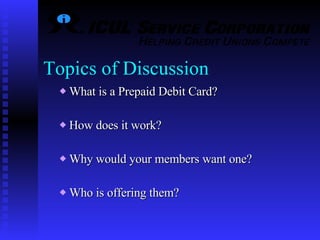

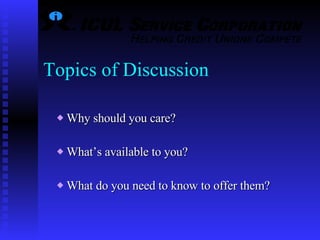

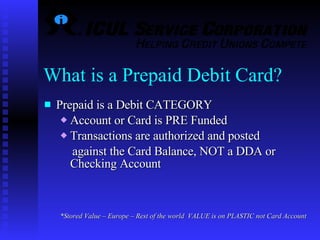

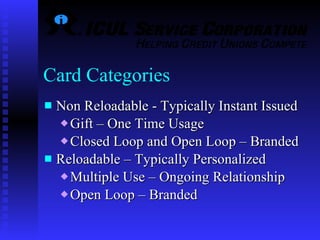

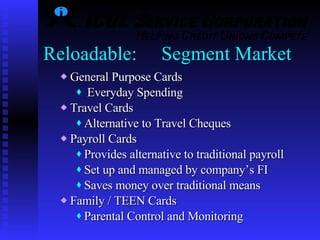

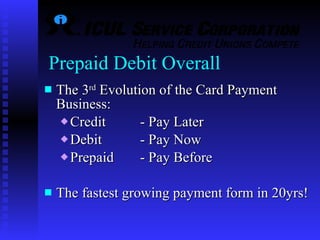

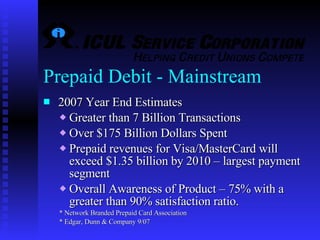

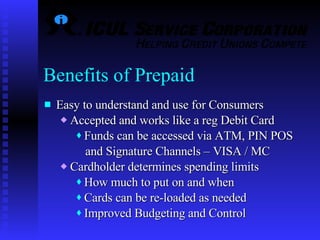

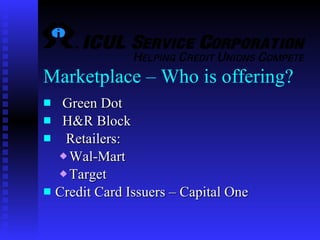

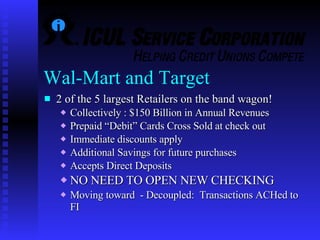

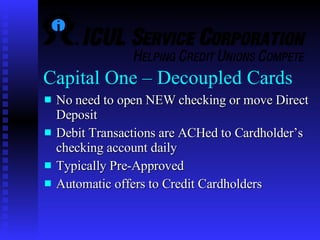

The document discusses prepaid debit cards as an emerging payment method and opportunity for credit unions. Prepaid debit cards work like debit cards but are pre-funded by the user. They provide benefits like convenience, control, and security compared to traditional checking accounts. The document outlines prepaid card categories and providers, as well as opportunities and options for credit unions to offer prepaid debit cards themselves.