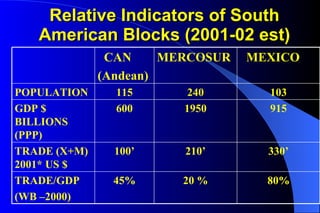

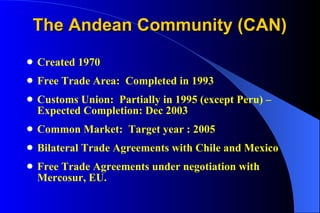

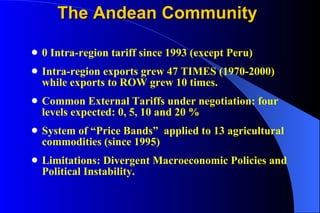

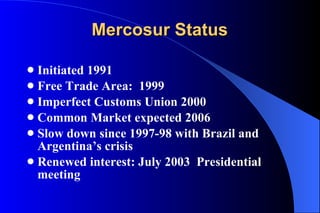

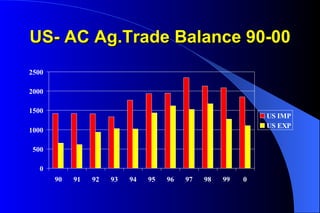

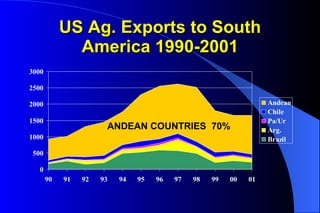

This document discusses the possibility of a South American Free Trade Area (SAFTA) given the current state of trade agreements in South America. It outlines the progress that has been made by the Andean Community and Mercosur in establishing free trade areas and common markets. While these two blocks have committed to concluding negotiations by December 2003 to increase trade between them, challenges remain from macroeconomic differences, political instability, and policies like the Andean Community's price bands for some agricultural goods. Several possible trade scenarios for 2005 are presented, including independent common markets for each block or a potential SAFTA, though divergences between countries could make a unified agreement difficult.