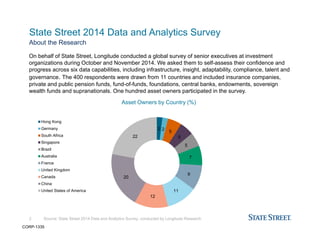

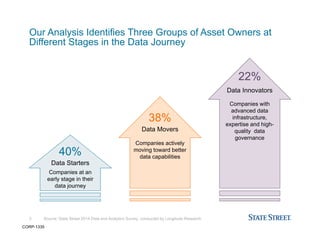

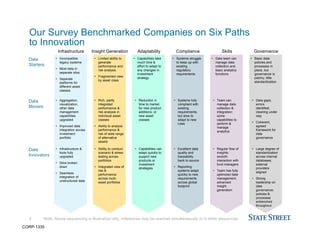

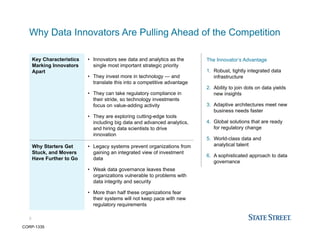

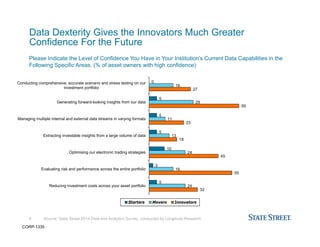

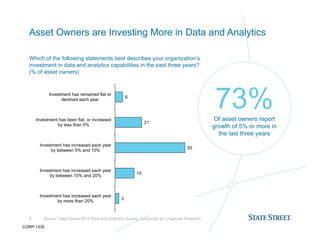

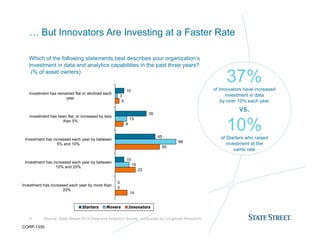

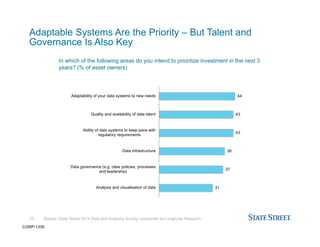

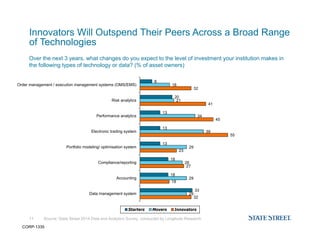

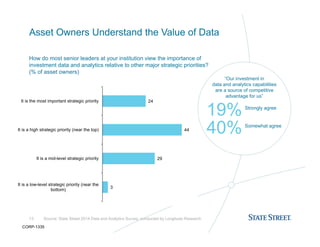

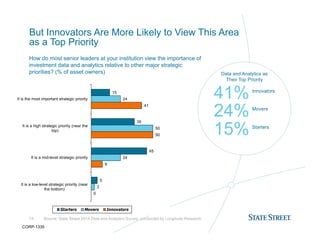

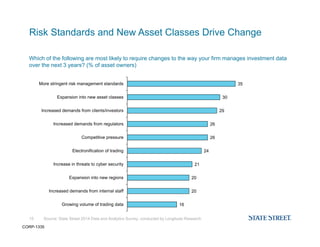

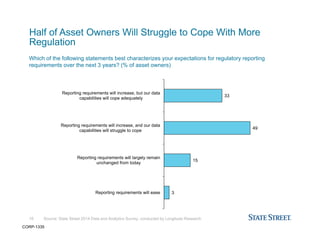

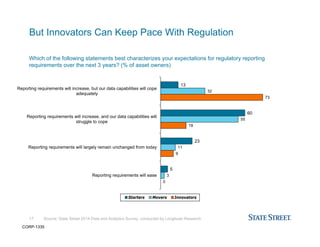

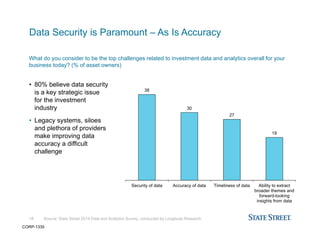

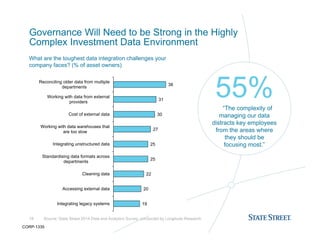

The document presents findings from State Street's 2014 Data and Analytics Survey, which analyzed the data capabilities and insights of 100 asset owners across various countries. It categorizes asset owners into three groups based on their data journey: data starters, data movers, and data innovators, highlighting that innovators invest more in data technology and governance, enhancing their competitive edge. The report emphasizes the challenges faced by asset owners, particularly in terms of legacy systems and compliance, while also outlining actionable strategies to improve data management and integration.