Initiating coverage Mahindra & Mahindra ltd

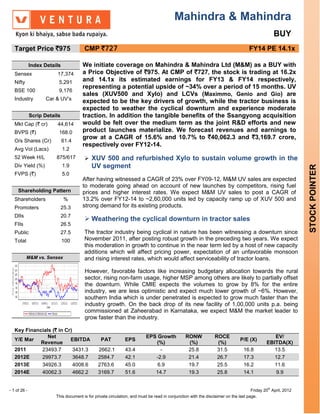

- 1. Mahindra & Mahindra BUY Target Price `975 CMP `727 FY14 PE 14.1x Index Details We initiate coverage on Mahindra & Mahindra Ltd (M&M) as a BUY with Sensex 17,374 a Price Objective of `975. At CMP of `727, the stock is trading at 16.2x Nifty 5,291 and 14.1x its estimated earnings for FY13 & FY14 respectively, representing a potential upside of ~34% over a period of 15 months. UV BSE 100 9,176 sales (XUV500 and Xylo) and LCVs (Maximmo, Genio and Gio) are Industry Car & UV’s expected to be the key drivers of growth, while the tractor business is expected to weather the cyclical downturn and experience moderate Scrip Details traction. In addition the tangible benefits of the Ssangyong acquisition Mkt Cap (` cr) 44,614 would be felt over the medium term as the joint R&D efforts and new BVPS (`) 168.0 product launches materialize. We forecast revenues and earnings to grow at a CAGR of 15.6% and 10.7% to `40,062.3 and `3,169.7 crore, O/s Shares (Cr) 61.4 respectively over FY12-14. Avg Vol (Lacs) 1.2 52 Week H/L 875/617 XUV 500 and refurbished Xylo to sustain volume growth in the Div Yield (%) 1.9 UV segment STOCK POINTER FVPS (`) 5.0 After having witnessed a CAGR of 23% over FY09-12, M&M UV sales are expected to moderate going ahead on account of new launches by competitors, rising fuel Shareholding Pattern prices and higher interest rates. We expect M&M UV sales to post a CAGR of Shareholders % 13.2% over FY12-14 to ~2,60,000 units led by capacity ramp up of XUV 500 and Promoters 25.3 strong demand for its existing products. DIIs 20.7 Weathering the cyclical downturn in tractor sales FIIs 26.5 Public 27.5 The tractor industry being cyclical in nature has been witnessing a downturn since Total 100 November 2011, after posting robust growth in the preceding two years. We expect this moderation in growth to continue in the near term led by a host of new capacity additions which will affect pricing power, expectation of an unfavorable monsoon M&M vs. Sensex and rising interest rates, which would affect serviceability of tractor loans. However, favorable factors like increasing budgetary allocation towards the rural sector, rising non-farm usage, higher MSP among others are likely to partially offset the downturn. While CMIE expects the volumes to grow by 8% for the entire industry, we are less optimistic and expect much lower growth of ~6%. However, southern India which is under penetrated is expected to grow much faster than the industry growth. On the back drop of its new facility of 1,00,000 units p.a. being commissioned at Zaheerabad in Karnataka, we expect M&M the market leader to grow faster than the industry. Key Financials (` in Cr) Net EPS Growth RONW ROCE EV/ Y/E Mar EBITDA PAT EPS P/E (X) Revenue (%) (%) (%) EBITDA(X) 2011 23493.7 3431.3 2662.1 43.4 - 25.8 31.5 16.8 13.5 2012E 29973.7 3648.7 2584.7 42.1 -2.9 21.4 26.7 17.3 12.7 2013E 34926.3 4008.6 2763.6 45.0 6.9 19.7 25.5 16.2 11.6 2014E 40062.3 4662.2 3169.7 51.6 14.7 19.3 25.8 14.1 9.9 - 1 of 26 - Friday 20th April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 2. We expect M&M (market leader with a share of ~40%) to post a CAGR of 7.5% over FY12-14 to reach ~2,72,000 units by FY14 and consequently revenues from this segment are expected to reach ~`11,500 crore by FY14 (CAGR of 8.6%). However, we expect significant pressure on margins led by higher raw material costs and lack of pricing power given the large capacity expansions across the industry. LCV growth momentum to continue Despite being a late entrant in the commercial vehicles (CV) market, M&M has carved for itself an enviable market share of ~30% in a relatively short span of time. Although the growth in the LCV markets is expected to tone down to a CAGR of 14% (from a 3 year CAGR of 32.9% over FY09-11), we expect M&M to outperform the industry and clock a volume growth of CAGR 17% over the next two years. The key drivers of growth are the increasing demand for transportation of consumer goods within cities and migration from three wheelers to nouveau products. Accordingly, we expect volumes from this segment to reach 2,10,000 units by FY14 on the back of strong showing from its portfolio brands – Maximmo, Genio and Gio. Ssangyong on the growth path; but profitability still a while away Post the acquisition of Ssangyong (`2,100 crore) in 2011, M&M has emerged as a global SUV player with a presence across 98 countries with 1200 dealerships. The acquisition will give M&M access to Ssangyongs’ technology and distribution network; whereas economies of scale resulting from combined sourcing will benefit both the firms. Currently, Ssangyong is experiencing losses and we believe, Ssangyong will not achieve a break even in the near term despite significant volume ramp up. Other business yet to prove their mettle Other than its core business, M&M has ventured into an array of new business segments – Two Wheelers, Commercial Vehicles, Defense goods and Aerospace among others. We expect the commercial vehicle arm – Mahindra Navistar and the defence business to contribute fairly to the group led by the growing opportunities in these businesses. However, from the other businesses, like Two Wheelers and Aerospace, we expect the performance to be muted. th - 2 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 3. Valuation We initiate coverage on Mahindra & Mahindra as a BUY with a sum of the parts (SOTP) valuation based price objective of `970 representing a potential upside of 33% from the CMP of `727. We have valued the standalone business at a P/E multiple of 13 on account of its leadership position in its core segments (Tractors and UV’s) while the subsidiaries have been valued on their respective P/E multiples and we have assigned a 30% holding company discount. While we have valued the profitable unlisted arm of M&M i.e. Mahindra Vehicle Manufacturers Ltd at P/E multiple of 10, the other non profitable businesses have been valued as shown in the table below. Also, we have not valued the defence business and Mahindra Reva Electric Vehicles Ltd as these businesses are in their nascent stage, but could add significant value to the group in the future. SOTP Valuation Assumptions Holding Co Value per Company FY14 EPS Multiple Measure M&M's stake Disc share Listed Entities Mahindra & Mahindra 51.6 13 P/E 670.8 Mahindra Financial Services Ltd 79.9* 2 P/B 56.0% 30% 62.7 Mahindra Lifespaces Ltd 3.0 6 P/E 51.0% 30% 6.4 Tech Mahindra 30.0 11.5 P/E 47.6% 30% 115.0 Mahindra Holidays 2.0 18 P/E 83.1% 30% 20.8 Mahindra Forgings 1.1 8 P/E 53.0% 30% 3.3 Mahindra Ugine 4.9** 2 EV/EBITDA 51.0% 30% 3.5 Unlisted Entitites MVML 7.7 10 P/E 100.0% - 77.1 Mahindra Two Wheelers Ltd -2.7 100.0% - -12.4*** Mahindra Navistar Ltd 0.0 Total Domestic Business 947.2 Market Cap Holding Co Value per Company M&M's stake (Rs in crore) Disc share International Business Ssangyong Motor Company 3338.0 70.0% 60% 22.8 Total 970.0 *Book Value, **Enterprise Value, ***Accumulated Loss per share th - 3 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 4. Company Background Established in 1945, Mahindra and Mahindra (M&M), the flagship company of Mahindra group, has emerged as a leading player in the farm equipment and utility vehicles segment. Additionally, it has a presence in agribusiness, aerospace, components, consulting services, defense, energy, financial services, industrial equipment, logistics, real estate, retail, steel, and two wheelers. With the recent acquisition of Ssangyong Motor Company it has marked its foray in the international SUV market. Mahindra Group – Overview Mahindra and Mahindra Mahindra & Mahindra Financial (Rs. 23,493 crore; 64%) Services Ltd. (56%)* (Rs. 2,043 crore. 5.5%) Utility Bolero, XUV500, Xylo, Vehicle Mahindra & Mahindra Financial Scorpio, Thar and Verito Services Ltd. (56%)* (Rs. 2,043 crore. 5.5%) Automotive Commercial Alfa, Gio, Bolero Maxi Sectors vehicle truck, Genio and Maxximo Mahindra Holidays & Resorts India Ltd. (83.1%)* (Rs. 500 crore; 1.4%) Arjun, Bhoomiputra, Tractors Sarpanch, Shaan, and Yuvraj Mahindra Forgings (53%)* (Rs. 1,918 crore, 5.2%) Other business (Rs. 2,613 crore; 7%) Mahindra Ugine (51%)* (Rs. 522 crore, 1.4%) Aircraft, Fighter Aircraft, and Lockheed-Martin Aerospace F-35 Tech Mahindra Ltd (47.6%)* Axe, Marksman, Mine protected vehicle, (Rs. 5,140.2 crore; 14%) Defense Rakshak, and Sea mines and Torpedo Decoy Ssangyong Rexton ,Korando, Chairman W, Kryon, Actyon, (70%)* Rodius 42.7% stake in Mahindra Satyam Mahindra Two Rodeo, Flyte, Duro and Stallio Wheelers Ltd Mahindra LCV’s and M&HCV’s Navistar Ltd Source: M&M, Figures in ()* indicate the parent holding in the subsidiaries th - 4 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 5. XUV 500 and refurbished Xylo to sustain volume growth in the UV segment After having witnessed a CAGR of 23% over FY09-12, M&M UV sales are expected to moderate going ahead on account of new launches by competitors, rising fuel prices and higher interest rates. We expect M&M UV sales to post a CAGR of 13.2% over FY12-14 to ~2,60,000 units led by capacity ramp up of XUV 500 and strong demand for its existing products. UV Industry to regain momentum After having experienced fiery growth of over 20% CAGR over the period 2009-11, the MUV industry has seen a brief slow down due to the impact of high interest rates. As per CMIE, the industry is expected to regain momentum and grow at a CAGR of 14% over the next couple of years despite the rising fuel cost, potential withdrawal of diesel subsidy and interest rates remaining firm over the medium term. UV Industry –Volume and Growth UV Industry - Monthly Volume and Growth 500000 25% 40000 70% 450000 35000 60% 400000 20% 30000 350000 50% 300000 15% 25000 40% 250000 20000 30% 200000 10% 15000 150000 20% 10000 100000 5% 5000 10% 50000 0 0% 0 0% UV Growth RHS(%) UV Growth RHS(%) Source: