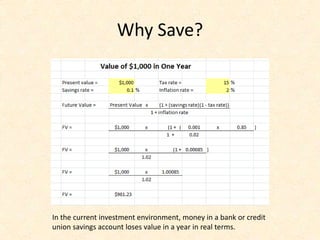

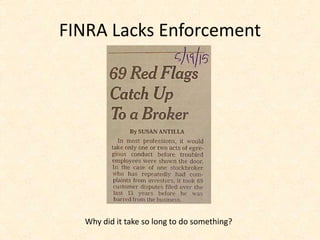

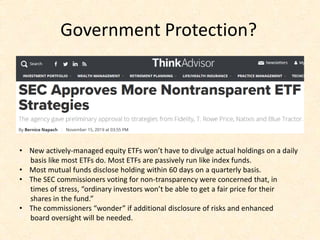

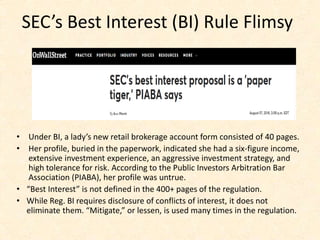

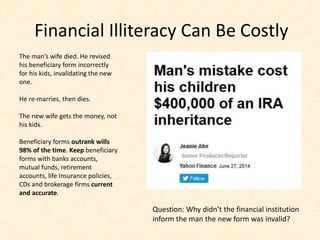

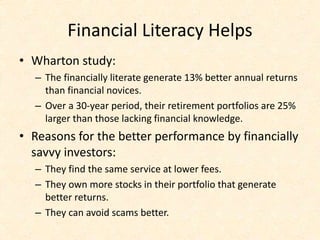

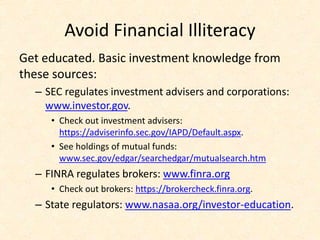

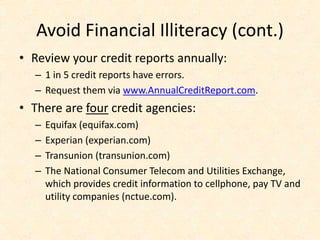

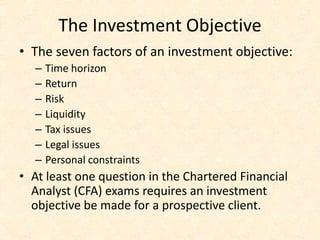

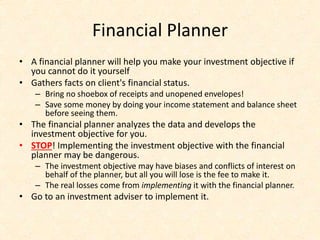

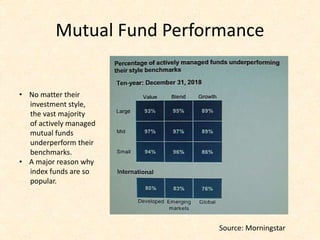

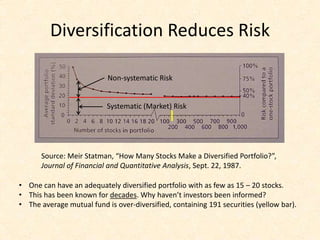

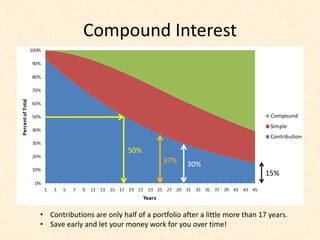

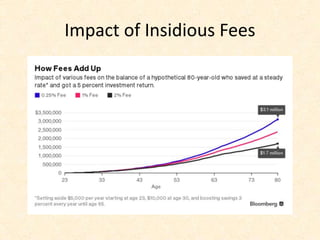

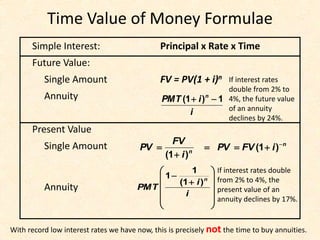

The document outlines critical investment concerns, highlighting that many investors fear outliving their money and are financially illiterate, with only 1 in 25 achieving financial independence in retirement. It discusses problems related to excessive fees, lack of transparency in investment products, and the importance of accurate beneficiary forms. Additionally, it emphasizes the benefits of financial literacy, advising investors to educate themselves to improve their financial outcomes and the need for qualified investment advisers to help construct and implement investment objectives.