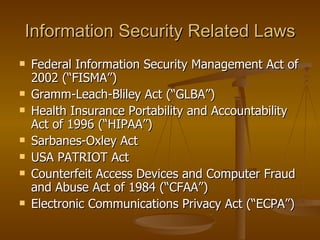

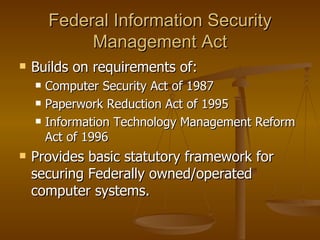

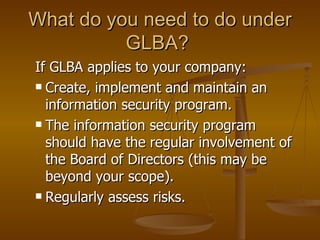

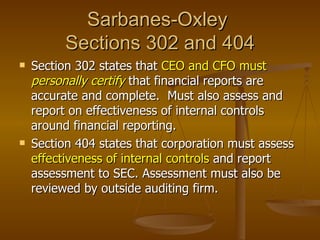

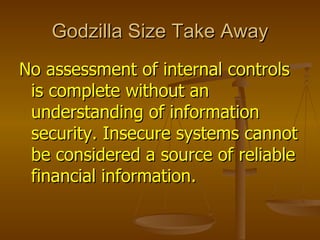

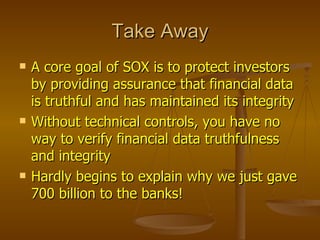

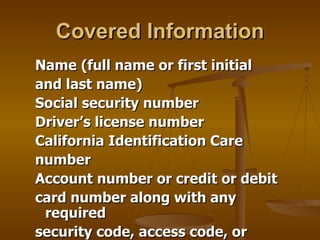

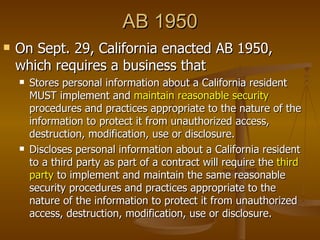

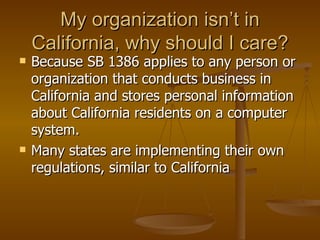

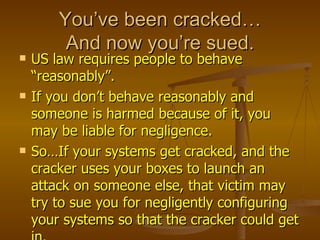

The document provides an overview of various industry regulations discussed in an Information Systems lecture. It summarizes key points about regulations including the Federal Information Security Management Act, Gramm-Leach-Bliley Act, Health Insurance Portability and Accountability Act, Sarbanes-Oxley Act, and California data privacy laws. The lecture emphasizes that major regulations require organizations to implement security controls around authentication, auditing, data protection, and integrity. It also notes an 80/20 rule, where regulations share about 80% of requirements but have 20% industry-specific differences.