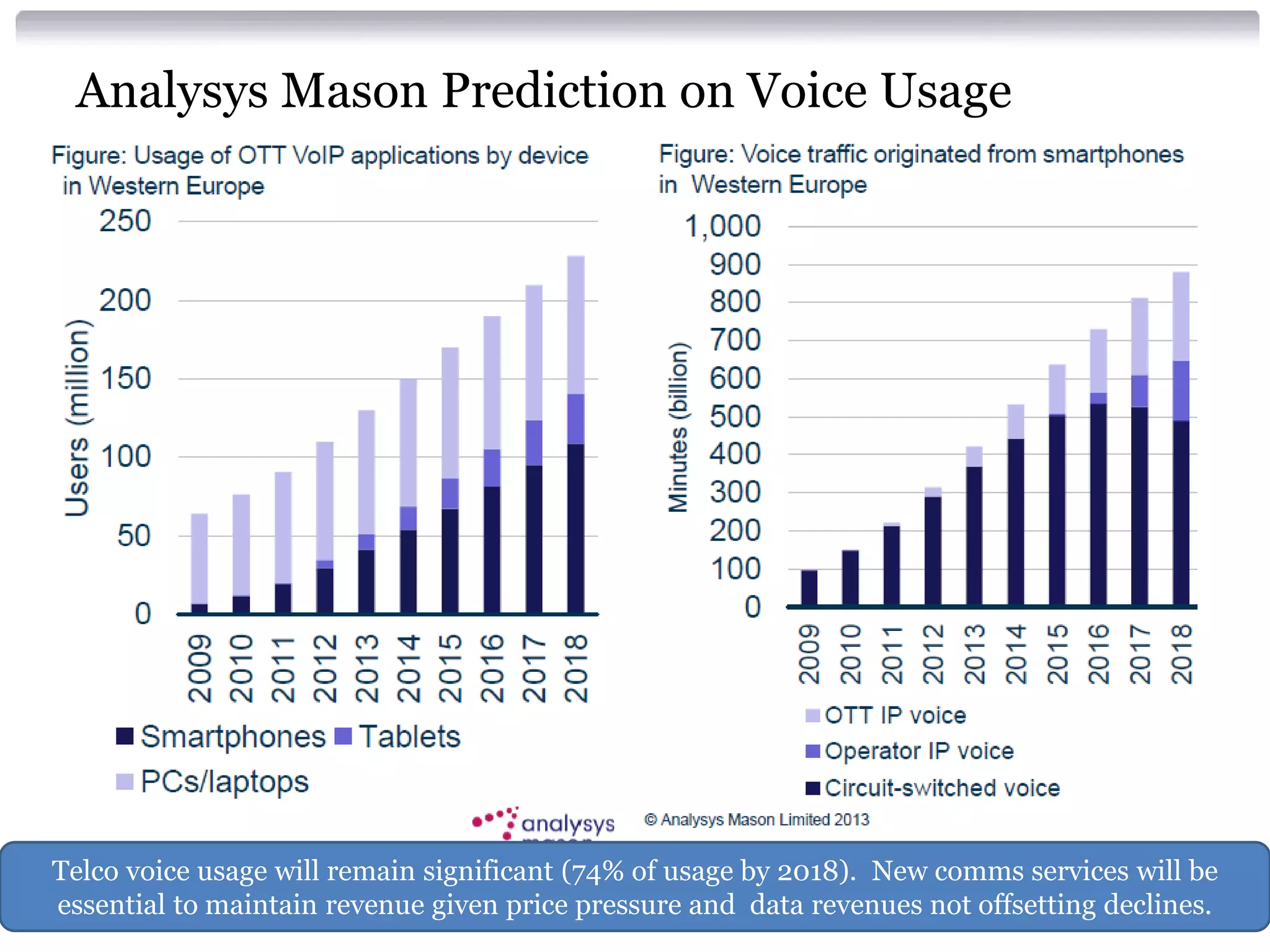

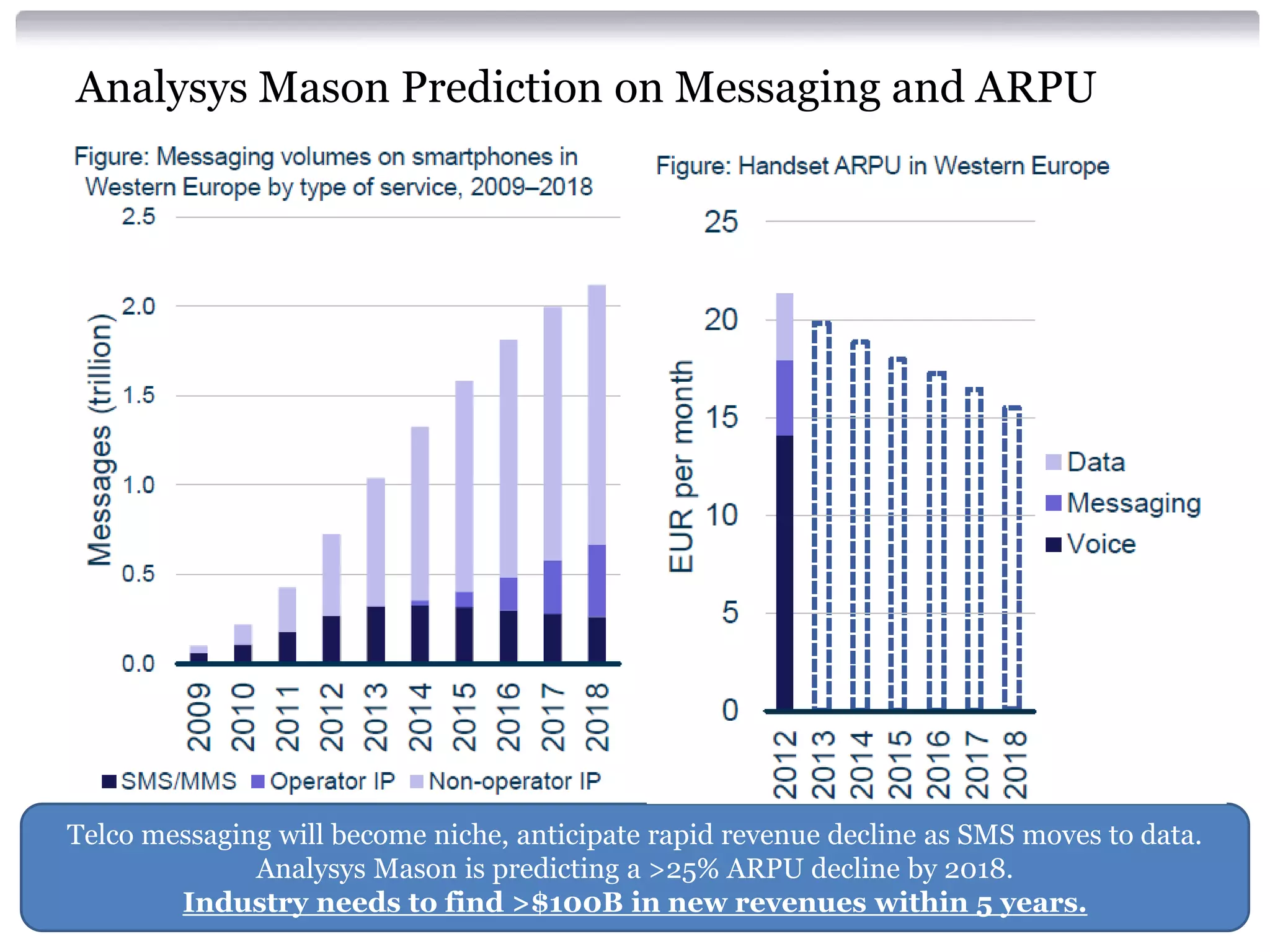

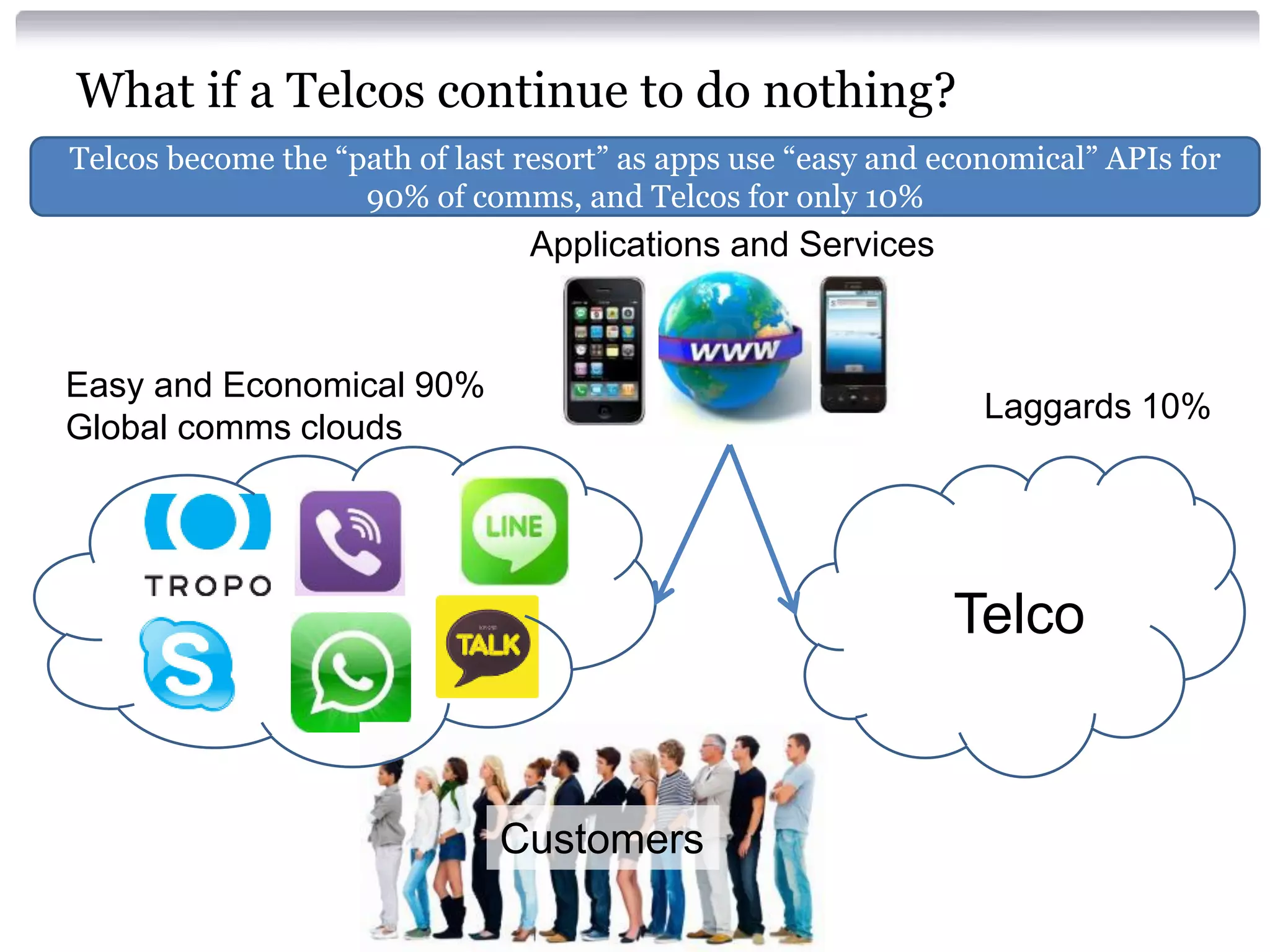

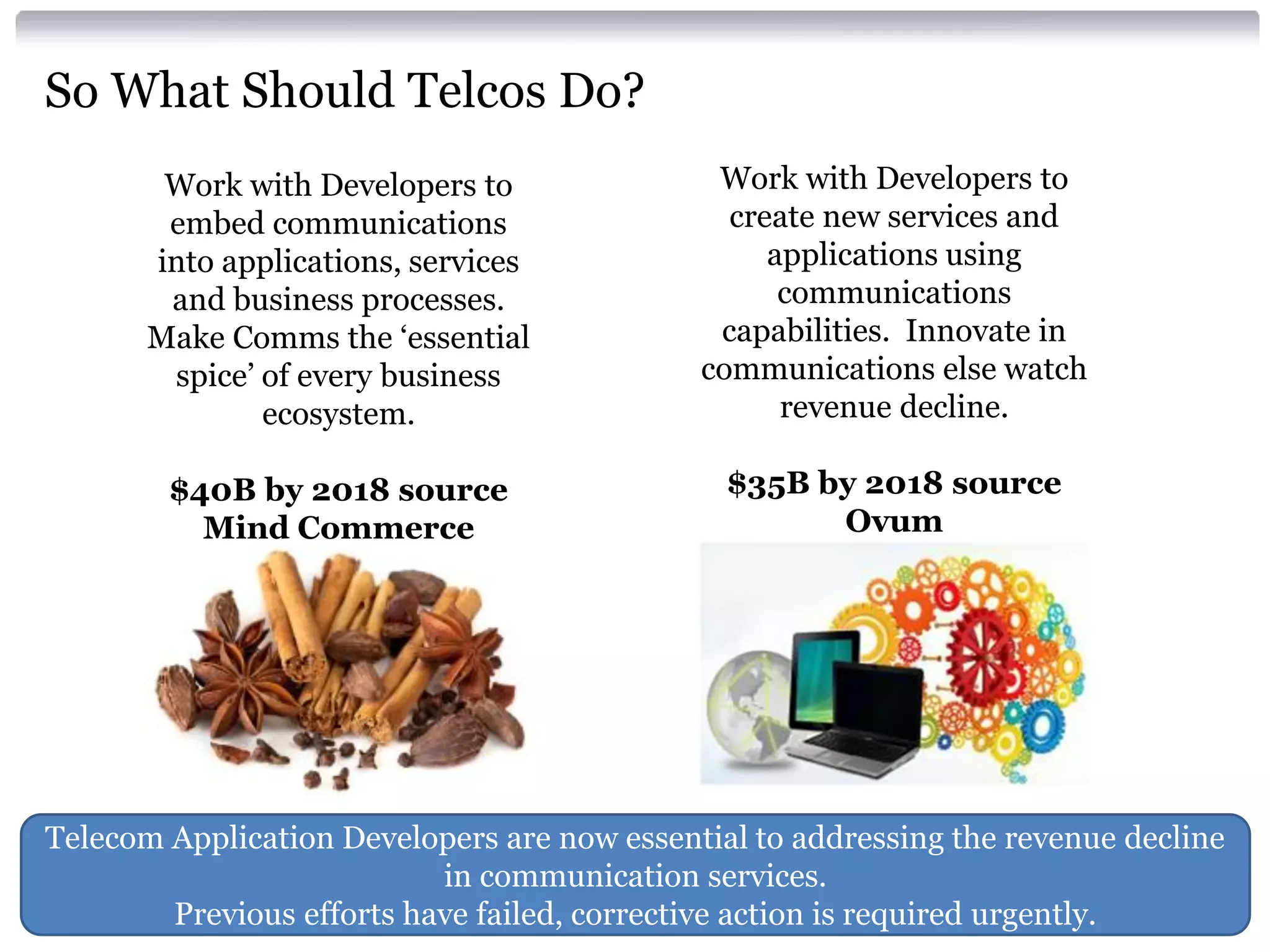

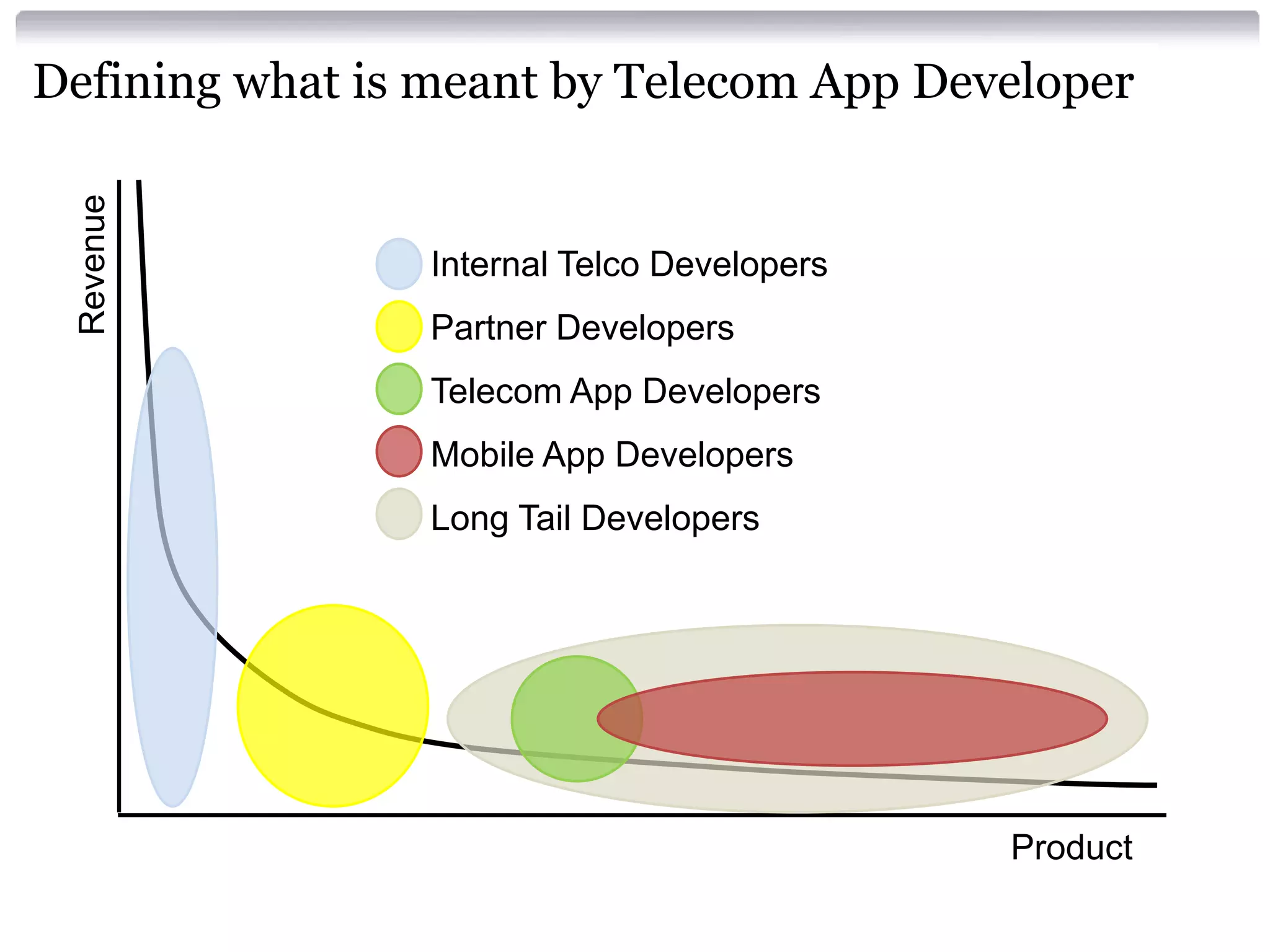

