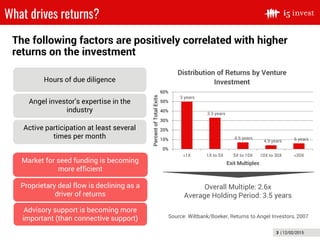

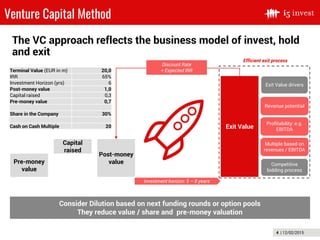

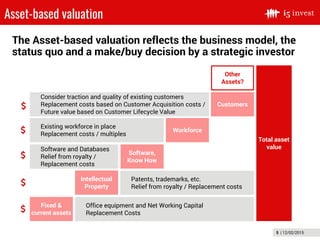

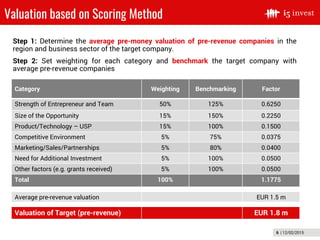

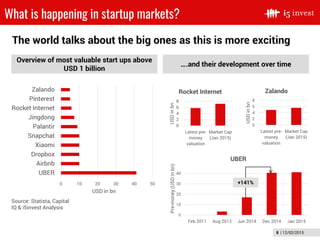

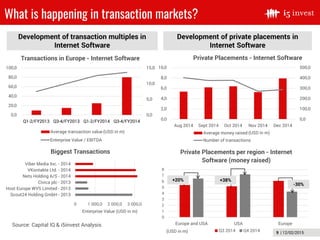

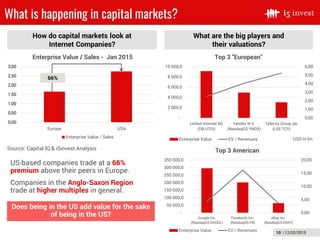

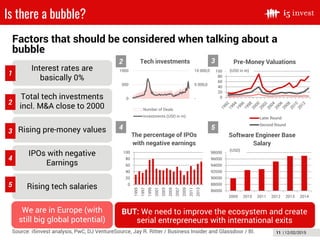

This document discusses startup valuation and whether there is a bubble in startup markets. It outlines several approaches to valuation, including looking at factors like the experience of the founder team, traction, and scalability of the business model. It also examines current transaction multiples and private placements in internet software companies. While some factors could indicate a potential bubble, such as low interest rates and rising valuations, the document argues that improvements are still needed in Europe's startup ecosystem to create more serial entrepreneurs with international exits.