This document provides an introduction and history of PepsiCo from its founding in 1893 to present day. It then outlines the contents of a financial analysis report on PepsiCo, which includes chapters on financial ratio analysis, the DuPont system of analysis, growth rates, beta coefficients, free cash flow, and valuation. The introduction describes PepsiCo's origins as Brad's Drink, its name changes and growth over the early 1900s, bankruptcy in the 1920s, and subsequent ownership changes. The document provides context for the upcoming financial analysis.

![26

earnings, sales and assets cannot grow any faster than the retained earnings plus the additional

debt that the retained earnings can support.

Assets = Liabilities + Equity

As a result of this assumption requiring that assets equal liabilities plus owners’ equity, any

changes in assets must be equal to changes in liabilities plus changes in owners’ equity.

Δ Assets = Δ Liabilities + Δ Equity

Furthermore, the sustainable growth model assumes that any change in equity can only result

from a change in retained earnings. Therefore, the firm cannot sell additional owners’ equity.

Δ Assets = Δ Liabilities + Δ Retained Earnings

This means the company’s future increase in assets is equal to the future increase in retained

earnings plus the additional debt that is supported by the additional owners’ equity as determined

by the equity multiplier. The equity multiplier is equal to total assets divided by owners’ equity.

Δ Assets = (Δ Retained Earnings) (Equity Multiplier)

[3-10]

An increase in total revenue must be accompanied by a proportionate increase in total assets.

Since any increase in total revenue is limited by the increase in total assets, growth in total

revenue is limited by the increase in retained earnings. Total asset turnover is equal to sales

divided by total assets.](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-26-320.jpg)

![27

Δ Total Revenue = (Δ Total Assets) (Total Asset Turnover)

[3-11]

The net income required to achieve the target return on equity is determined by total revenue

times the net profit margin. Net profit margin is equal to net income divided by total revenue.

Δ Net Income = (Δ Total Revenue) (Net Profit Margin)

Earnings retention is equal to retained earnings divided by net income.

Earnings Retention = Retained Earnings/Net Income

Sustainable growth is equal to return on equity times the earnings retention rate of the company.

Sustainable Growth = (Return on Equity) (Earnings Retention)

Analysis of ROE and Sustainable Growth for PepsiCo.

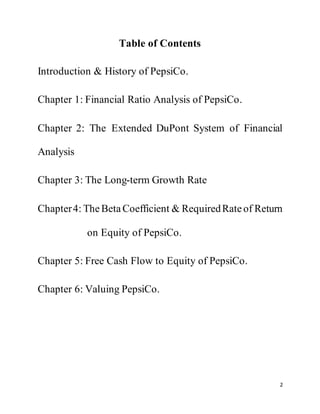

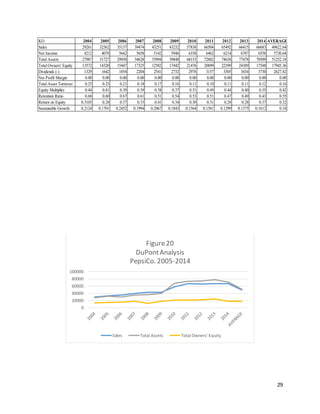

The following table contains the data and ratios for the DuPont system of financial

analysis of return on equity as well as the analysis of sustainable growth (G) for PepsiCo based

on data from 2005 to 2014. Lines two through 6 contain the raw data that was used to compute

the ratios used in the DuPont system of financial analysis as well as in the computation of the

sustainable growth rate. From 2004 to 2014, total revenue for PepsiCo increased from $29,261

million to $66,683 million. Total revenue for PepsiCo. Increased every year over the sample time

period except for 2009 due to the nationwide recession. Net income rose from $4,212 million to

$6,558 million over the course of ten years. Total assets rose from $27,987 million to $70,509](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-27-320.jpg)

![37

Calculating Returns for the S&P 500 Index and for PepsiCo

To compute the beta coefficient, arithmetic returns are used. Arithmetic returns are

calculated by dividing the ending index or stock value (𝑉𝑎𝑙𝑢𝑒1 ), by the beginning value

(𝑉𝑎𝑙𝑢𝑒0) and subtracting one, as in

Equation [5-1]. An alternative method to calculate the return is to subtract the beginning value

(𝑉𝑎𝑙𝑢𝑒0) from the ending value (𝑉𝑎𝑙𝑢𝑒1 ) and dividing by the beginning value (𝑉𝑎𝑙𝑢𝑒0), as in

Equation [5-2]. Both returns are adjusted for dividends and stock splits. The returns used in the

regression analysis are arithmetic returns.

