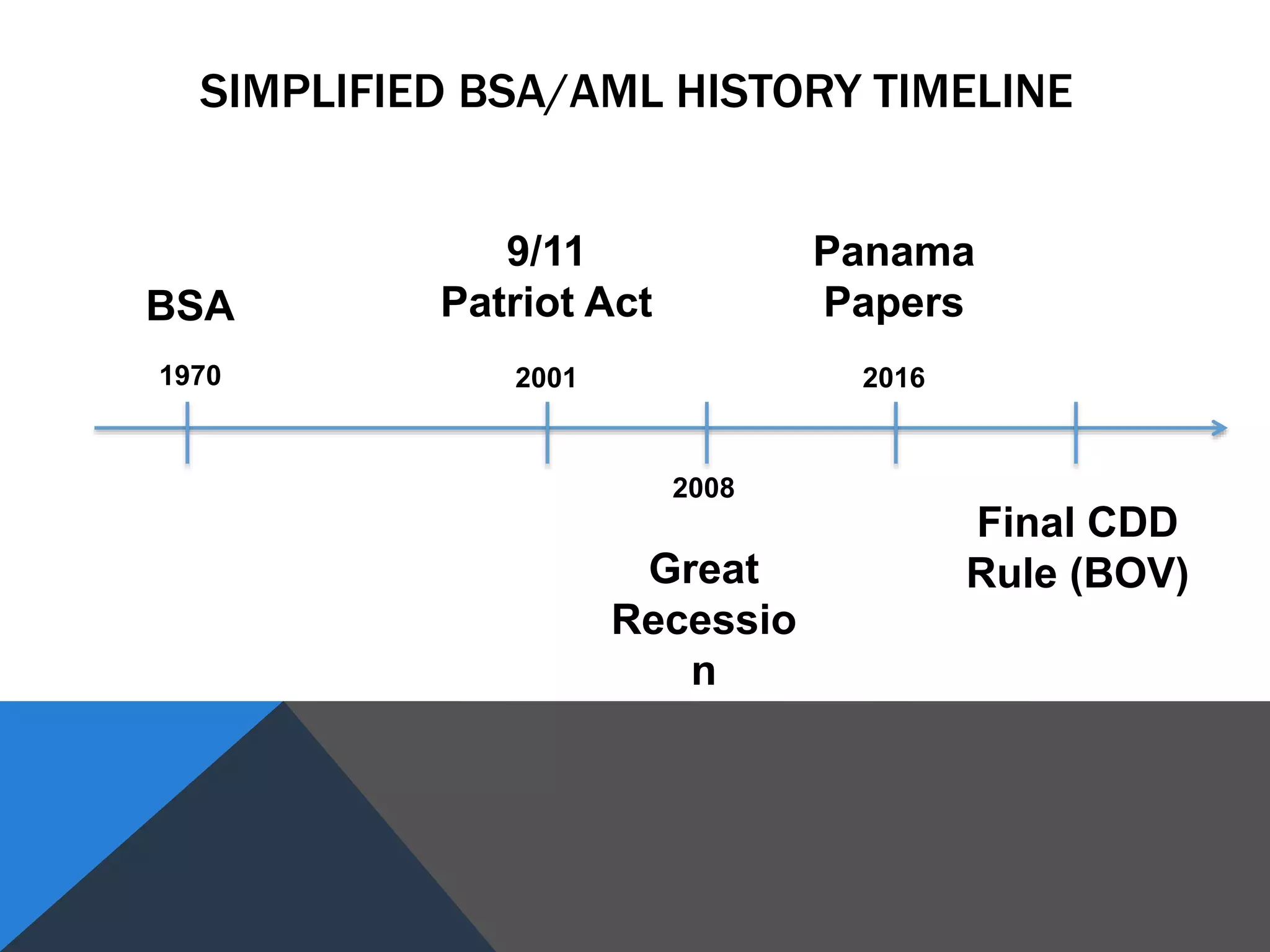

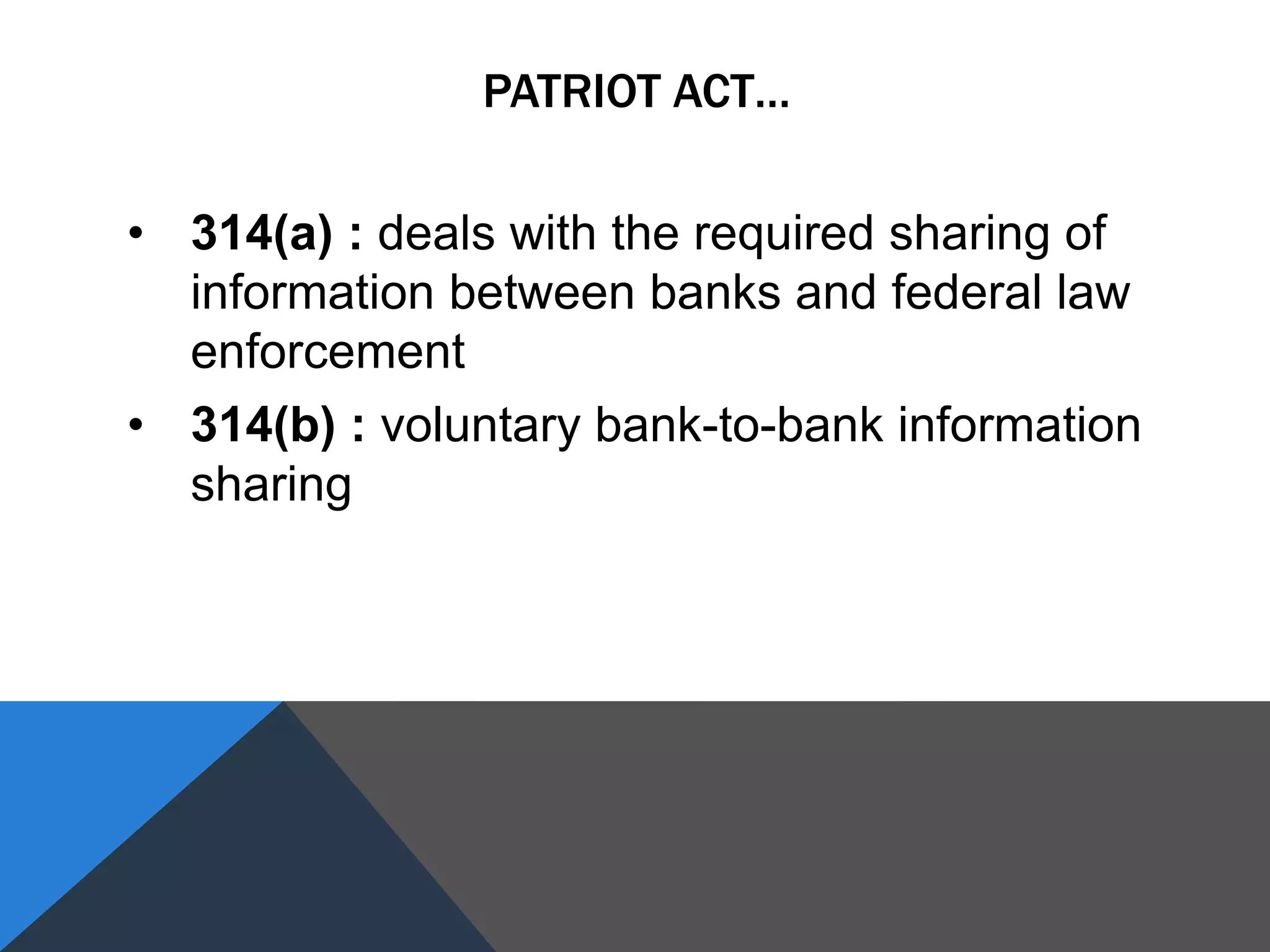

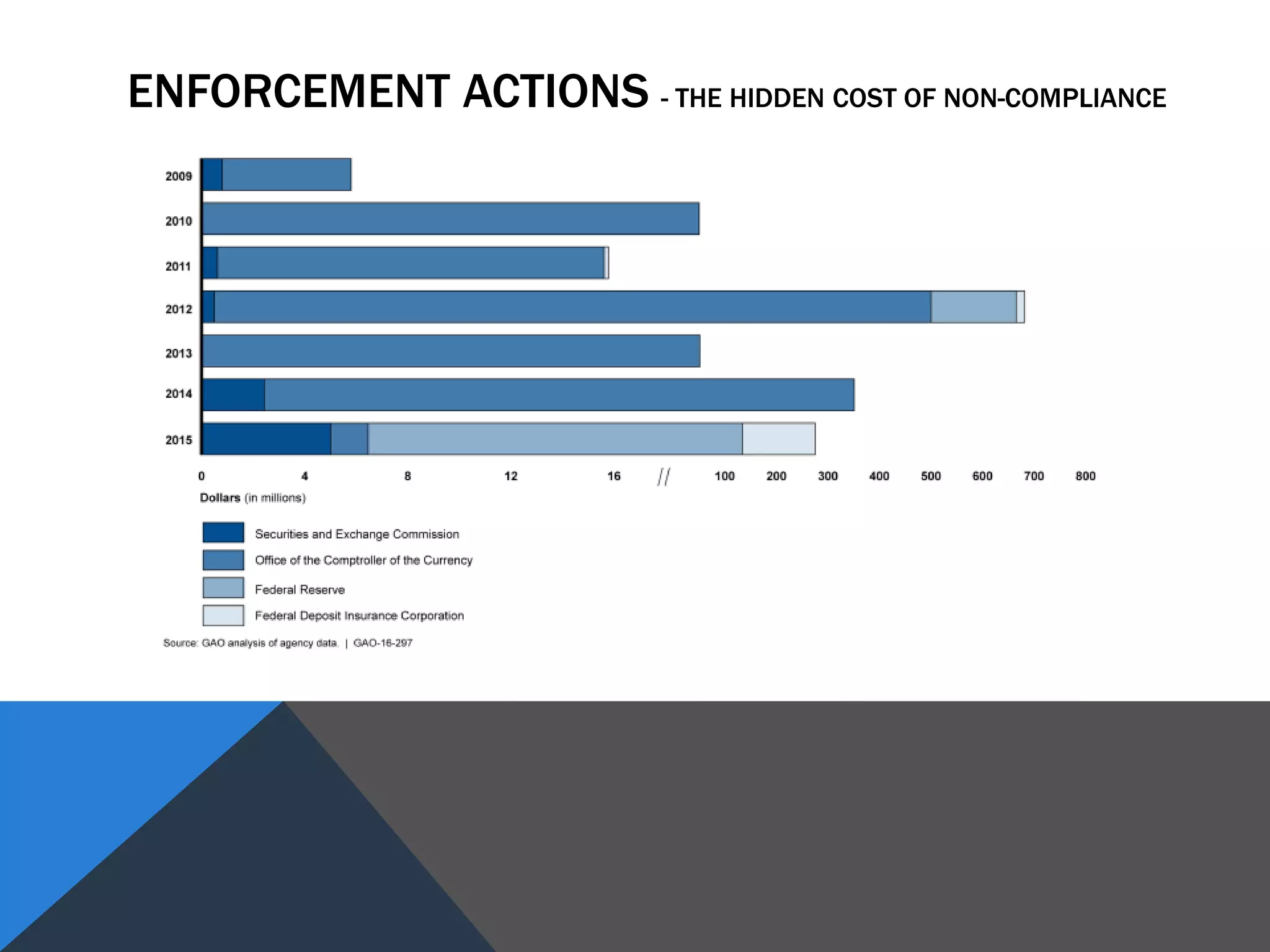

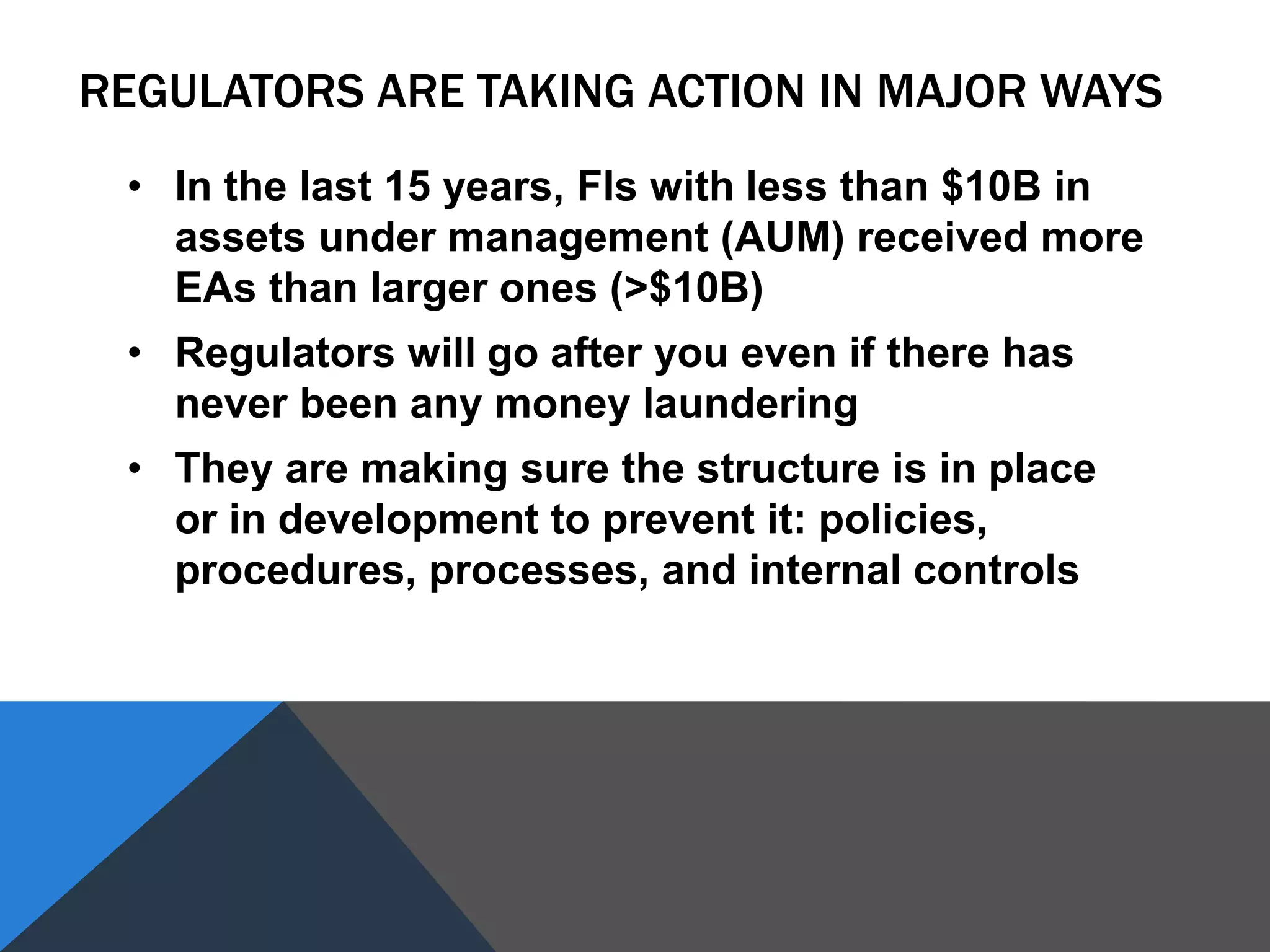

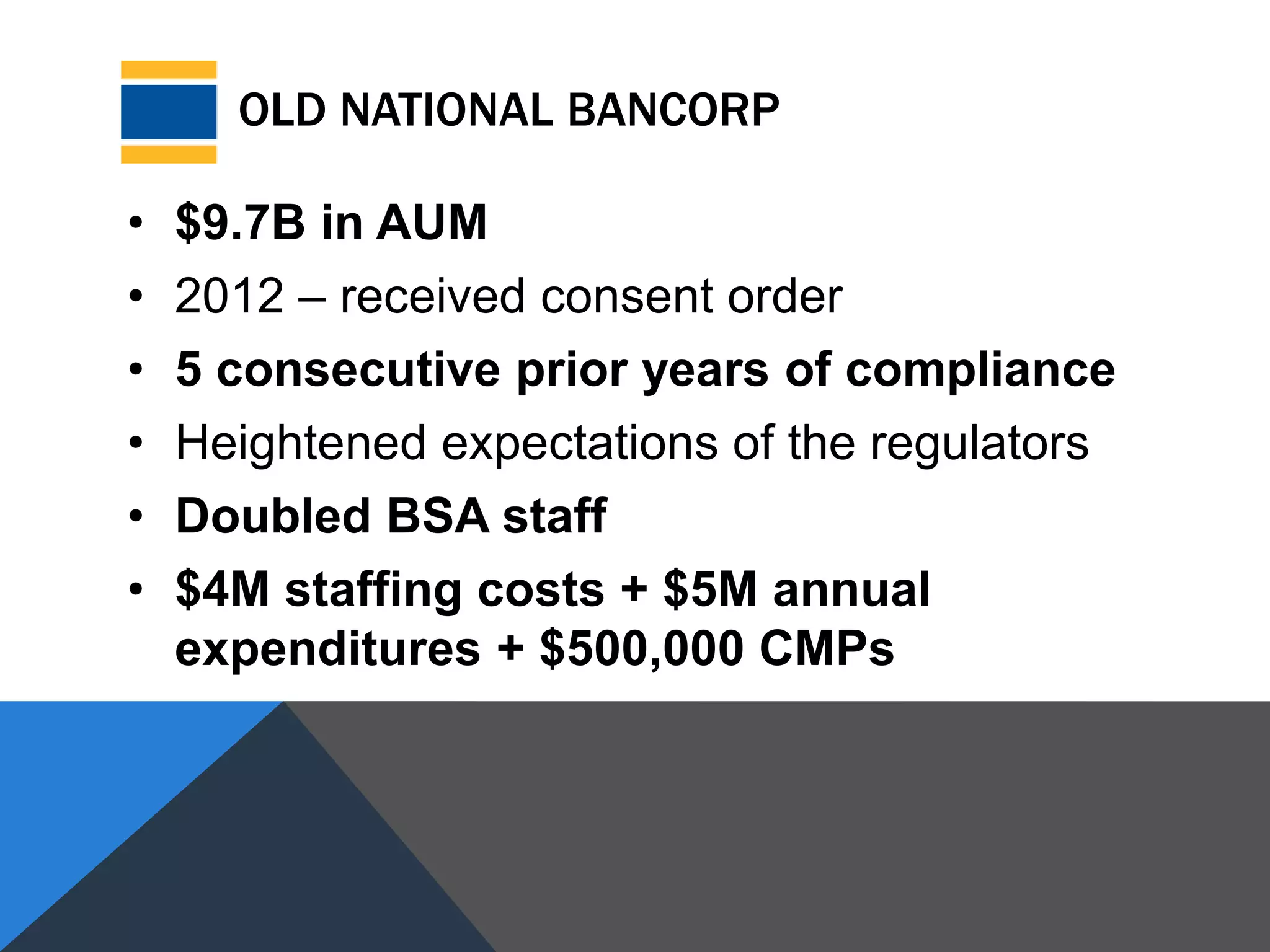

