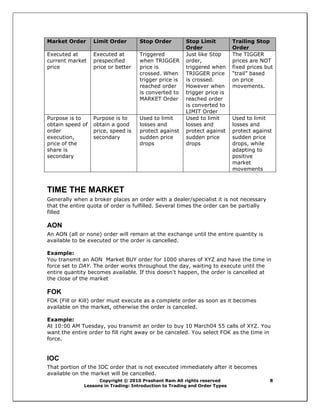

This document serves as an introduction to basic trading concepts and order types for MBA candidates and finance students. It covers key topics such as market orders, limit orders, stop orders, and various trading strategies like going long and selling short. Additionally, it explains different types of orders and their implications in trading to help enhance understanding of the stock market mechanics.