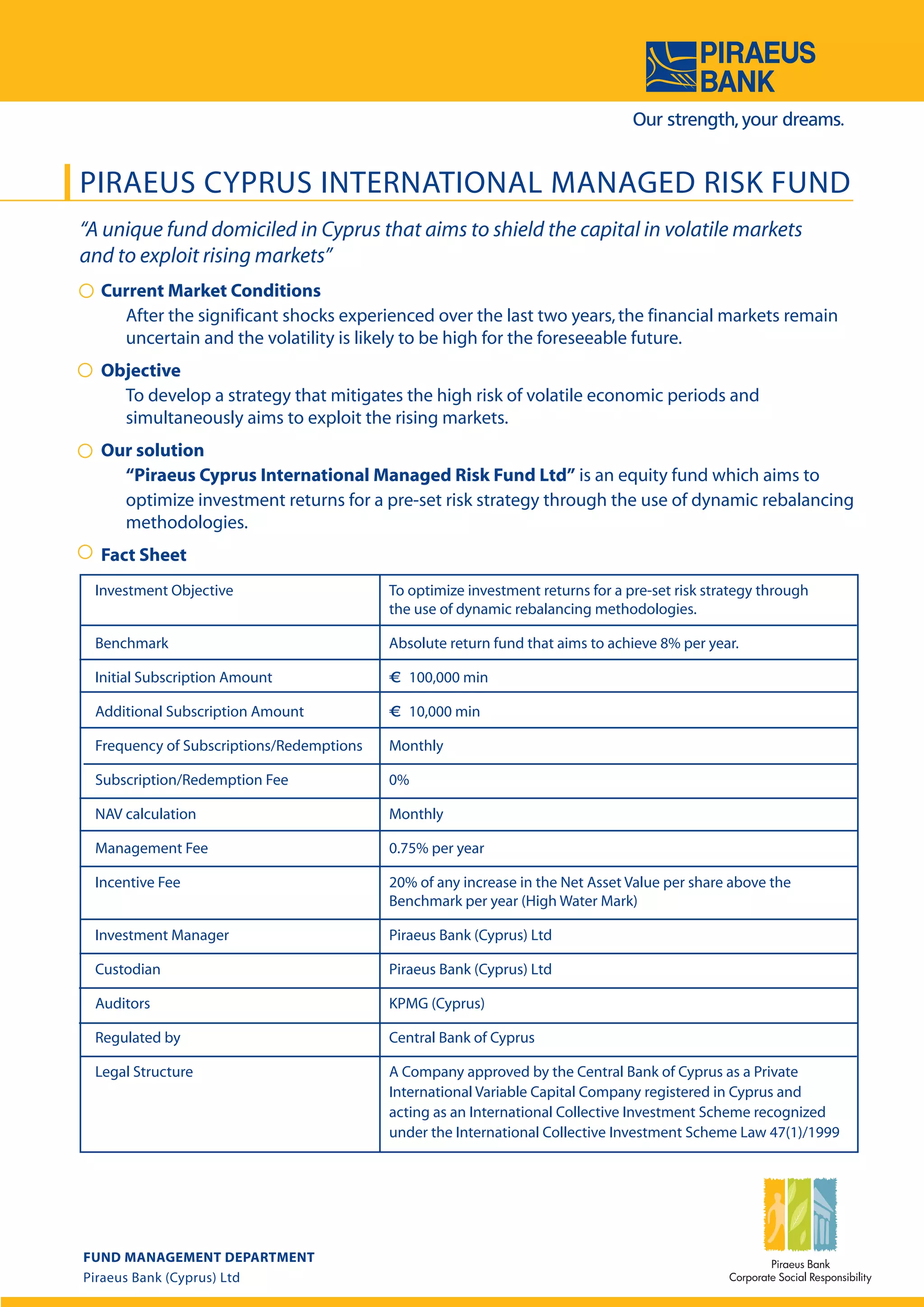

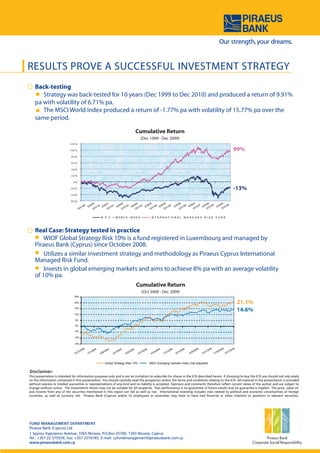

The Piraeus Cyprus International Managed Risk Fund aims to optimize returns while mitigating risk through dynamic rebalancing. Back-testing showed the strategy achieved 9.91% annual returns with 6.71% volatility over 10 years, outperforming world markets. The strategy is also used in the WIOF Global Strategy Risk 10% fund, which has achieved returns of 21.1% since 2008 with 14.6% volatility, outperforming emerging markets. The fund seeks an 8% annual return with 10% average volatility through investing in global emerging markets.