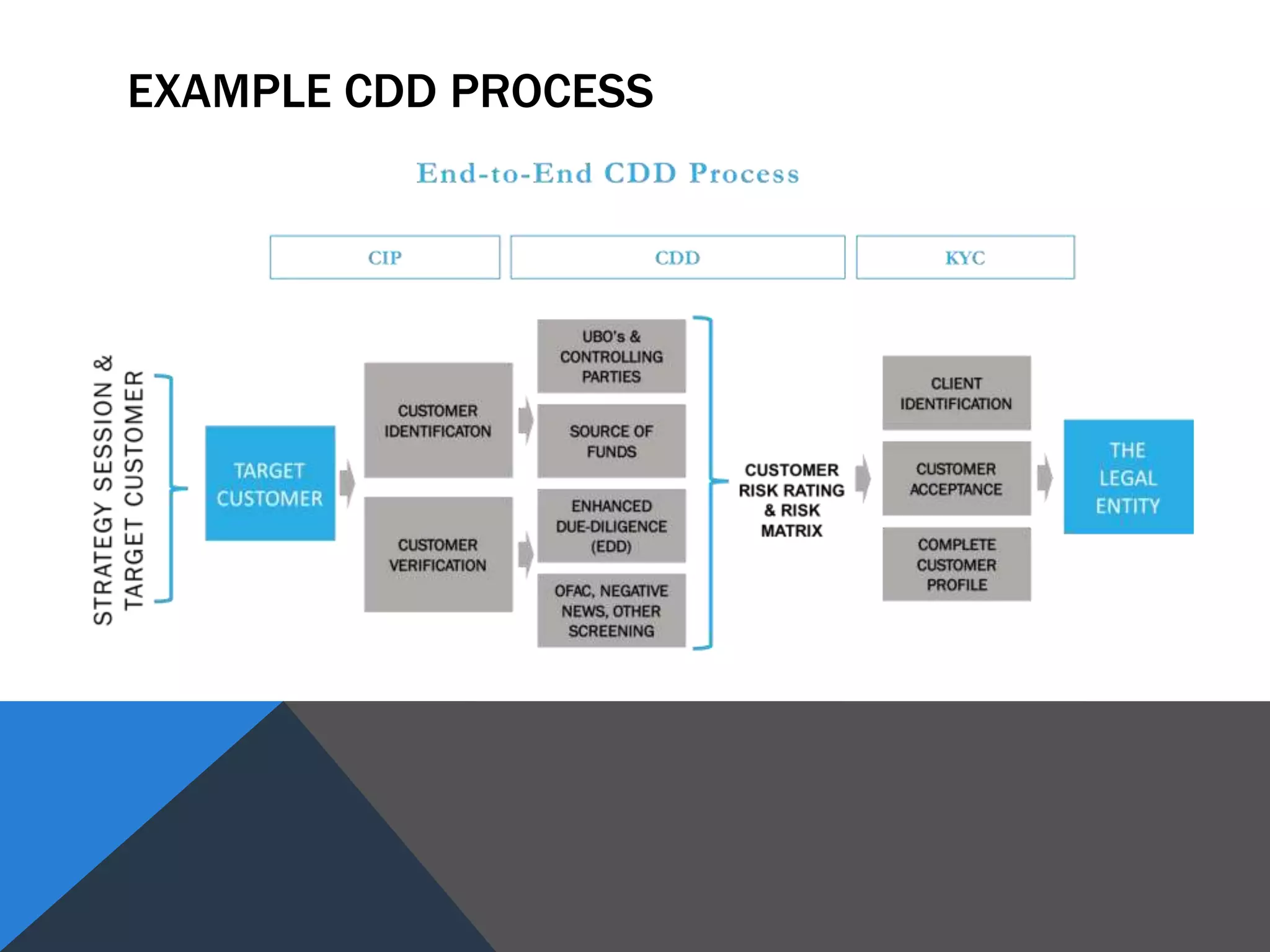

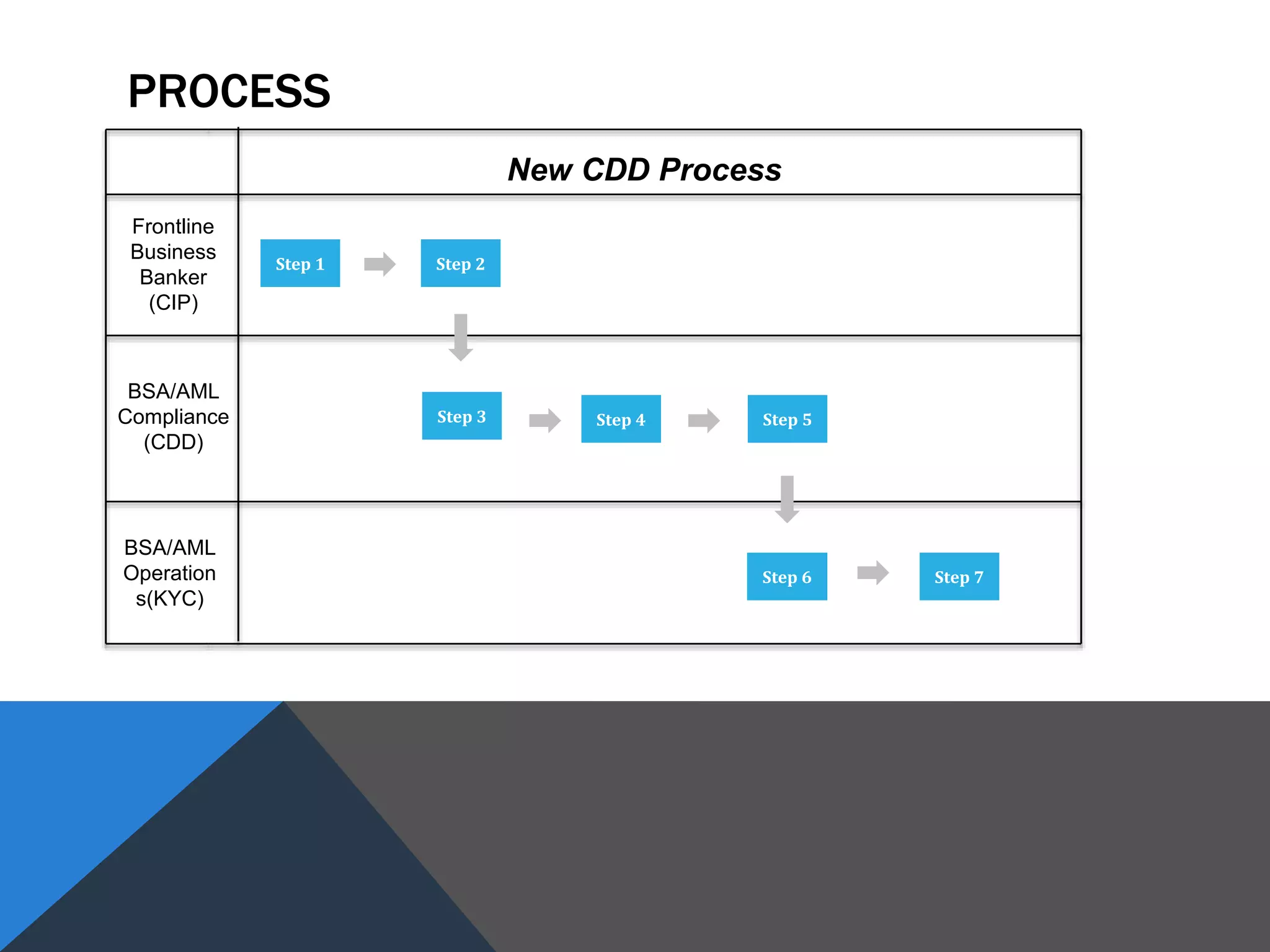

This document provides information about autoAML, a company that provides BSA/AML compliance software and services. It introduces the CEO, Carey Rome, and Director of BSA Risk, Nick Guest, and their relevant experience. The document then outlines the history of BSA/AML regulation in the US from 1970 to present day. It discusses key events that shaped regulation, such as the passage of the Bank Secrecy Act, the 9/11 terrorist attacks, and the 2008 financial crisis. It emphasizes that the one consistent weakness highlighted in all enforcement actions is the failure to properly identify beneficial owners. The document argues that banks need to properly align their BSA/AML policies, procedures, and processes with regulations to

![COMPLIANCE COMMUNICATION IS ESSENTIAL

“We're seeing situations where business

decisions are made that run counter to an

institution's AML policy [or] counter to the

advice of the compliance department, situations

where the compliance department is being

deprived of information required to do its job.”

- Shasky Calvery, previous director of FinCEN](https://image.slidesharecdn.com/cddwebinarppt03-170302152142/75/Final-CDD-Rule-How-We-Got-Here-and-What-To-Do-Now-69-2048.jpg)