The document summarizes the global financial crisis, its causes, responses, and future implications. It also discusses Israel's relative insulation and need for public sector reform. The key points are:

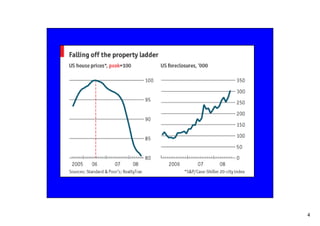

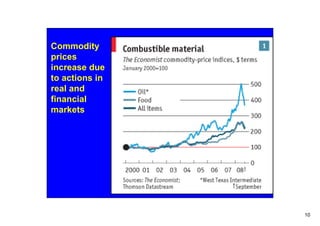

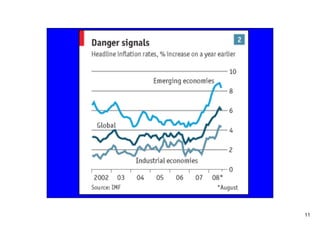

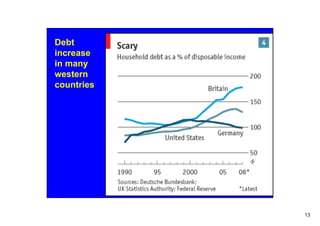

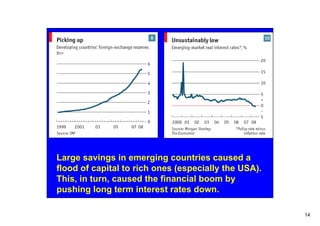

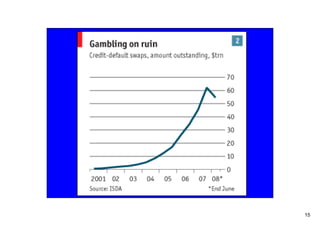

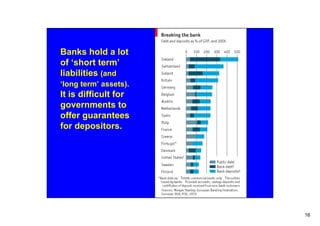

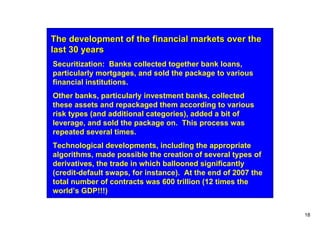

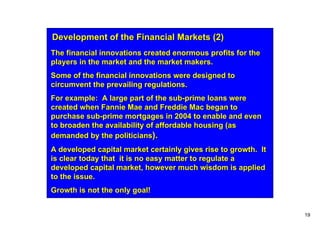

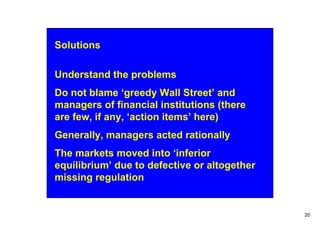

1) The crisis began in subprime mortgages but became a liquidity crisis due to over-complex financial assets and defective regulation.

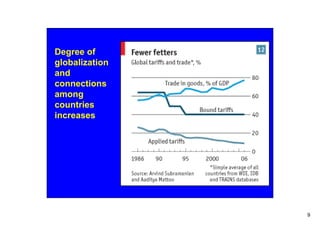

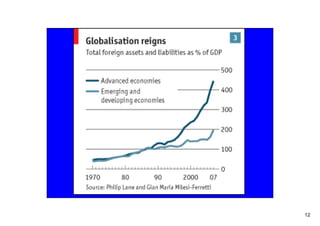

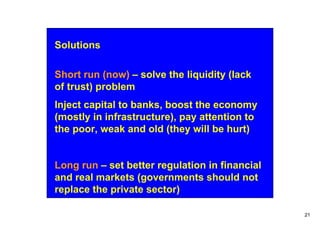

2) Responses focused on injecting capital into banks while improving long-term regulation. Emerging markets will have more influence going forward.

3) Israel was less affected due to avoiding complex assets and prudent bank regulation, but needs reform of weak public infrastructure planning and regulation of oligopolies.