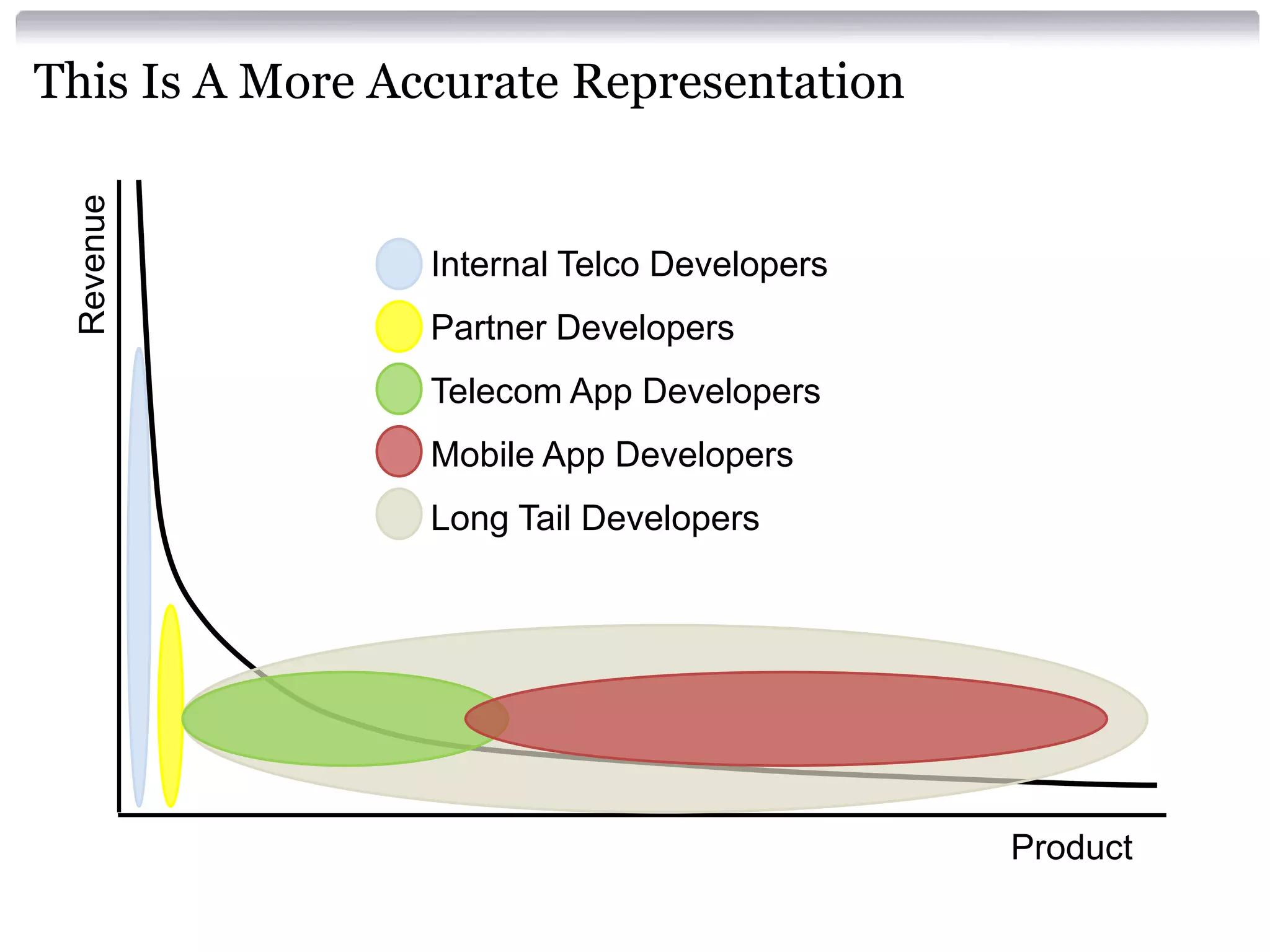

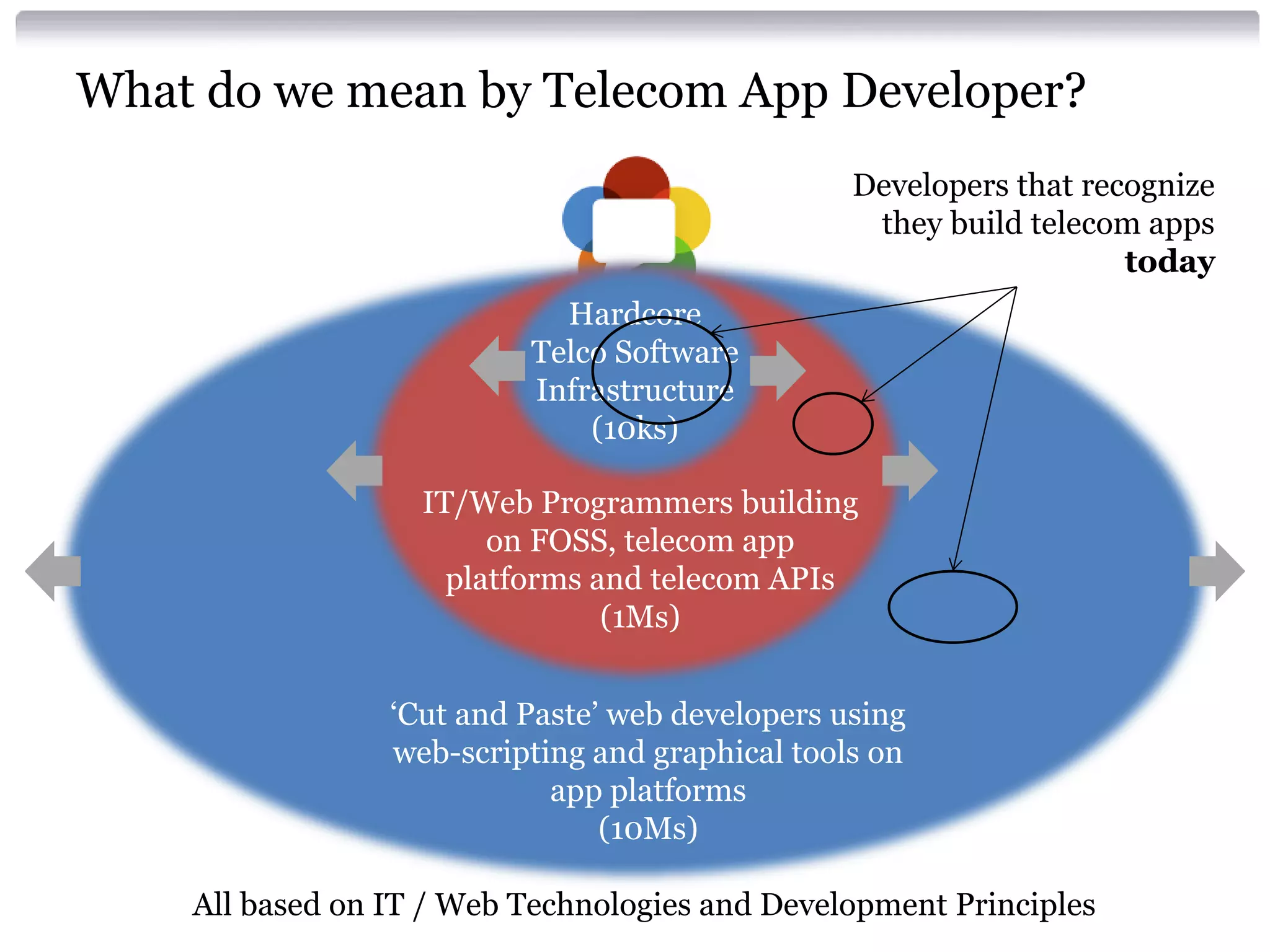

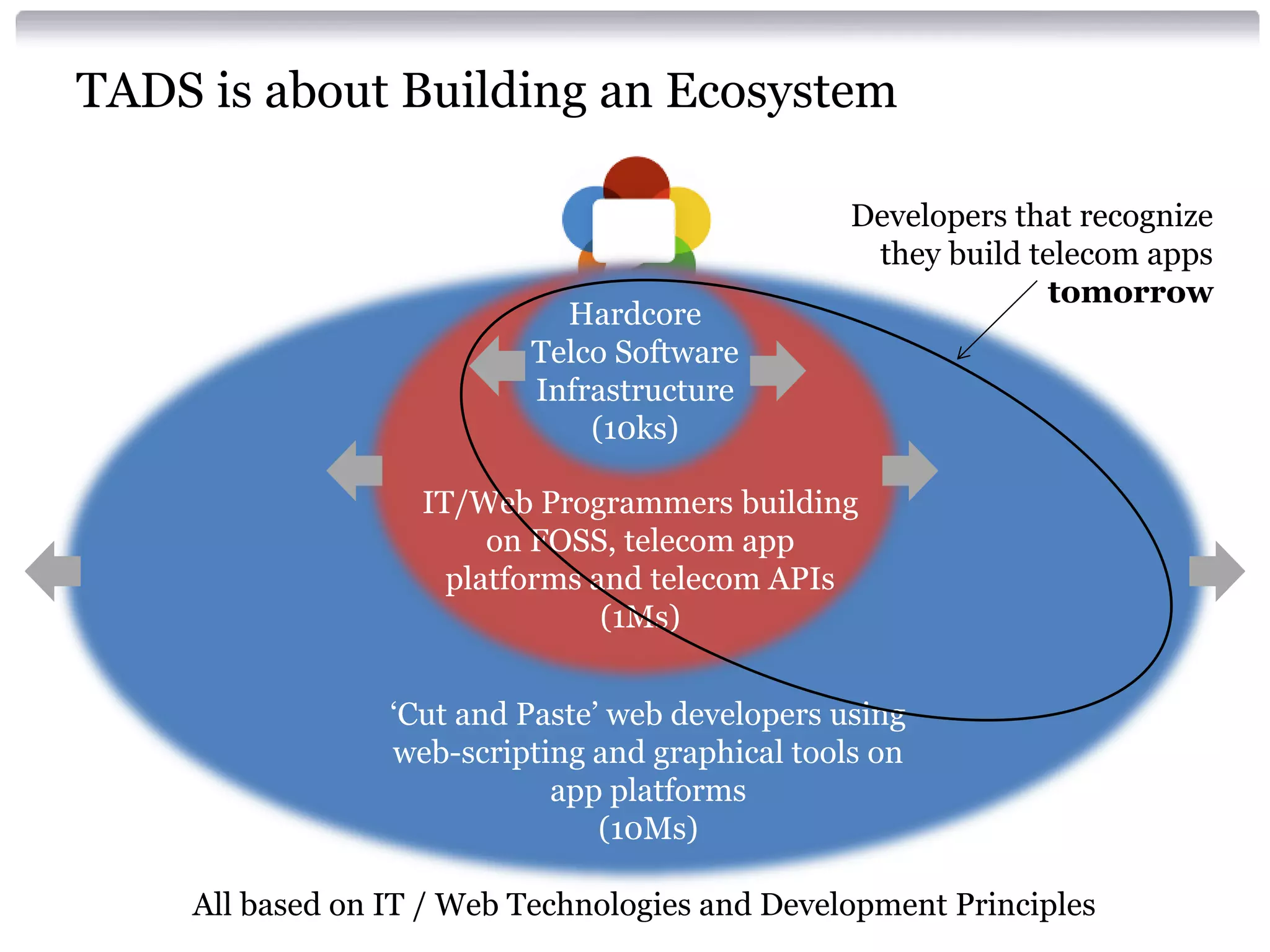

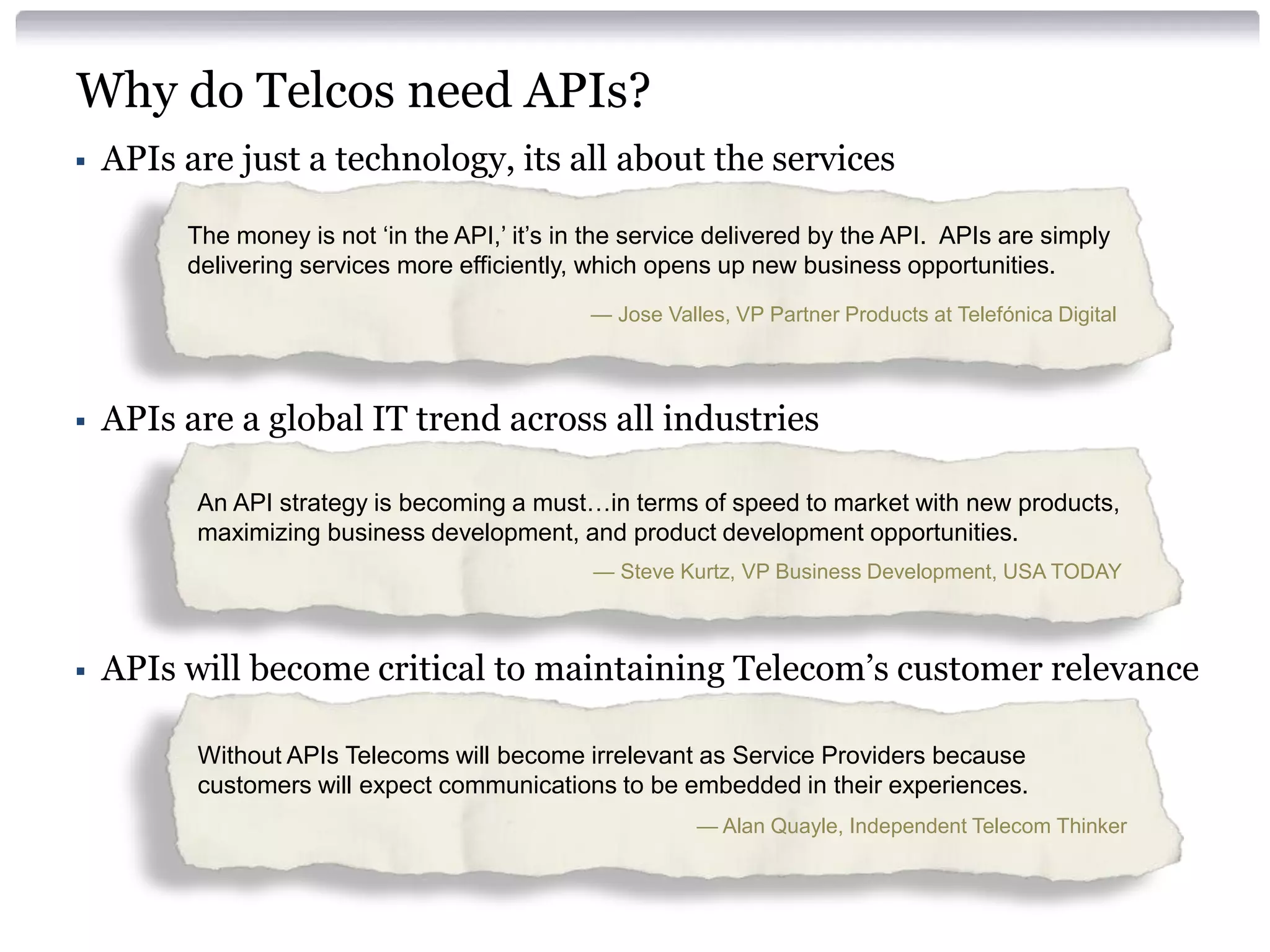

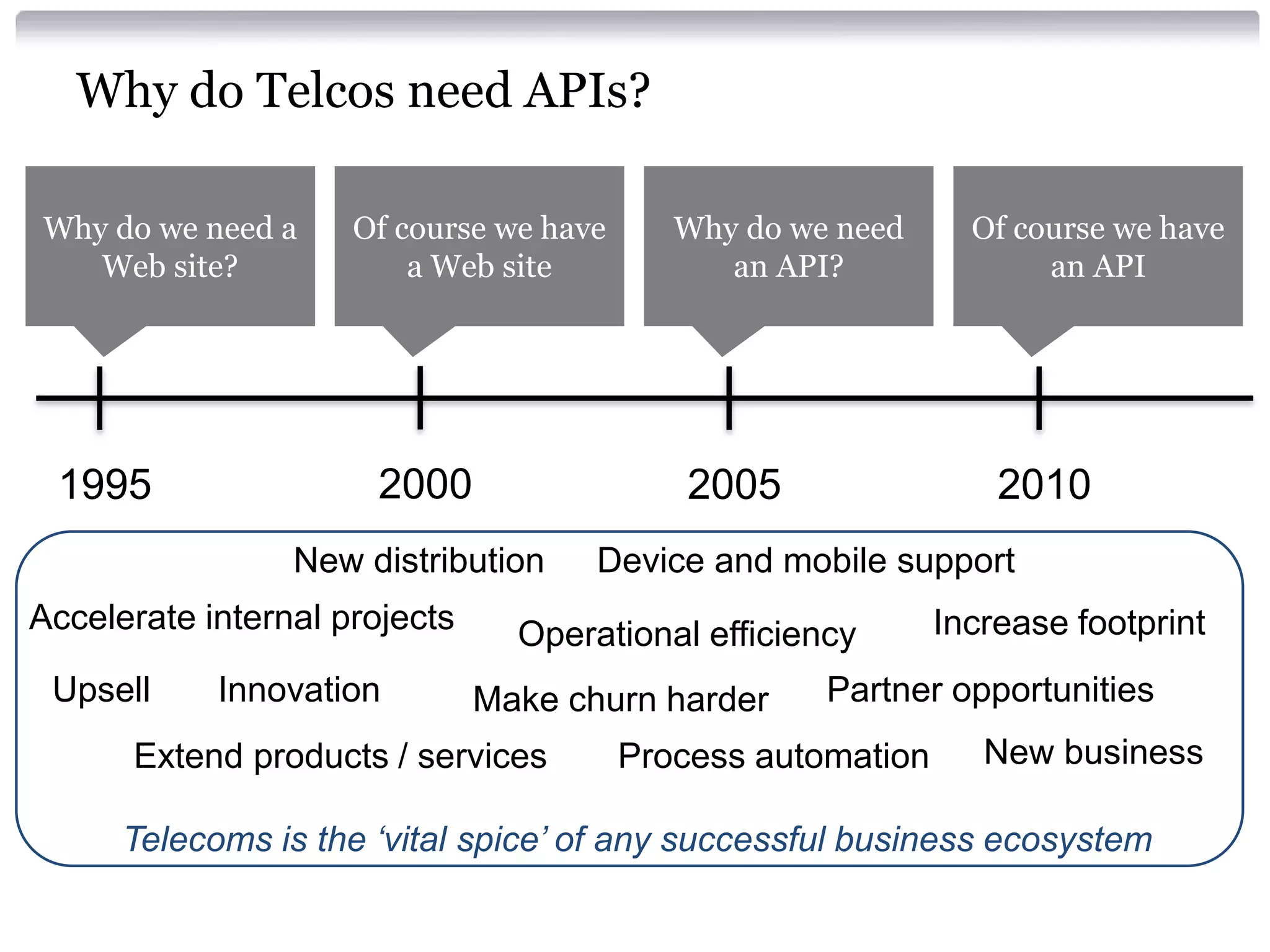

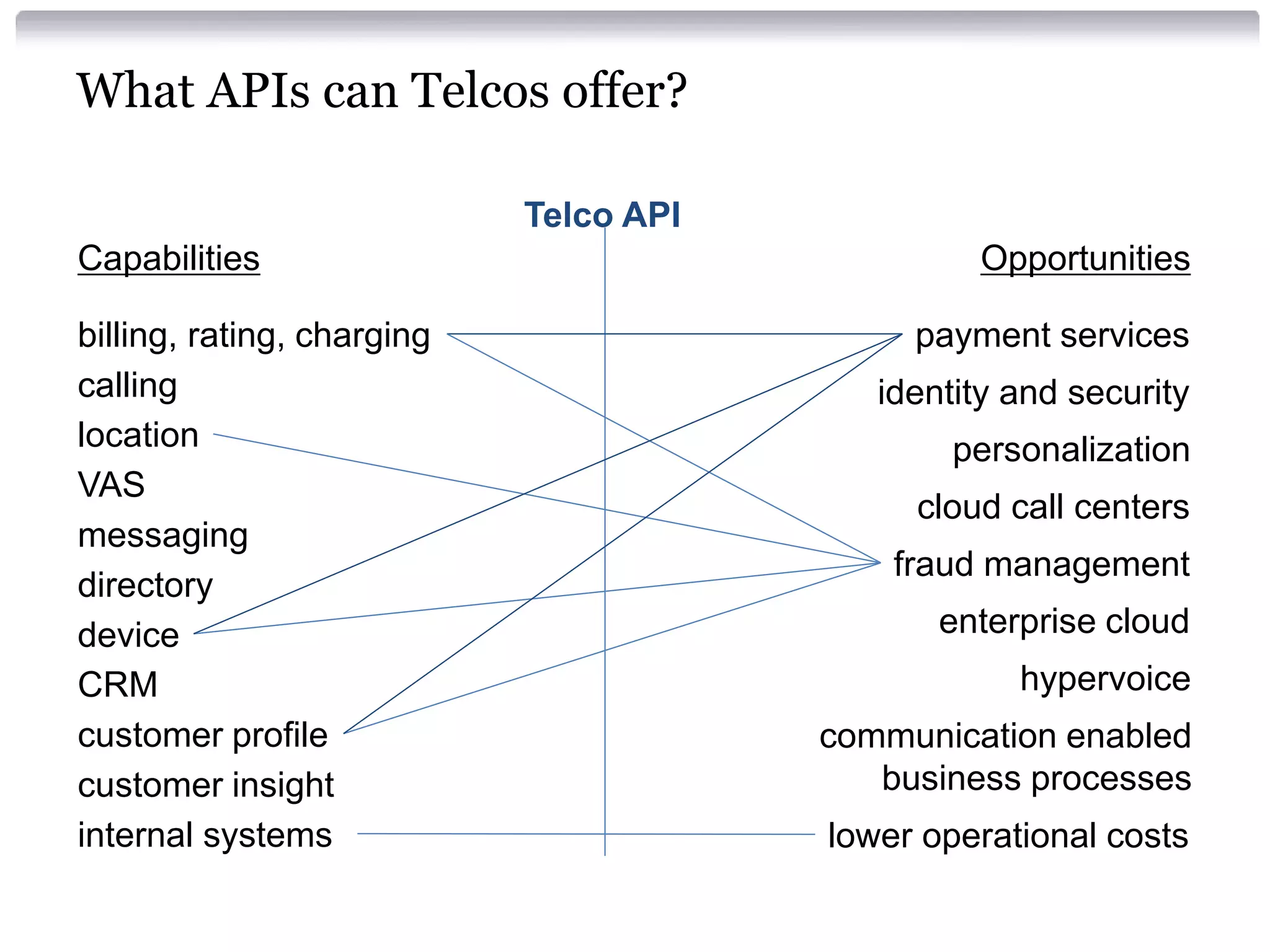

