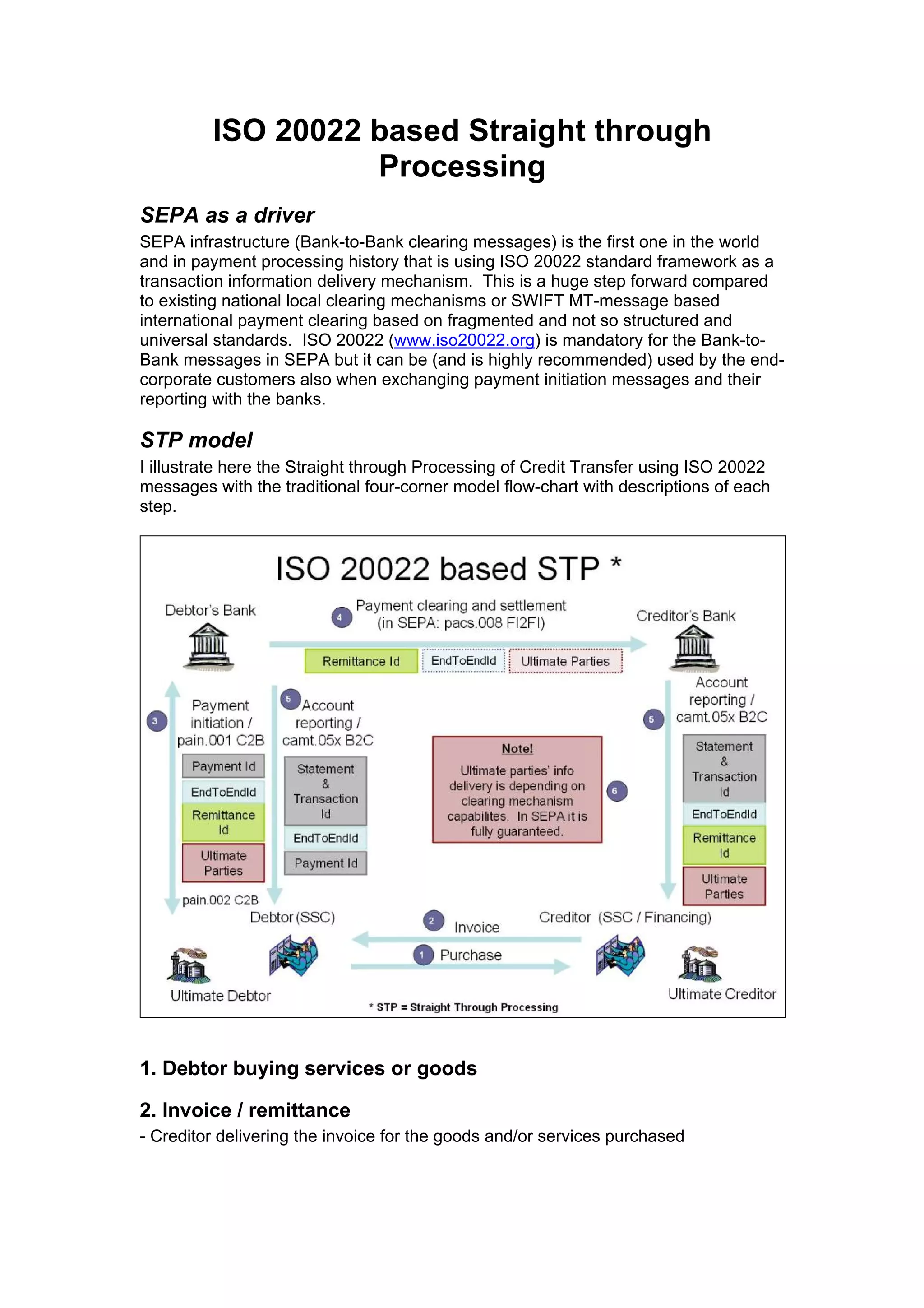

ISO 20022 based Straight through Processing

SEPA uses the ISO 20022 standard for bank-to-bank clearing messages, representing a major step forward from previous national and SWIFT MT standards. ISO 20022 can also be used by corporate customers to exchange payment initiation messages and reports with banks. Straight through processing with ISO 20022 enables automated end-to-end payment processing from debtor to creditor banks. Common Global Implementation guidelines are being developed to standardize usage of ISO 20022 messages internationally and avoid fragmentation.