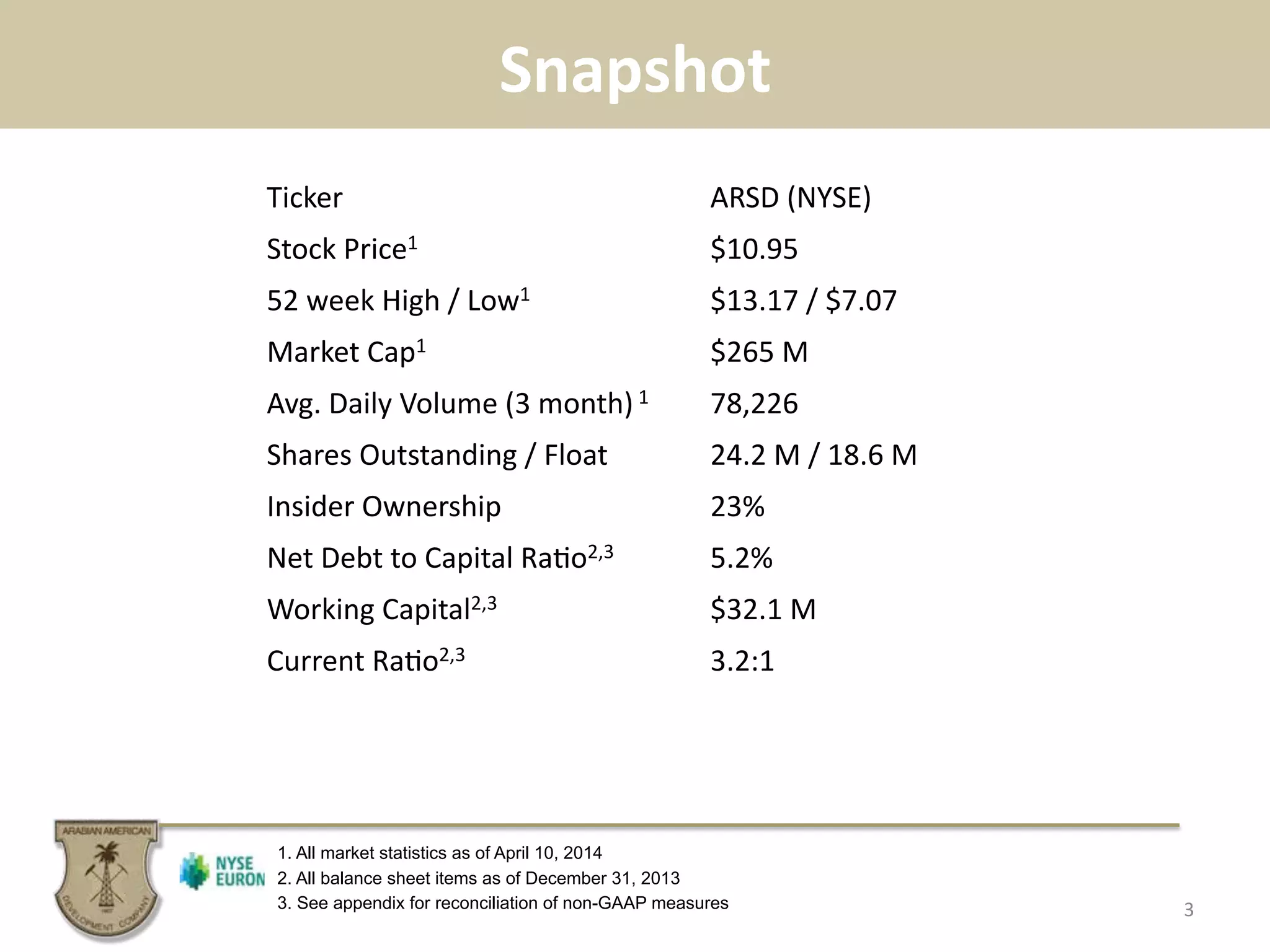

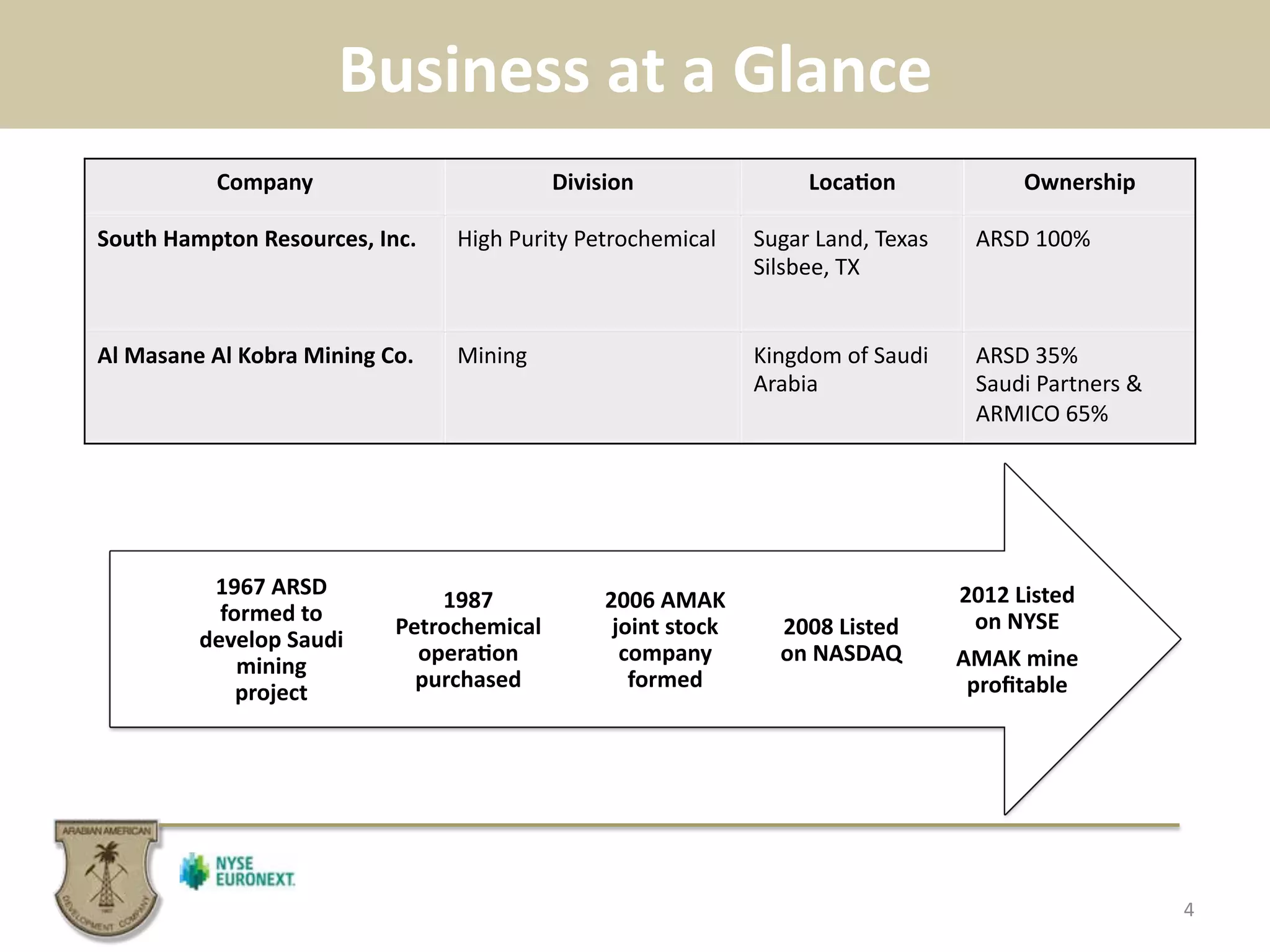

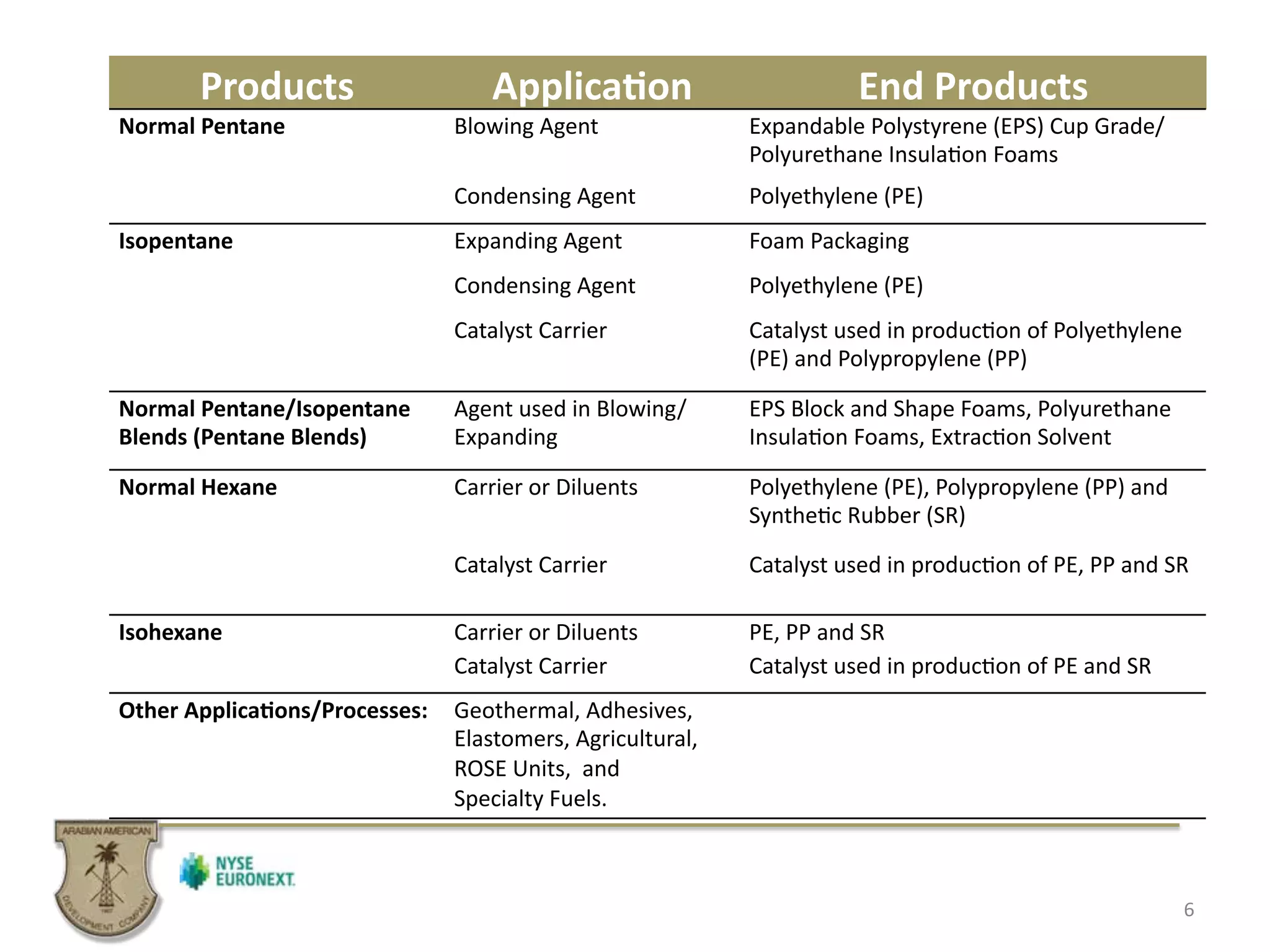