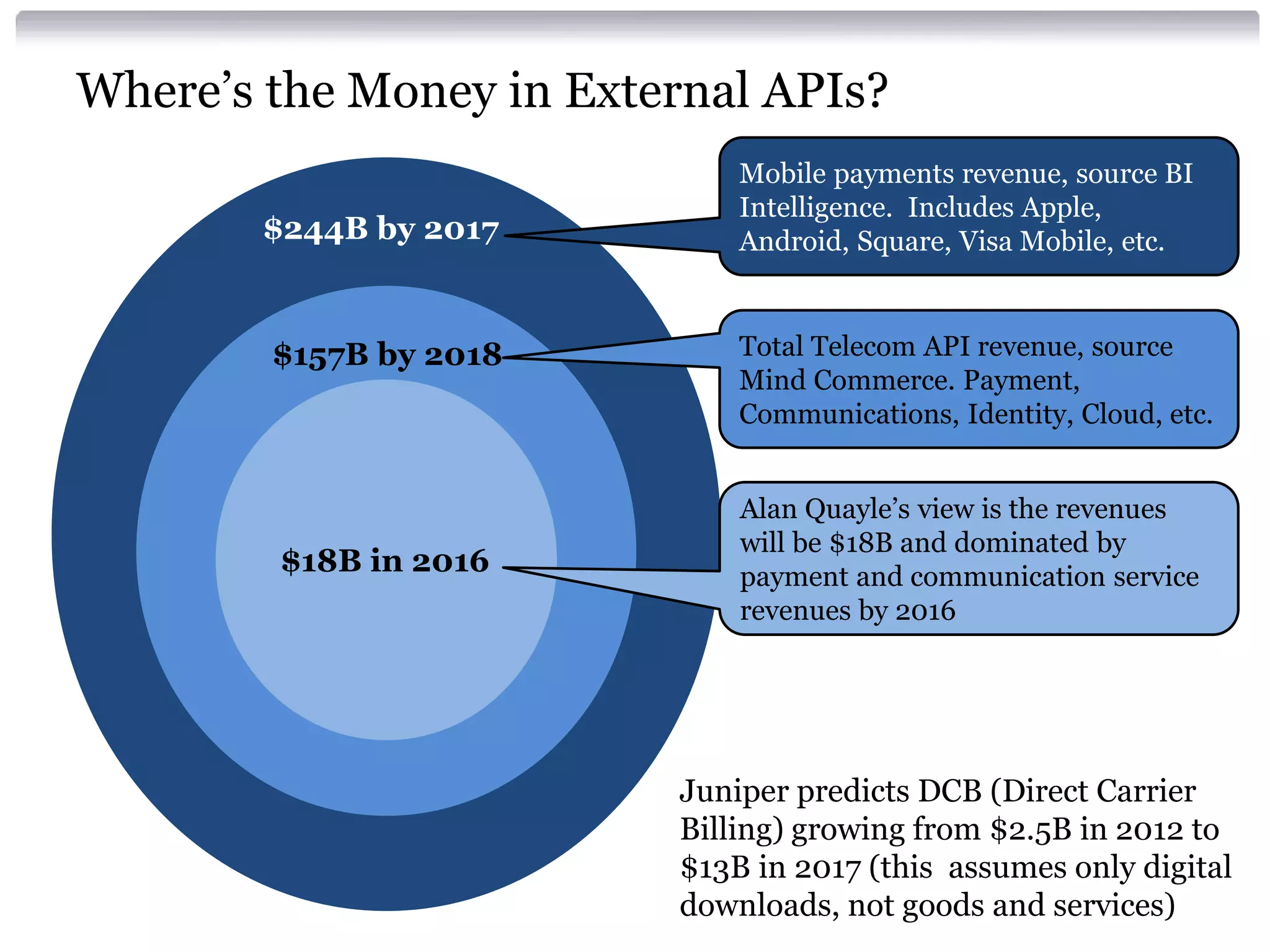

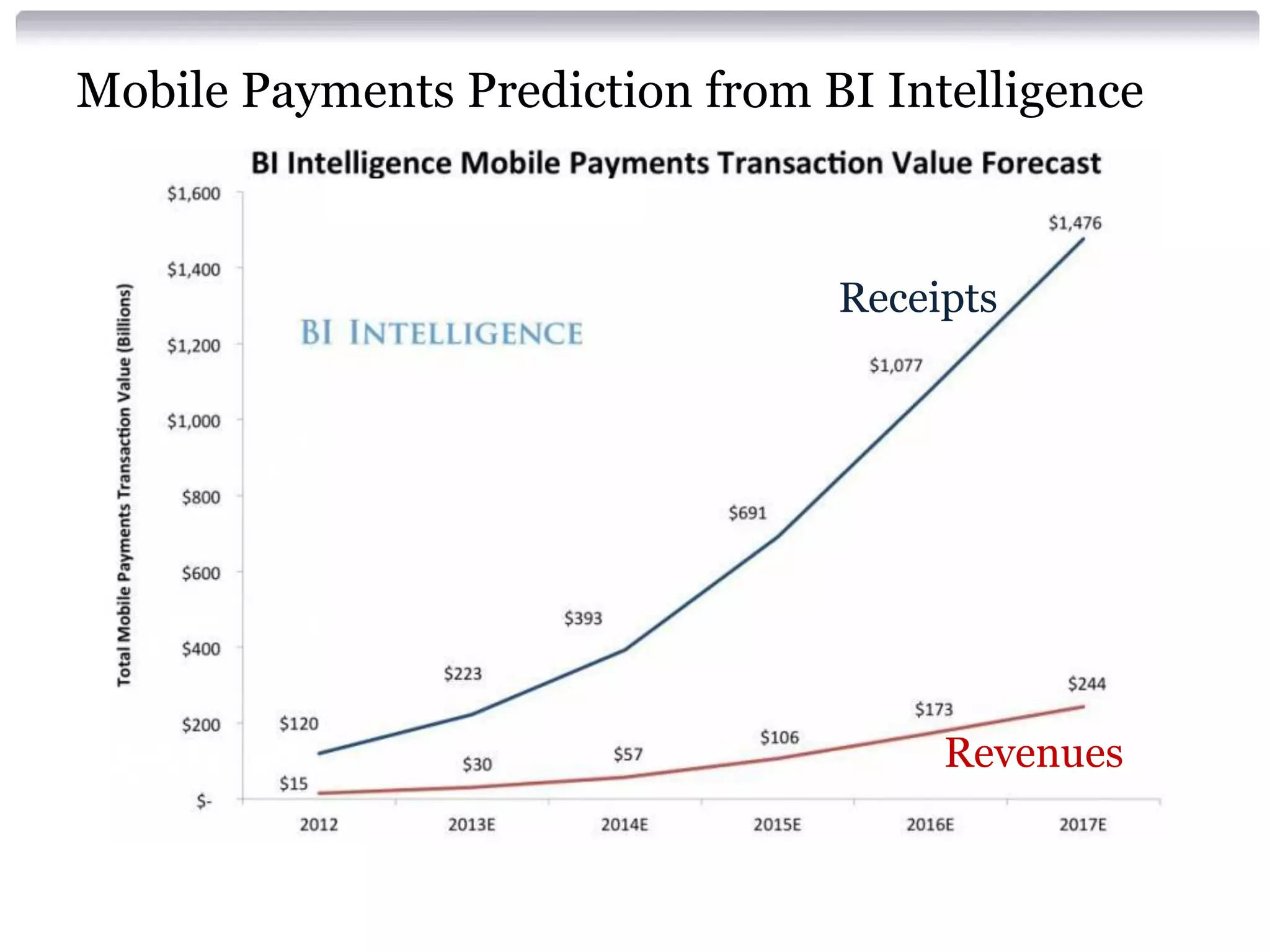

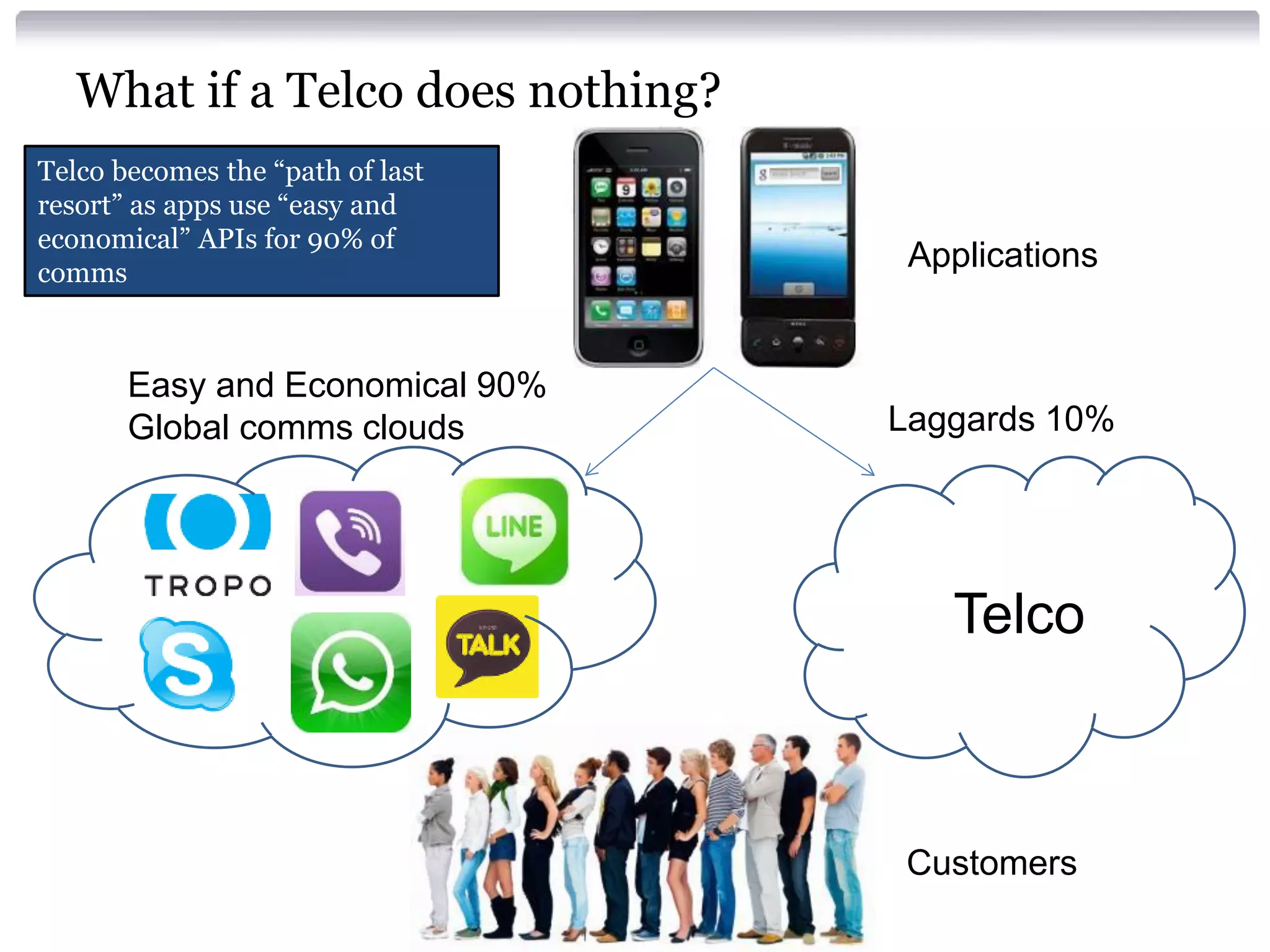

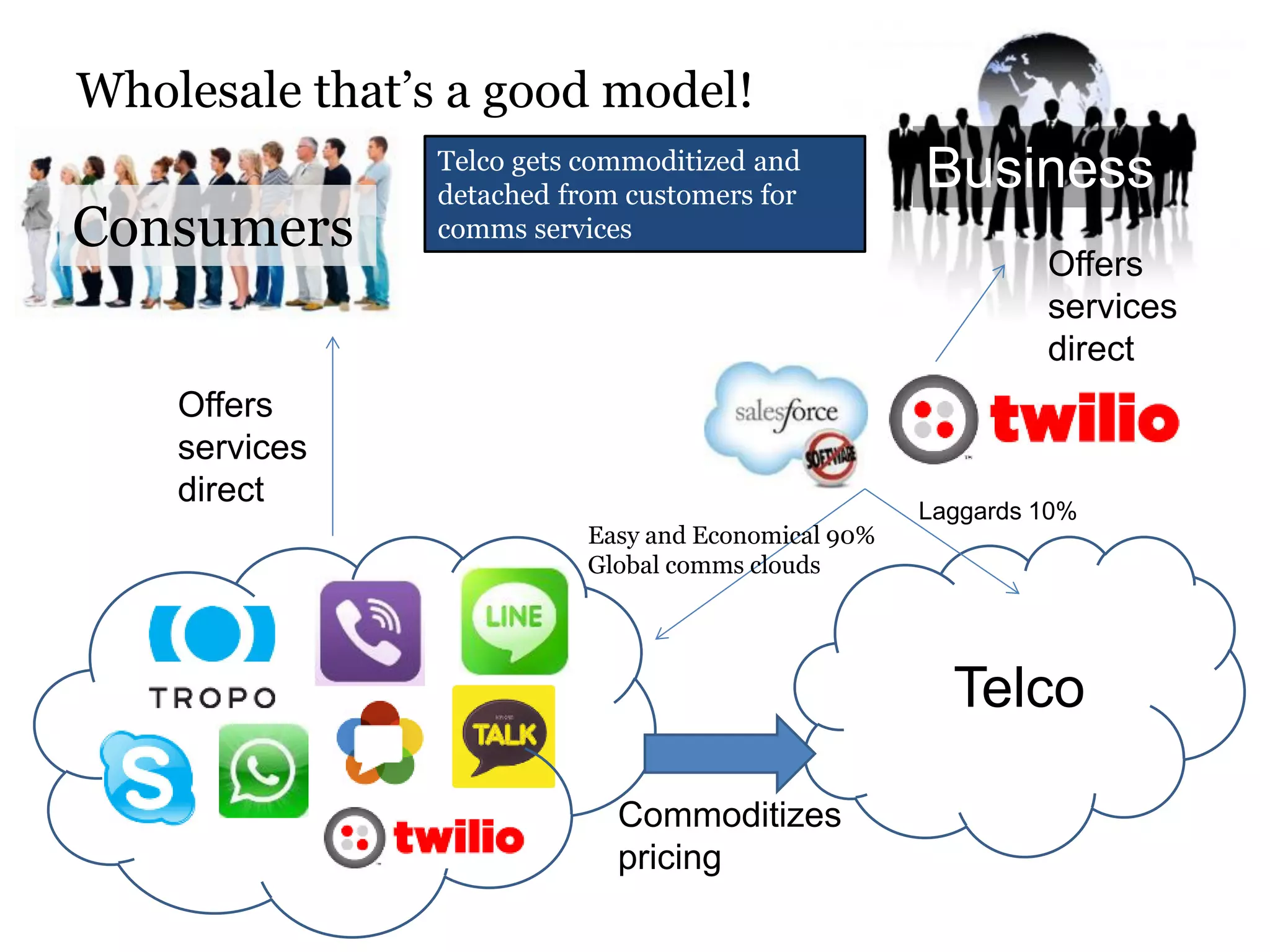

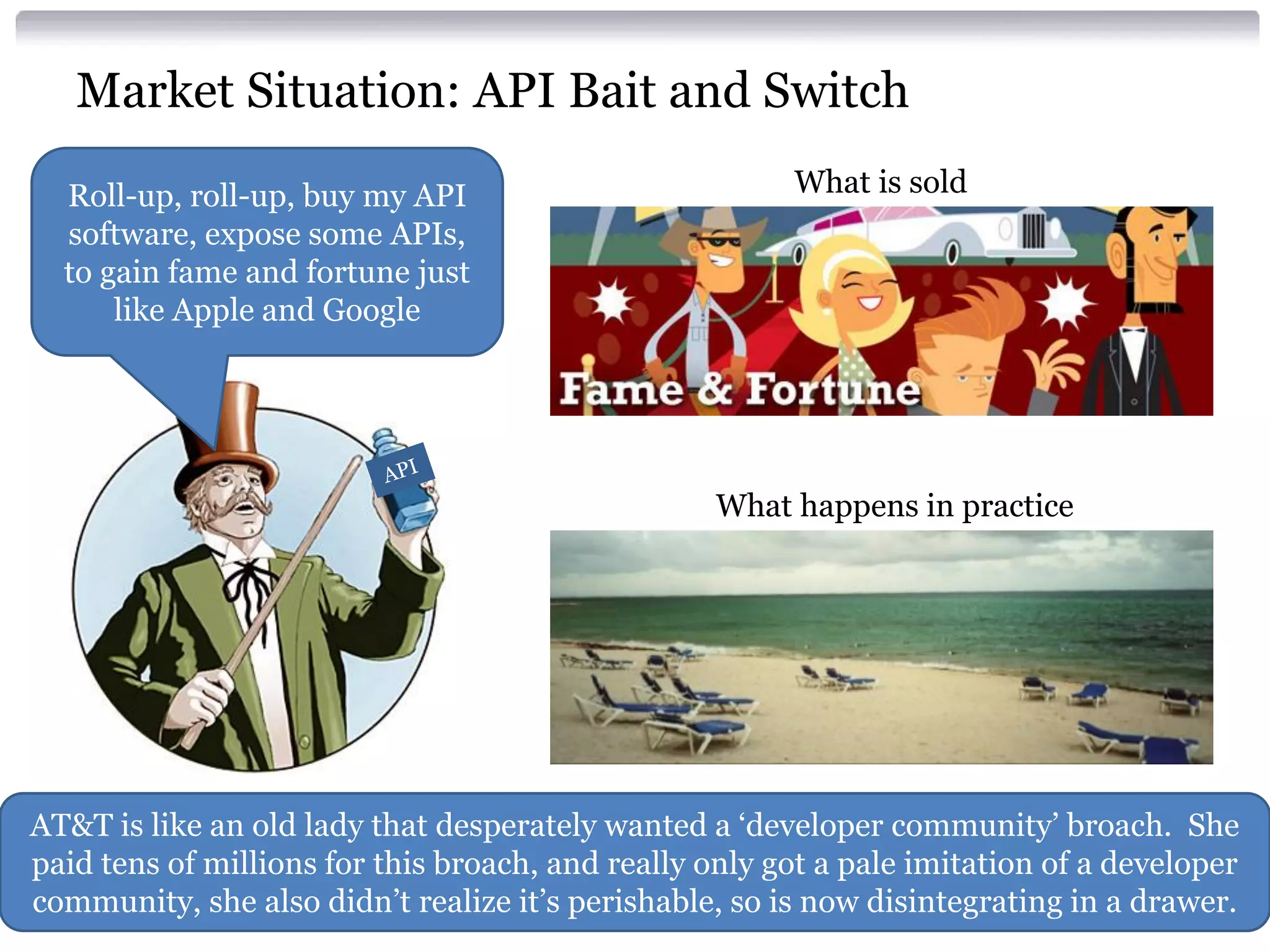