M&M, IAS, Ventura Research Estimates Source: M&M, IAS, Ventura Research Estimates M&Ms UV sales to grow in line with that of the industry Although M&M’s growth has outperformed UV industry growth in the past, we do not expect the outperformance to continue going forward as it already has a dominant market share of 56% and competition is undertaking aggressive launches. Although the refurbished Xylo and XUV 500 are expected to take competition head on, we still expect a slight dip in the market share going forward. Thus, we expect volumes to post a CAGR of 13.2% over FY12-14 and reach ~2,60,000 units by FY14 from the current 2,02,000 units led by XUV 500 capacity ramp up and robust demand for Xylo. th - 5 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 6. Market share of various UV players General Others Motor 7% 7% Tata Motor 12% M&M Toyota 56% Motor 18% Source: M&M, IAS, Ventura Research Estimates M&M UV – Volume and Growth M&M UV - Monthly Volume and Growth 300000 45% 20000 70% 40% 18000 250000 60% 35% 16000 14000 50% 200000 30% 12000 40% 25% 150000 10000 20% 8000 30% 100000 15% 6000 20% 10% 4000 50000 10% 5% 2000 0 0% 0 0% M&M Growth RHS(%) M&M Growth RHS (%) Source: M&M, Ventura Research Estimates Source: M&M, Ventura Research Estimates Refurbished Xylo and XUV 500 to be the stalwarts of the growth story M&M’s recently launched XUV 500, a premium SUV has received a favorable response in the markets - indicated by the 9,000 bookings received within 10 days of launch. XUV 500 competes with the higher end products in the segment and its lower pricing point has done wonders for the company. M&M is in the process of ramping up capacity for the vehicle to 3,000 units from the current 2,500 units to meet the growing demand. Also, the recently launched refurbished Xylo has evoked a positive response from the consumers. We expect these products to drive volume growth for the company in the near term and keep the portfolio invigorated. th - 6 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 7. M&MUV portfolio vis-à-vis competition Price Range Company 6l - 7l 7l - 10l 10l - 14l >14l M&M Bolero (11 variants) Scorpio (12 variants) Scorpio (9 variants) Ssangyong Rexton* Xylo (10 variants) XUV 500 (3 variants) Ssangyong Korando* GM Tavera (11 variants) Captiva (3 variants) Tata Motors Sumo (7 variants) Safari (5 variants) Aria (4 variants) Aria (6 variants) Safari Storme* Safari (7 variants) Toyota Innova (8 variants) Innova (7 variants) Fortuner (3 variants) Avanza* Maruti Ertiga* Ford Eco Sport* Foocus 2WD* Endeavour (4 variants) Source: M&M, Ventura Research Estimates. *Upcoming Launches Weathering the cyclical downturn in tractor sales The tractor industry being cyclical in nature has been witnessing a downturn since November 2011, after posting robust growth in the preceding two years. We expect this moderation in growth to continue in the near term led by a host of new capacity additions which will affect pricing power, expectation of an unfavorable monsoon and rising interest rates which would affect serviceability of tractor loans. However, favorable factors like increasing budgetary allocation towards the rural sector, rising non - farm usage, higher MSP among others are likely to partially offset the downturn. While CMIE expects the volumes to grow by 8% for the entire industry, we are less optimistic and expect much lower growth of ~6%. However, southern India which is under penetrated is expected to grow much faster than the industry growth. On the back drop of its new facility of 1,00,000 units p.a being commissioned at Zaheerabad in Karnataka, we expect M&M the market leader to grow faster than the industry. We expect M&M (market leader with a share of ~40%) to post a CAGR of 7.5% over FY12-14 to reach ~2,72,000 units by FY14 and consequently revenues from this segment are expected to reach ~`11,500 crore by FY14. (CAGR of 8.6%). However, we expect significant pressure on margins led by higher raw material costs and lack of pricing power given the large capacity expansions across the industry. th - 7 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 8. Tractor Industry Volumes and growth 800000 40.0% Cyclical Downturn 700000 30.0% 600000 20.0% 500000 10.0% 400000 0.0% 300000 200000 -10.0% 100000 -20.0% 0 -30.0% Tractors Growth (RHS) Source: IAS, M&M, Ventura Research Estimates Tractor sales enter a cyclical downtrend Tractor sales are typically cyclical in nature and after having experienced good growth over FY10-FY11, they have shown a marked deceleration since November’11. We expect the cyclical downturn in tractor sales to continue for at least another two years given the huge capacity additions, expectation of a poor monsoon (based on global weather model forecasts) and persistent high interest rates. However scarcity of farm labour (in light of alternate employment opportunities), increasing budgetary allocation towards the rural sector, government support for farm mechanization