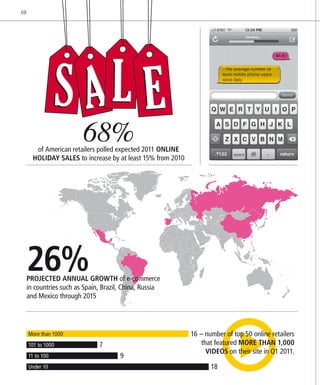

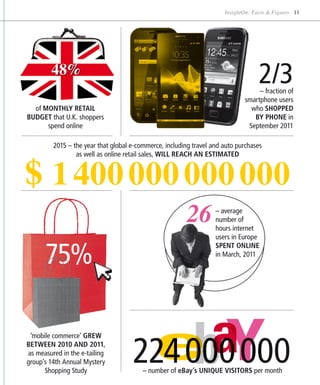

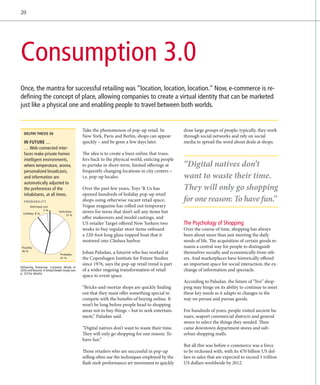

This document provides an overview of trends in e-commerce and online shopping. It discusses how e-commerce is changing the way people consume products and places increasing demands on logistics and delivery. Collaboration between companies is presented as a way to help address challenges in e-commerce, such as delivering products globally in an efficient and cost-effective manner. The rest of the document explores trends in e-commerce, perspectives from industry experts, and ways that companies can collaborate throughout the supply chain to better serve customers ordering products online.