Return = [(𝑉𝑎𝑙𝑢𝑒1 -𝑉𝑎𝑙𝑢𝑒0) – 1] [5-1]

Return = [(𝑉𝑎𝑙𝑢𝑒1 -𝑉𝑎𝑙𝑢𝑒0)/ 𝑉𝑎𝑙𝑢𝑒0)] [5-2]

Calculating Beta for PepsiCo

The Modern Portfolio Theory illustrates that investors not rewarded for the total risk of

an investment but for the systematic risk. This is because total risk includes those that are firm-

specific and that can be eliminated in a well-diversified portfolio. The regression line between

the monthly returns for the individual security and the market index, which is also the slope

coefficient, shows the specific risk of an individual stock. The coefficient lines are calculated

using a sixty month regression. In this analysis, the beta coefficient for PepsiCo is calculated](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-37-320.jpg)

![38

using sixty monthly observations of returns from 01/03/2004 to 01/03/2015 and returns for the

S&P 500 Index for the same time period. Beta is the covariance between returns for PepsiCo and

returns for the S&P 500 divided by the variance for the S&P 500.

𝑅 𝑃𝐸𝑃 = 𝐴𝑙𝑝ℎ𝑎 𝑃𝐸𝑃 + 𝐵𝑒𝑡𝑎 𝑃𝐸𝑃(𝑅 𝑀) [5-3]

Where,

𝑅 𝑃𝐸𝑃 The return for PepsiCo stock

𝐵𝑒𝑡𝑎 𝑃𝐸𝑃 The slope of the regression line between returns for the market and returns for

PepsiCo

𝐴𝑙𝑝ℎ𝑎 𝑃𝐸𝑃 The intercept coefficient for the regression line between returns for the market

and returns for PepsiCo.

𝑅 𝑀 The return on the S&P 500 Stock market Index

(𝑅 𝑀– 𝑅 𝐹) the market risk premium is the additional return that stock holders receive for the

additional risk of holding stocks rather than the risk free asset, long-term

government bonds.

The following table contains the data used to compute the PepsiCo beta and are downloaded

from the yahoo finance website. Column 1 shows the date and Columns 2 and 3 contain the

stock split and dividend adjusted index and price values for the S&P 500 Index and for PepsiCo

stock, respectively. The independent variable is the return for the S&P 500 and the dependent

variable is the return for PepsiCo. The returns are calculated by dividing the ending index or

stock value by the beginning value and subtracting one. An alternative method to calculate the

return is to subtract the beginning value from the ending value and dividing by the beginning](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-38-320.jpg)

![39

value. Both returns are adjusted for dividend and stock splits. The returns used are arithmetic

returns.

In this paper, the CAPM is used to compute the required rate of return for PepsiCo. The

required rate of return for PepsiCo is the minimum rate of return demanded by stockholders of

PepsiCo stock. The model used in this paper is based on the CAPM derived from the work of

Sharpe (1964).

𝑅 𝑃𝐸𝑃 = 𝑅𝑓 + 𝐵𝑒𝑡𝑎 𝑃𝐸𝑃 (𝑅 𝑚 – 𝑅 𝐹)

[5-4]

𝑅 𝑃𝐸𝑃 = the required rate of return for PepsiCo Stock

𝑅𝑓 = the risk free rate of return

𝐵𝑒𝑡𝑎 𝑃𝐸𝑃= the beta coefficient for PepsiCo

𝑅 𝑚= the rate of return on the stock market

(𝑅 𝑚 – 𝑅 𝐹) = the market risk premium

The required rate of return for PepsiCo is the risk-free rate of return plus the risk

premium. The risk premium is the beta for PepsiCo times the market price of risk.](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-39-320.jpg)

![41

correct independent and dependent variable. If the trend line and statistics in the graph are not

identical to the numbers in the regression, the variables may have been reversed.

Calculating the Required Rate of Return for Stocks

In this paper, the CAPM is used to compute the required rate of return for PepsiCo. The

required rate of return for PepsiCo is the minimum rate of return demanded by stockholders of

PepsiCo stock. The model used in this paper is based on the CAPM derived from the work of

William F. Sharpe (1964).

𝑅 𝑃𝐸𝑃 = 𝑅𝑓 + 𝐵𝑒𝑡𝑎 𝑃𝐸𝑃 (𝑅 𝑚 – 𝑅 𝐹)

[5-4]

𝑅 𝑃𝐸𝑃 = the required rate of return for PepsiCo Stock

𝑅𝑓 = the risk free rate of return

𝐵𝑒𝑡𝑎 𝑃𝐸𝑃= the beta coefficient for PepsiCo

𝑅 𝑚= the rate of return on the stock market

(𝑅 𝑚 – 𝑅 𝐹) = the market risk premium

The required rate of return for PepsiCo is the risk-free rate of return plus the risk

premium. The risk premium is the beta for PepsiCo times the market price of risk.

