ICICI Prudential Mutual Fund | Impact analysis

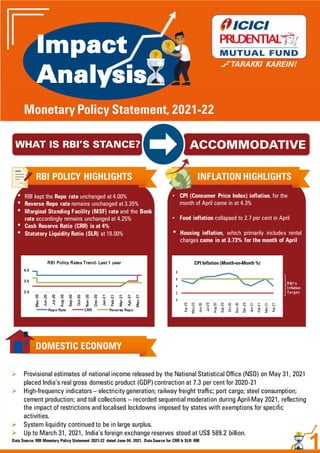

- 1. Impact Analysis Monetary Policy Statement, 2021-22 Provisional estimates of national income released by the National Statistical Office (NSO) on May 31, 2021 placed India’s real gross domestic product (GDP) contraction at 7.3 per cent for 2020-21 High-frequency indicators – electricity generation; railway freight traffic; port cargo; steel consumption; cement production; and toll collections – recorded sequential moderation during April-May 2021, reflecting the impact of restrictions and localised lockdowns imposed by states with exemptions for specific activities. System liquidity continued to be in large surplus. Up to March 31, 2021, India’s foreign exchange reserves stood at US$ 589.2 billion. 1 RBI POLICY HIGHLIGHTS INFLATION HIGHLIGHTS DOMESTIC ECONOMY WHAT IS RBI’S STANCE? ACCOMMODATIVE • CPI (Consumer Price Index) inflation, for the month of April came in at 4.3% • Food inflation collapsed to 2.7 per cent in April • Housing inflation, which primarily includes rental charges came in at 3.73% for the month of April • RBI kept the Repo rate unchanged at 4.00% • Reverse Repo rate remains unchanged at 3.35% • Marginal Standing Facility (MSF) rate and the Bank rate accordingly remains unchanged at 4.25% • Cash Reserve Ratio (CRR) is at 4% • Statutory Liquidity Ratio (SLR) at 18.00% Data Source: RBI Monetary Policy Statement 2021-22 dated June 04, 2021, DataSource for CRR & SLR: RBI RBI’s Inflation Target 2.5 3.5 4.5 May -20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov -20 Dec-20 Jan-2 1 Feb-21 Mar-21 Apr-21 May -21 RBI Policy Rates Trend- Last 1 year Repo Rate CRR Reverse Repo 0 2 4 6 8 Apr-20 Ma y-20 Jun-20 Jul-20 Aug-20 Sep-20 Oc t-20 Nov-20 Dec -20 Ja n-21 Feb-21 Ma r-21 Apr-21 CPI Inflation (Month-on-Month %)

- 2. GLOBAL ECONOMY Since the MPC’s meeting in April, the global economic recovery has been gaining momentum, driven mainly by major advanced economies (AEs) and powered by massive vaccination programmes and stimulus packages. CPI inflation is firming up in most AEs, driven by release of pent-up demand, elevated input prices and unfavourable base effects. Inflation in major EMEs has been generally close to or above official targets in recent months, pushed up by the sustained rise in global food and commodity prices. Global financial conditions remain benign. OUR ANALYSIS & OUTLOOK The Reserve Bank of India (RBI) kept its policy rates, stance and liquidity management decisions unchanged in June-2021 was largely expected and following were the key pointers pertaining to the policy: • Continuation of GSAP Programme : (GSAP 1.0 third tranche of INR 40,000 Crore and GSAP 2.0 of INR 1.2 Lakh Crore in Q2: 2021-22) • RBI’s inflation and growth outlook turns adverse: Growth projections revised downwards to 9.5% for F2022 from 10.5% earlier. On the inflation front, RBI expects headline CPI to average 5.1% in F2022 • Inclusion of SDLs (State Development Loans) in third tranche of GSAP1.0 auction (INR 10,000 Crore) • Targeted liquidity and regulatory measures : RBI announced a few more targeted liquidity and regulatory measures in the current policy : 1. A Separate liquidity window of INR15,000 Crore for contact-intensive sectors 2. Additional liquidity support of INR16,000 Crore to Small Industries and Development Bank of India (SIDBI) 3. Expansion of the coverage of borrowers under the debt restructuring scheme announced on 5 May by enhancing the maximum aggregate exposure threshold from INR 25 Crore to INR 50 Crore for MSMEs, non-MSME small businesses and loans to individuals for business purposes. Source: RBI Policy Document OUR VIEW • Overall policy continued dovish bias and the MPC again reinforced its priority on reviving durable growth even as the risks to inflation have also been adequately highlighted. • Going forward, RBI may have to do a fine-balancing act. On one hand, support for growth trajectory is needed due to second wave and on the other hand RBI would need to keep an eye on upside risk to inflation. • The growth recovery got disrupted due to second wave, but we expect it to pick-up owing to aggressive vaccine roll- out measures, easy liquidity conditions and fiscal support. • Inflation trajectory need to be monitored closely on the back of: 1. Reflationary global environment with Global Food Price Index also at elevated levels 2. Commodity prices getting heated up 3. Monetary policy is already expansionary with 115 bps rate cut in last CY-2020 and ample system liquidity. • Based on the above two points of growth normalizing and upside risk to inflation, we continue to believe for a gradual withdrawal of monetary stimulus. • The decision to continue with the GSAP program is positive for continued orderly evolution of yield curve and may remain supportive for longer term yields. • As communicated earlier, we believe that we are at the fag-end of interest rate cycle and in the current phase where growth and inflation dynamics is evolving, more nimble and active duration management strategy is recommended to benefit from high term premium (difference in yield between the long and short end of the curve) and to manage portfolios from expected high interest rate sensitivity • We continue to recommend Accrual strategy with an aim to benefit from higher carry. 2 Monetary Policy Statement, 2021-22 Data Source: RBI Monetary Policy Statement 2020-21 dated June 04, 2021, Data Source for CRR & SLR: RBI

