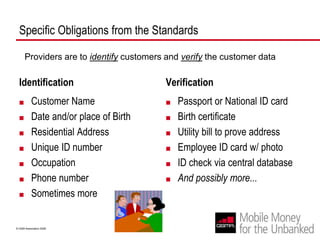

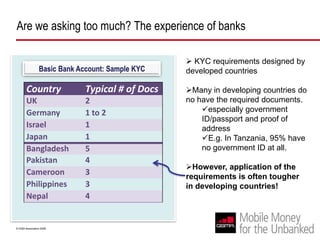

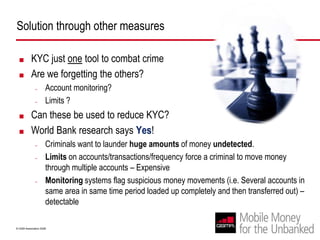

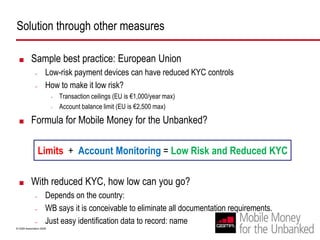

This document discusses Know Your Customer (KYC) procedures for mobile money providers. KYC involves collecting customer identity information and verifying it to help prevent money laundering. International standards set specific KYC obligations, but these can exclude many poor customers who lack documents like IDs. However, alternatives like transaction limits and account monitoring may allow for reduced KYC while still mitigating risks. The World Bank has found this approach works, and an interview with a mobile money provider in the Philippines provides a real-world example. Tools are available to help assess money laundering risks and determine appropriate KYC levels.