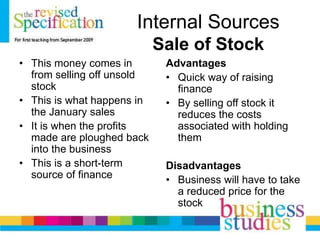

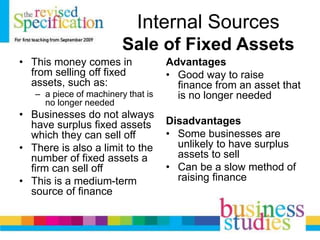

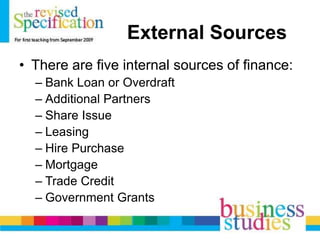

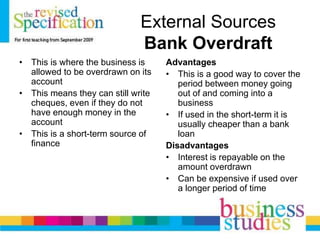

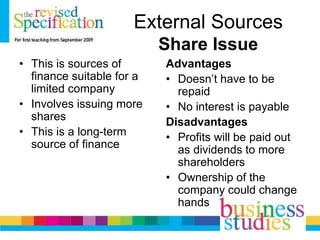

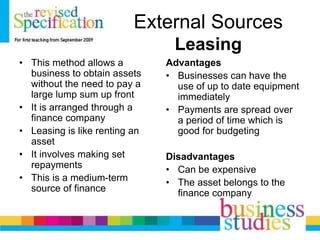

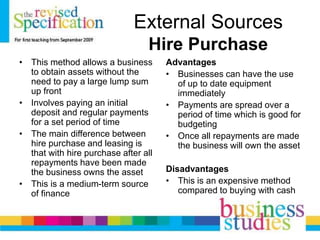

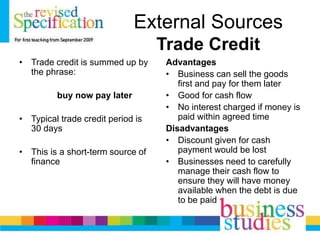

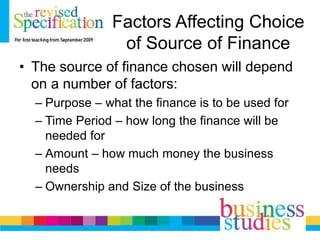

This document discusses various internal and external sources of finance that businesses can use to obtain funding. Internal sources include owner's investment, retained profits, sale of stock, sale of fixed assets, and debt collection. External sources include bank loans, overdrafts, additional partners, share issues, leasing, hire purchase, mortgages, trade credit, and government grants. The choice of financing depends on factors like the purpose of funds, time period needed, amount required, and type of business ownership.