and increasing non-farm usage are expected to be favorable factors which can to a certain extent negate the cyclical downturn. We expect tractor sales to witness CAGR of 6% over the next couple of years. However, aided by capacity expansion and leadership position we forecast M&M’s tractor sales to grow at CAGR of 7.5% over the medium term. Tractor Industry –Volume and Growth Tractor Industry - Monthly Volume and Growth 800000 30.0% 80000 60% 700000 70000 25.0% 50% 600000 60000 20.0% 40% 500000 50000 400000 15.0% 40000 30% 300000 30000 10.0% 20% 200000 20000 5.0% 10% 100000 10000 0 0.0% 0 0% Tractors Growht RHS(%) Tractors Growth RHS (%) es Source: M&M, IAS, Ventura Research Estimates Source: M&M, IAS, Ventura Research Estimates th - 8 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 9. M&M Tractors – Volume and Growth M&M Tractors - Monthly Volume and Growth 300000 50% 80000 60% 45% 70000 250000 50% 40% 60000 35% 40% 200000 50000 30% 40000 30% 150000 25% 20% 30000 20% 100000 20000 15% 10% 10% 10000 50000 5% 0 0% 0 0% M&M Growht RHS(%) Tractors Growth RHS (%) es Source: M&M, Ventura Research Estimates Source: M&M, Ventura Research Estimates Demand for tractors in the high and low HP category is encouraging The Indian tractor industry has traditionally been a medium HP market comprising of the 31-40 HP range of tractors. However, since early 2010, the industry witnessed significant traction from the higher and lower HP segments. The key drivers for high HP tractors have been increasing demand from the under penetrated south Indian market, replacement demand from the northern region, increasing use in non- agricultural applications and growth in exports. In addition to the easy finance availability, farm labour shortages and rising costs of bullocks has led to robust growth in the low HP segment (21-30 HP) amongst small and marginal farmers. This segment has historically been the domain of the unorganized sector, but with the entry of players like M&M and VST Tillers, the share of the organized sector is only expected to grow. Thus, M&M being the largest player in this space is expected to be the biggest beneficiary. Tractor market mix Growth in various segments of tractor industry es= 600000 50% 500000 40% 400000 30% 300000 20% 200000 10% 100000 0% FY07 FY08 FY09 FY10 FY11 0 -10% FY07 FY08 FY09 FY10 FY11 -20% 21-30 HP 31-40 HP 41-50 HP 51 HP & Above 21-30 HP 31-40 HP 41-50 HP 51 HP & Above es Source: M&M, IAS, Ventura Research Estimates Source: M&M, IAS, Ventura Research Estimates th - 9 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 10. M&M tractor portfolio vis-à-vis competition Company <20HP 21-30 HP 31-40HP 41-50 HP >51 HP M&M Arjun 1 variant 2 variants Sarpanch 1 variant 1 variant 3 variants 1 variant Bhoomiputra 1 variant 3 variants 1 variant Shaan 1 variant Yuvraj 1 variant Tafe + EIC Tafe 1 variant 1 variant Eicher 3 variants 3 variants 4 variants Massey ferguson 1 variant 2 variants 6 variants 2 variants Escorts Escorts 2 variants Farmtrac 6 variants Powertrac 5 variants Source: M&M, Ventura Research Estimates Product mix of various tractor players Market share of various tractor players 100% FNH JD 5% 80% 8% Others 3% 60% Sonalika M&M 8% 42% 40% Escorts 11% 20% TAFE+EIC 0% 23% Escorts Tractors M&M Tractors & John Deere Inter. Farm Equi. 21-30 HP 31-40 HP 41-50 HP > 51 HP s es Source: M&M, IAS, Ventura Research Estimates Source: M&M, IAS, Ventura Research Estimates Zaheerabad capacity expansion one amongst many planned by the industry M&M is setting up a tractor manufacturing facility at Zaheerabad, Karnataka to raise the capacity of its tractors by 1,00,000 units to cater to the fast growing under penetrated market of south India. The facility entailing an investment of `300 crore is expected to be commissioned by H2FY13. Overall the industry capacity is expected to grow to 10.7 lakhs by March 2013 which is faster than the demand growth and hence we expect the pricing also to come under pressure impacting margins. th - 10 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 11. New capacity additions in the industry New capacities Capacity to be Total Expected Company/Project/Locations Capacity in FY11 commisioned in commisioned in Cost (Rs.Cr) Compl.by capacity by FY13 FY12 FY13 Same Deutz-Fahr India Pvt. Ltd. 11,000 - 9,000 20,000 25.0 June-12 Ranipet, Vellore, Tamil Nadu Mahindra & Mahindra Ltd. 256,000 - 100,000 356000 300.0 July-12 Zaheerabad, Andhra Pradesh John Deere India Pvt. Ltd. 109,000 - 50,000 159000 90.7 September-12 Maharashtra and M.P V S T Tillers Tractors Ltd. 30,000 - 30,000 60000 100.0 December-12 Hosur, Dharmapuri, Tamil Nadu Escorts Ltd. 98,940 25,000 50,000 173,940 March-13 New Holland Fiat (India) Pvt. Ltd 36,000 - 30,000 66000 221.0 December-13 Ghaziabad, Uttar Pradesh Rajkot Tractors 148,100 12,000 - 160,100 Rajkot ITL 30,000 20,000 25,000 75,000 Hoshiyarpur Total 719,040 57,000 294,000 1,070,040 Source: IAS, ICRA, M&M, Ventura Research Estimates Union