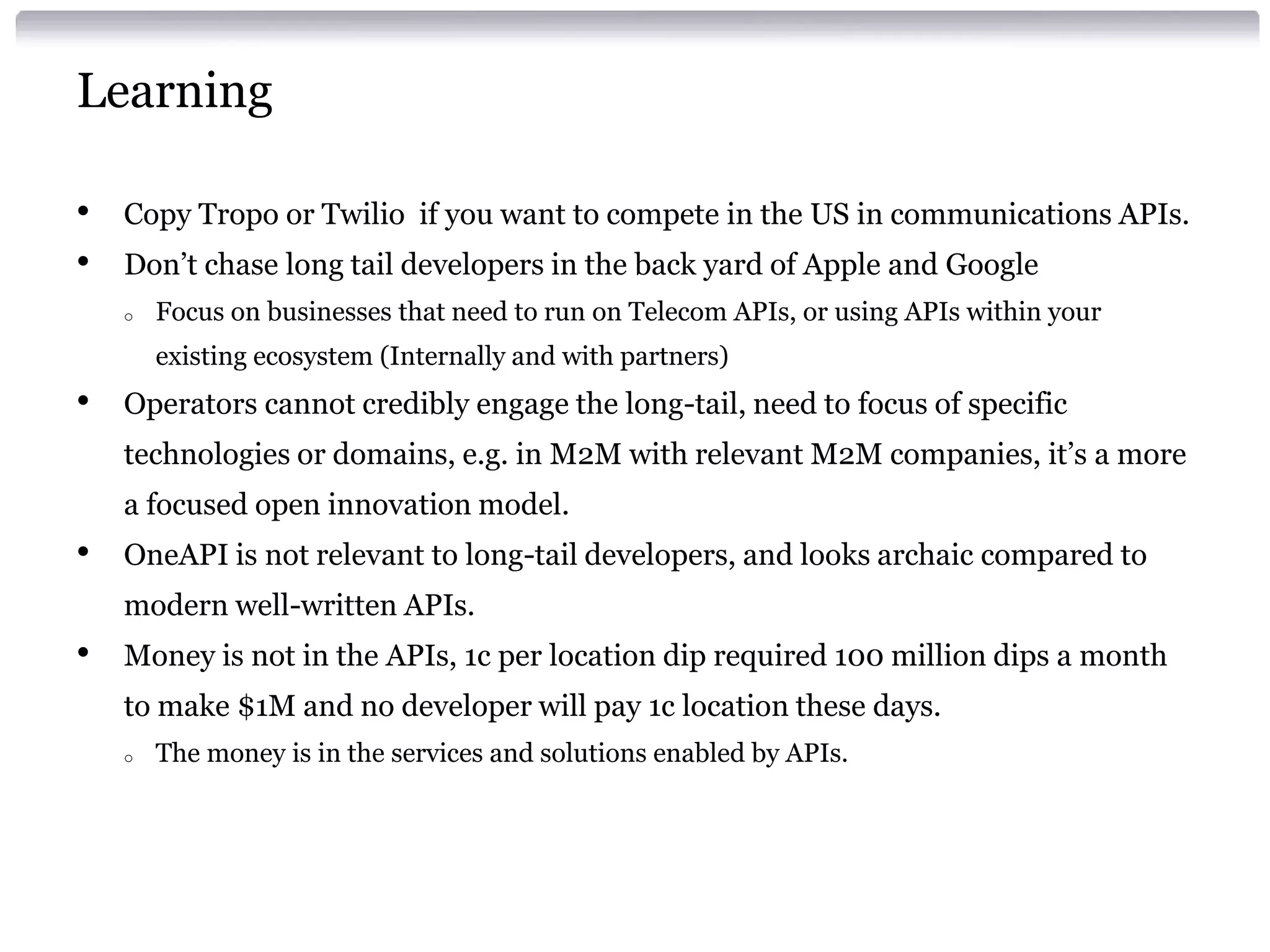

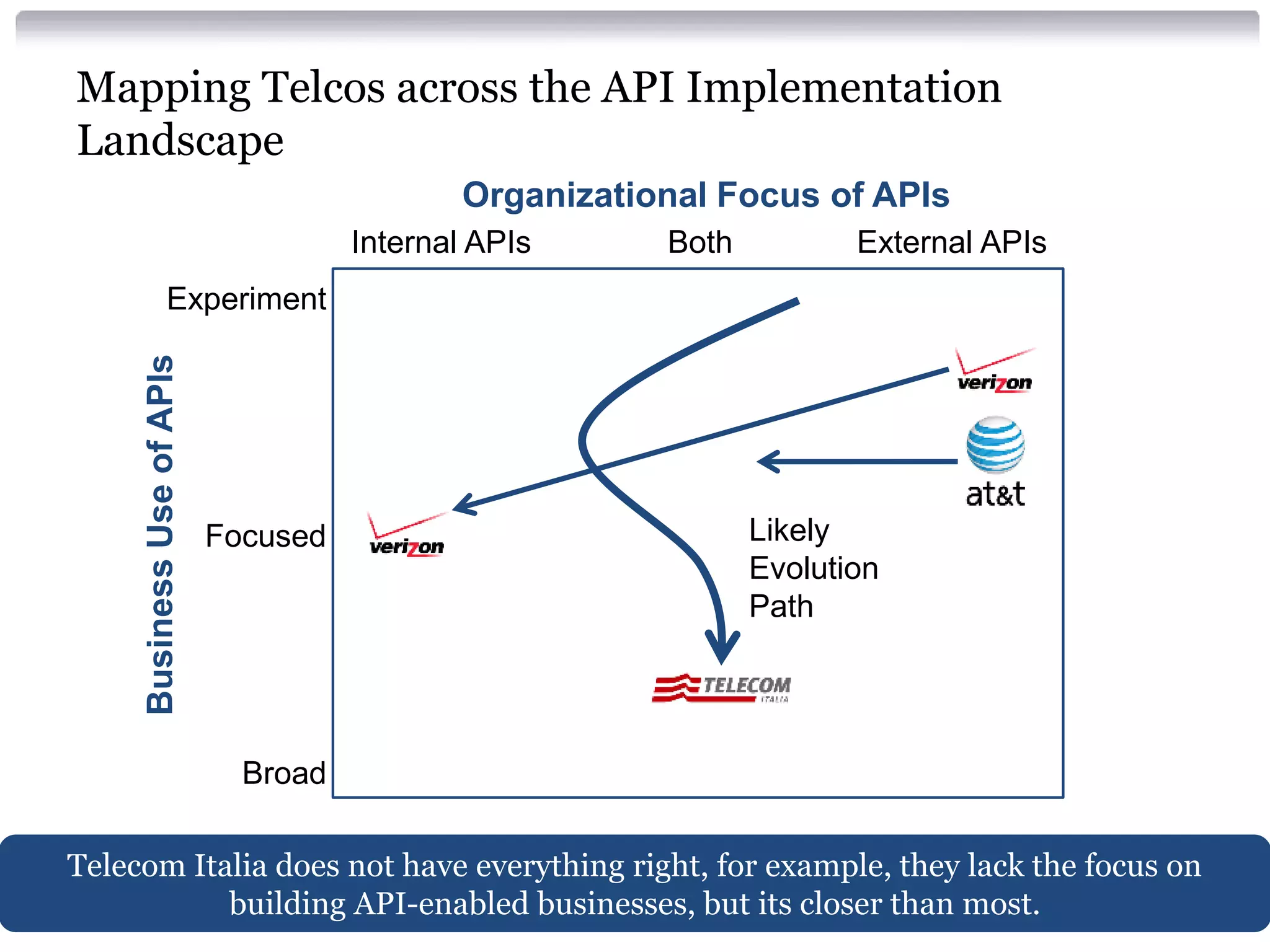

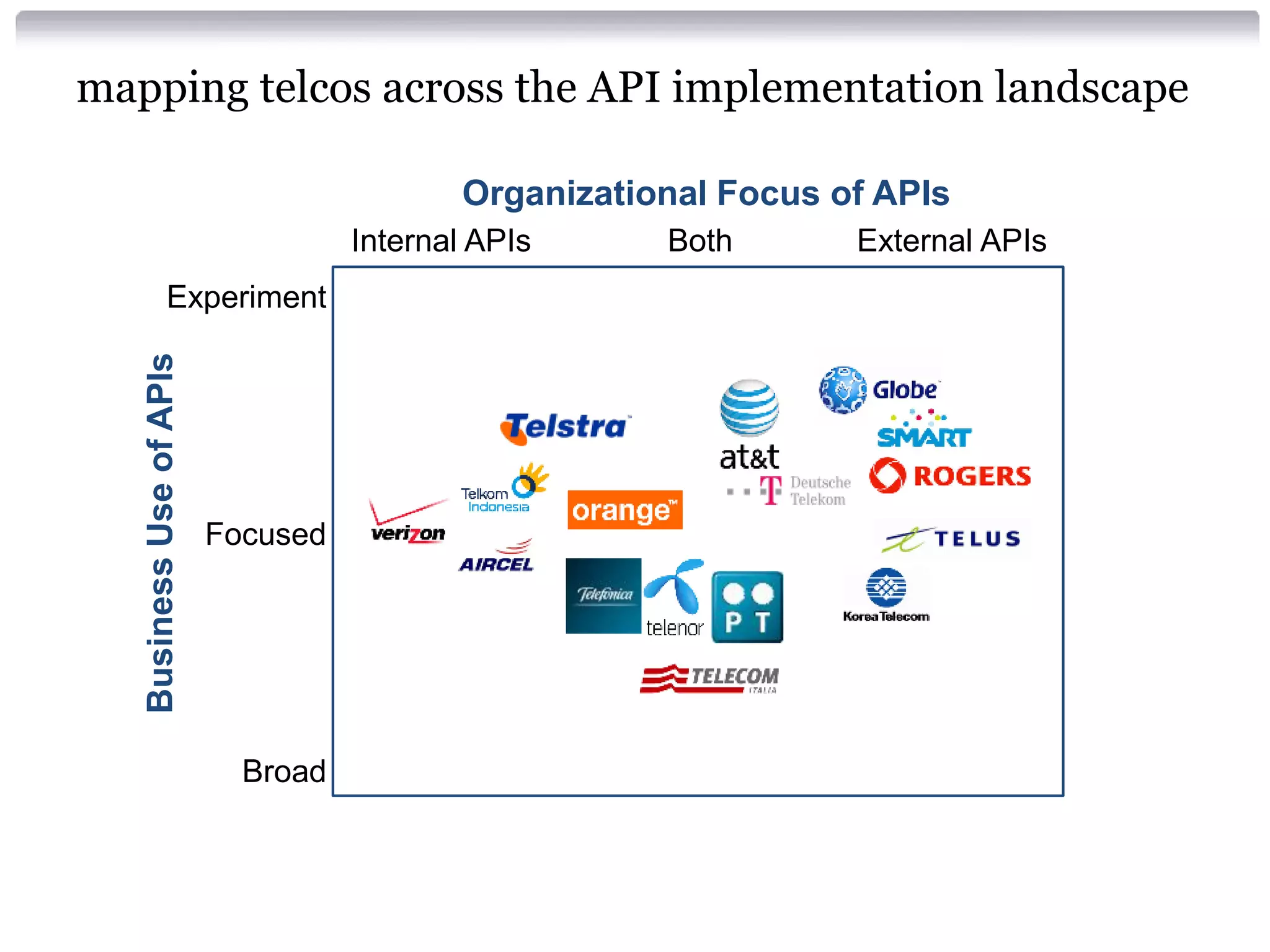

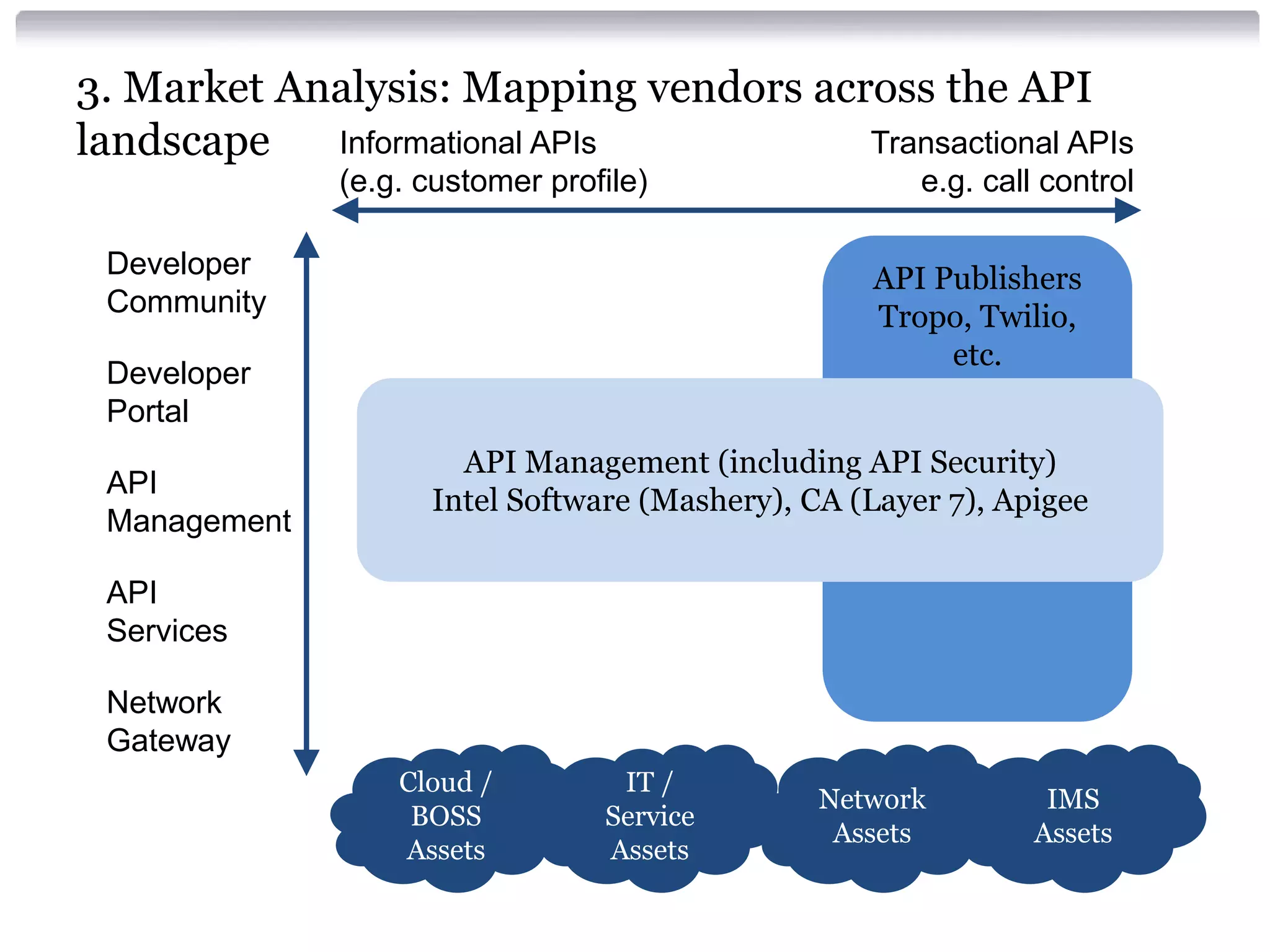

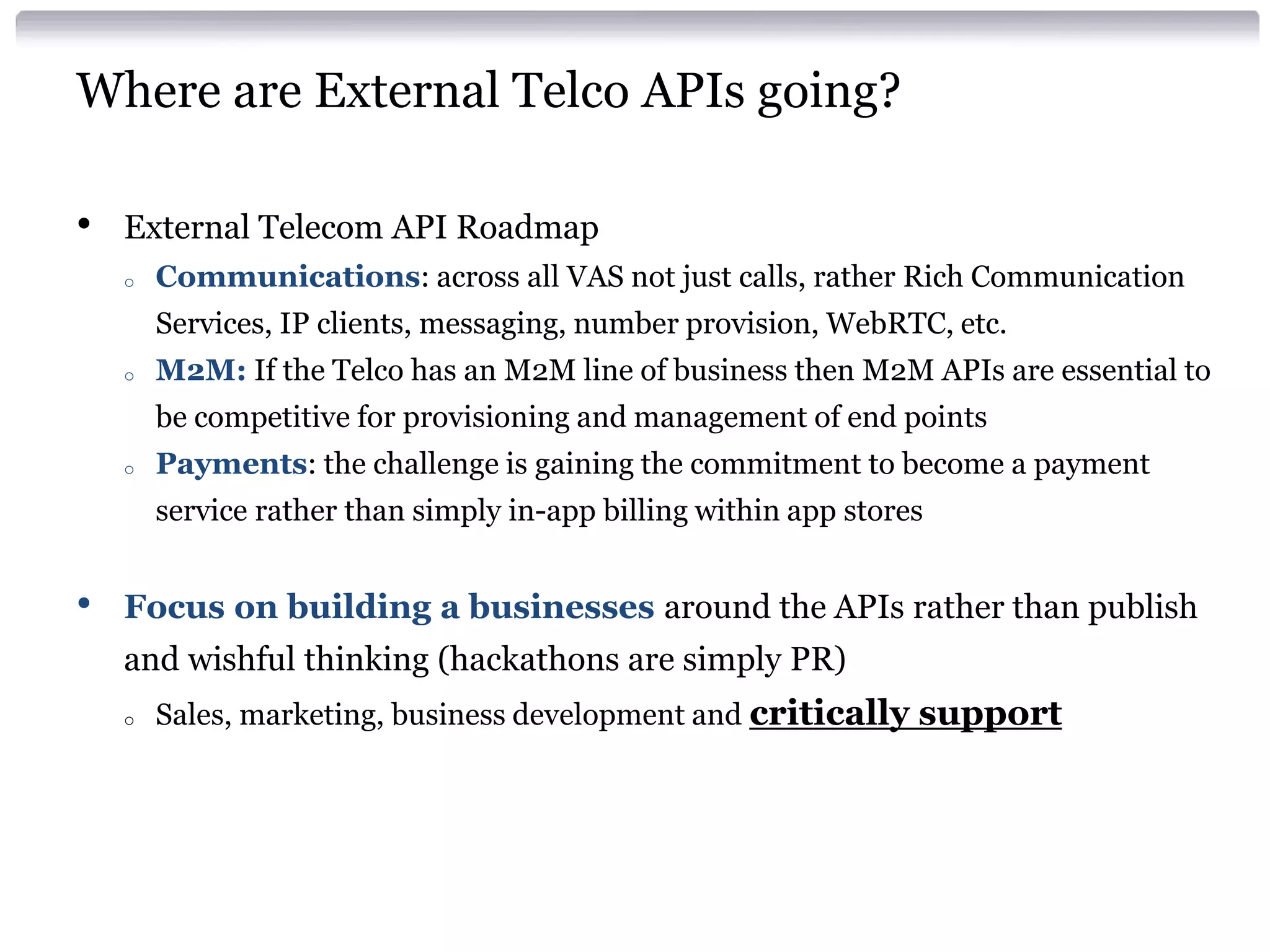