- 3. ICICI Prudential Credit Risk Fund (An open ended debt scheme predominantly investing in AA and below rated corporate bonds) is suitable for investors who are seeking*: Moderate • Medium term savings • A debt scheme that aims to generate income through investing predominantly in AA and below rated corporate bonds while maintaining the optimum balance of yield, safety and liquidity Investors understand that their principal will be at LOW HIGH moderate risk *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Approach Scheme Name Call to Action Rationale Short Duration Schemes ICICI Prudential Savings Fund ICICI Prudential Floating Interest Fund ICICI Prudential Ultra Short Term Fund Invest for parking surplus funds Accrual + Moderate Volatility Accrual Schemes ICICI Prudential Medium Term Bond Fund ICICI Prudential Credit Risk Fund Core Portfolio with >1 Yr investment horizon Better Accrual Dynamic Duration Scheme ICICI Prudential All Seasons Bond Fund Long Term Approach with >3 Yrs investment horizon Active Duration and Better Accrual SCHEME RECOMMENDATIONS DISCLAIMER Mutual Fund investments are subjectto market risks, read all scheme related documents carefully. None of the aforesaid recommendations are based on any assumptions. These are purely for reference and the investors are requested to consult their financial advisors before investing. All data/information used in the preparation of this material is specific to a time and may or may not be relevant in future post issuance of this material. ICICIPrudential Asset Management CompanyLimited (the AMC) takesno responsibilityof updating anydata/information in this material from time to time. The AMC (includ- ing its affiliates), ICICI Prudential Mutual Fund (the Fund), ICICI Prudential Trust Limited (the Trust) and any of its officers, directors, personnel and employees, shall not liable for anyloss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Nothing contained in this document shall be construed to be an investment advice or an assurance of the benefits of investing in the any of the Schemes of the Fund. Sectors/stocks mentioned in the article do not constitute any recommendation and the Fund through its schemes may or may not have any future position in these sectors/stocks. Recipient alone shall be fully responsible for any decision taken on the basis of this document. The information contained herein is only for the purpose of information and not for distribution and do not constitute an offer to buy or sell or solicitation of any offer to buy or sell any securities or financial instruments in the United States of America ("US") and/or Canada or for the benefit of US persons (being persons falling within the definition of the term "US Person" under the US SecuritiesAct, 1933, as amended) or persons residing in Canada. RISKOMETERS 3 Monetary Policy Statement, 2021-22 Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis as per SEBI circular dated October 05, 2020 on Product Labeling in Mutual Fund schemes - Risk-o-meter. Please refer to https://www.icicipruamc .com/news-and-updates/all-news for more details.

- 4. 4 ICICI Prudential Medium Term Bond Fund (An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 Years and 4 Years. The Macaulay duration of the portfolio is 1 Year to 4 years under anticipated adverse situation) is suitable for investors who are seeking* Moderate • Medium term savings • A debt scheme that invests in debt and money market instruments with a view to maximize income while maintaining optimum balance of yield, safety and liquidity *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential All Seasons Bond Fund (An open ended dynamic debt scheme investing across duration) is suitable for investors who are seeking*: Moderate •All duration savings • A debt scheme that invests in debt and money market instruments with a view to maximise income while maintaining optimum balance of yield, safety and liquidity LOW HIGH *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Ultra Short Term Fund(An open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 months and 6 months) is suitable for investors who are seeking*: Moderate • Short term regular income • An open ended ultra-short term debt scheme investing in a range of debt and money market instruments Investors understand that their principal will LOW HIGH be at moderate risk *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. ICICI Prudential Floating Interest Fund (An open ended debt scheme predominantly investing in floating rate instruments (including fixed rate instruments converted to floating rate exposures using swaps/derivatives) is suitable for investors who are seeking*: Moderate • Short term savings • An open ended debt scheme predominantly investing in floating rate instruments *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. *Investors should consult their financial advisers if in doubt about whether the product is suitable for them Note: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the cash flow by the price. RISKOMETERS Monetary Policy Statement, 2021-22 ICICI Prudential Savings Fund (An open ended low duration debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 6 months and 12 months) is suitable for investors who are seeking*: Moderate Investors understand that their principal will LOW HIGH be at moderately low risk • Short term savings • An open ended low duration debt scheme that aims to maximize income by investing in debt and money market instruments while maintaining optimum balance of yield, safety and liquidity *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis as per SEBI circular dated October 05, 2020 on Product Labeling in Mutual Fund schemes - Risk-o-meter. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details.