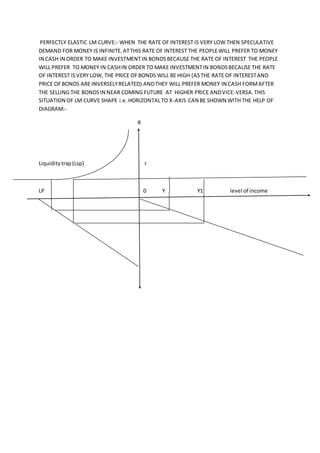

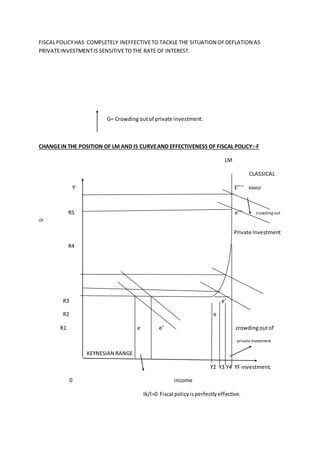

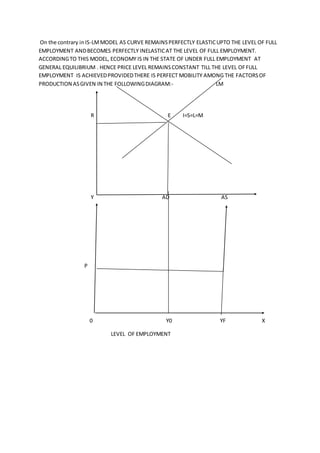

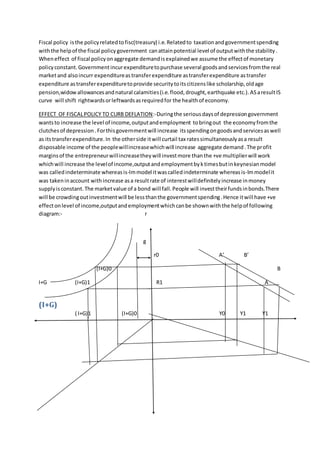

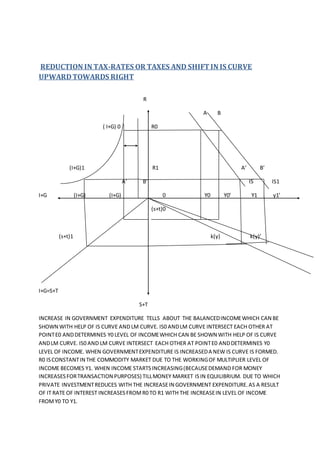

This document discusses the effectiveness of fiscal policy in controlling inflation or deflation based on the slope of the IS curve. It explains that fiscal policy will be more effective when the IS curve has a steeper slope (is less elastic) as it will allow a change in fiscal policy to more significantly impact the level of income and interest rates without crowding out private investment. It also discusses how the slope of the LM curve and positions of the IS and LM curves impact the fiscal multiplier.

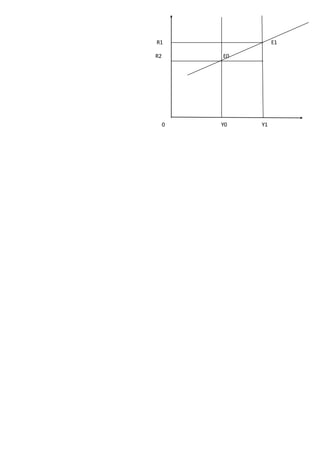

![IS ANDLM CURVE INTERSECT EACH OTHER AT POINTE1, i.e. the commoditymarketandmoney

bothare in equilibrium.Inportion B of the diagram, withthe increase the government

expenditure(G),aggregateDemand(AD) increasesto(AD1).

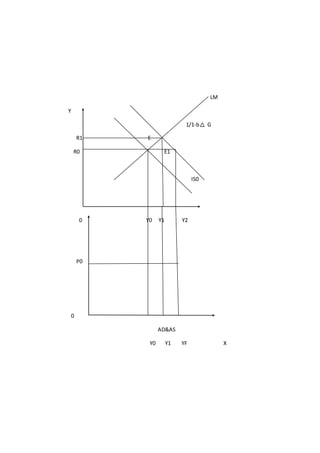

Workingof GovernmentmultiplierinISLMmodel:- IN IS-LMMODEL, WITH THE INCREASESIN

GOVERNMENT EXPENDITURETHE INCOME MULTIPLIER MANY FOLDS DUE TO THE WORKINGOF

INVESTMENT.IN KEYNESIAN MODEL THE VALUE OF MULTIPLIER DECREASES DUE TO THE

INVOLVEMENT OF MONEY .KEYNESIAN MULTIPLIER IS LIMITED TO ISCURVE WHICH CAN BE SHOWN

WITH THE HELP OFEQUATION:-

K=1/1-b(1-t) --------------------------------------------------------------------------------------(1)

