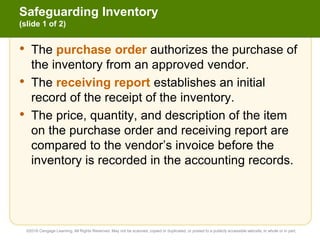

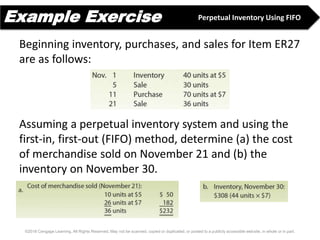

This document provides an overview of inventory accounting, including key concepts such as inventory cost flow assumptions, inventory costing methods, and controls over inventory. It describes the objectives of inventory control as safeguarding inventory and proper financial reporting. The three main inventory cost flow assumptions - FIFO, LIFO, and weighted average - are explained in detail along with their impacts on the income statement and balance sheet. The document also compares and contrasts the perpetual and periodic inventory systems and demonstrates calculations using each costing method.