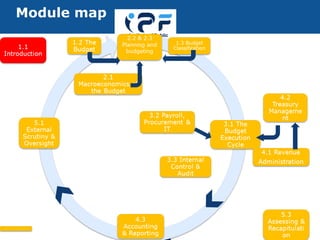

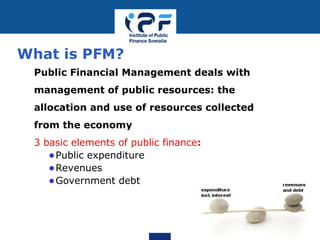

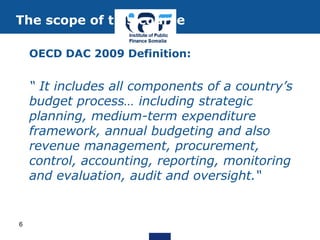

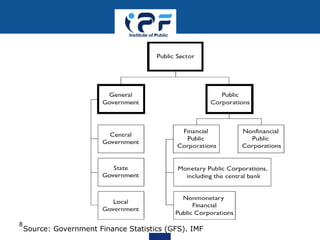

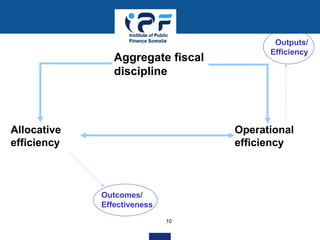

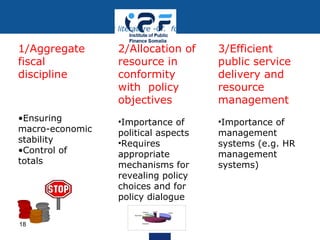

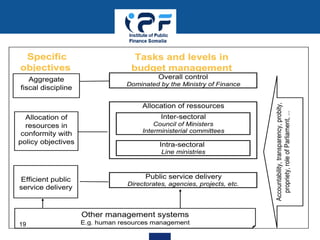

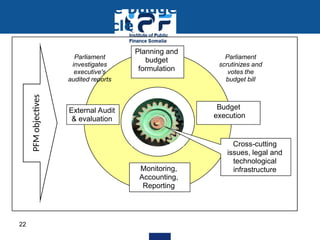

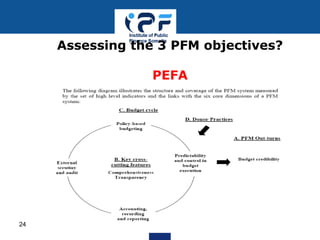

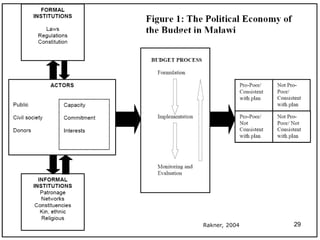

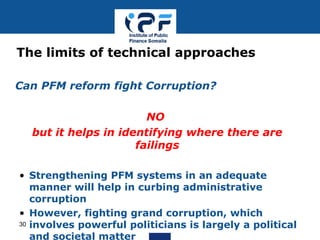

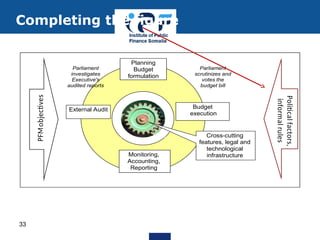

The document introduces Public Finance Management (PFM), defining its importance, objectives, and various components such as public expenditure, revenues, and government debt. It outlines the three main objectives of PFM: aggregate fiscal discipline, operational efficiency, and allocative efficiency, emphasizing the role of PFM in implementing public policies. The document also discusses the limits of technical approaches to PFM, highlighting the need for transparency and accountability within the context of political factors.