Imperious Group is a venture capital firm based in the US, Israel, and Eastern Europe that invests in startups in areas like advertising, e-commerce, SaaS, mobile products, online education, and financial services. The document provides details on Imperious Group's investments from 2013 to 2015, including portfolio breakdown by country, category, and stage. It also outlines some of the firm's top investments and partnerships with companies like Amazon Web Services, PayPal, and Facebook.

![Imperious Group is a rapidly developing

venture capital company based in USA,

Israel and Eastern Europe.

The founder and the president of the fund

is Timur Yakubaros, businessman with 10+

years of experience in real-estate area.

The focus of our work — to invest in the growth

of strong, interesting startups in such areas:

• advertising (AdTech),

• e-commerce,

• SaaS,

• mobile-products,

• online education,

• big data,

• financial services.

We also consider the products aimed

at the corporate sector [b2b], as well

as a mass market [b2c] in niches

in which teams have the experience.

How We Work

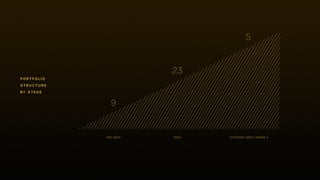

• focused on startups at pre-seed,

seed and series A stage;

• investment range: $50k–500k [average],

$1m+ [series a];

• target locations of teams: cis, Israel, Europe,

usa, Asia;

• target markets: Europe, usa, Asia;

• no intervention into operational processes;

• connections with best tech /r&d teams

for quick growth.

about

venture](https://image.slidesharecdn.com/e59eaf8c-7914-40cb-9de6-08a0b7b91b2d-160111120757/85/ig_3years_en-2-320.jpg)