Calculating the Required Rate Return for PepsiCo Using the CAPM

The risk free rate is the total return (income plus capital appreciation) on Long-term

Government Bonds taken from SBBI 2007. For the years from 1926 to 1976, SBBI used the](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-41-320.jpg)

![44

dividend decision involves the allocation of funds; even though it is not an asset decision, it does

affect the financial leverage.

The distribution of future cash flows, which is a decision maker’s estimate, is based on

accounting information that is provided by financial managers. The probability distribution of

expected cash flows is used to determine the total market capitalization (value) of the company.

Higher expected cash flows along with lower required rates of return equate to a higher value

company.

Valuing a Share of Stock Using the Free Cash Flow Model

A stock’s value is determined by the future free cash flow to equity (FCFE).

𝑃0= 𝐹𝐶𝐹𝐸1 + 𝐹𝐶𝐹𝐸2 + 𝐹𝐶𝐹𝐸3 + …….. [6-1]

However, since the Free Cash Flow to Equity is in the future, each Free Cash Flow to Equity

must be discounted to the present time by the cost of equity (k).

Therefore,

𝑃0=

𝐹𝐶𝐹𝐸1

(1+𝑘)1 +

𝐹𝐶𝐹𝐸2

(1+𝑘)2 +

𝐹𝐶𝐹𝐸3

(1+𝑘)3 + ……… [6-2]

The discounted present value of the future stream of Free Cash Flow to Equity discounted at the

cost of equity can be represented as: the sum of each Free Cash Flow to Equity (𝐹𝐶𝐹𝐸𝑡)

discounted by one, plus the cost of equity (1 + 𝑘 ) 𝑡

, from time zero to time infinity.

𝑃0 = 𝐹𝐶𝐹𝐸𝑡/(1 + 𝑘 ) 𝑡

[6-3]](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-44-320.jpg)

![45

If we assume that the future Free Cash Flow to Equity will grow at a constant rate (g), each

future Free Cash Flow to Equity is equal to the Free Cash Flow to Equity at time zero times one,

plus the growth rate raised to the power of t. 𝐹𝐶𝐹𝐸𝑡 = 𝐹𝐶𝐹𝐸0 (1 + 𝑔 ) 𝑡

. We can substitute this

value of 𝐹𝐶𝐹𝐸𝑡 into formula [6-3].

𝑃0 = 𝐹𝐶𝐹𝐸0 (1 + 𝑔 ) 𝑡

/ (1 + 𝑘 ) 𝑡

[6-4]

If g and k are constant and k is strictly greater than g, Equation [6-4] can be simplified to

Equation [6-5]. That is, the value of an investment is equal to the anticipated Free Cash Flow to

Equity at time t=1 discounted at the cost of equity minus the growth rate.

𝑃0 = 𝐹𝐶𝐹𝐸1/ (k - g) [6-5]

That is the value of a share of stock in the firm is equal to the anticipated future dividend divided

by the required rate of return for equity minus the expected future growth rate of FCFE for the

firm. This model assumes that FCFE will be greater than zero and that k is strictly greater than g.

The Super-Normal Growth Model

The super-normal growth period is the time period where the growth rate will be above

average. After the super-normal growth period, the growth of the company returns to the long-

term growth rate of the economy (based on the GDP). The present value of the shares in the firm

is equal to the discounted present value of the Free Cash Flow to Equity ( 𝐹𝐶𝐹𝐸𝑡) for the super-

normal growth period, plus the present value of the future Free Cash Flow to Equity for the

normal growth period. The practice for company valuations is to compute five years of super-

normal growth and then assume a constant long-term growth rate.](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-45-320.jpg)

![46

𝑃0 =

𝐹𝐶𝐹𝐸1

(1+𝑘)1 +

𝐹𝐶𝐹𝐸2

(1+𝑘)2 +

𝐹𝐶𝐹𝐸3

(1+𝑘)3 +

𝐹𝐶𝐹𝐸4

(1+𝑘)4 +

𝐹𝐶𝐹𝐸5

(1+𝑘)5 +

𝑃5

(1+𝑘)5 [6-

6]

The Free Cash Flow to Equity values for years 1 to 5 are computed using the super

normal growth rate ( g*) and the Free Cash Flow to Equity for year six is computed using the

long-term normal growth rate,(g). 𝐹𝐶𝐹𝐸1 is equal to the value of 𝐹𝐶𝐹𝐸0 times the growth

factor [ 𝐹𝐶𝐹𝐸0(1 + 𝑔 ∗)1

]. 𝐹𝐶𝐹𝐸2 is equal to the value of 𝐹𝐶𝐹𝐸1 times the growth factor

[ 𝐹𝐶𝐹𝐸1(1+ 𝑔 ∗)1

]. The rest of the Free Cash Flow to Equity values until 𝐹𝐶𝐹𝐸5 are computed

using the super-normal growth rate. 𝐹𝐶𝐹𝐸6 is equal to the value of 𝐹𝐶𝐹𝐸5 times the normal

growth rate, 𝐹𝐶𝐹𝐸5 (1 + 𝑔)1

.

