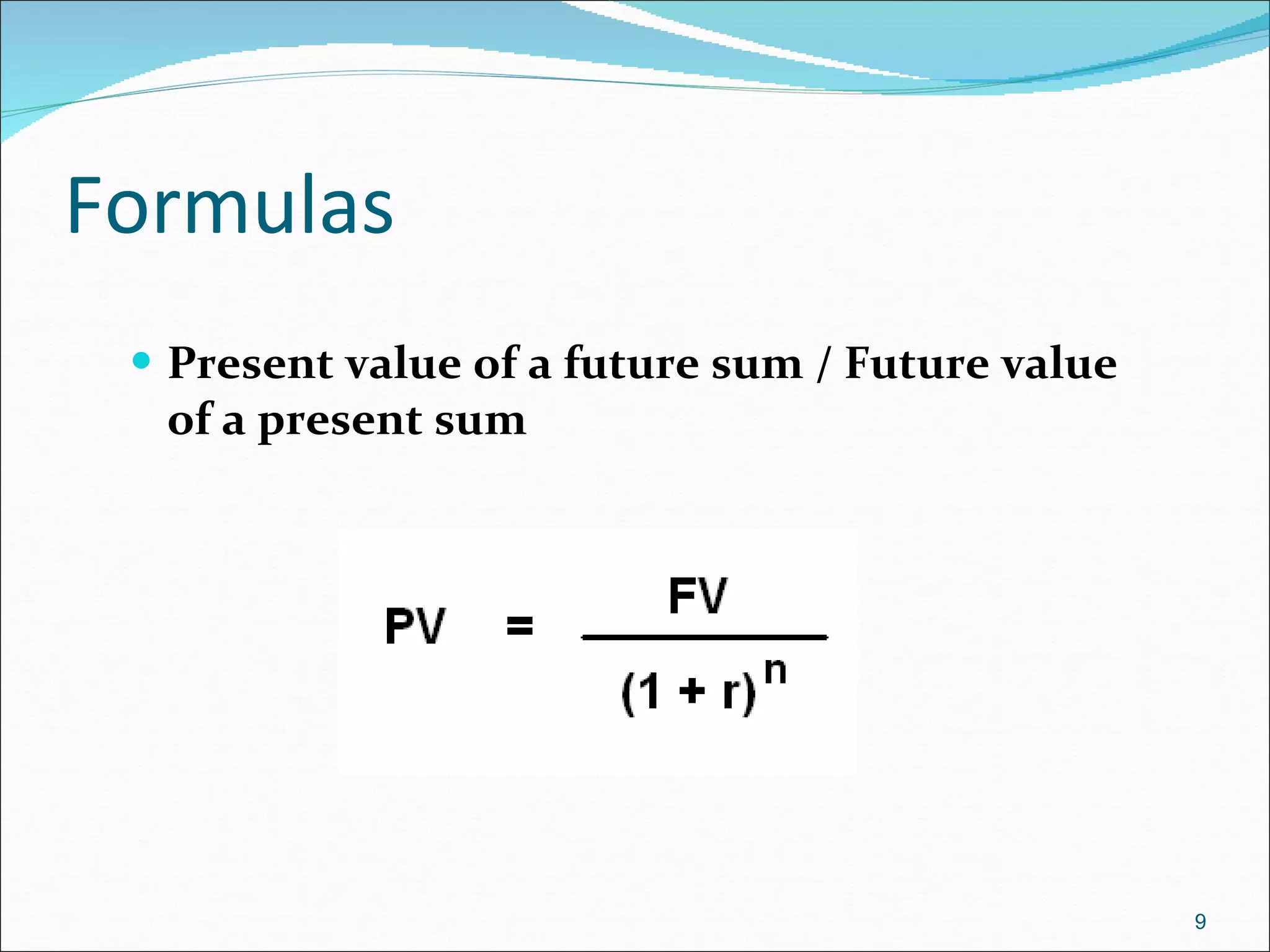

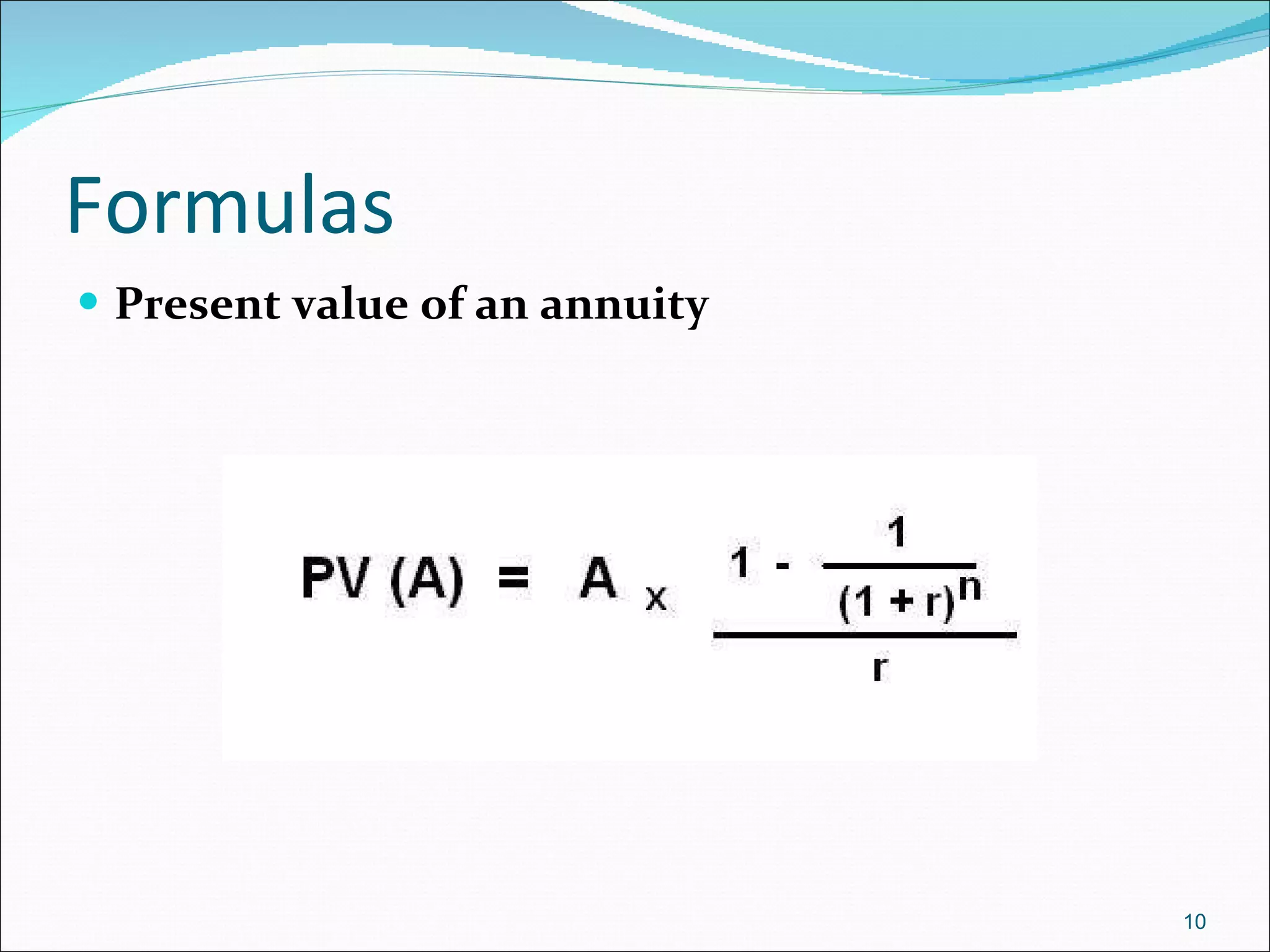

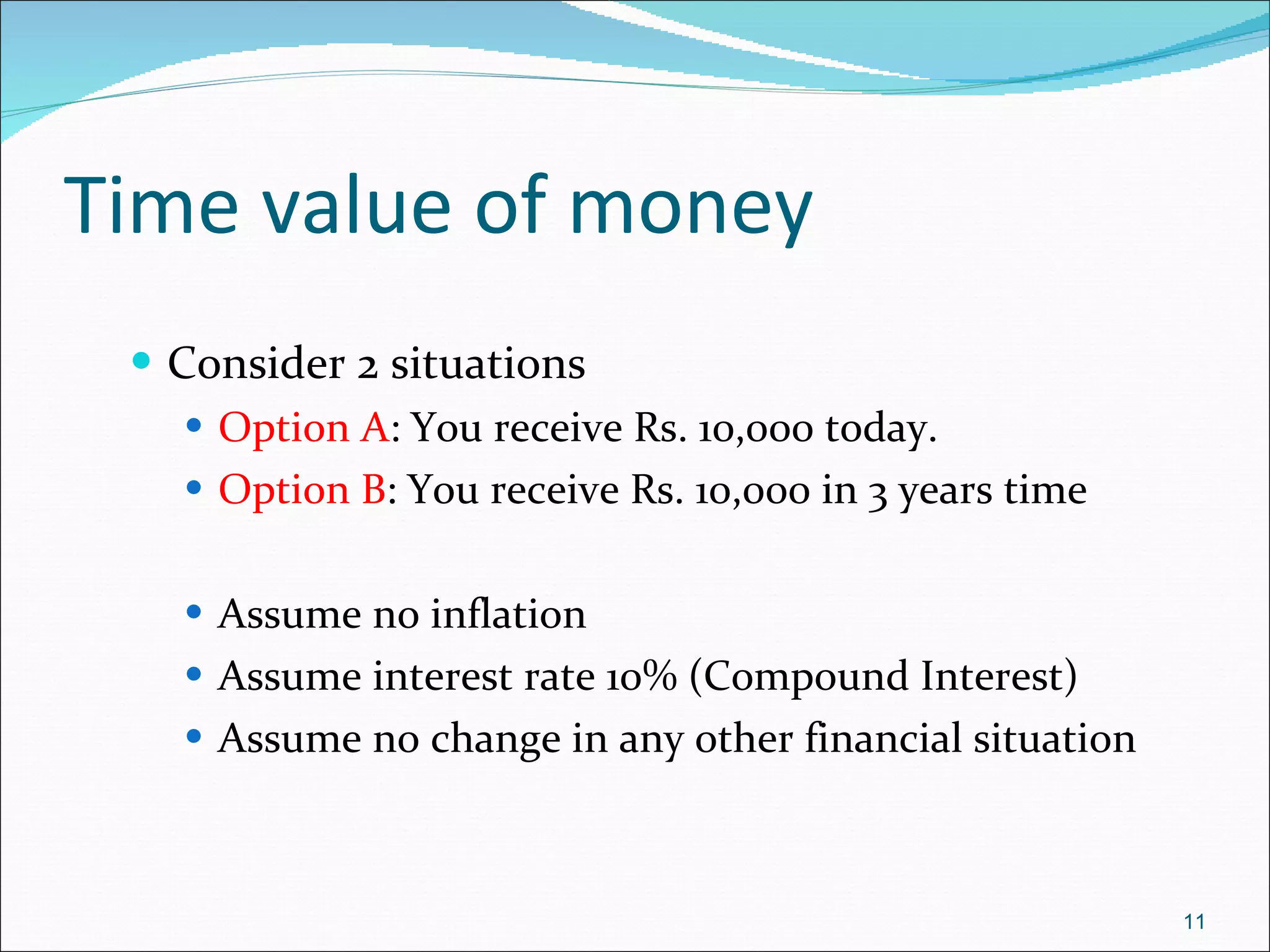

