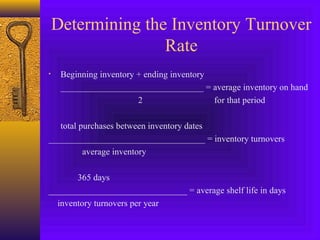

This document discusses key concepts in inventory management for veterinary practices. It defines important terms like inventory, suppliers, and costs associated with inventory. Effective inventory management is critical for practice profitability as inventory is the second largest operating cost after staffing. The document outlines the goals of inventory control and describes an effective inventory system, including tracking item information, reorder points, costs, storage locations, and pricing. It also discusses determining ordering quantities and timing to balance inventory levels and costs.