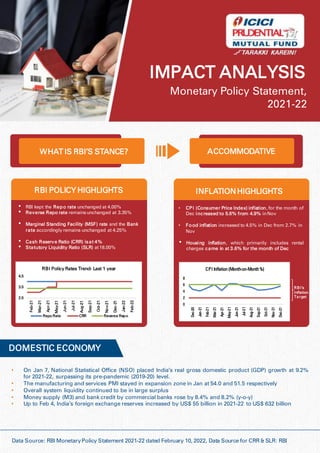

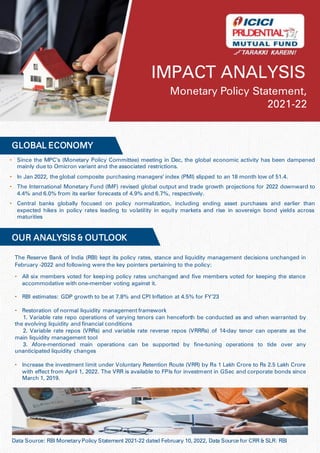

The Reserve Bank of India (RBI) maintained its repo rate at 4.00% and reverse repo rate at 3.35% in February 2022, reflecting an accommodative stance despite rising inflation, with CPI reaching 5.6% in December. GDP growth is projected at 7.8% for FY23, amidst challenges from the Omicron variant affecting global economic activity, while RBI emphasizes the need for continued policy support for domestic recovery. The analysis suggests a focus on liquidity normalization and warns of potential adjustments in future policies stemming from growth-inflation dynamics.