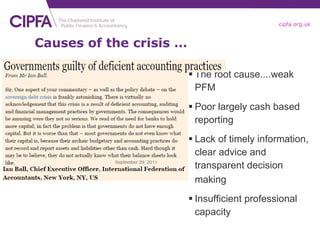

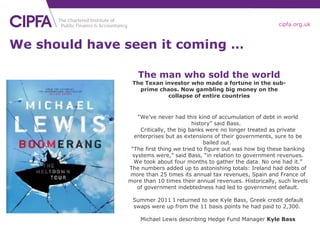

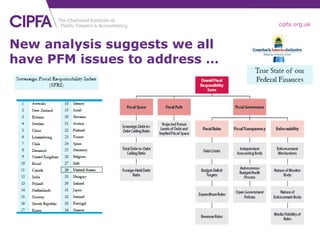

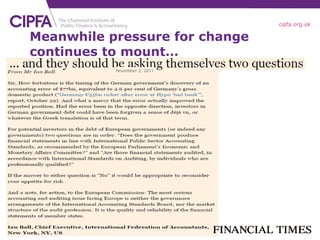

The document discusses the need for a global public financial management (PFM) profession in response to issues revealed by the sovereign debt crisis. It outlines weaknesses in PFM that contributed to the crisis and proposes developing a global PFM certification and training program through partnerships between organizations. The goals are to improve PFM standards and capacity on a global scale and establish PFM as a sustainable professional field.

![It’s not as though we were not aware … “ It was an error because Greece entered with false [economic] figures … it was not ready. ” President Sarkozy](https://image.slidesharecdn.com/icgfmneedforglobalpfmprofessionnov11vfinal-111205140222-phpapp02/85/Improving-PFM-The-need-for-a-Global-PFM-profession-4-320.jpg)

![improving PFM The need for a global PFM profession Alan Edwards International Director CIPFA [email_address] Tel +44 207 543 5690](https://image.slidesharecdn.com/icgfmneedforglobalpfmprofessionnov11vfinal-111205140222-phpapp02/85/Improving-PFM-The-need-for-a-Global-PFM-profession-23-320.jpg)