This document discusses intergovernmental fiscal relations and the assignment of functions, revenues, and expenditures across levels of government. It addresses key topics such as:

- Assigning functions like macroeconomic stabilization, income distribution, and resource allocation between national and subnational governments.

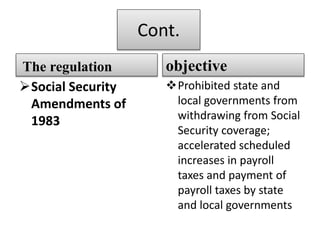

- Assigning revenue sources and balancing revenue-raising responsibilities with expenditure responsibilities to avoid vertical and horizontal imbalances.

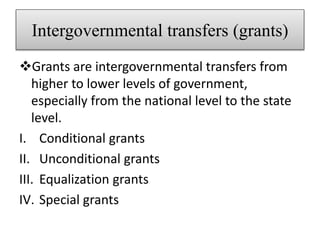

- Using intergovernmental transfers to equalize fiscal capacities and needs among jurisdictions.

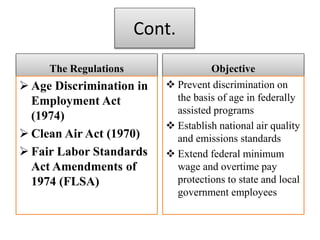

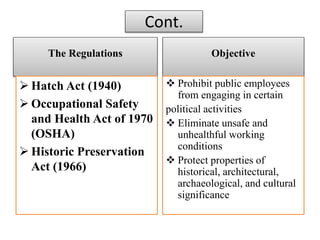

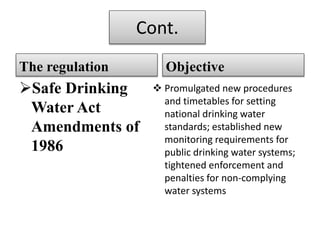

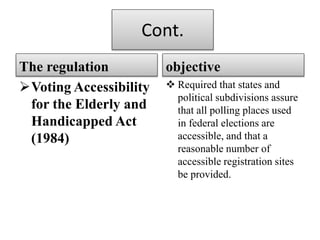

- Techniques for regulating intergovernmental relations like attaching conditions to grants or establishing national standards.