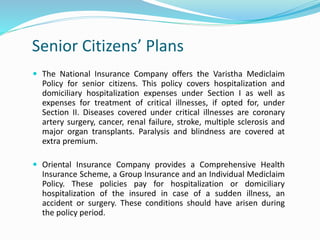

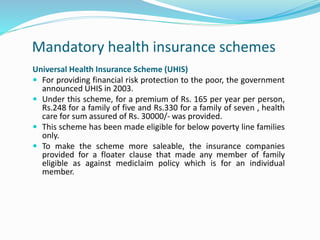

This document provides an overview of health insurance in India, including what it is, its importance, and common products. It discusses how health insurance works by pooling risks collectively. It outlines the rising costs of healthcare as a driver for health insurance penetration. Common plan types include individual, family floater, senior citizens, critical illness, daily hospital cash, and unit-linked plans. It also discusses government schemes like ESIS and CGHS, as well as community-based and employer-provided insurance options. Impediments to the industry like lack of data, pricing challenges, and government provision of care are also covered.