Budget 2012-13: What is in it for Indian Agriculture??? To fast track the growth of agriculture, total plan outlay for the Department of Agriculture and Co-operation has been increased by 18% i.e. from `17,123 crore in 2011-2012 to `20,208 crore in 2012-13. Outlay for Rashtriya Krishi Vikas Yojana (RKVY) increased to `9,217 crore in 2012-13 from `7,860 crore in 2011-12. With the initiative of Bringing Green Revolution to Eastern India (BGREI) to boost the production and productivity of paddy field. Allocation for the scheme increased to `1,000 crore in 2012-13 from `400 crore in 2011-12. Allocation of Rs.300 crore is made for VIIDP (Vidarbha Intensified Irrigation Development Programme) under RKVY. Targeted credit for agriculture has been elevated by `1,00,000 crore to `5,75,000 crore in 2012-13. Interest subvention scheme of 3% for prompt paying farmers has been introduced. Kisan Credit Card (KCC) Scheme has been modified with KCC smart card, which can also be used at ATMs. Structural changes in Accelerated Irrigation Benefit Programme (AIBP) increased by 13% to `14,242 crore in 2012-13 th - 11 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 12. Tractor Exports and International business Tractor exports account for 10% of the total tractor volumes. After posting a CAGR of 16.8% over FY07-11 tractors exports witnessed a growth of 14.8% YTD in FY12. Although, Nepal, Bangladesh, Sri Lanka and the United States remain major export destinations, African and new South-East Asian markets are expected to drive exports over the medium-to-long term. Export to neighboring countries such as Thailand, Malaysia and Indonesia which are supported by the Asian Free Trade Agreement are expected to augur well for growth going ahead. Although, exports do not contribute significantly to the total volumes we expect them to partially offset the cyclical downturn being witnessed in the domestic tractor market. M&M’s tractor presence is in over 40 countries. In addition to exports, M&M has three major subsidiaries in USA-Mahindra USA, China- Mahindra (China) Tractor Company, and Mahindra Yueda (Yancheng) Tractor Company (a joint venture with the Jiangsu Yueda Group). LCV growth momentum to continue Despite being a late entrant in the commercial vehicles (CV) market, M&M has carved for itself an enviable market share of ~30% in a relatively short span of time. Although the growth in the LCV markets is expected to tone down to a CAGR of 14% (from a 3 year CAGR of 32.9% over FY09-11), we expect M&M to outperform the industry and clock a volume growth of CAGR 17% over the next two years. The key drivers of growth are the increasing demand for transportation of consumer goods within cities and migration from three wheelers to nouveau products. Accordingly, we expect volumes from this segment to reach 2,10,000 units by FY14 on the back of strong showing from its portfolio brands – Maximmo, Genio and Gio. M&M LCV’s – Volume and Growth Market share of various LCV players 250000 50% Force Motors 45% 5% 200000 40% 35% Others 150000 30% 9% 25% 100000 20% 15% M&M Tata 28% Motors 50000 10% 58% 5% 0 0% FY11 FY12E FY13E FY14E M&M growth % (RHS) es es Source: M&M, Ventura Research Estimates Source: M&M, IAS, Ventura Research Estimates th - 12 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 13. M&M LCV portfolio vis-à-vis competition M&M Piaggio Ashok Leyland Force Motors Tata Motors Gio, Maximmo, Trump 15, Products Ape Truck Ape Mini Dost Ace, Ace Zip, Magic Super Ace Genio Trump 40 Capacity (in tonnes) 0.5/0.8/1.2 0.8 0.5 1.25 0.8/ 1.1 1/0.5 1.2 Price 3 lacs/5 lacs 2.25 1.75 3.6-4.7 lacs 2.7-3 lacs 3 lacs/1.9 lacs 3.7 lacs Source: M&M, Ventura Research Estimates International business scaling up well on the back of recent acquisitions with Ssangyong Prior to M&M’s take over, Ssangyong had always been in financial trouble due to frequent changes in its ownership and underinvestment which lead to the lack of product development and consequent downturn in its business. However, after M&M took a 70% stake in the entity for `2100 crore (`1675 crore of equity and `425 crore of corporate bonds) the business has experienced a turnaround with volumes expanding and losses diminishing. We believe that the Ssangyong acquisition will benefit M&M immensely from access to Ssangyong’s technology, presence in 98 countries and its distribution network of 1200 dealerships. On the other hand, economies of scale resulting from combined sourcing will be advantageous to both the firms. M&M – Ssangyong have zeroed upon a combined future product portfolio strategy which will see the launch of 3 new platforms and 4 new products (a sedan, a mid-sized SUV and two compact SUV’s,) over the next 5 years. To offset the impact of slowdown in the developed markets, Ssangyong is focusing on emerging economies like China, India, Africa and Latin America. M&M is also looking forward to launch Ssangyong’s two premium SUV models – Rexton SUV and Korando crossover