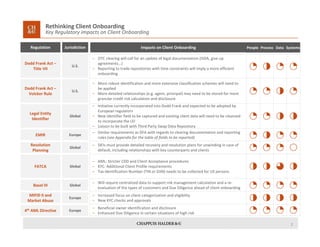

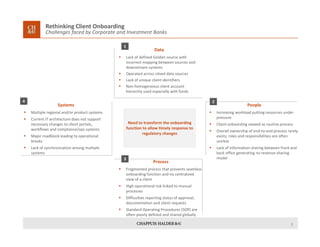

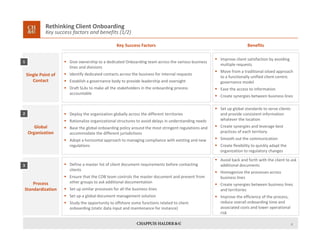

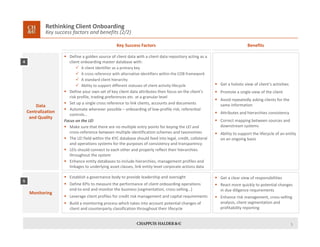

The document discusses the regulatory impacts and challenges of client onboarding in financial institutions, highlighting the necessity for updated legal documentation, enhanced regulatory compliance, and improved data management systems. It emphasizes the importance of a centralized onboarding process that streamlines communication, standardizes client document requirements, and establishes clear responsibilities among team members. Key success factors include global organization, process standardization, data centralization, and effective monitoring to improve operational efficiency and regulatory adherence.