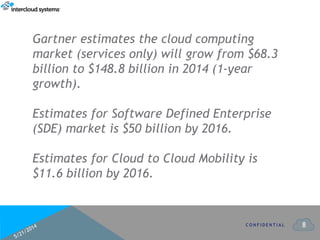

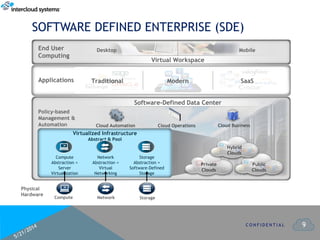

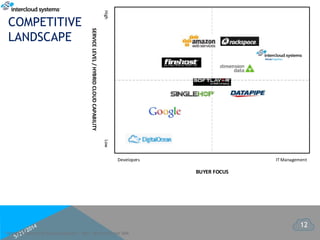

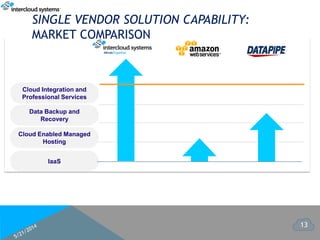

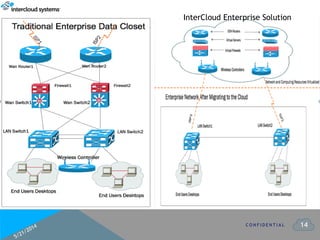

Intercloud Systems is a cloud-centric solutions company focused on partnering with enterprises and service providers to modernize their infrastructure and adopt cloud strategies. The document outlines the opportunities within the growing cloud computing market, highlighting key areas like software-defined enterprise and cloud mobility solutions. It emphasizes the company's strengths, including a seasoned leadership team and strategic partnerships to drive growth in disruptive markets.