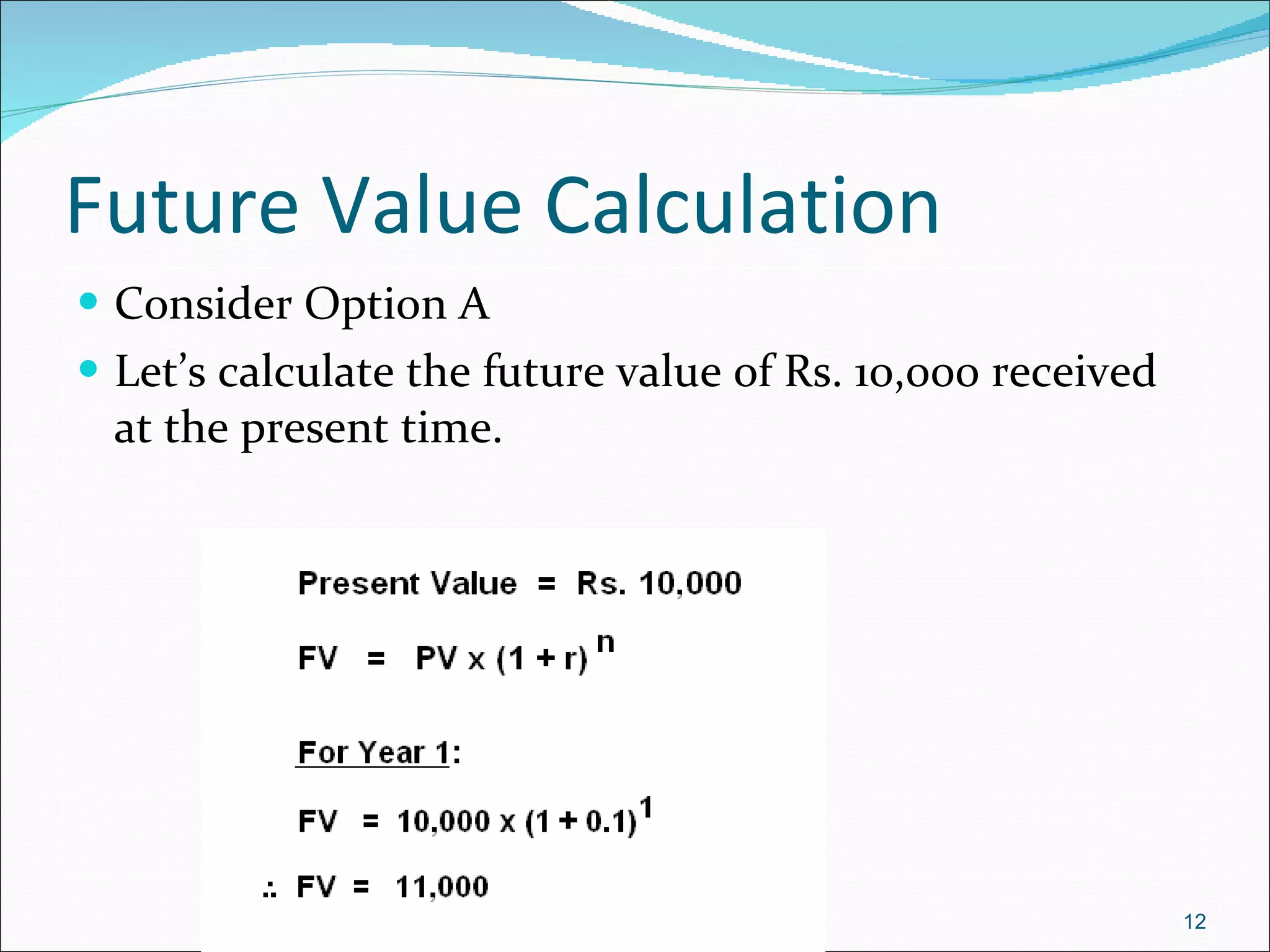

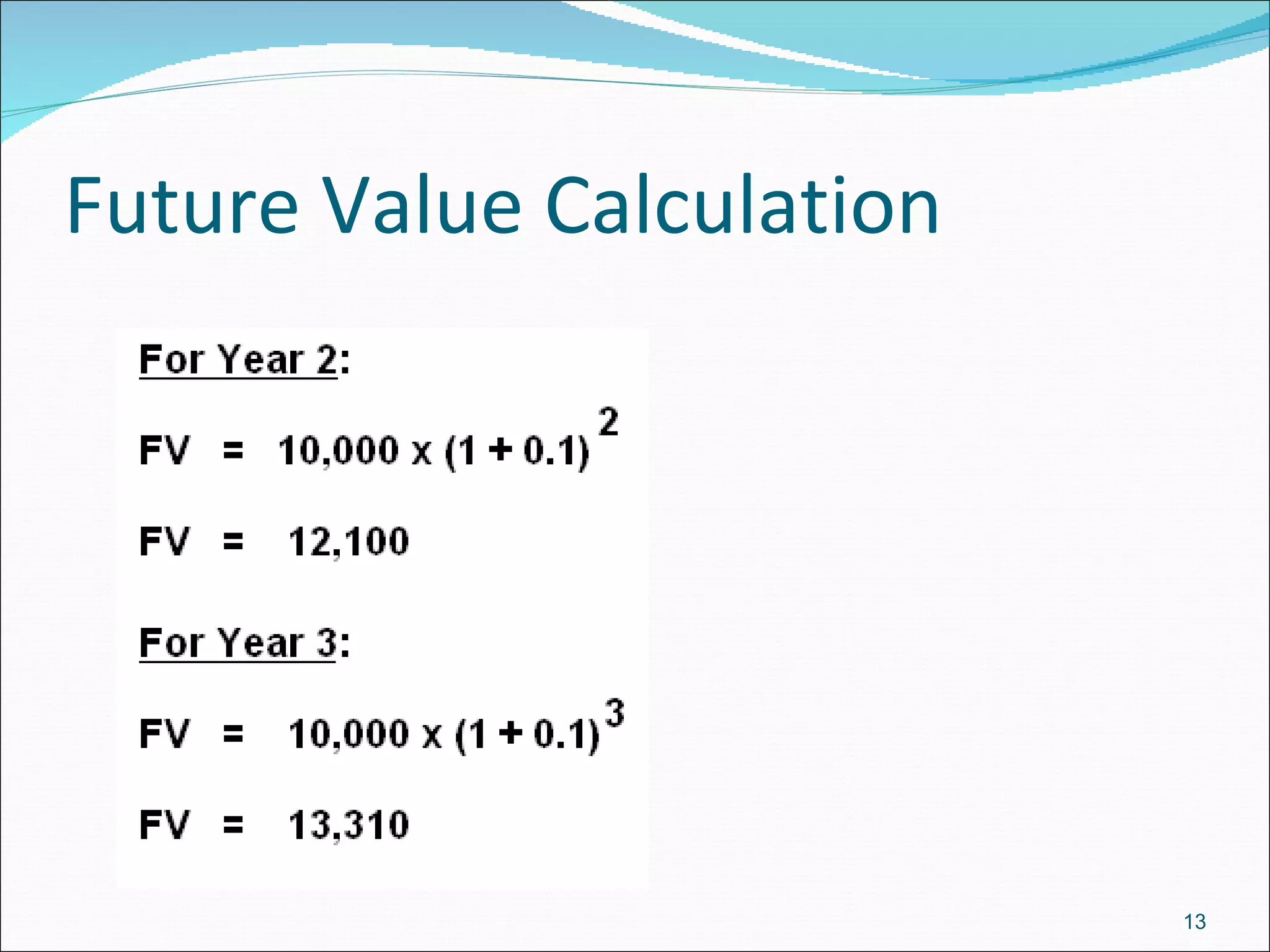

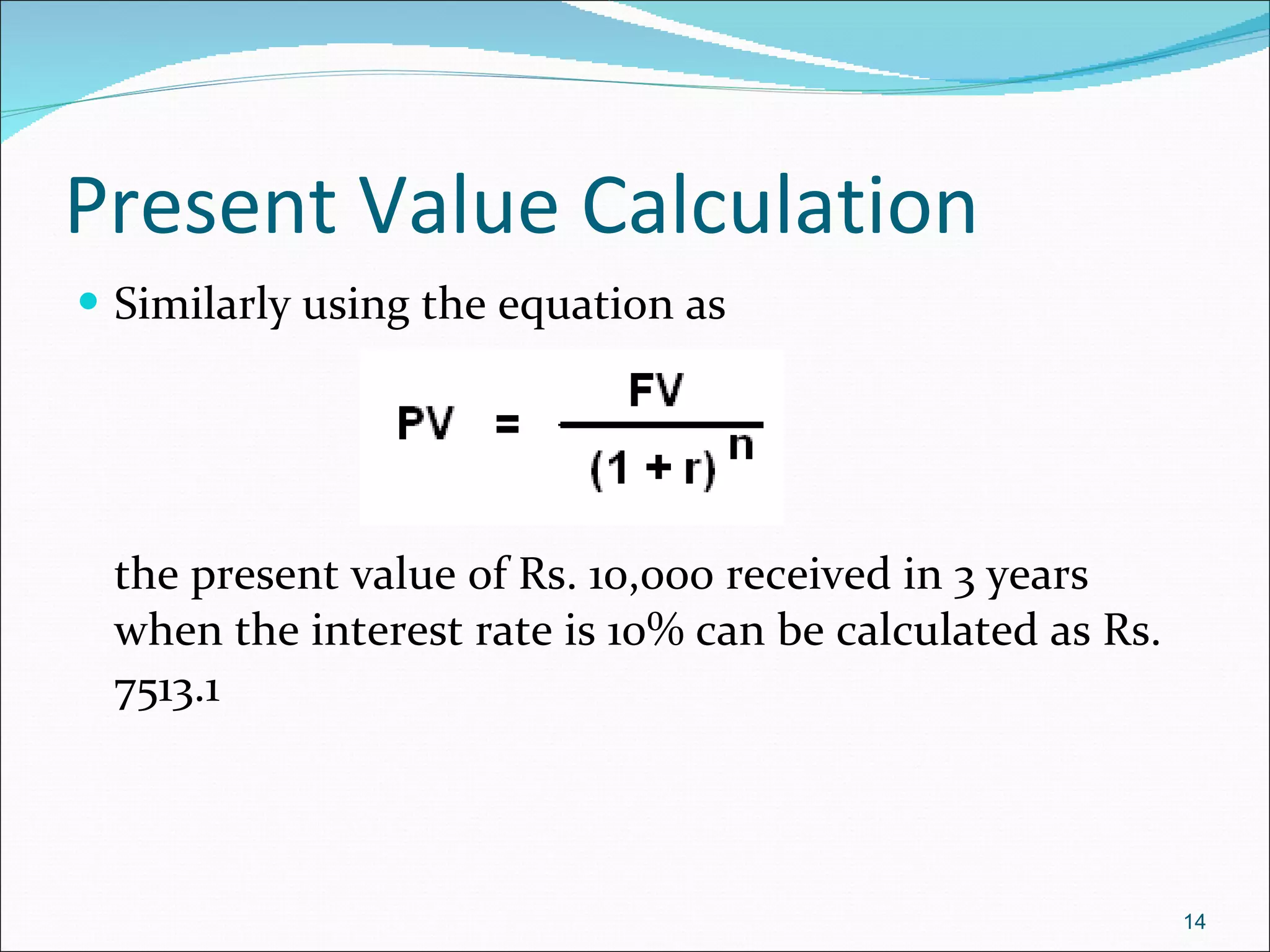