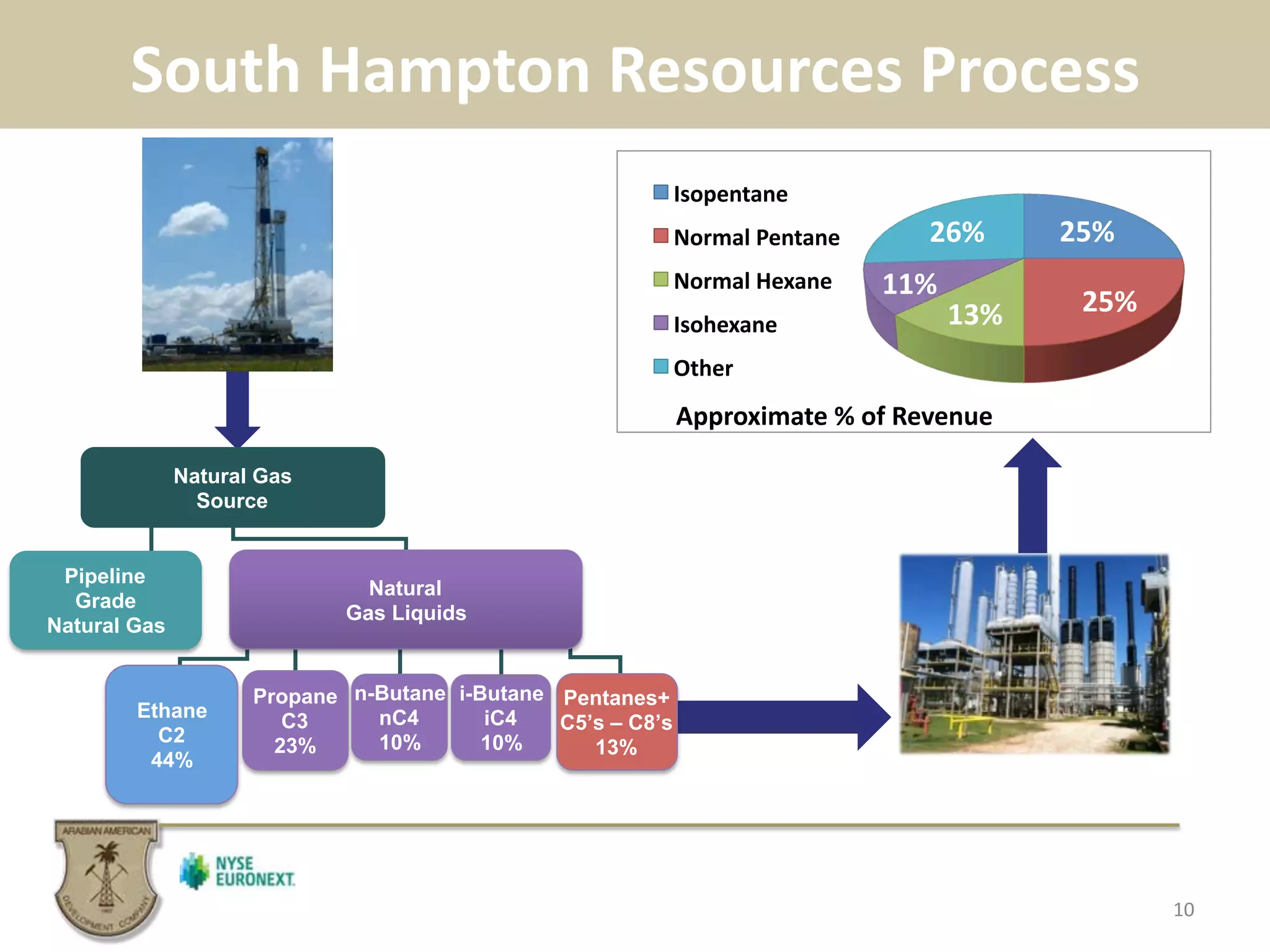

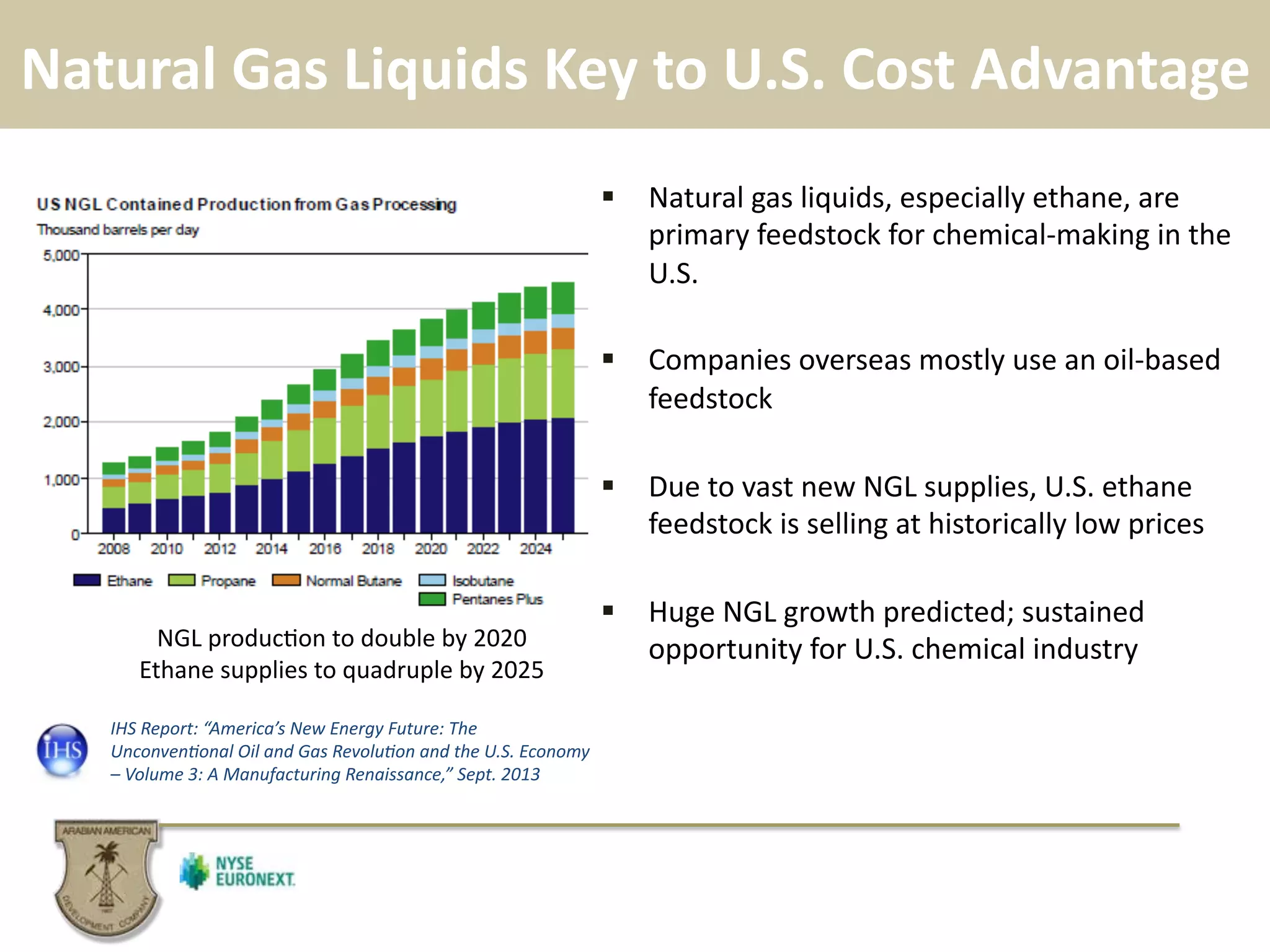

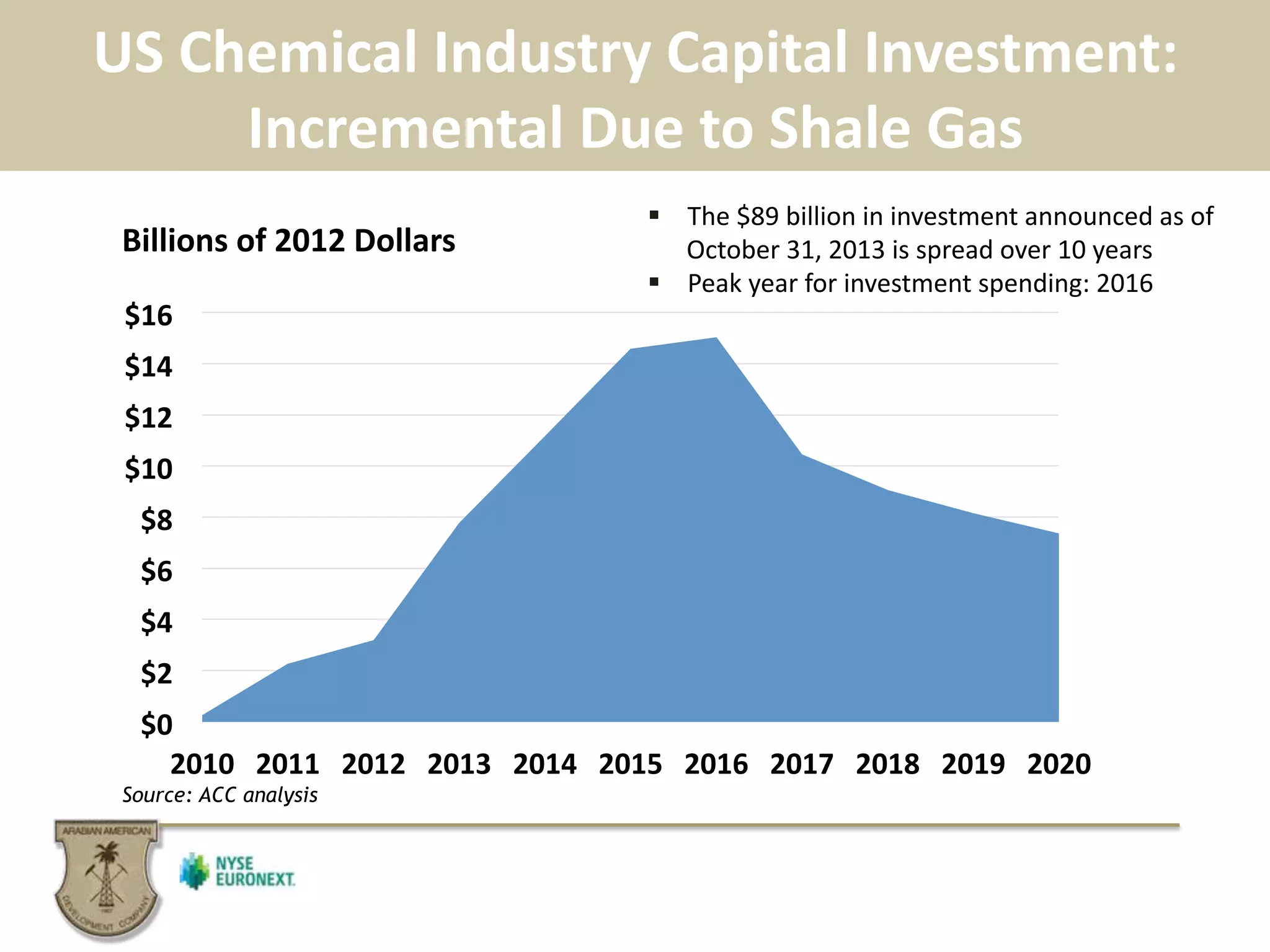