𝐹𝐶𝐹𝐸1 = 𝐹𝐶𝐹𝐸0(1 + 𝑔 ∗)1

[6-7]

𝐹𝐶𝐹𝐸2 = 𝐹𝐶𝐹𝐸1(1 + 𝑔 ∗)1

[6-8]

𝐹𝐶𝐹𝐸3 = 𝐹𝐶𝐹𝐸2(1+ 𝑔 ∗)1

[6-9]

𝐹𝐶𝐹𝐸4 = 𝐹𝐶𝐹𝐸3(1+ 𝑔 ∗)1

[6-10]

𝐹𝐶𝐹𝐸5 = 𝐹𝐶𝐹𝐸4(1+ 𝑔 ∗)1

[6-11]

𝐹𝐶𝐹𝐸6 = 𝐹𝐶𝐹𝐸5(1+ 𝑔)1

[6-12]

After time = 5, it is assumed that the firm will return to a normal long term growth rate that is

constant. The terminal value of the investment at time = 5 is the discounted present value of all

of the future Free Cash Flow to Equity, beginning with Free Cash Flow to Equity six. The

terminal value ( 𝑃5) is equal to the discounted present value of all of the future FCFE. Beginning

with 𝐹𝐶𝐹𝐸6, the future cash flows are assumed to grow at a constant rate (g).](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-46-320.jpg)

![47

𝑃5 = 𝐹𝐶𝐹𝐸6 / (k-g) [6-13]

After the future Free Cash Flow to Equity values are computed for years one to five and the

terminal value at time five is computed, each cash flow is discounted to the present time (t=0).

The future cash flows are discounted at the cost of equity (k), and discounted for the number of

years in the future that the cash flow will be received.

𝑃𝑉 (𝐹𝐶𝐹𝐸1) = 𝐹𝐶𝐹𝐸1(1+ 𝑘)1

[6-14]

𝑃𝑉 (𝐹𝐶𝐹𝐸2) = 𝐹𝐶𝐹𝐸2(1 + 𝑘)2

[6-15]

𝑃𝑉 (𝐹𝐶𝐹𝐸3) = 𝐹𝐶𝐹𝐸3(1 + 𝑘)3

[6-16]

𝑃𝑉 (𝐹𝐶𝐹𝐸4) = 𝐹𝐶𝐹𝐸4(1 + 𝑘)4

[6-17]

𝑃𝑉 (𝐹𝐶𝐹𝐸5) = 𝐹𝐶𝐹𝐸5(1 + 𝑘)5

[6-18]

𝑃𝑉 (𝑃5) = 𝑃5/(1+ 𝑘)5

[6-19]

Hence, the present value of the investment is equal to the sum of the six present values of the

future Free Cash Flow to Equity and the future terminal value.

𝑃0 = 𝑃𝑉 (𝐹𝐶𝐹𝐸1) + 𝑃𝑉 (𝐹𝐶𝐹𝐸2) + 𝑃𝑉 (𝐹𝐶𝐹𝐸3) + 𝑃𝑉 (𝐹𝐶𝐹𝐸4) + 𝑃𝑉 (𝐹𝐶𝐹𝐸5) + 𝑃𝑉 (𝑃5)

Free Cash Flow to Equity

In this analysis, the super-normal growth rate model is combined with the free cash flow

to equity model. In the FCFE model, FCFE is defined as net income minus net capital

expenditures minus the change in working capital plus net changes in the long-term debt

position. Net income is taken from the income statement. Net capital expenditure equals capital](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-47-320.jpg)

![48

expenditures minus depreciation; and are both derived from the statement of cash flows. The

change in working capital is the difference of accounts receivable plus inventory from one year

to the next minus the difference in accounts payable from one year to the next.

Therefore,

FCFE = NI – (CE-D) – (Δ WC) + (NDI-DR) [6-21]

Where,

FCFE Free Cash Flow to Equity

(CE-D) Net Capital Expenditures

(Δ WC) Changes in non-cash working capital accounts: accounts receivable, inventory,

payables

(NDI-DR) New debt issues are a cash inflow while the repayment of outstanding debt is a

cash outflow. The difference is the net effect of debt financing on cash flow.

NI Net Income

CE Capital Expenditure

D Depreciation

Δ WC Change in Working Capital

NDI New Debt Issued

DR Debt Retired](https://image.slidesharecdn.com/1ee5b5c1-2f54-47f1-99ca-0eab5605ae0e-160516004700/85/Financial-Analysis-Text-48-320.jpg)