B=mpc t=taxrate

=MPT K=multiplier

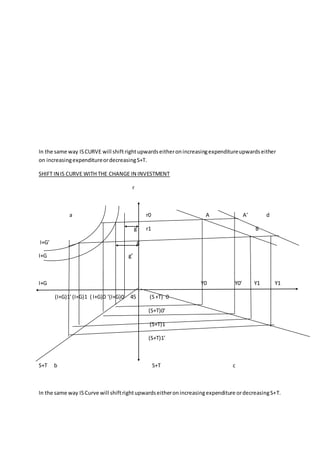

With the change in G, IS CURVE SHIFTS UPWARDSOR DOWNWARDSWITH THE CHANGE IN RATE

OF INTEREST.IT IS CALLED IS-LMMULTIPLIER. DUE TO THE CHANGEIN GOVERNMENT EXPENDITURE

IT IS CALLED IS-LMFISCALMULTIPLIER. DUE TO CHANGEIN GOVERNMENTEXPENDITURE IT IS

CALLED IS-LMFISCALMULTIPLIER. IT CAN BE OBTAINEDIS-LMFISCALMULTIPLIER. IT CAN BE

OBTAINEDISLMEQUATIONS AREDIFFERENTATED ASFOLLOWS:-

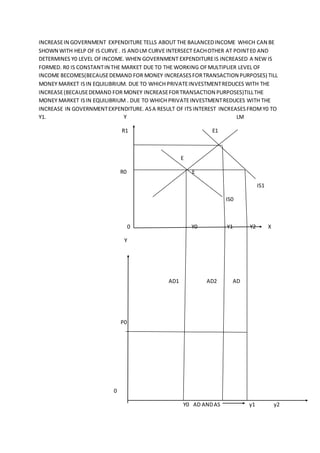

ISLMEQUATIONS AREDIFFERENTED AS FOLLOWS:-ISCURVETELLS THE VARIOUSCOMBINATIONSOF

Y (INCOME) ANDR (RATEOF INTEREST )ATWHICH EQUILIBRIUM IS ATTAINEDIN THE COMMODITY

MARKET WHICH CAN BE EXPLAINEDWITH FOLLOWINGEQUATIONS:-

Y=C[Y-T(Y)] +I(R)+G---------------------------------------------------------(1)

LM CURVES TELLS THE VARIOUSCOMBINATIONSOFY ANDR AT WHICH EQUILIBRIUM ISATTAINED

IN THE MONEY MARKET WHICH CAN BE EXPLAINEDWITH FOLLOWINGEQUATION:-

M/P0=L(R)+K(Y)

M/P0= QUANTITY OFREAL MONEY SUPPLY .

L(R)=LIQUIDITY PREFERENCEFOR SPECULATIVE.

K(Y)=THE RATIOOF INCOME SPENDFOR LP(LIQUIDITYPREFERENCE FOR PRECAUTIONARYMOTIVE).

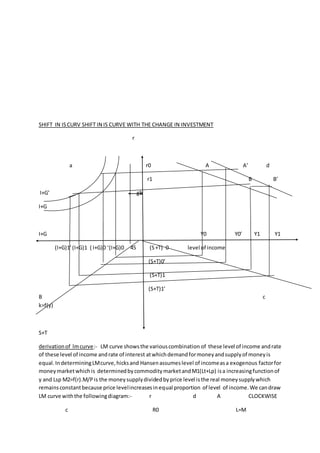

THE GOVERNMENT MULTIPLIER IS-LMEQUATIONS DIFFERENTATEDW.R.T.INCOME(y),WE GET

IS EQUATION:------ Y=C[Y- T(Y)]+I(R)+G-----------------------------------------------------------(1)

DIFFERENTIATED W.R.T. Y:-

dy/dy=dc/dy[dy/dy - dt/dy(dy/dy)]+ Di/dy(dr/dy)+dg/dy

dc/dy=bdt/dy=t di/dy=i

dy/dy=b[dy/dy+dt/dy(dy/dy)]+di/dy(dr/dy)+dg/dy](https://image.slidesharecdn.com/is-lmmodel-220213082545/85/Is-lm-model-13-320.jpg)

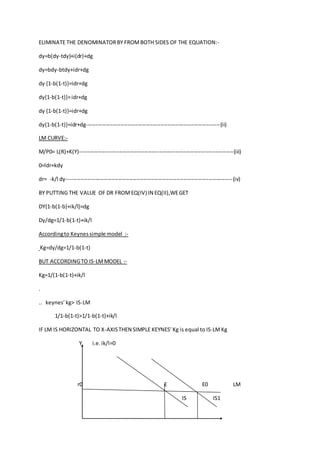

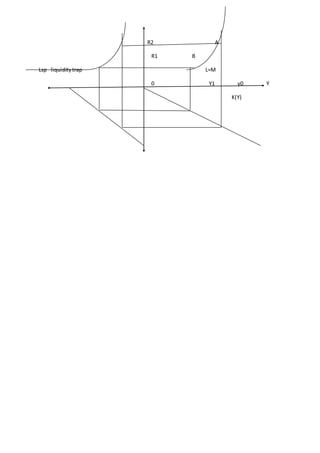

![SLOPE OF LM CURVE:- SLOPE OFLM SHIFTS UPWARDS FROMRIGHT TO LEFT . THE SLOPE OFLM

CURVE IS MORE OR LESS DEPENDSUPON THE ELASTICITY OF SPECULATIVEDEMAND FOR MONEY

[Ms=f(r)] at givenrate of interestandthe value of kis more or less. If the elasticityof speculative

demandformoneyat givenrate of interestthenLMcurve will be more elastic.If the value of kis

more or less.If the elasticityof speculative demandformoneyatgivenrate of interestthenlmcurve

will be more elastic.If the value k is more thenlmcurve will be elastic .THE SHAPEOF LM CURVE

IN SPECIALCASES IS GIVEN BELOW:-

1. PERFECTLY INELASTICLMCURVE:- LM CURVE IS PERFECTLY INELASTIC AT R(RATE OF

INTEREST).WHEN RATE OF INTEREST ISHIGH ANDECONOMY ATTAINSTHE SITUATION OF

FULL EMPLOYMENT AT HIGHER RATE OF INTEREST IN THIS SITUATION SPECULATIVE

DEMAND FOR MONEY IS ZERO.

Y LM

Rate of interest](https://image.slidesharecdn.com/is-lmmodel-220213082545/85/Is-lm-model-22-320.jpg)