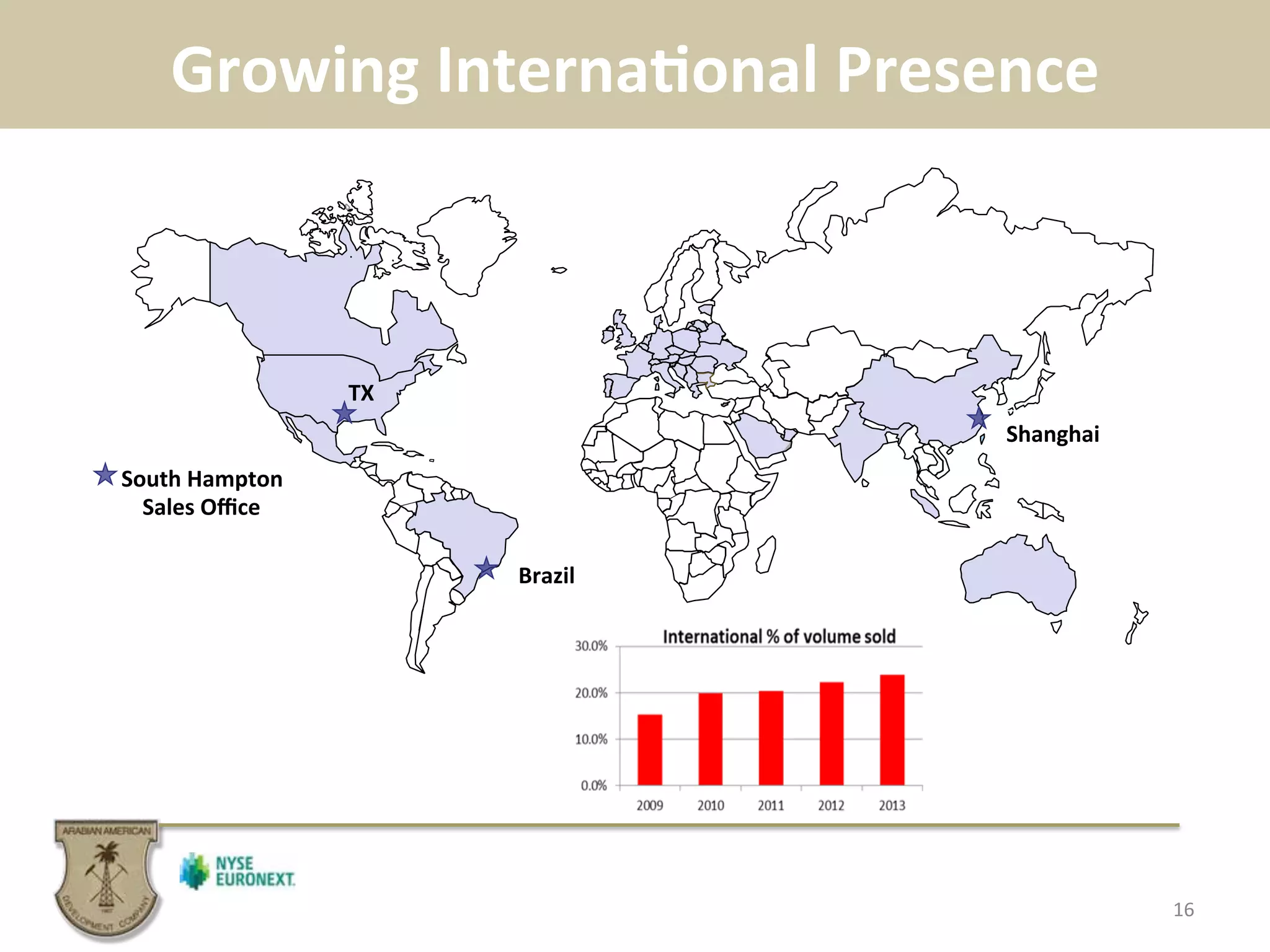

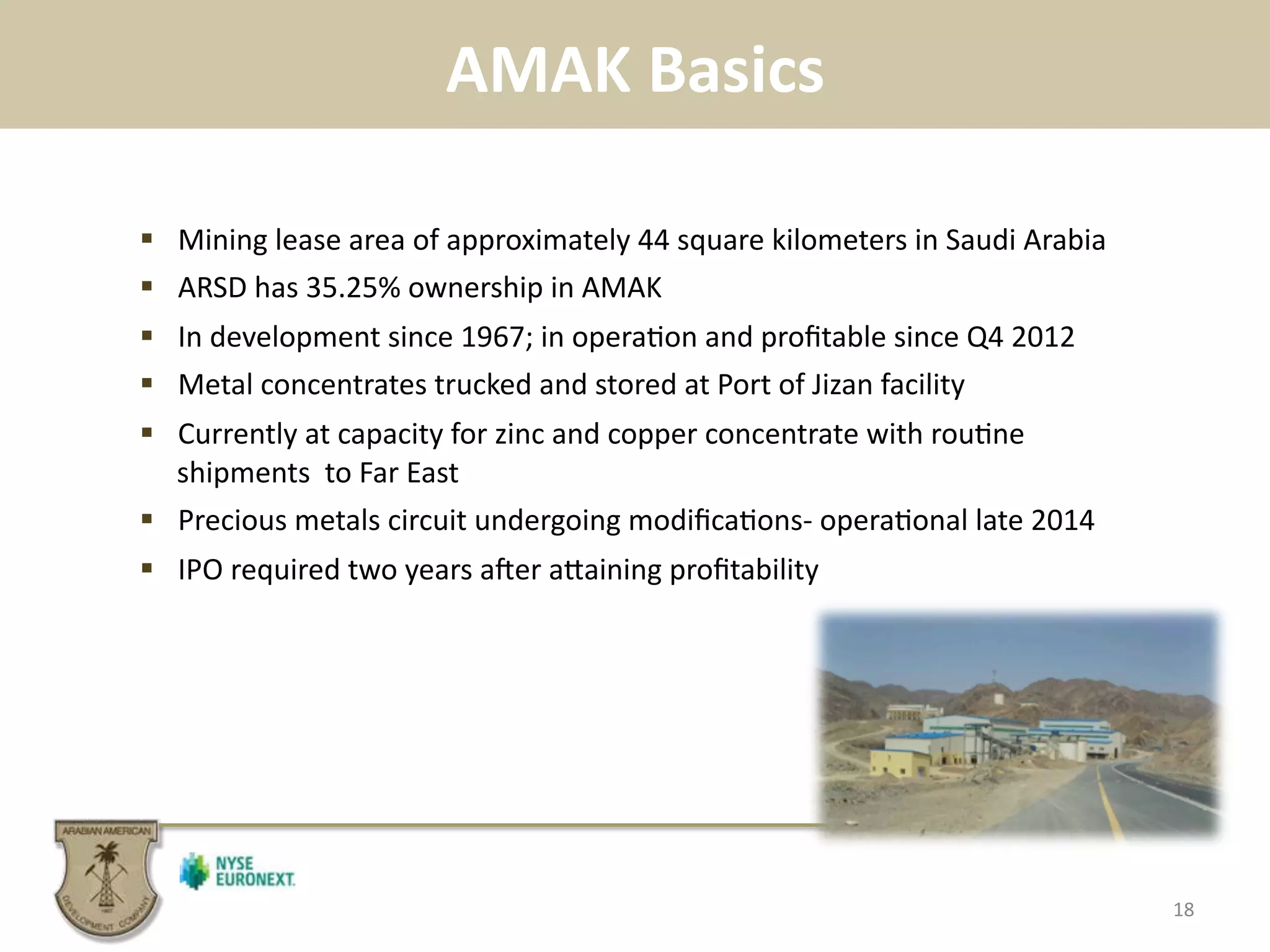

