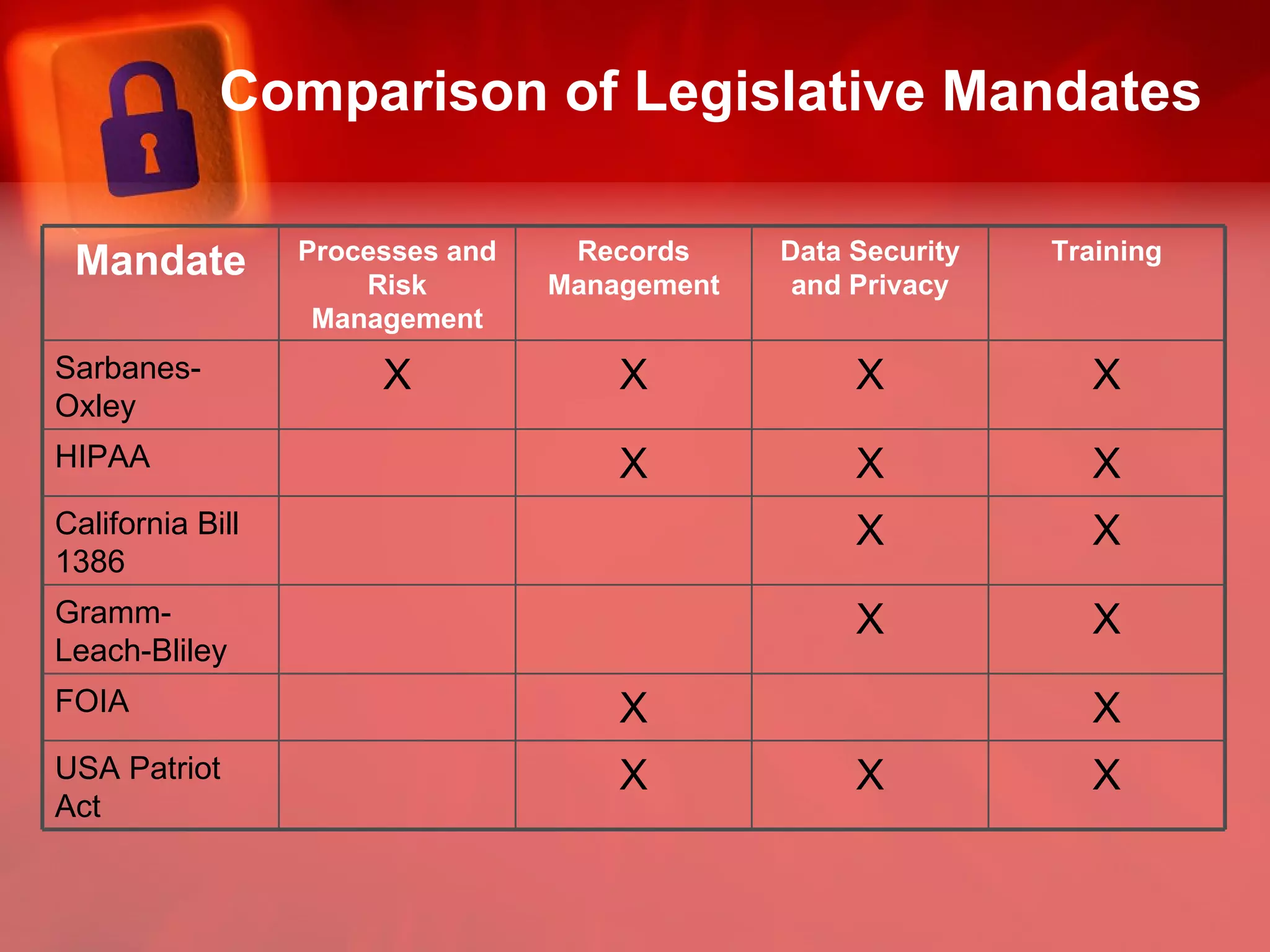

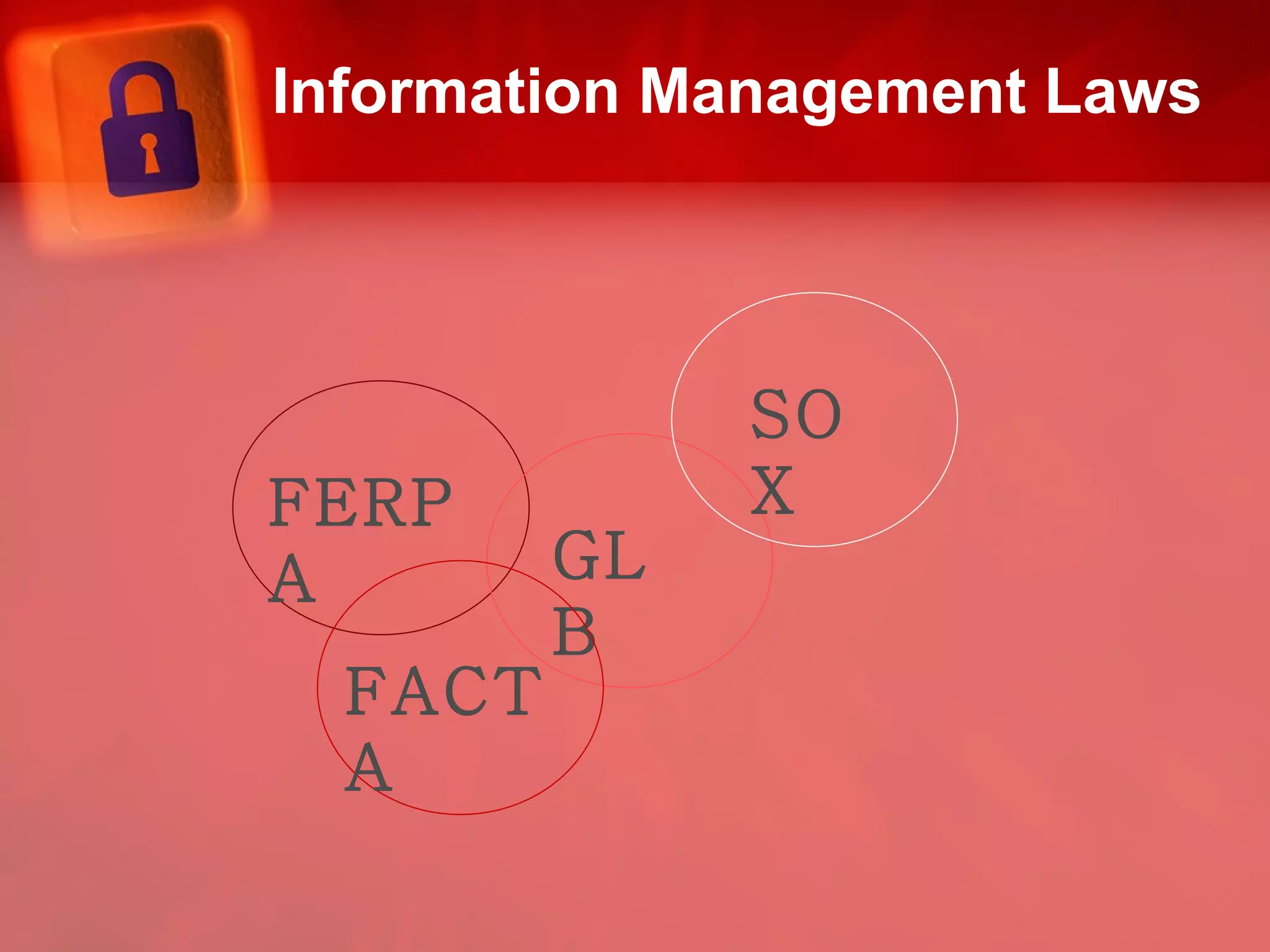

Higher education institutions experience more data breaches than any other industry. The document discusses privacy and security laws and regulations that apply to higher education such as FERPA, GLB, and state privacy laws. It provides recommendations for developing a comprehensive privacy program including inventorying information assets, assessing risks, reviewing policies, training employees, and monitoring compliance.

![Contact information Raymond K. Cunningham, Jr. Manager of Records Services University of Illinois Foundation Urbana IL 61801 [email_address] 217 244-0658](https://image.slidesharecdn.com/raycunninghamebig10devit-111218093148-phpapp01/75/Protecting-Donor-Privacy-48-2048.jpg)