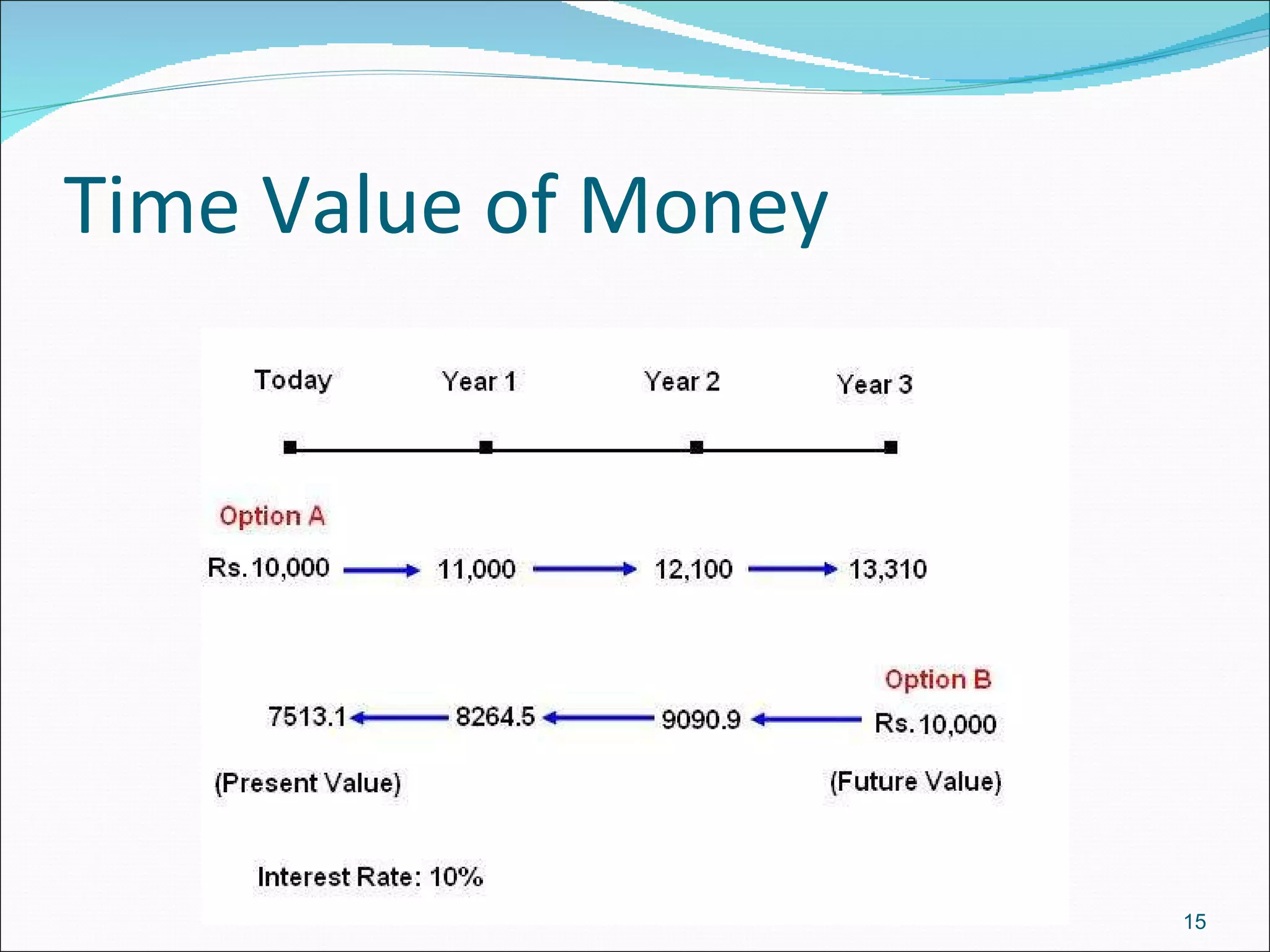

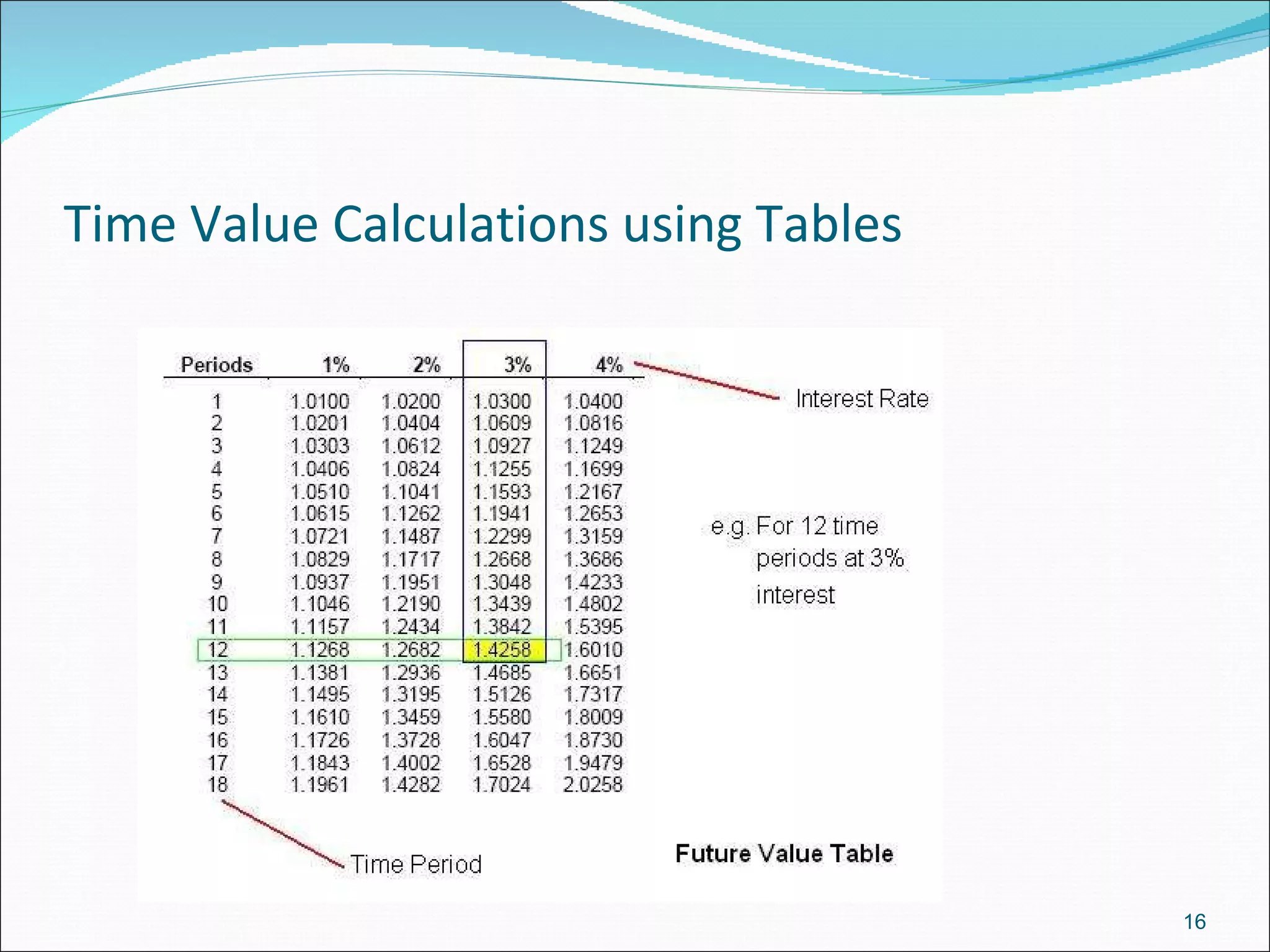

The document discusses the concept of time value of money, which is the principle that money received today is worth more than the same amount in the future due to its potential to earn interest. It defines key terms like present value and future value and provides formulas to calculate them. An example calculation demonstrates that receiving $10,000 today is preferable to receiving the same amount in 3 years, since the present value of $10,000 in 3 years at a 10% interest rate is $7,513.10. Understanding time value of money is important for financial decision making regarding investments, loans, savings, and more.