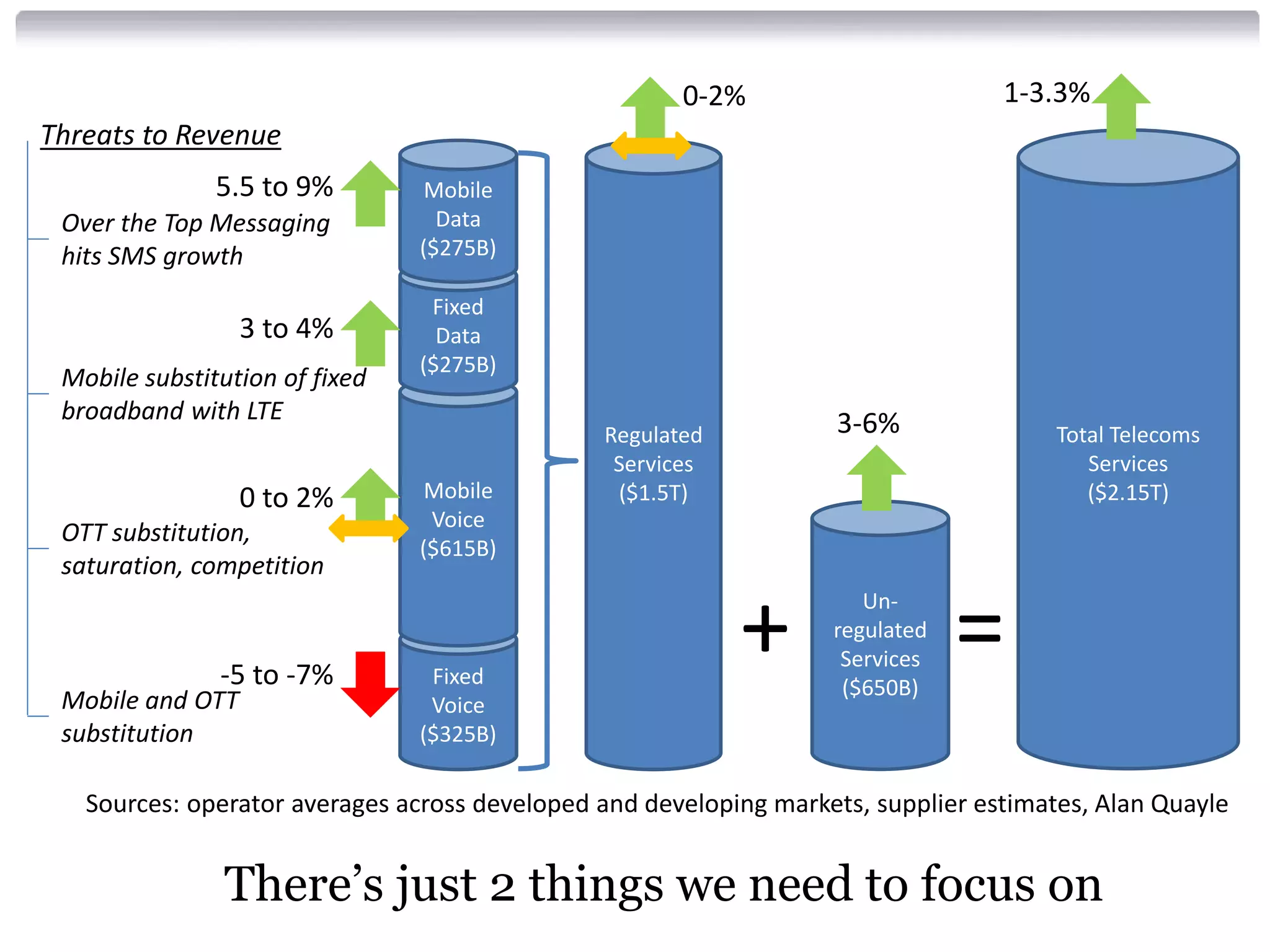

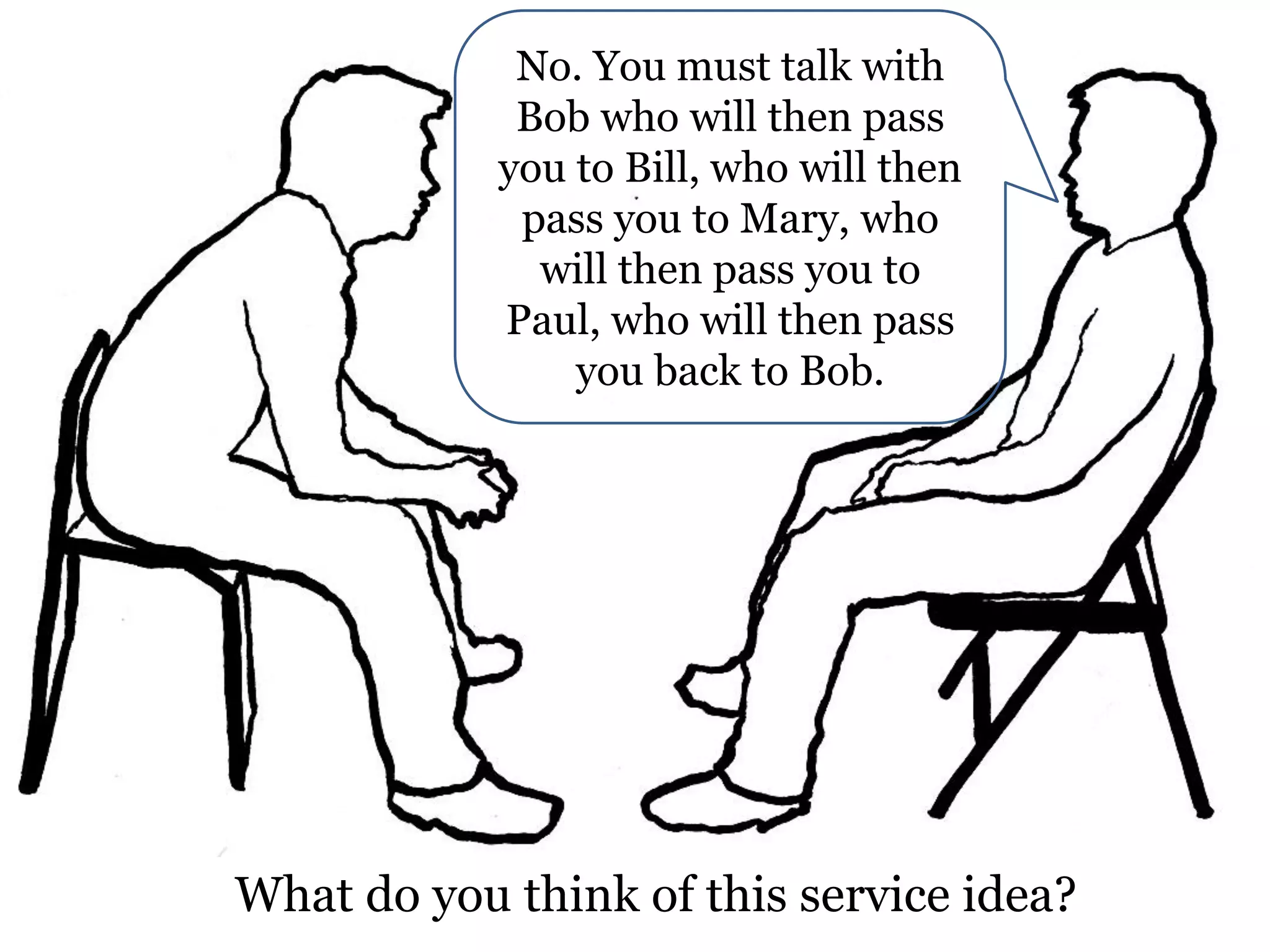

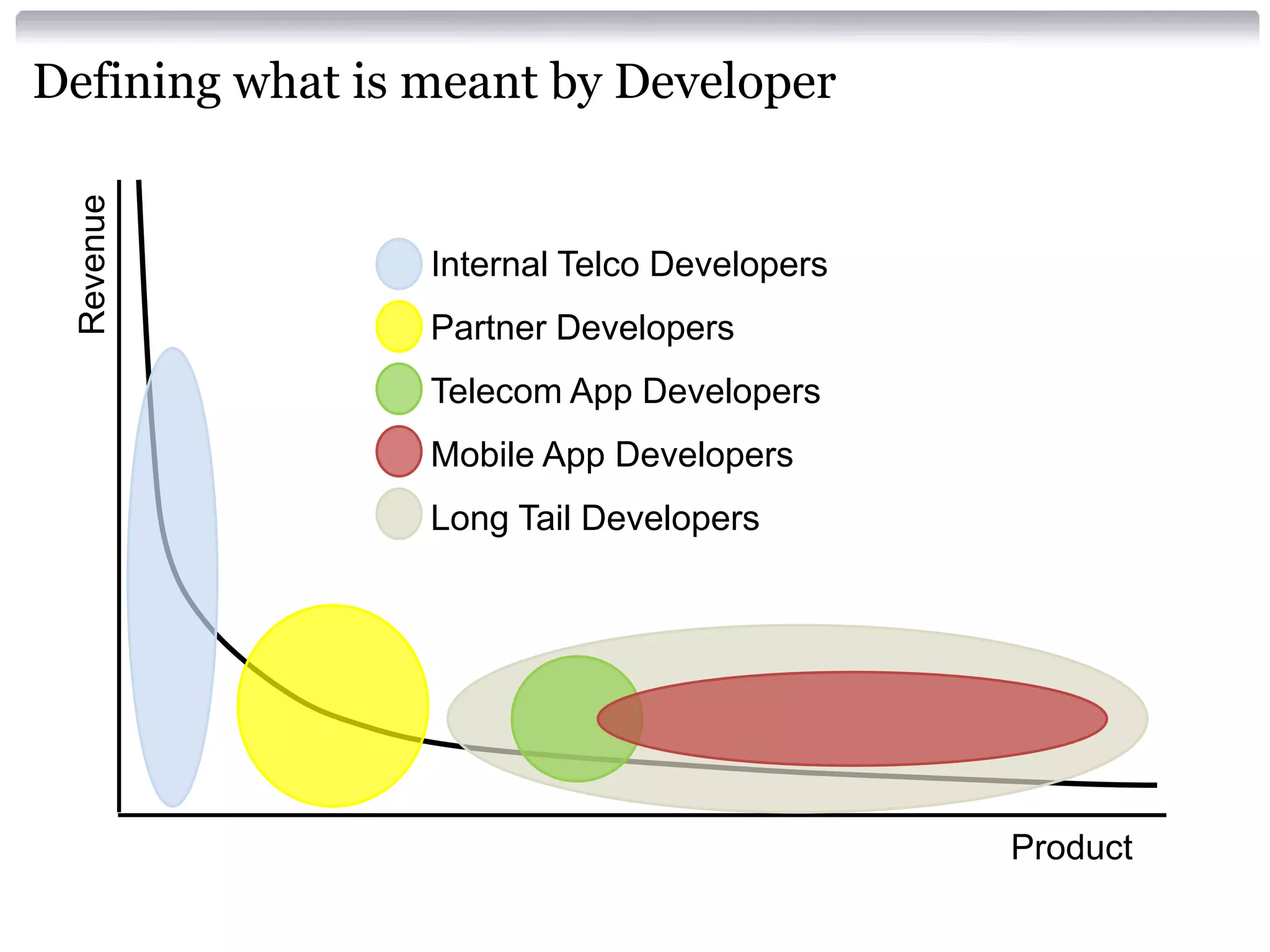

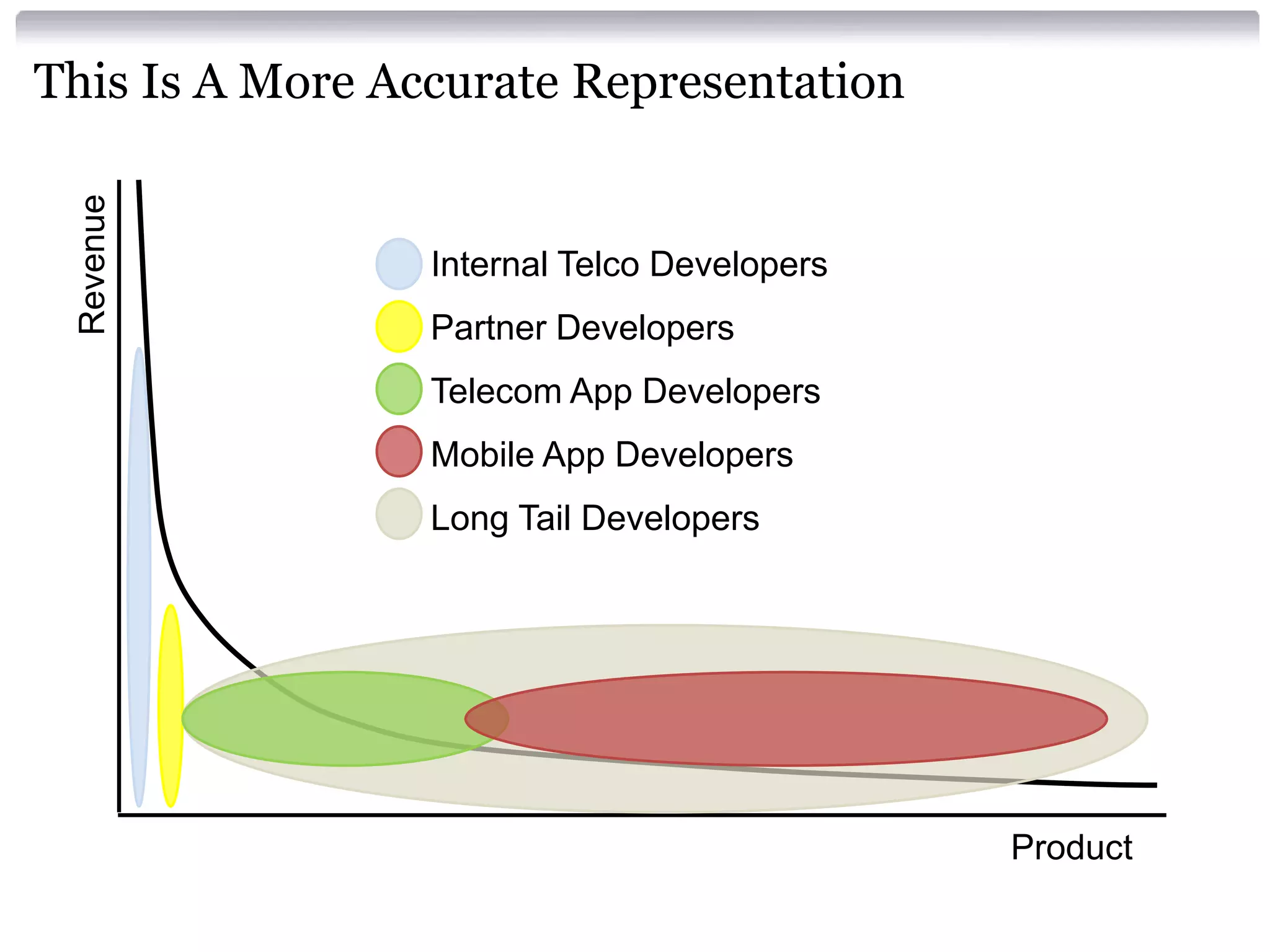

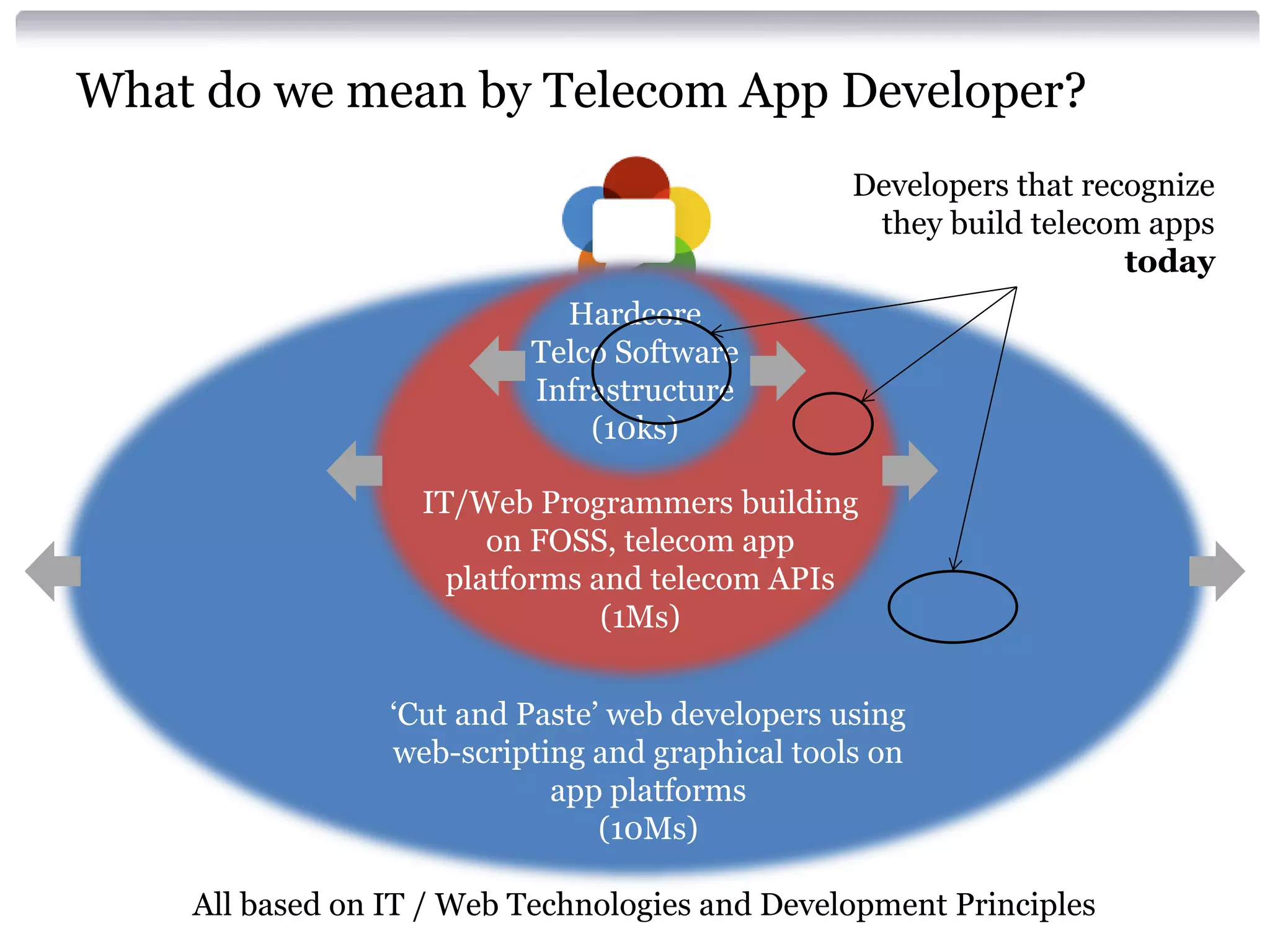

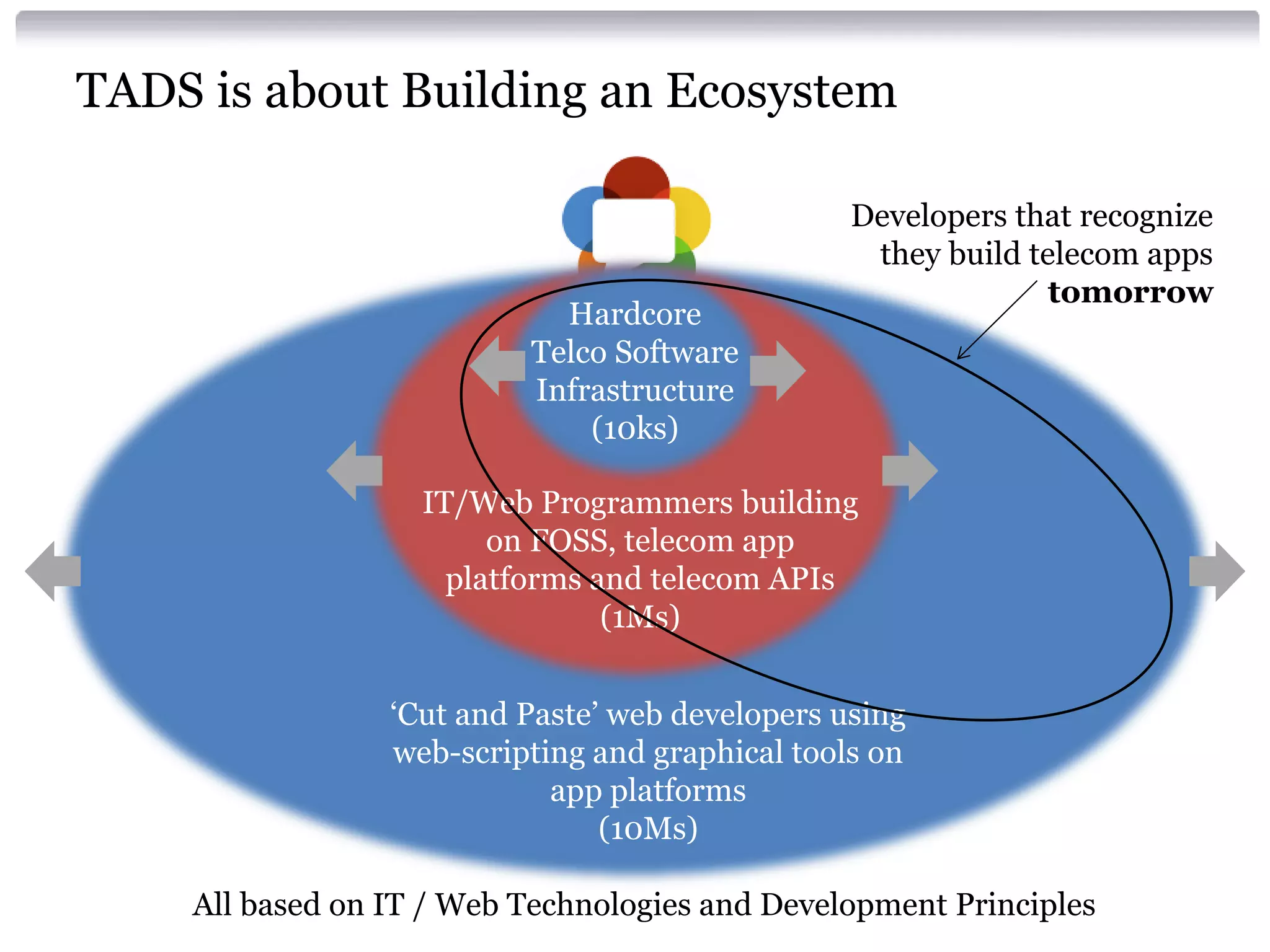

The document provides an overview of an independent review of telecom APIs. It includes summaries of four presentations: Alan's presentation discusses why telcos need APIs, common API strategies, and predictions about the telecom industry. Luis' presentation features details on the APIDAZE API and case studies. Jean's presentation is about the RestComm platform and a health case study. Sam's presentation provides information on Tropo products and case studies. The document emphasizes that the value of APIs is in the services delivered, not the APIs themselves, and that telecoms need to work with developers to create new services and applications.