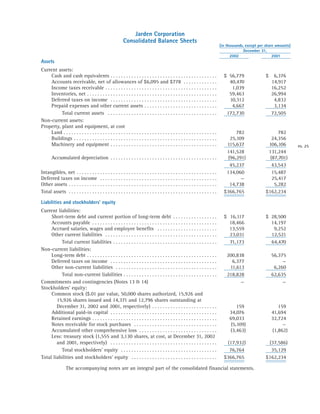

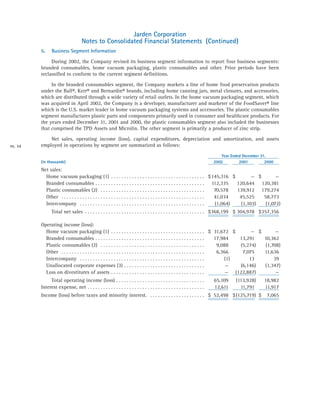

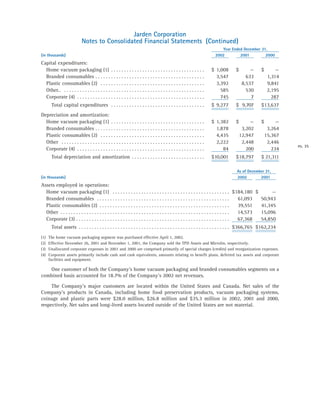

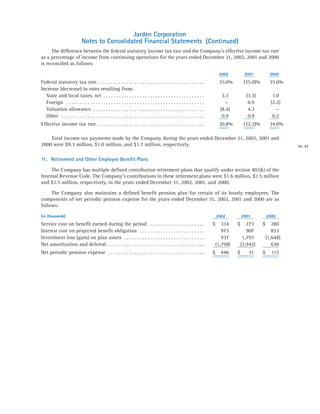

This document is Jarden Corporation's 2002 Annual Report. It provides an overview of the company's performance in 2002 including financial highlights and summaries of its main business segments: branded consumables, home vacuum packaging, plastic consumables, and other. It discusses the company's acquisition of Tilia and strategic direction to build a world-class consumer products company with leading market shares in niche branded consumable products.