in the Indian markets in H2FY13. Ssangyong is targeting sales of 1,60,000 units in CY2013 and expects to double the volumes to 3,00,000 units by 2016. Despite, the volume growth we do not expect the company to achieve a break even in the near term. Ssangyong sales trend 160000 150.0% 140000 100.0% 120000 100000 50.0% 80000 60000 0.0% 40000 -50.0% 20000 0 -100.0% CY03 CY04 CY05 CY06 CY07 CY08 CY09 CY10 CY11 Domestic Exports Growth (RHS) Source: M&M, Bloomberg, Ventura Research Estimates th - 13 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 14. Other business yet to prove their mettle Other than its core business, M&M has ventured into an array of new business segments – Two Wheelers, Commercial Vehicles, Defense goods and Aerospace among others. We expect the commercial vehicle arm – Mahindra Navistar and the defence business to contribute fairly to the group led by the growing opportunities in these businesses. However, from the other businesses, like Two Wheelers and Aerospace, we expect the performance to be muted. Two wheelers to show muted growth The financial performance of Mahindra Two Wheelers Ltd has not been satisfactory and is suffering from operating losses since the commencement of operations. Given the lack of volume growth (de-growth of 15% yoy in YTD FY12) due to strong competition from other well established players, and negative cash flows, we don’t expect Mahindra Two Wheelers to breakeven in the near term. M&M made its foray in the two wheeler segment following the acquisition of business assets of Kinetic Motor Company in late 2008 with the launch of Mahindra Rodeo, Duro and Flyte. M&M has been able to gain 7.5% market share in the scooter segment despite strong competition from existing players like Honda Motors & Scooters India and TVS However, its foray in the motorcycle segment with the launch of Mahindra’s Stallio was short lived as it met with a technical problem and had to be discontinued. It is now going to re launch Stallio in the markets in mid 2012. Mahindra Vehicle Manufacturers Ltd Mahindra Vehicle Manufacturers Limited, a fully owned subsidiary of M&M is a manufacturing arm of M&M which manufactures LCV’s for M&M and M&HCV’s for Mahindra Navistar Auto Ltd. We expect increasing production from MVML going ahead as demand for LCV’s is expected to remain strong in the medium term. We expect the earnings from MVML to add value to the group as a whole. M&HCV on the growth track Mahindra Navistar Auto Ltd (51:49 JV between M&M and Navistar) manufactures HCV’s in the range of 25, 31, and 40 tonnes. It currently sells 300 trucks per month at its Chakan manufacturing facility which has a capacity to produce 50,000 trucks per annum. MNAL plans to launch at least two new models—a 49-tonne tractor trailer and a 25-tonne tipper for the mining sector in the second half of FY2012. These new product launches along with the launch of additional variants, will help MNAL achieve full capacity utilizations over the next three years. The JV is expected to breakeven by Q3FY13. th - 14 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 15. Mahindra Aerospace Markings its foray in the aerospace business M&M acquired two Australian companies - Aerostaff Australia and Gippsland Aeronautics in 2009. AA supplies metal sheets and value added products to the Aerospace and Defense industry whereas GA develops and manufactures a family of 2-20 seat utility aircraft. With these acquisitions it is well poised to participate in the opportunities presented by India’s defense and civil aerospace market. It is also in the process of developing a state-of-the-art component manufacturing facility in Bangalore to focus on component and aero-structure assembly expertise in sheet metal, machining, and special processing. Mahindra Reva Through acquisition of a 55.2% controlling stake in the electric cars manufacturer Reva (re-christened as Mahindra Reva Electric Vehicle Pvt Ltd) M&M has got access to Reva's electric powertrain technology. Currently, the company has around 3,500 electrics vehicle on road and is looking at expanding its product to the UV, three- wheeler and mini –trucks segment. Reva plans to sell 30,000 cars in the next 3 years aided by the national mission plan for hybrid and electric vehicles. Currently, Mahindra Reva has its manufacturing facility in Bangalore and is setting up its second unit at the same place. It is also looking for opportunities to set up its first overseas assembly unit in Austalia. Its next offering NXR will be launched in the latter half of calendar year 2012. Defence sector is a high growth area We believe the company's defence business can increase multifold given India's huge defence spending. Infact the opportunity is estimated at ~USD 10 bn over the next five years, if we consider the current defense allocation of ~US$38.5bn, the separate allocation for Paramilitary and police forces coupled with the current offset policy of Defence Procurement