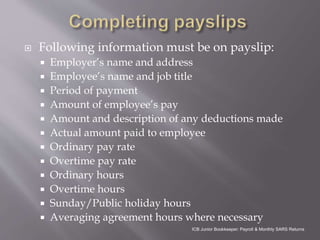

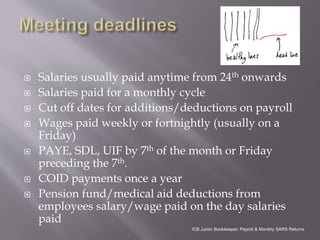

The document outlines the key responsibilities and regulations for junior bookkeepers regarding payroll management and monthly SARS returns, emphasizing tax implications and statutory compliance. It details various types of employee tax liabilities, including PAYE calculations and deductions for benefits, along with the necessity of timely and accurate record-keeping and submissions. Additionally, it highlights requirements for payslips and payment schedules to ensure compliance with tax regulations.