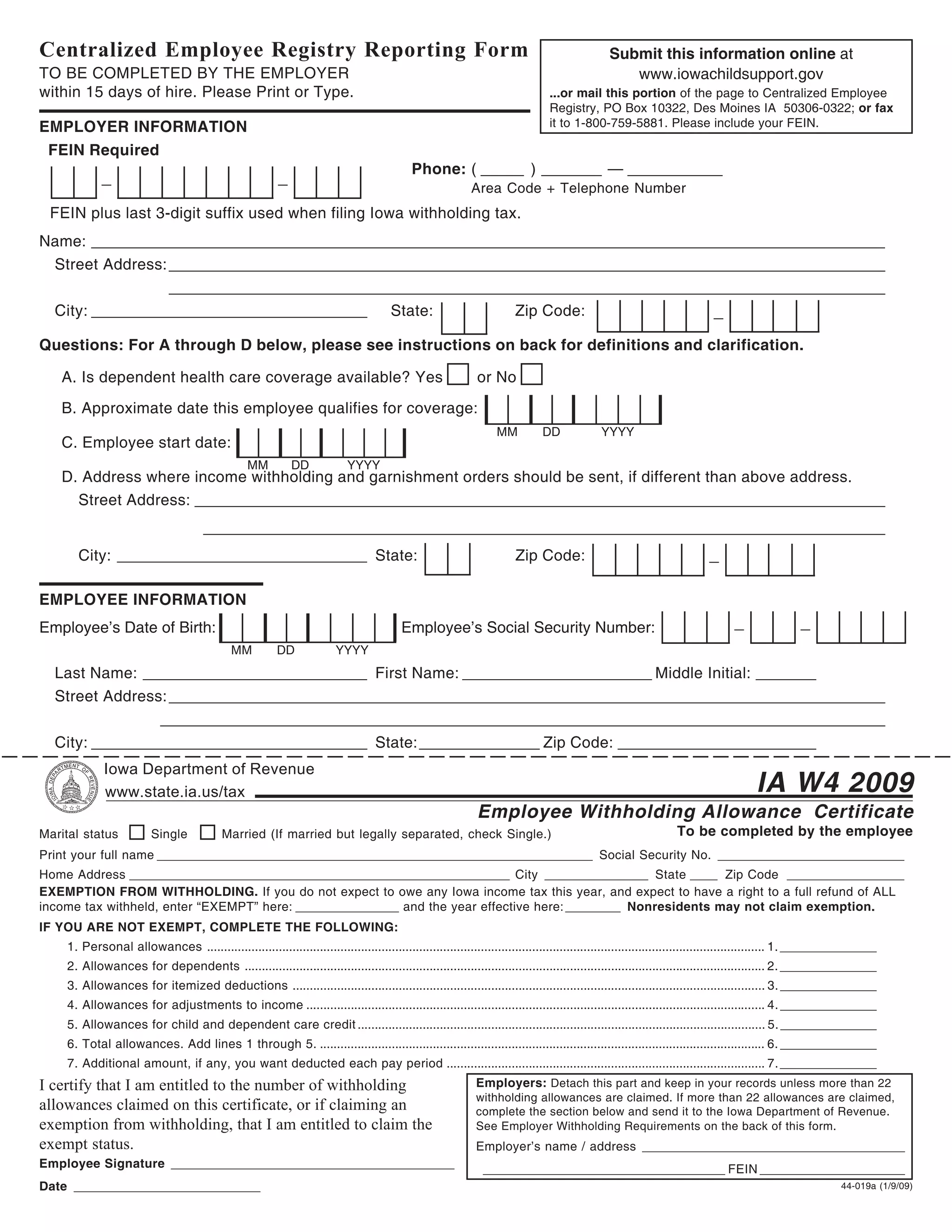

This document contains two forms: a Centralized Employee Registry Reporting Form for employers to report new hires, and an Iowa W4 Employee Withholding Allowance Certificate for employees. The employer form requires reporting employee information such as name, address, start date, and whether dependent health insurance is offered. The Iowa W4 form allows employees to claim withholding allowances to determine how much Iowa income tax should be withheld from their paychecks. Instructions are provided to help employees accurately calculate their allowances.