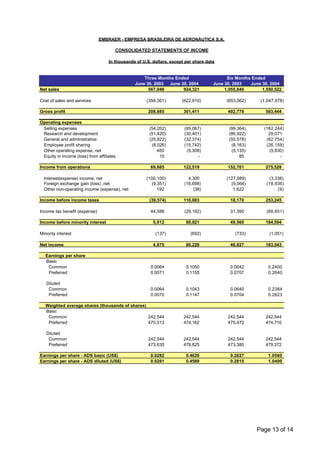

- Embraer announced its second quarter 2004 results reported under US GAAP, registering record net sales of $924.3 million and net income of $80.2 million.

- Key highlights included the highest quarterly net sales in the company's history, driven by a 63% increase in commercial aviation sales and growth across all business segments.

- Net income increased almost 17 times over the prior year period due to higher sales and a $10 million gain on derivative instruments, though gross margins declined slightly from aircraft mix changes.

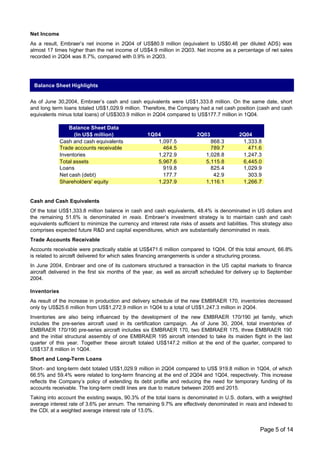

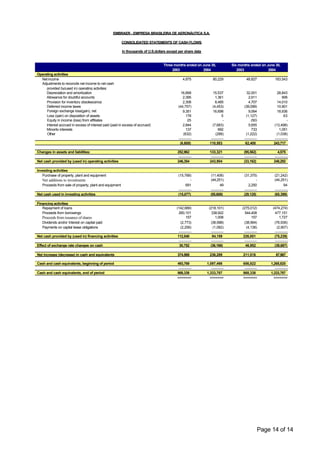

- The company exited the quarter with a record backlog of $28.3 billion and a net cash position of $303.9 million.