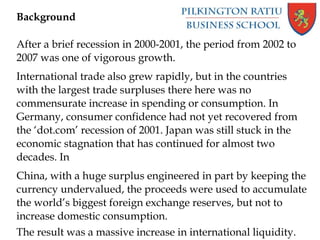

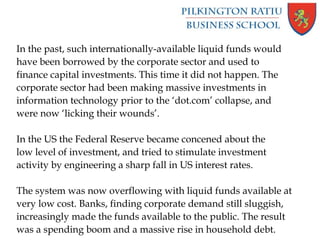

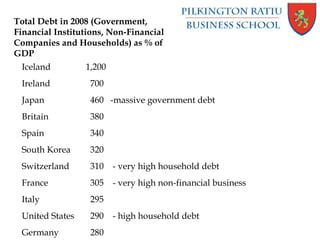

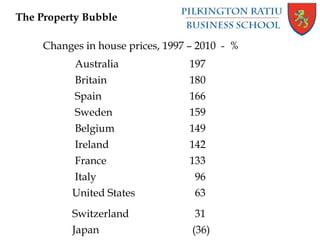

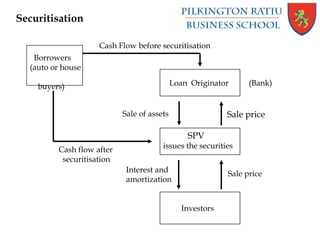

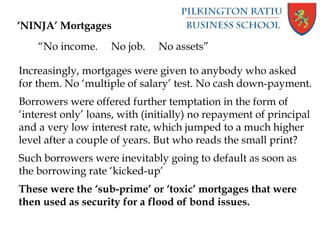

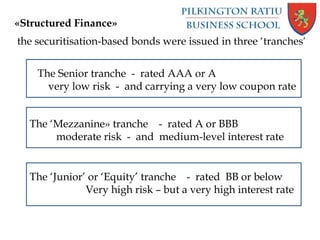

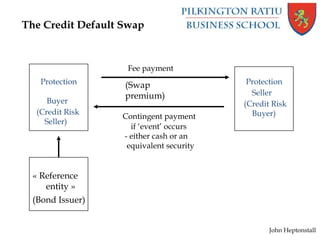

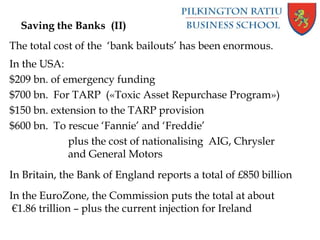

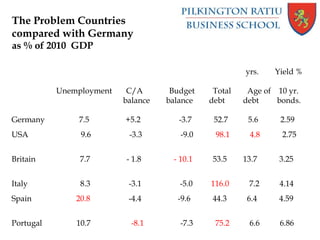

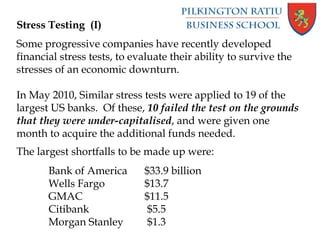

The document provides background on the global financial crisis. It discusses how a period of growth from 2002-2007 was followed by a recession. Countries like Germany, Japan, and China saw trade surpluses but did not increase domestic spending. Low interest rates in the US led to a spending boom and rise in household debt. Risky "NINJA" mortgages were securitized and sold, fueling a property bubble. The defaults began with subprime mortgages, causing interbank lending to dry up. Governments launched expensive bailouts of banks but now face high debt levels. International groups like the IMF, EU stabilization fund, and Financial Stability Board are working to reform regulations and restore stability.