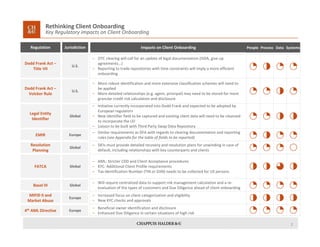

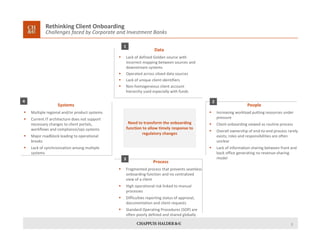

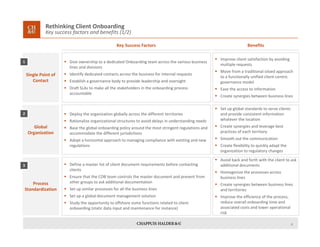

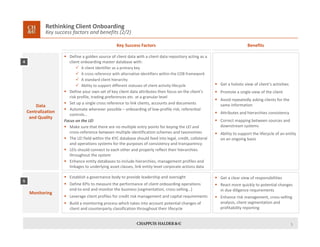

This document discusses rethinking client onboarding processes in response to increasing regulations. It identifies key regulatory impacts that are driving changes to client onboarding, including more robust client identification and data collection. It also analyzes current challenges faced by banks in onboarding clients, such as fragmented processes, lack of data standardization and system interoperability issues. Finally, it proposes several key success factors for transforming client onboarding, such as establishing a single point of contact, globalizing and standardizing processes, centralizing data, focusing on legal entity identifiers, and implementing ongoing monitoring.