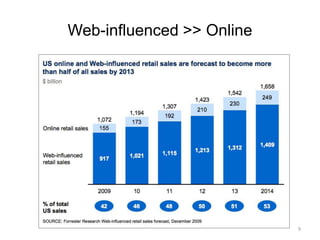

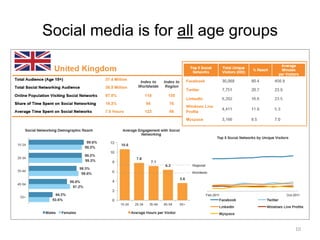

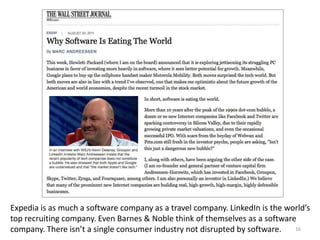

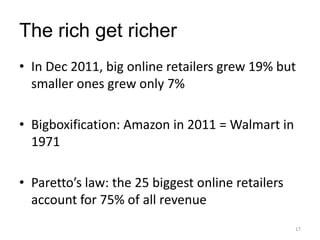

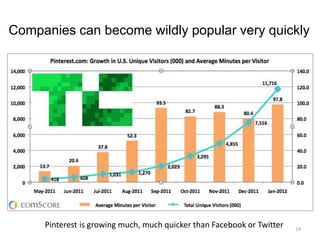

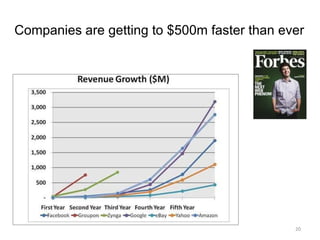

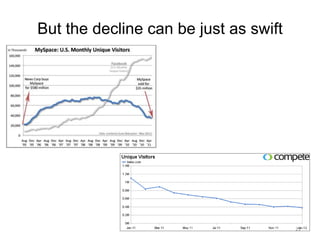

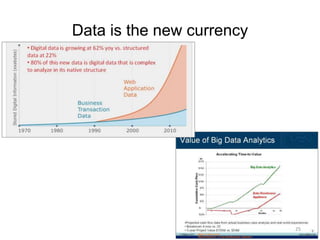

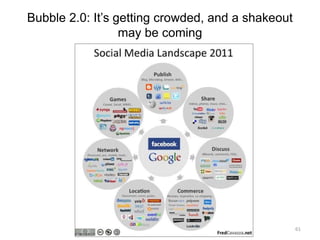

This document provides an overview of key eCommerce trends and their implications. It discusses the rise of social, local, and mobile (SoLoMo) technologies and their impact on consumer behavior and industry trends. Major topics covered include the growth of mobile commerce, big data and personalized experiences, the importance of design and customer experience, and the need for companies to adapt quickly to emerging technologies and business models.