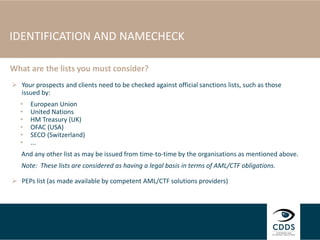

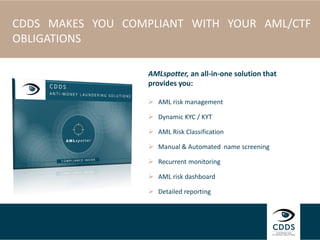

The document discusses customer due diligence (CDD) and know-your-customer (KYC) processes for anti-money laundering (AML) compliance. It outlines the steps of identifying customers, verifying their identities against official documents, screening customer names against sanctions lists, and identifying politically exposed persons (PEPs). Proper CDD including name screening is required by law to ensure high-risk clients like criminals and PEPs are avoided. An automated global system is recommended to efficiently manage these AML/CTF obligations.