Procedure (DPP) 2005 which requires 30% of the overall expenditure in defence sector from a foreign company to be sourced from Indian companies. M&M in line with its ambitions for the defense segment has formed a 74:26 JV with BAE Systems Plc., a premier global defense security and aerospace company. To add to its capabilities it recently inked a JV with Rafael Advanced Defence Systems Ltd (manufacturer of defence applications for air, space land and sea applications) and Telephonics Corporation (manufacturer of high-technology integrated information, communication and sensor system solutions) enabling it to provide a wide array of offerings and services. M&M is eyeing half a billion dollar revenues from each of the JV’s over a period of ten years and plans to set up a facility in Bangalore next year. PV business to remain a marginal business M&Ms ambitions to have a significant presence in the PV space continue to remain illusive. After the failed attempt with its ‘Logan’ launched in JV with Renault, the car was rebranded as ‘Verito’. This has helped improve sales by almost 78% in FY12 and it now has a 10% market share in the Super Compact Segment. To further improve th - 15 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 16. sales, M&M is planning to launch a sub four meter Verito by the end of the current financial year. Going forward, we expect this segment to remain a marginal business for M&M. After purchase of the entire stake of Renault in the JV, the company is now 100% owned by M&M. Financial Performance M&M witnessed a 37% yoy increase in revenue to `8,368.6 crore led by strong performance across all segments and price increases of ~1-2% taken during the quarter. Operating income rose by 10.5% yoy to `1,020.8 crore, however margins were lower by 290 bps at 12.2% on account of higher commodity prices and subdued tractor demand. While reported earnings were lower by 9.9% yoy to `662.7 crore adjusted for the exceptional gain of `117 crore in Q3FY11 on sale of long term investment earnings were higher by 16% yoy. Revenues for FY11 were higher by 25.7% yoy to `23,493.7 crore led by strong volume growth in the UV and tractor segments. Cost pressures pulled down the EBITDA margins by 120 bps to 14.7%. However, lower interest costs and higher exceptional income helped the company post a 10 bps rise in the net profit margins to 11.3%. Thus, earnings for the company increased by 27.5% yoy and stood at `2,662.1 crore as against `2,087.8 crore in FY10. Quarterly Financial Performance Particulars Q3FY12 Q3FY11 FY11 FY10 Net Sales 8386.8 6121.1 23493.7 18602.1 Growth % 37.0 26.0 Total Expenditure 7366.0 5197.3 20062.4 15647.1 EBIDTA 1020.8 923.8 3431.3 2955.0 EBDITA Margin % 12.2 15.1 14.6 15.9 Depreciation 140.8 102.2 413.9 370.8 EBIT (EX OI) 880.0 821.6 3017.5 2584.2 Other Income 67.7 64.1 455.5 328.7 EBIT 947.7 885.7 3473.0 2912.9 Margin % 11.3 14.5 14.8 15.7 Interest 33.7 19.5 70.9 156.9 Exceptional items 0.0 117.5 117.5 90.8 PBT 914.0 983.6 3519.6 2846.8 Margin % 10.9 16.1 15.0 15.3 Provision for Tax 251.9 249.0 857.5 759.0 PAT 662.1 734.7 2662.1 2087.8 PAT Margin (%) 7.9 12.0 11.3 11.2 Source: M&M, Ventura Research Estimates th - 16 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 17. Financial Outlook On the back of sustained volume growth across the UV and LCV segments and tractors growing at a moderate pace, we expect revenues to grow at a CAGR of 15.6% over FY12-14 to `40,062.3 crore. Operating profits are expected to post a CAGR of 13% over FY12-14 to `4,661 crore. EBITDA margins are expected to decline by 60 bps to 11.6% from the current 12.2% on account of higher input costs. Consequently, we expect earnings to grow to `3,169.7 crore (CAGR of 10.7%) over FY12-14. Revenue Growth PAT Trend 45000 45% 3500 40000 40% 3000 35000 35% 30000 30% 2500 Rs in crore Rs in crore 25000 25% 2000 20000 20% 15000 15% 1500 10000 10% 1000 5000 5% 0 0% 500 FY08 FY09 FY10 FY11 FY12E FY13E FY14E 0 Revenue Growth (RHS) FY07 FY08 FY09 FY10 FY11 FY12E FY13E FY14E es= es Source: M&M, Ventura Research Estimates Source: M&M, Ventura Research Estimates th - 17 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 18. Valuation We initiate coverage on Mahindra & Mahindra as a BUY with a sum of the parts (SOTP) valuation based price objective of `970 representing a potential upside of 33% from the CMP of `727. We have valued the standalone business at a P/E multiple of 13 on account of its leadership position in its core segments (Tractors and UV’s) while the subsidiaries have been valued on their respective P/E multiples and assigned a 30% holding company discount. While we have valued the profitable unlisted arm of M&M i.e. Mahindra Vehicle Manufacturers Ltd. at P/E multiple of 10 the other non profitable businesses have been valued as shown in the table below. Also, we have not valued the defence business and Mahindra Reva Electric Vehicles Ltd as these businesses are in their nascent stage, but could add