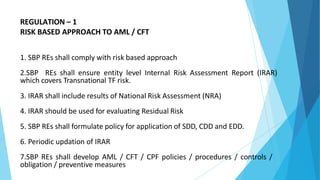

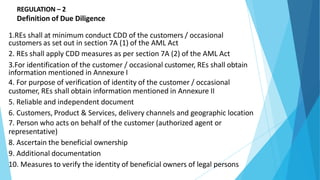

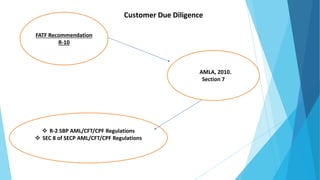

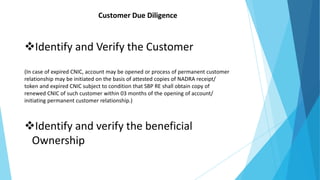

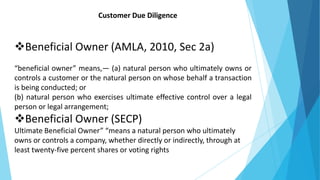

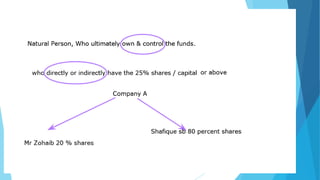

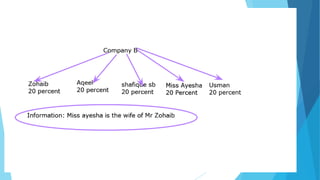

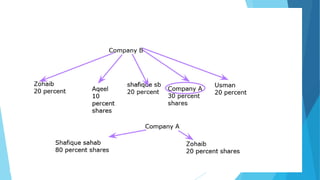

This document provides a summary of Anti-Money Laundering, Combating the Financing of Terrorism & Countering Proliferation Financing (AML/CFT/CPF) regulations for State Bank of Pakistan's regulated entities. It outlines 10 key regulations, including requiring a risk-based approach to AML/CFT, defining customer due diligence requirements, reliance on third parties for CDD, financial sanctions screening, enhanced due diligence for politically exposed persons, NGO/NPO/charity accounts, reporting suspicious transactions, record keeping, correspondent banking, and money value transfer services. The document is intended to help regulated entities understand and comply with Pakistan's AML/CFT/CPF

![Detail of Amended Regulations: Regulation – 4

Targeted Financial Sanctions under UNSC Act, 1948 and ATA, 1997

▶ 3) SBP REs shall ensure mechanisms, processes and procedures for real-time

screening of customers/ occasional customers, by implementing effective name

screening solution and allocate sufficient trained resources. Unquote]

▶ In this regard you are advised to coordinate with Country Operations to create

tool for screening of Home remittance transactions with Sanctions Lists i.e. UNSC,

OF

AC, EU, NACT

A and FIA Redbook, and share it with concerns who perform Homer

remittance transactions and instruct them to keep proper record of screen results

alongwith copy of valid ID document with each transaction for audit review.](https://image.slidesharecdn.com/regulationsoverview-221026091856-86fcb887/85/Regulations-Overview-pptx-29-320.jpg)