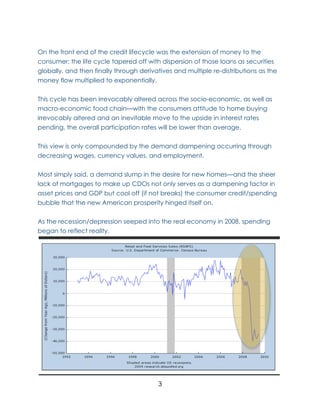

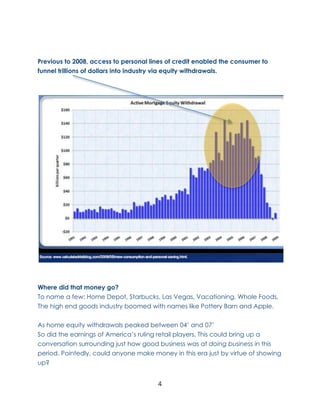

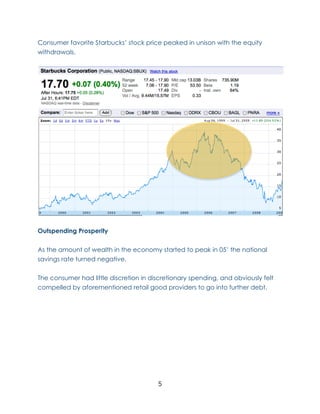

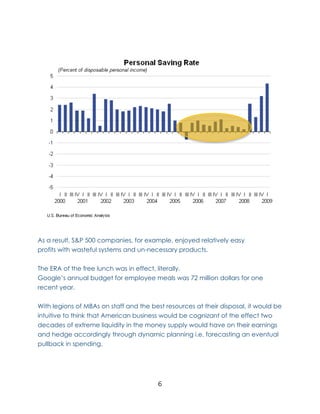

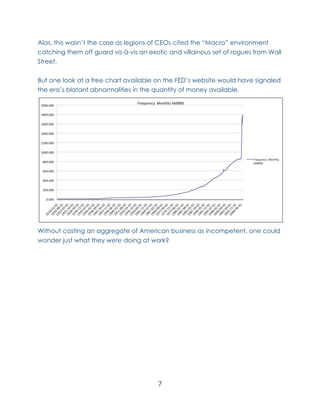

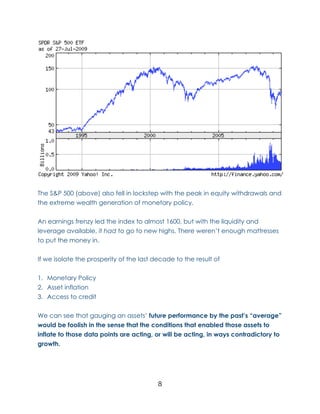

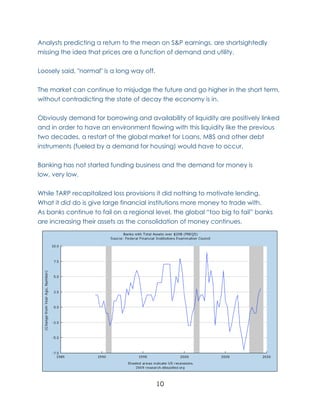

The document discusses how the US economic growth of the last decade was fueled by consumer spending and easy credit access, but these conditions have now changed in ways that make a return to "normal" unlikely. It argues that earnings and GDP growth depended on factors like monetary policy, asset inflation, and consumer leverage that are no longer applicable. It questions where future earnings, buying power, and credit will come from to support previous levels of economic activity and asset prices.

![Adam Steinberg financial Research

adam

steinberg

Building intuition into the Macro Environment

[Type

the

abstract

of

the

document

here.

The

abstract

is

typically

a

short

summary

of

the

and understanding the earnings discrepancy

contents

of

the

document.]

July/Aug 2009

[Company

Address]

1](https://image.slidesharecdn.com/macroresearch-12492585516797-phpapp01/75/Macroresearch-1-2048.jpg)