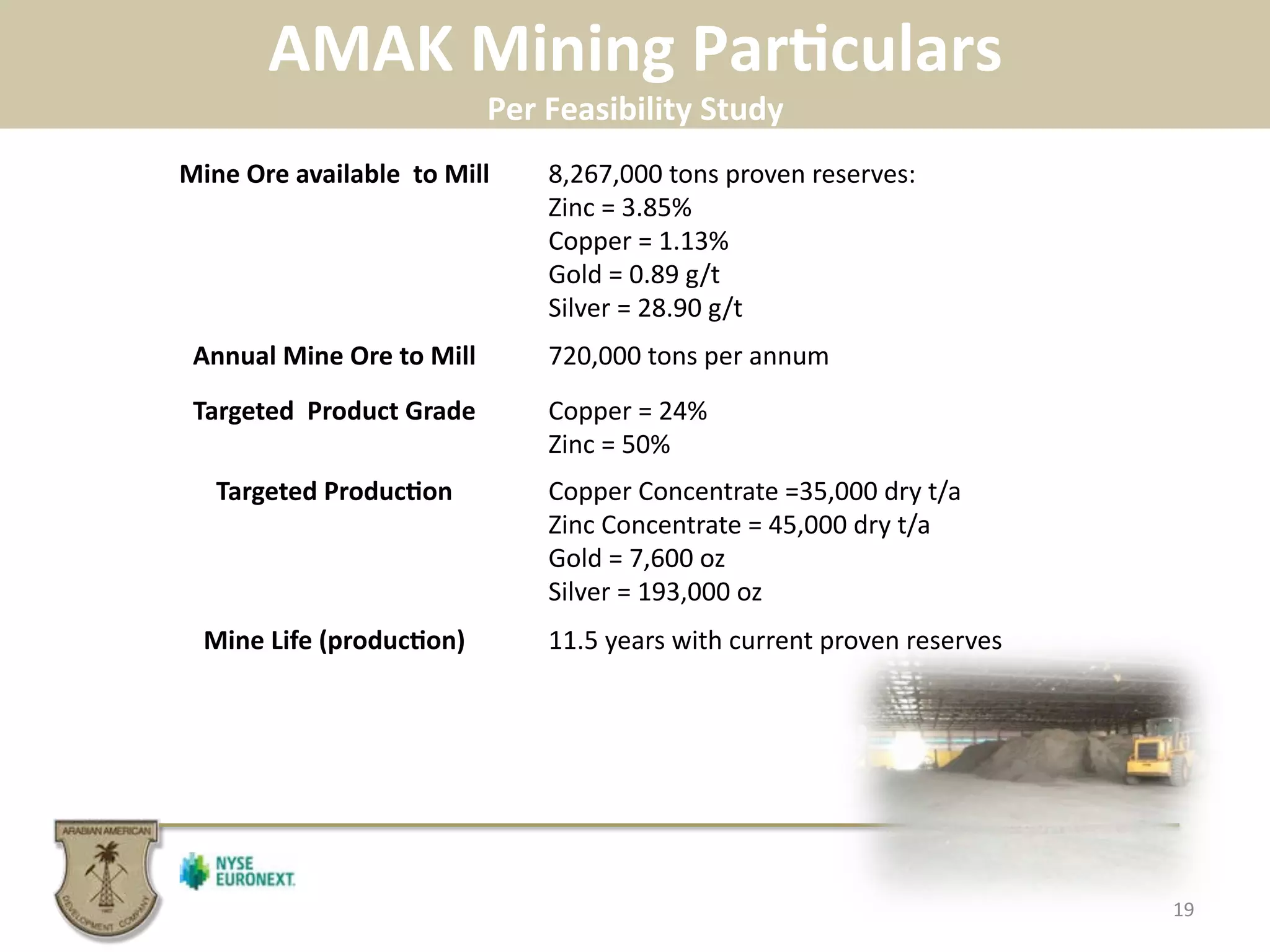

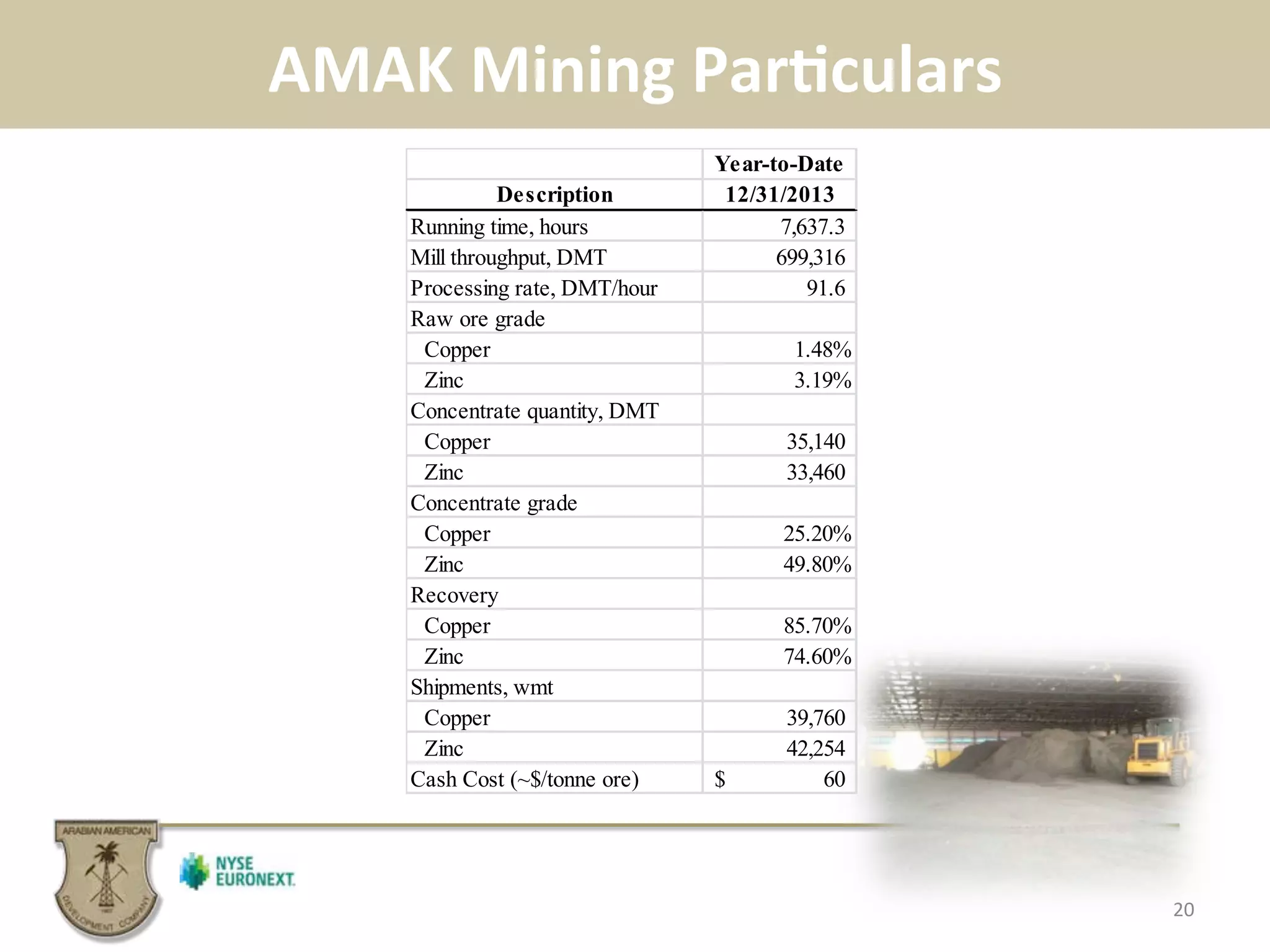

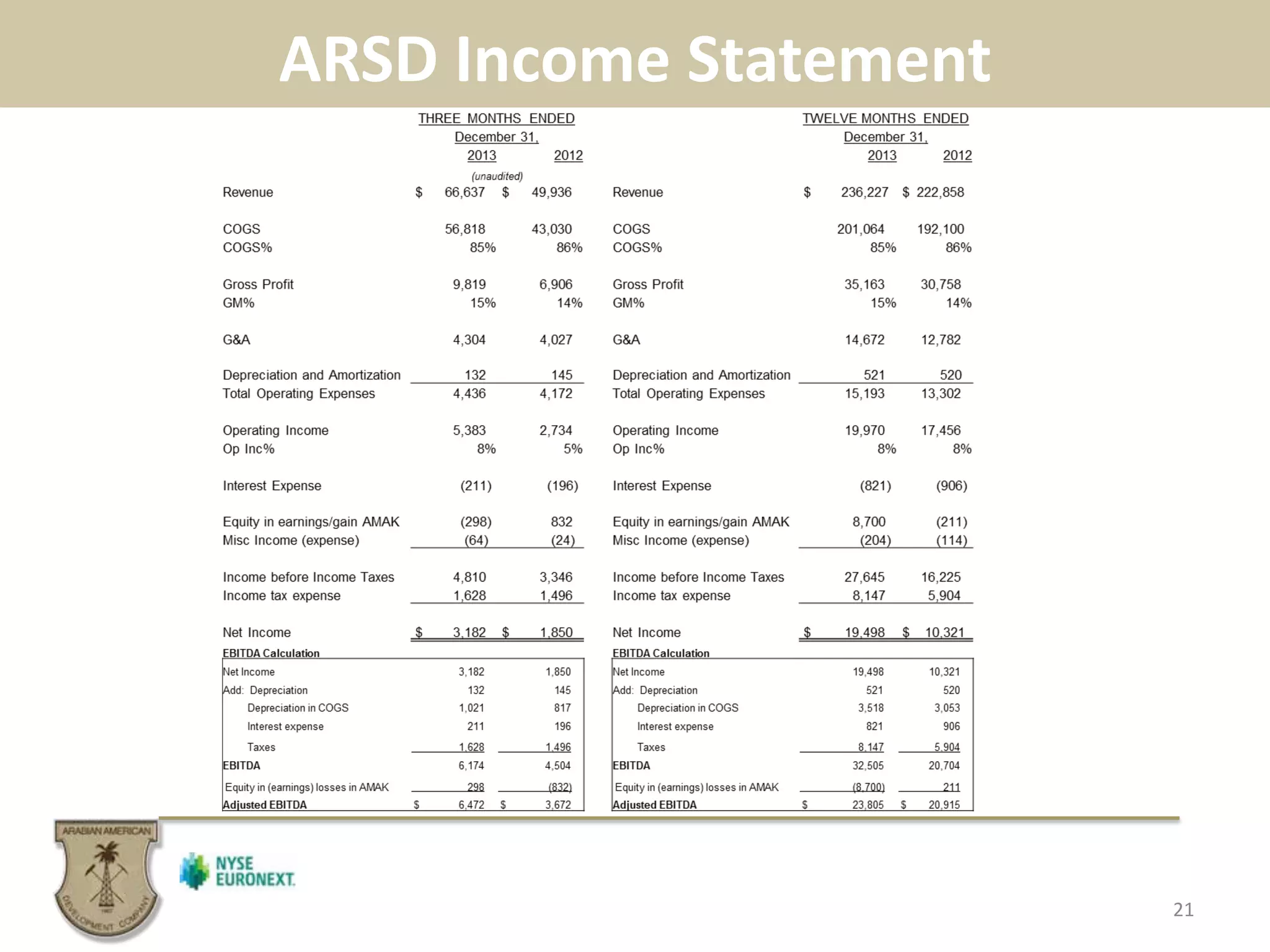