significant value to the group in the future. SOTP Valuation Assumptions Holding Co Value per Company FY14 EPS Multiple Measure M&M's stake Disc share Listed Entities Mahindra & Mahindra 51.6 13 P/E 670.8 Mahindra Financial Services Ltd 79.9* 2 P/B 56.0% 30% 62.7 Mahindra Lifespaces Ltd 3.0 6 P/E 51.0% 30% 6.4 Tech Mahindra 30.0 11.5 P/E 47.6% 30% 115.0 Mahindra Holidays 2.0 18 P/E 83.1% 30% 20.8 Mahindra Forgings 1.1 8 P/E 53.0% 30% 3.3 Mahindra Ugine 4.9** 2 EV/EBITDA 51.0% 30% 3.5 Unlisted Entitites MVML 7.7 10 P/E 100.0% - 77.1 Mahindra Two Wheelers Ltd -2.7 100.0% - -12.4*** Mahindra Navistar Ltd 0.0 Total Domestic Business 947.2 Market Cap Holding Co Value per Company M&M's stake (Rs in crore) Disc share International Business Ssangyong Motor Company 3338.0 70.0% 60% 22.8 Total 970.0 *Book Value, **Enterprise Value, ***Accumulated Loss per share th - 18 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 19. P/E 1000 900 800 700 600 500 400 300 200 100 0 Mar-02 Mar-04 Mar-06 Mar-08 Mar-10 Mar-12 CMP 5X 8X 11X 14X 17X Source: M&M, Ventura Research Estimates P/BV 1000 900 800 700 600 500 400 300 200 100 0 Mar-02 Mar-04 Mar-06 Mar-08 Mar-10 Mar-12 CMP 1X 1.75X 2.5X 3.25X 4X Source: M&M, Ventura Research Estimates EV/EBITDA 100000 90000 80000 70000 60000 50000 40000 30000 20000 10000 0 Mar-02 Mar-04 Mar-06 Mar-08 Mar-10 Mar-12 EV 10X 13.14X 16.28X 19.42X 22.56X Source: M&M, Ventura Research Estimates th - 19 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 20. Valuations of listed subsidiaries Mahindra & Mahindra Financial Services Ltd. Mahindra & Mahindra Financial Services Ltd. (MMFSL) is one of the leading NBFC’s focused on the rural and semi-urban sector providing finance for Utility Vehicles, tractors and cars. In addition, the company has also forayed in rural housing finance and insurance products through dedicated subsidiaries. Backed by its wide distribution network of ~450 branches and well diversified product portfolio we expect the revenues and earnings to post a CAGR of 27.4% and 33.4% to `4,361 crore and `998 crore respectively by FY14 respectively. We have assigned a 2.0 P/B multiple (in line with peers) to MMFSL and arrived at a target price of `958 representing a potential upside of 41% from the CMP of `676 over a period of 18 months. Key Financials (` in Cr) Net Non P/E P/Adj. ROA ROE Y/E Mar Interest Interest PAT EPS EPS Growth (x) BV(x) (%) (%) Income Income (%) 2011 1222.6 129.2 478.0 45.2 - 14.9 2.7 4.6 22.0 2012E 1445.3 136.1 561.4 53.1 17.5 12.7 2.3 3.6 19.8 2013E 1914.8 151.1 785.1 74.7 40.5 9.0 1.8 3.8 22.4 2014E 2381.6 157.8 998.9 95.4 27.6 7.1 1.4 4.0 22.3 Revenue and PAT Growth ROA & ROE Trend 5000 Rs.Crore 70% 25% 4500 60% 4000 20% 3500 50% 3000 40% 15% 2500 2000 30% 10% 1500 20% 1000 5% 10% 500 0 0% 0% FY10 FY11 FY12E FY13E FY14E FY10 FY11 FY2E FY13E FY14E ROA (%) ROE (%) Revenue PAT Revenue Growth RHS (%) PAT Growth RHS(%) Source: MMFSL, Ventura Research Estimates Source: MMFSL, Ventura Research Estimates th - 20 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.

- 21. Tech Mahindra Tech Mahindra, the IT arm of M&M is engaged in providing information technology, networking technology solutions and business process outsourcing services to the global telecommunications industry. Since, the merger of Mahindra Satyam with Tech Mahindra has been announced we value the merged entity at a P/E multiple of 11.5 with a target price of `917 representing a potential upside of 29.1% from CMP of `710. The combined entity will further benefit from cost synergies emanating from operational metrics, economies of scale and sourcing benefits. However, we have not built this in our model and represents an upside risk to our estimates. Further, the merger is also expected to reduce Tech Mahindra’s dependence on revenues from a single vertical (telecom) and will enable its presence across all verticals. Revenues from the telecom vertical are expected to be ~47% (down from 100% earlier) of total revenues of the merged entity. Key Financials (` in Cr) Net EPS Growth RONW ROCE EV/ Y/E Mar EBITDA PAT EPS P/E (X) Revenue (%) (%) (%) EBITDA(X) 2011 5140.2 1003.3 644.2 56.3 - 22.3 21.7 14.2 9.5 2012E 5588.0 954.1 1098.4 51.1 -9.2 15.1 18.7 8.3 9.9 2013E* 13187.0 2131.0 1761.8 76.3 49.3 30.7 21.2 9.5 4.9 2014E* 14160.0 2235.7 1842.5 79.8 4.6 24.9 18.9 9.1 4.6 *Figures of the merged enitity hence not comparable to earlier years Revenue and PAT Growth ROE & ROCE Trend 16000.0 Rs.Crore 160% 35.0% 14000.0 140% 30.0% 12000.0 120% 25.0% 10000.0 100% 20.0% 8000.0 80% 15.0% 6000.0 60% 4000.0 40% 10.0% 2000.0 20% 5.0% 0.0 0% 0.0% FY10 FY11 FY12E FY13E FY14E FY10 FY11 FY2E FY13E FY14E Revenue PAT ROE (%) ROCE (%) Revenue Growth (RHS) EBITDA Margin (RHS) Source: TechM, MSat, Ventura Research Estimates Source: TechM, MSat, Ventura Research Estimates th - 21 of 26 - Friday 20 April, 2012 This document is for private circulation, and must be read in conjunction with the disclaimer on the last page.