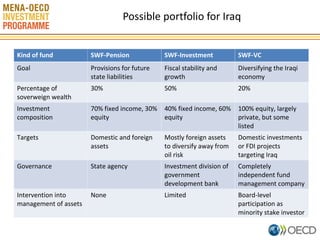

The document discusses the role of sovereign wealth funds (SWFs) in managing government portfolios, primarily derived from natural resources or trade surpluses, with a focus on Iraq's investment strategy. It suggests establishing a government venture capital fund to support non-oil economic sectors, emphasizing the need for private sector management and transparency in investment processes. Additionally, it highlights the importance of creating a favorable investment climate to attract foreign direct investment and enhance the country's economic diversification.