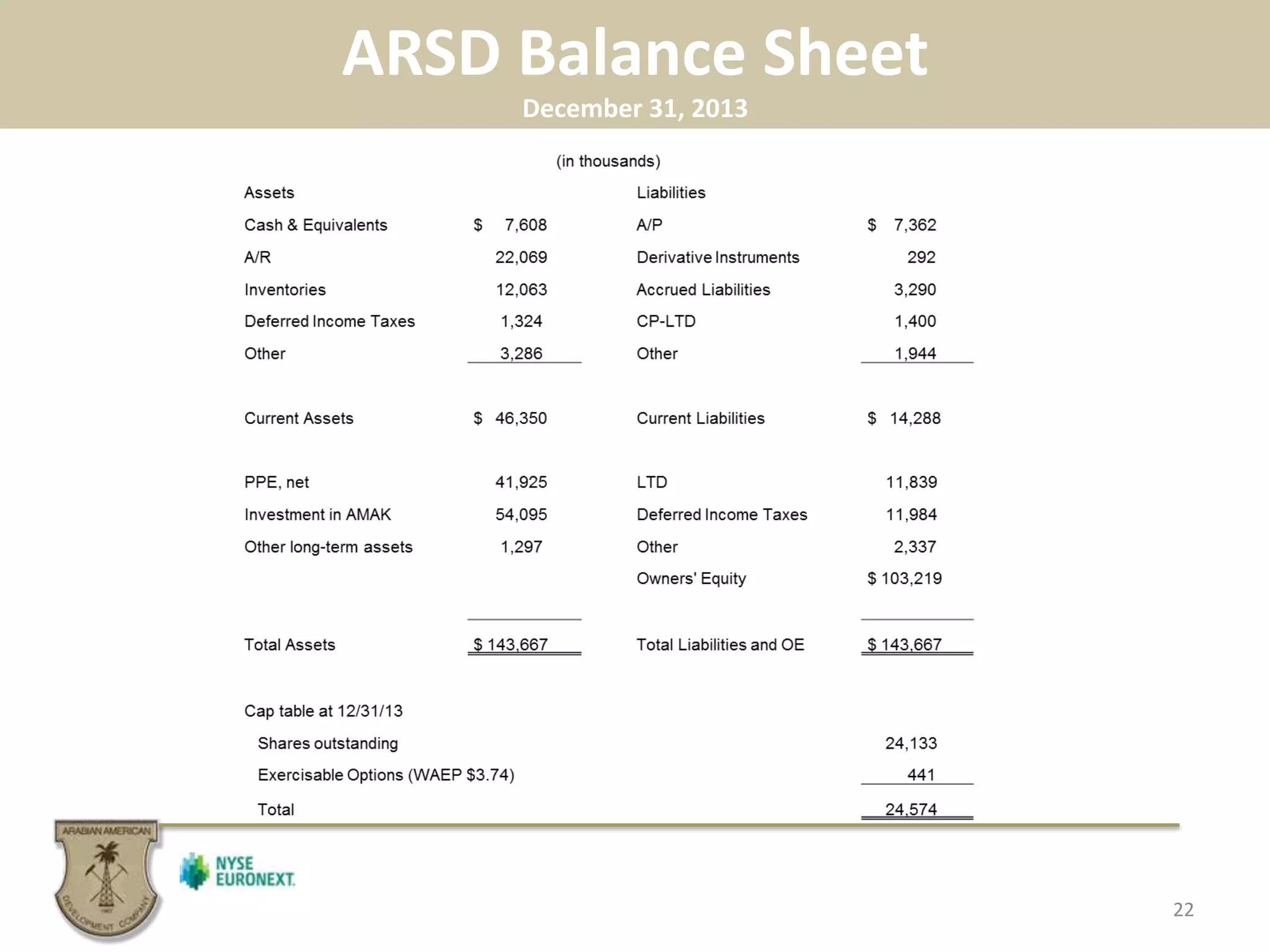

This document provides an overview of Arabian American Development Co., including its petrochemical and mining segments. The petrochemical segment, South Hampton Resources, operates a processing facility in Texas and markets high purity hexanes and pentanes used in products like polyethylene, polyurethane foams, and synthetic rubber. The mining segment consists of a 35% ownership in a joint venture mining company in Saudi Arabia.