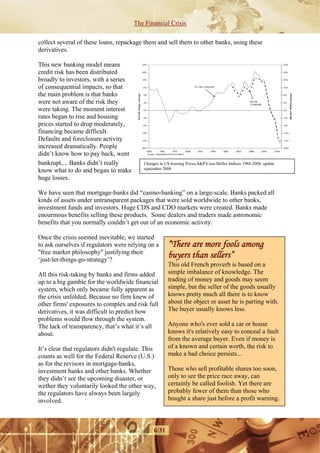

The document provides a summary of the key causes and events of the global financial crisis that began in 2007-2008. It discusses how a decline in lending standards and rising housing prices in the US encouraged many homeowners to take on difficult mortgages. Once housing prices dropped and interest rates rose, defaults and foreclosures increased dramatically. US banks had repackaged risky mortgages into complex financial products that were distributed globally, spreading risk throughout the financial system and making the effects of the crisis global in scale. The document outlines several major events such as the failures of Bear Stearns and Lehman Brothers that accelerated the crisis.